The course is designed for the newcomers in trading. Follow 10 actions step by step. Don’t rush, the market won’t go away. Don’t skip “uninteresting” things, because you want to go learn some that you are interested in. Don’t forget that, you invest your time in learning, do it efficiently. These “investments” will pay you dividends, you want it, right?

1. Do you really need scalping?

Scalping is a popular kind of trading, but not the only one. There are also others, for example swing trading. Do you really need scalping? Watch the video What is scalping. Who are scalpers?(4 min)

Make sure you understand the main points of the video.Then answer the questions below. If you answer “Yes” to all three questions, then move on. If at least one answer is “no”, it is better not to waste your time learning how to scalp.

Do you have time for learning?

Trading is like a sport. Success is the result of the longterm training. Six months, a year, or even two years, you have to “adjust” your head for the beginning to understand the market. Even if you are a potentially talented trader, the first profits will not come right away.

Do you have time that you are willing to spend on learning how to trade? If this time is not available, what is the point of starting?

Do you understand that scalping is a craft?

Scalping is not an art, Scalping is a craft. The scalper sits down at the computer every morning and works more than when he worked by employment. «A trader sits under palm trees, presses two buttons a day and becomes a millionaire» – this is an alluring fairy tale from the Internet, but it is a fairy tale. In reality it’s not like this. When trader works – he takes profit. When a trader goes on vacation where there are many palm trees (traders often do this), he does not earn, but only spends money. Do you realize that scalpers spend most of their time at work, rather than traveling and having fun? Are you ready for this?

Do you really like scalping?

Before you start making money using Scalping, you will give it a lot of your time and effort. If scalping is just a way to “make easy money” for you, this means you will get nothing. You will finish earlier, because you can get bored. If trading is your favorite thing, therefore, the road to profit will be faster, more interesting and more exciting. Is scalping more than just another job to earn money for you? Do you have enough motivation?

Majority of YouTube trading videos are montages and fairy tales of video bloggers, so trust our recommendation and watch this video (3 hours). It’s in russian language, but the best example of scalping stream. This is what real scalping looks like (hookah does not count). Are you interested in this kind of work? If so, then we move on.

2. Sources and services

In this part, we will give tips on information sources and services that you should use at the start. But first, a few thoughts.

There is a huge amount of information about trading on the Web sources – the whole life is not enough to learn it at all. Studying everything in a row is a bad tactic. Why? You will create confusion in your head, spend time on useless content, and make the standard mistakes of beginners.

It is important to understand that scalping is not a profession, it is a craft. According to the authors, the theoretical course can be completed in 2-3 weeks. Then you need to move on to the practice of the craft (to trading). It is useless to continue learning theory without practice.

Below is a list of verified sources of information and services. It will be enough for you at the start.

The primary source for his information: scalping course.

Additional sources:

CScalp News – English-speaking CScalp community channel.

CScalp TV EN – Official CScalp YouTube channel, there you may find trading educational videos, shorts with crypto ideas and later there will be streams from experienced traders!

Trader signals –these are Telegram channels where you will follow the trading ideas of other traders, discuss situations and trades.

Chats with other traders and CScalp team:

CScalp traders ENG – English community traders’ chat from CScalp

Crypto traders’ chat –here we discuss signals and crypto trades.

Discord server – we communicate in chats and voice channels on the topic of trading.

Services:

Trader’s Diary – here you can analyze your trades and correct mistakes.

CScalp bot– bot which helps the trader. Learn how to use the “What’s moving” button.

CScalp_support_bot – CScalp support. Live support will help to solve the problem.

The above will be enough at the start. Do not overload your head with unnecessary information. Do you have time and attention? It is better to spend your attention and time in the practice of trading.

3. Open an account

To start trading, you will need an account on one of the exchanges that CScalp “knows” how to work with. These exchanges are: Binance, Bybit, EXMO, BitMEX, Bitfinex, OKX (OKEx).

You can connect several accounts from different exchanges to CScalp, as well as several accounts from the same exchange. This is convenient, you save time on switching between accounts.

If you already have an account on one of these exchanges, use it. If there is no account, then you should open a new one. This can be done on the exchange’s website. It will take 2-3 minutes, you will only need an email.

Cryptocurrency and exchange trading laws vary between countries. Before opening an account, ensure that you respect the laws of your country.

If the exchange has a referral program, then open an account using a referral link to deduct the fee! Scalpers trade actively, so the fee size is important. Referral links for different exchanges can be found here.

Check out our Cyber Security Guide for Traders.

Then top up your account. We recommend you to start with a small amount, it is not worth transferring a lot of money to the exchange for a beginner! You can top up your account in various ways, read about it on the website of your exchange.

Discover the personal account of the exchange, install the mobile application. You will need a mobile application for insurance. If there are problems on the PC you work on, then you will be able to close the position urgently through the mobile application.

Can you trade professionally using a mobile app? The answer is in the video: CScalp Mobile: is it ever coming? Check it out and see for yourself.

4. Connect CScalp to the Exchange

Download and install CScalp for free according to the instructions (or according to the video How to download and install CScalp). You can get CScalp directly from this form:

Please note that the exchanges are divided into several “internal” platforms. Instruments of a certain type are traded on each platform. For example, on the Moscow Stock Exchange, stocks, futures and currencies are traded in different sections. On cryptocurrency exchanges as well as on stock exchanges.

First of all, scalpers on cryptocurrency exchanges are interested in perpetual futures. Do not confuse perpetual futures with quarterly futures. What are the advantages of perpetual futures? They have the maximum trading activity. The best scalping trades in crypto trading are made with perpetual futures.

However, spot is also important. Cryptocurrencies, tokens, and fiat are traded here. Even if the scalper trades only perpetual futures, trader still “looks” at the spot. In the order book of spots, scalpers usually convert assets (as in an exchange), and trade cryptocurrencies and tokens in the margin trading mode.

Typically, CScalp uses a separate connection for each “internal platforms” (spot, margin trading, perpetual and quarterly futures).

Connect to perpetual futures, to spot (in view mode). CScalp will be connected automatically if trader is launching Binance perpetual futures (video tutorial with text)

After connecting, set the minimum traded amount and train yourself to make orders until you stop getting confused. Here is the instruction.

After you have the first trades, set up a Trader’s Diary. With its help, you will analyze your trading, search for and correct mistakes.

The rates of crypto exchanges are quite complex to understand. The amount of the fee is influenced by many factors: referral program, trading volume, exchange token, maker/taker, etc. Try to understand the example of Binance (detailed article here), the other exchanges have similar rates.

Learn how to convert decimal pricing to money. Try to calculate how many profit points on different instruments you need to take to earn your money back that you spend on the trading fee.

5. Make a configuration of CScalp trading terminal

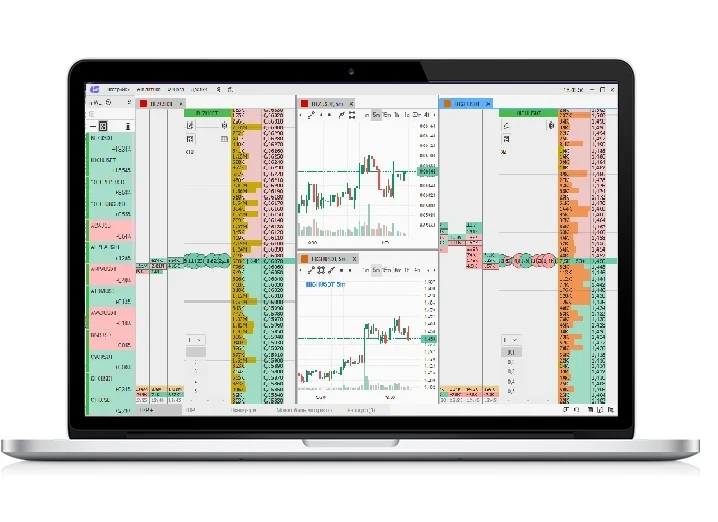

CScalp is your main tool. It’s like a hunter’s rifle. CScalp may seem complicated for the beginners. But when you feel free with the usage of the terminal, you will be satisfied by the simplicity.

Configure the CScalp according to the video Setting CScalp up from scratch (20 min). Video is 20 minutes long, so sit back, relax, grab a cup of coffee/tea and watch it attentively. Watch again the difficult moments, read the instruction manual. Don’t be greedy. You should study your working tool in detail and invest as much time as you need to study.

Learn how to compress an order book according to this article. You will often have to compress or increase it. You will also need to learn how to configure trading amounts. You can see how to set up a trading amount in this video (6 min).

Much interesting in FAQ. Also, study our FAQ, there is so much interesting information which will help you to solve technical matters.

Learn All types of Binance orders from article or video tutorial Binance types of orders (12 min).You need not only be able to set all types of orders, but also to understand the logic of their triggering.

6. Risk management

Before you start to make trades, you need to learn the basics of risk-management in scalping. Remember, if a trader does not know how to manage risks (majority of beginners don’t know how to do it), they will lose money in any case. No matter how the trader understands the market.

Working with risks divided in two parts:

- The understanding how to control them (theory);

- The learning to control them (practice).

For people of certain psychetypes, the second part is too difficult.

Watch the video of How to control risks in scalping (20 min). Take a piece of paper and then following the author calculate the control of the scalping risk manually. Use your own account size for calculations. After you have learned to count manually”, learn to count through a bot.

Learn what slippage is. Slippage could also be if the trading amount is not large (minimum trading amount on each exchange is different). The larger your traded amount, the greater the slippage. If you understand the essence of slippage, you will understand why scalping is limited by the liquidity in the order book.

Test yourself:

What is a daily drawdown?

Why is this a key concept in scalping? Why is it impossible to assess the level of a trader if you only see the results of trading and do not know his drawdown? What daily drawdown will you set for yourself when you start the trading day tomorrow?

Trade’s drawdown?

How to calculate how much money you are ready to lose in each trade? How to understand how many losing trades in a row you can afford today? When calculating the drawdown on a trade, do you use the amount of the taker’s or maker’s fee?

How to calculate the instrument’s amount for a trade?

How quickly can you calculate the amount for a trade if you know where you want to enter and where to put a stop? Do you know how to convert the points of your trading instruments into money “in your mind”?

How does slippage affect risks?

If the price can fly behind the stop by several percent, how can this be taken into account when calculating the working volume for a transaction? Where is the slippage greater: on liquid Finance instruments or on illiquid ones?

7. Basic course

Watch the high-frequency trading video about crypto trading. This is the main part of the course, the largest one. Dive in, look and revise, make a summary.

1st lesson Scalping on Binance. Free course from CScalp: Part 1 (56 min)

2nd lesson Scalping on Binance. Free course from CScalp: Part 2 (75 min)

3rd lesson Scalping on Bnance. Free course from CScalp: part 3 (1 h 13 min)

What to think about in the 1st lesson.

Accumulation area – close position, accumulation area – close position

Scalper’s market is simple: accumulation area – close position, accumulation area – close position. The market for the scalper means an infinite trading zone, situations (Flat market, trend market etc.) and then how to close position considering the situation. The tactics is very simple. Wait for the accumulation zone and make profit when the market moves and leaves its local zone.

Chart + order book + cor

Scalpers make their decisions using three things: the chart, the order book, and using the correlation instrument. Here are three things that you should be able to analyze, to understand the one instrument is not enough to make a trade decision. What is the ideal entry position? You may see an ideal entry position when your method of analysis is based on the three instruments. In fact, this is not always the case.

When everyone sees the same thing, it’s good

Good old-fashioned technical analysis works. Yea-yea, it works. Zones of the support and resistance, triangle patterns etc.

Now it’s a controversial idea, some of the traders don’t agree with it. We consider that when the majority of participants (usually robots (trading bots) trade synchronously with people) see the situation. It may make the situation much easier to take the profit. The breakout of a level will be impulsive if the level is clear for the majority of participants.

What to think about in the 2nd lesson.

The lesson is dedicated to market participants and the analysis of the order book. No matter how strong a trader or a robot is, the actions always leave traces (orders and trades). It is impossible to place a large position unnoticed. If a trader is able to compare an order book, a trades line and clusters, he will be able to understand and predict the actions of other market participants.

Spot market and futures market are “close friends”

Even if a trader only uses futures, the trader still looks at the order book spot and futures markets. The order books are linked by arbitrage bots and correlator bots. Spot and futures affect each other. Where one moves, the other moves in the same way.

Details are really important

If for other traders it’s enough to know that the level is broken out, so for the scalper it’s not enough. Scalper wants to know how the level was broken out. An experienced scalper has seen thousands of broken out levels in his life. By matching the order book, clusters, and trade’s tape, he makes his decision and predicts a breakout or the bounce from a level. And, of course, traders try to make money on it.

Bots aren’t so scary as we think

There are different types of bots. There is no point in competing with the fast ones in terms of speed. If the trader sees what the bot is doing, he tries to follow its steps and make money with it.

After the main part of the course, study additional educational videos:

Trader’s workplace with one monitor (4 min)

What type of order do you need for breakout a huge volume amount? (18 min)

What are “knives” and how to “catch a knife” (10 min)

Robots in order book and their use in scalping (15 min).

8. Mini-course “breakouts trading strategy”

The mini-course “Breakout Trading Strategy” is more complex. Do not start it until you have completed the basic course.

The course is dedicated to breakout (true and false).Scalpers can trade with a big profit using breakout strategies.

1st lesson Breakout Trading Strategy (9 min)

2nd lesson Breakout Trading Strategy (7 min)

3rd lesson Breakout Trading Strategy (9 min)

9. Live streams and masterclasses

Check out our catalogue of master classes and streams from experienced traders. The CScalp team knows each author personally, we are sure that they speak their mind. Think on their ideas, take note of their methods and try to apply those in practice. Some of it will pass you by, some of it will stick.

What is the best video format for learning? Of course, it’s live streams with trading online. Watching live streams is hard, they are long, few deals are made along the way, but that’s trading! Watching a live stream like that is more useful than edited “cuts” from video bloggers (those usually only show profitable deals and cut out the losing ones).

Sergey Danilin: Trading on Binance (1 h 49 min)

Konstantin Akhmetov: Trading on Binance (1 h 18 min)

You can find more master classes on our YouTube channel CScalp.TV.

Study the deal breakdown section: this way, you’ll get a clearer picture of how traders usually find entry points and how they go about their deals.

10. What’s next? Practice!

If you have successfully completed the previous 9 steps, then you are ready for development in scalping better than 99% of beginners. But it’s too early to be happy. There is a long way of self-improvement ahead.

You have a lot of training days ahead of you. Each day will be similar to the previous one as a twin brother. At the beginning, we said that if scalping is not your hobby, it will be boring…

After trades that you’ve made, you gain experience. Your experience will improve your results. However, the trading experience is always different. The experience can be huge or close to zero.

How can i maximize the experience of the trade? Make trades according the algorithm:

1. Choose the situation (think clearly: what is the reason? what is the risk?);

2. Make trade (entry/exit);

3. Write a detailed comment in the diary;

4. Come back in time and analyze your actions.

Traders often miss points 3 and 4. I made a trade, looked at the result, forgot and “ran on”. You grow slow, because of it.

It is good if you record your trades. Then you can review both profitable and unprofitable trades for analysis. The benefits of this exercise can hardly be overestimated. You will study faster.

When you get your first results, start gradually increasing your trading amount. Where is the limit? Someone stops at earning $1,000 a month, someone goes further. It’s all by your own choice.

Happy profits guys!

P.S.: we try to update the course regularly. Don’t be surprised if something changes when you visit this page next time.