Exploring Binance Fees, Charges and Discounts: A Comprehensive Review

Trading fees are the main expenses of traders. We have prepared a comprehensive guide about Binance fees to show in detail how exchange rates are arranged and how traders can reduce fees.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Binance Trading Fees Review

There are six markets of interest for traders on Binance: Spot, USDT-M Perpetual Futures, COIN-M Futures, Cross Collateral, Liquid Swap and P2P. The most popular market is Perpetual Futures.

Certain fees are set on each market. Binance fees are calculated on a maker/taker basis. Its final size is influenced by several factors: BNB, referral link and VIP level. Let’s talk about each type of fee.

Understanding Binance Fees: What is Maker and Taker?

The fees for makers are comparatively lower compared to takers. “Makers” refers to orders listed in the order book, awaiting a matching counter order for execution. “Takers,” on the other hand, are promptly executed at the expense of makers. Essentially, makers contribute liquidity to the exchange while takers consume it. Consequently, makers incur lower fees, whereas takers face higher ones.

It is a common misconception among newcomers that takers exclusively involve market orders, and makers solely pertain to limit orders. A maker encompasses any order placed in the order book, awaiting execution, whereas a taker represents an order that matches and executes an order from the order book.

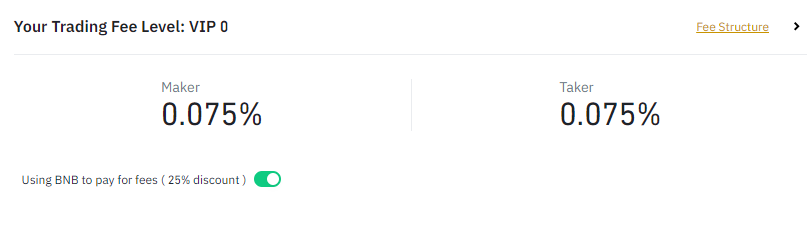

Discount for BNB Holders on Binance

BNB Holders Discount Binance users can reduce fees using BNB (Binance’s own token). At the moment it is 25% on Spot and 10% on Futures.If you’re interested in finding the most cost-effective options when operating in the futures market, check out our blog “Binance Futures Fees vs. Other Exchanges.”

BNB fee discount is valid in spot and USDT-M perpetual futures markets for all levels of the bonus program. On COIN-M futures market, there is no BNB discount.

Binance’s Referral Link and VIP Program

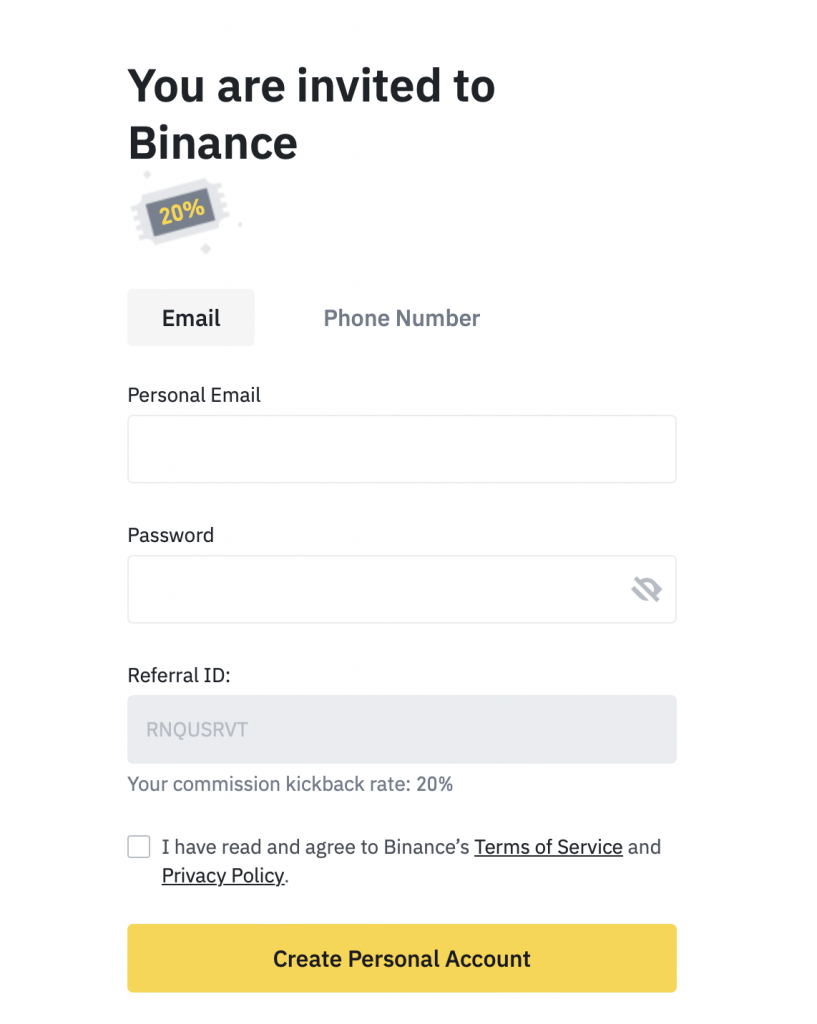

You can receive an additional discount by registering on Binance via a referral link.The maximum discount is 20% for spot market and 10% for perpetual futures. The referral link discount works as a kickback, which means that the full amount of fee will be debited, then the transaction occurs, and after that the kickback fee will be returned to your account. The CScalp referral link is valid for 12 months from the date of registration.

If a trader is already registered on Binance, it will be required to sign up again for getting bonuses from the referral link.

VIP Program and Fee Benefits on Binance

Binance VIP Program contains 9 levels. The trader’s level depends on its trading turnover in the equivalent of BTC and the number of BNBs held. There are basic fees at zero level.

VIP program and referral link discounts are combined only at zero and first VIP program levels. After reaching the second level, the discount for the referral link will be canceled.

The terms and conditions for participation in the VIP program in spot and futures markets are different and the trading volumes in different markets are not summarized.

Example: When you trade only on spot market and your monthly volume is greater than or equal to 50 BTC, you will receive first level in the VIP program only at the spot market.

In order to up the level in the futures market, you need to have a large turnover (due to the ability to trade with a credit shoulder up to 125x). That is why there is a division between VIP levels.

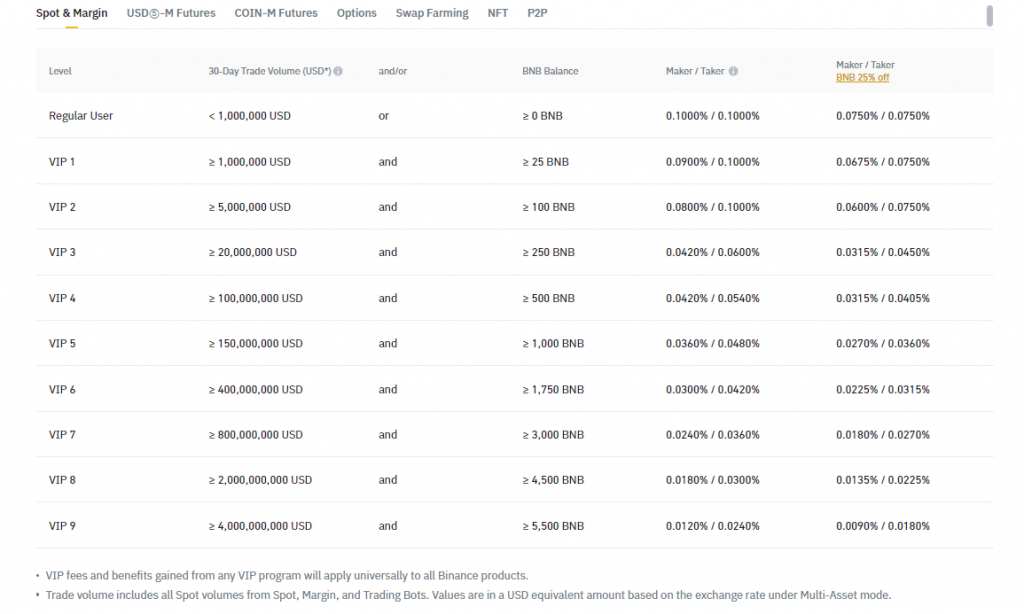

Binance Spot Market Fees

The Binance Spot base fee is 0.1% for both makers and takers. If you use BNB to pay the fees, you receive a 20% discount, resulting in a fee of 0.08%. Details about the Binance Spot fees, including VIP level considerations and BNB usage, can be found in the screenshot below.

Binance Spot Market Fees

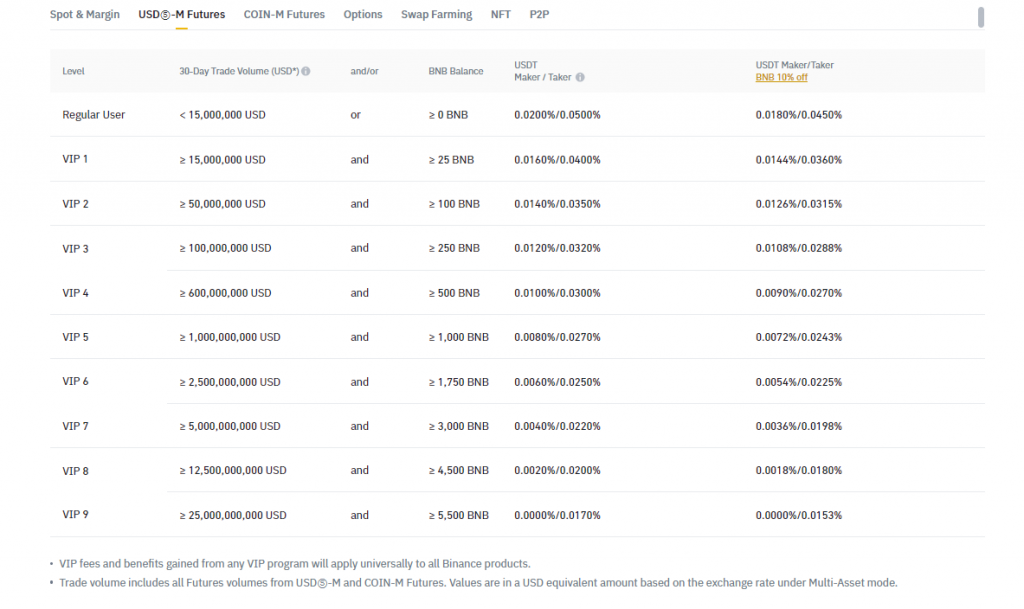

Binance USDS-M Perpetual Futures Market Fees

The base Binance futures fee is 0.02% for makers and 0.05% for takers. With a referral link (10% discount), the fees are 0.01998% for makers and 0.04995% for takers. Binance’s commission rates for USDT futures transactions, taking into account VIP levels and BNB, are shown in the screenshot below.

Binance Fees for USDT-M Perpetual Futures Market

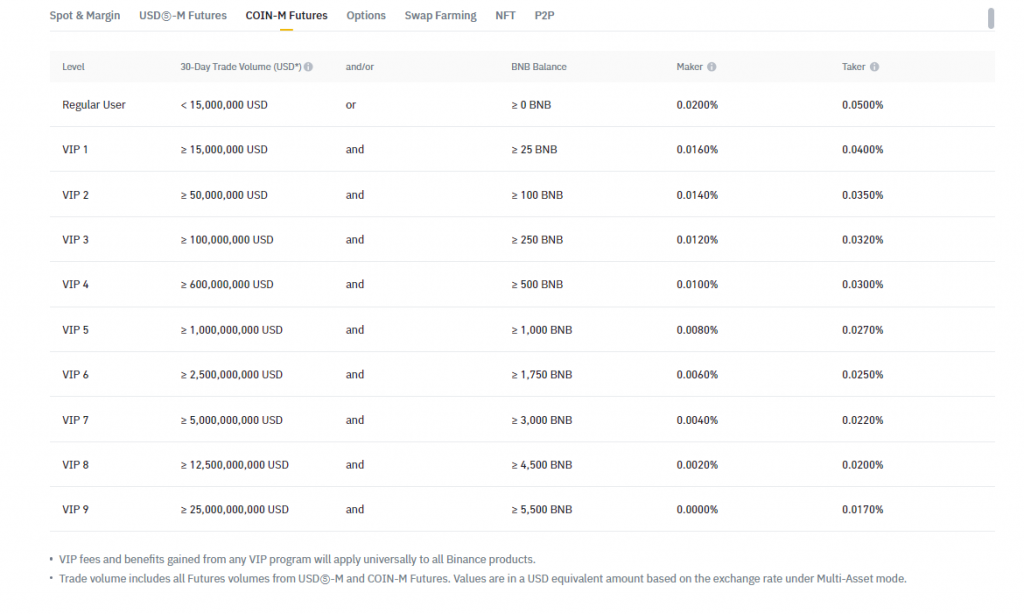

Binance COIN-M Futures Market Fees

The base Binance COIN-M futures fee is 0.02% for makers and 0.05% for takers. There are no discounts for using BNB. The Binance COIN-M fee rates, including VIP levels, are shown in the screenshot below.

Binance COIN-M Futures fees

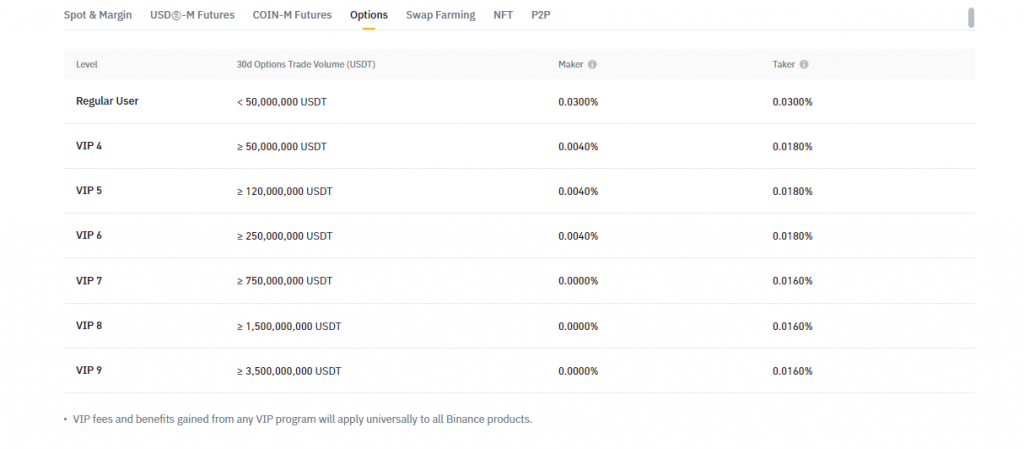

Binance Options Market Fees

The base Binance options fee is 0.03% for both makers and takers. There is no discount for using BNB. The VIP program applies from the fourth level onwards – users with VIP 1/2/3 status do not receive discounts on Binance options transactions.

Binance Options Market fees

Crypto Trading: How to Reduce Binance Fees

You can reduce fees on Binance. Let’s discuss some of the most popular and effective ways to do so.

Cscalp Referral Link

If you register on Binance using the CScalp referral link, you will receive a 20% discount on spot market fees and 10% for perpetual futures. The CScalp referral link is valid for 12 months. If you register using the link, a code will be shown at the “Referral ID” field, as in the screenshot below.

Usage of BNB Deduction

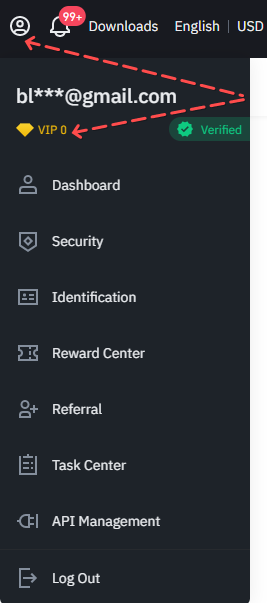

To pay the fees on spot and perpetual futures markets using BNB tokens, you should enable this function in your personal account. Open User Center to enable it.

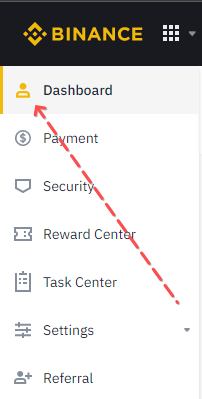

Then follow “Dashboard” tab.

Scroll down the page. There, you will see a switch to enable / disable using BNB deduction.

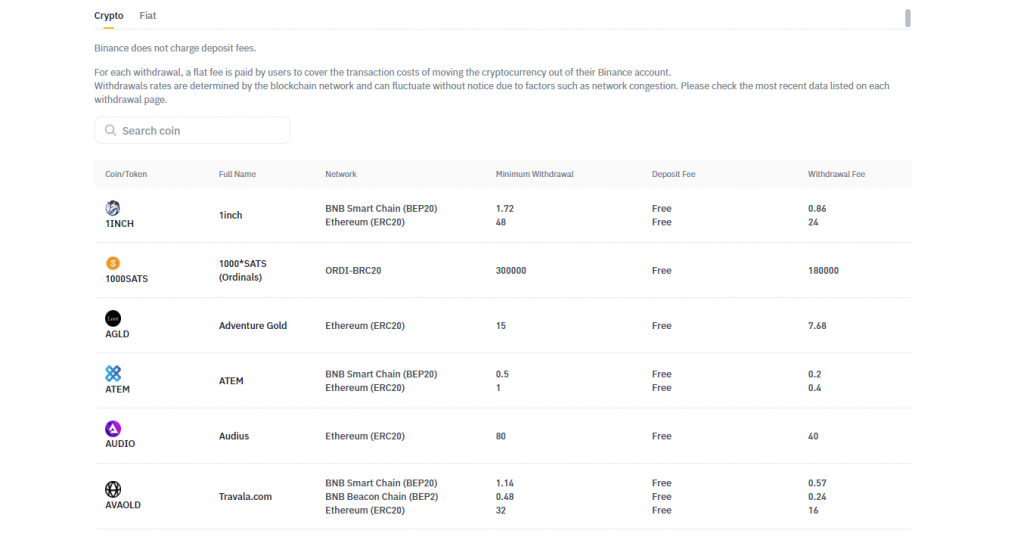

Binance Deposit and Withdrawal Fees

Binance does not charge a fee for depositing cryptocurrency onto the exchange. The withdrawal fees from Binance for popular cryptocurrencies are:

- BTC – 0.00085 BTC (Bitcoin network)

- ETH – 0.01 ETH (ERC-20 network)

- LTC – 0.002 LTC (Litecoin network)

- USDT – 10 USDT (TRC-20 network), 0.29 USDT (BEP-20 network)

Binance Withdrawal Fees for cryptocurrencies

Binance’s fiat deposit fee varies depending on the currency and transaction method. In P2P trading, only the maker pays the commission. For transactions in USD, the fee is 0.35%; for EUR and GBP, it’s free. Transactions in RUB, KZT, and UAH have a fee of 0.1% for all cryptocurrencies.

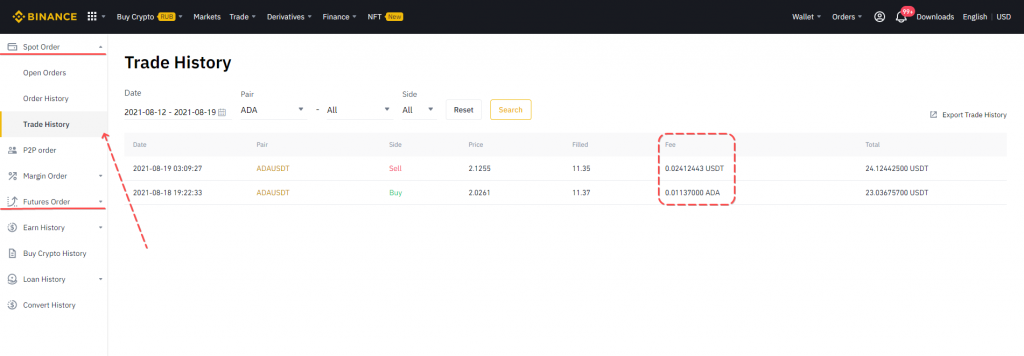

How to Find Out the Fee Amount Charged on Binance

The amount of Binance fee can be found in several ways: in Binance personal account, by report from the CScalp Telegram bot and in the Trade History using Free trader’s diary.

Binance Dashboard

To view fees in your Binance account, click on the “Orders” tab.

Select the market you need (spot or futures) and click on the “Trade History” tab.

Note: When the function of using BNB deduction Binance fees is enabled, the debited amount will be displayed in BNB, regardless of the trading pair.

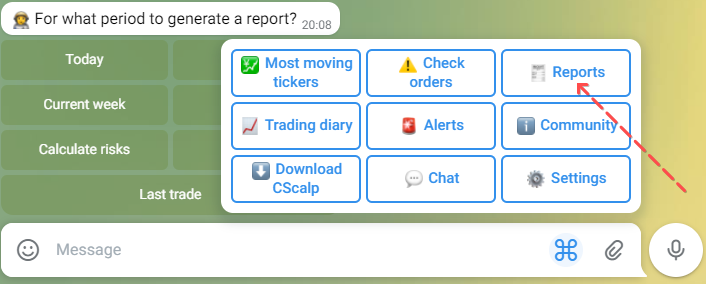

CScalp Telegram Bot

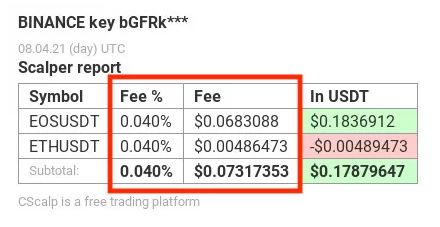

It is faster and more convenient to view the size of the debited Binance fee through CScalp Telegram Bot. To do this, write to the bot and click on the “Reports” button.

The bot will offer to generate reports for today, yesterday, current or last week and also for the last trade. Select the period you need and CScalpbot will instantly send a report within a few seconds.

The CScalpbot report displays the size of the fee and its percentage of the trade amount.

Note: Currently, CScalp only prepares reports for Binance perpetual futures trades.

Free Trader’s Diary

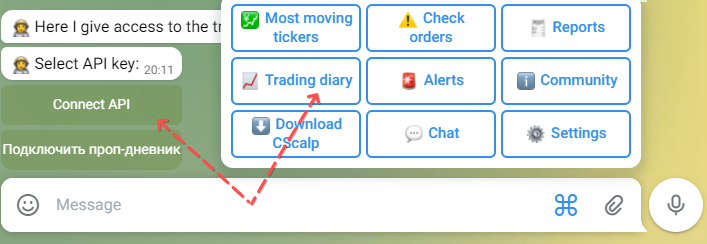

The size of the debited Binance fee can also be found in the service for traders Free trader’s diary. To open the diary, write CScalpbot and click on the “Trading Diary” button. Then click “Connect API“.

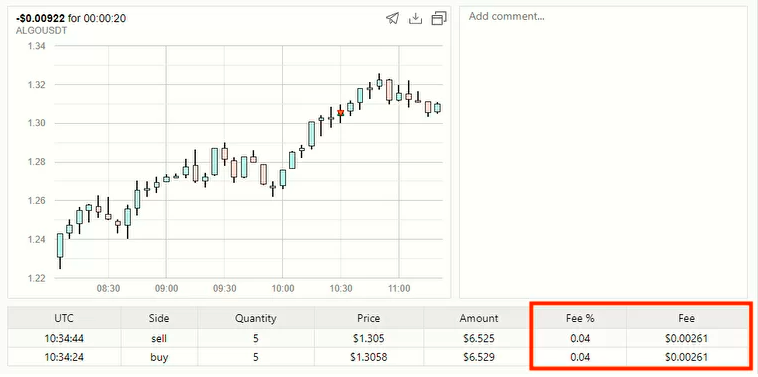

The diary also displays the percentage and size of the fee debited from the trade amount.

To generate reports on trades through CScalpbot or use a diary, you need to connect your Binance API keys to the bot.

Note: Currently, Trader’s Diary only works with Binance perpetual futures.

Maximizing Cost Savings on Binance Fees

Binance trading fees are primarily important for traders who trade using large volumes or make a large number of trades.Trading with a referral link and using BNB for paying fees can significantly reduce costs. You don’t have to buy tokens to use BNB. You can convert “dust” (a small amount of cryptocurrency left after trading) into Binance coins.

If you have any questions about Binance fees, ask our support team! We do not manage or work for the exchange, but we will try to answer you as fully as possible.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT