BINANCE TYPES OF ORDERS

Date of update: 16.08.2023

Binance and Binance-Futures have market, limit and some types of stop orders (stop limit and stop market). You’d better know how to use these types of orders in order to trade well.

In this article we will review the orders which are implemented in CScalp terminal, so there is a Binance exchange markets an example of using such types of order.

We have prepared a video version of this article for those who prefer video to text.

Limit Order

Limit order is the most common and widespread trading order in CScalp trading platform and on Binance exchange market as well.

A Limit Order — is an order that you place on the order book with a specific buying or selling limit price.

If the trader places the limit order in the order book, this type of order can be executed instantly (depending on the price action) or it will be placed in the order’s book queue.

Limit orders are completely anonymous, but the price and its amount are visible to everyone. So when you place a limit order, the trade will only be executed if the market price reaches your limit price.The limit placed order will be triggered only in that case.

Traders can remove limit order until it will be filled.

Advantages: Order will be filled by the price you’ve placed.

Disadvantages: Filling of the order isn’t guaranteed. “Limit order” – is the passive order, if the market has better offers on the market, the order may be partially fulfilled or not fulfilled at all.

95% of orders which are placed by professional traders are the limit orders. Most of the scalpers trade just limit orders, other orders they may not use at all. We strongly recommend to the new traders to use “stop-orders” (stop loss) for the minimizing losses.

Pay attention! CScalp sends limit orders on the Binance exchange so that orders will be placed on the market server automatically. That is why if you have connection problems, or you’ve closed the terminal by accident, all the orders you’d placed before will be still active and will be fulfilled if the price reaches your order.

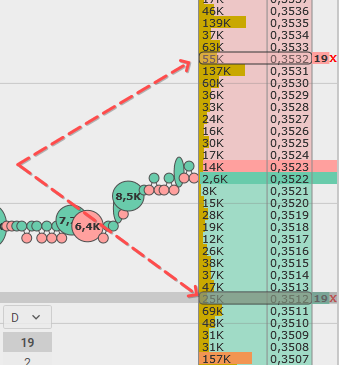

For example, there are two placed limit orders BTC/USDT sized 0.001. Sell-limit order is placed on the top of the order’s book in the sellers’ zone (the red zone). Buy-limit order is placed in the bottom of the order’s book in the buyers’ zone (the green zone).

If we place buy-limit order in the sellers’ zone, this order will be fulfilled. You will buy it at the best price. The order is considered to be filled if the price which is placed in the limit order has already been requested by the market.

Important! CScalp features the simultaneous cancelation of limit orders on Binance. Hotkeys to simultaneously cancel all orders (by default):

“Space“: Cancels exchange orders throughout the entire application.

“F“: Cancels exchange orders in one order book.

Market order

The Market order – is the simplest order but also one of the most unsafe for the newcomers.

The market order — is a type of order to buy instantly or sell at the best available price.

If the order book contains limit orders of the participants, if the trading instrument has a huge 24h volume, then your order will be executed instantly with minimal slippage.

The Market order ensures the trade, however a trader won’t be able to be executed at the current price of it. The market order will be completed at the best price, but such price can be changed for a split second.

Advantages: The market order is executed securely (If the order book contains trading orders).

Disadvantages: The main minus of the market order is the process of slippage.

Slippage – means the deal completed for the unfavorable price while the best price is proposed by the orders book at the moment of an offered order.

The slippage most frequently happens, when a trader works with a big amount of an instrument. In this case the market order will be completed in different prices executing the best prices in orders book. The slippage the lowest overall happens on the volatile market, when orders book’s been set up the empty trade spots by the major traders.

Hot Keys for the Binance market orders:

- Close Position at market price;

- Buy/Sell at Market price;

- Reverse the position.

Notes: CScalp creates Binance Market order as a limit order artificially. When the trader places market order, CScalp creates limit order on the bottom of the red zone or on the top of the green zone simultaneously (depending on your need, also you can set it up). It’s invisible to the trader.

Stop-Order

Stop – orders will be executed only if all terms of the order are completed.

CScalp orders on Binance can be divided into two types of categories: closing position or not-related to the opened position.

Closing positions of stop orders – basically it’s called stop-loss and take-profit. There is no trading amount setting in the related order because in the beginning of the placing order the amount will be set automatically. That works for the trader, because it doesn’t take time to set up the amount. For example, the position for 17 lots is opened, meaning that stop-loss or take-profit will close the entire position.

Not-related stop-orders (Limit stop-orders).

There are 4 types of limit stop-orders on Binance exchange: buy-stop, sell-stop, buy-limit and sell-limit. These orders are placed in the CScalp by the trader, and they are not related to the open position.

Other traders won’t be able to see your stop orders, because they are not visible in the orders book until it will be fulfilled.

Let’s figure it out, these types of orders.

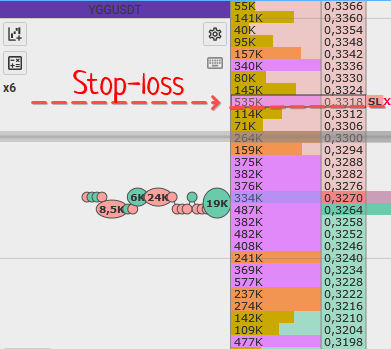

Stop-loss

Stop-loss is the type of order to close position. The main purpose of such order is to minimize your losses.

Stop-loss can be placed only under the condition of the currently opened position. Stop-loss can be placed on the market exchange servers as well as in the CScalp terminal. The position of the order depends on the settings. Stop-loss is placed in the CScalp terminal by default.

If stop-loss is placed on the market exchange servers, operation will be closed by market orderwhen the order is called. The position will certainly be closed.

If stop-loss is placed in the CScalp terminal, the terminal will close your position by the limit order. Limit order will be sent on the edge of the orders book, thereafter your position will be closed immediately.

To set the Stop-Loss, hover the cursor over the order book and hold down the hotkey C (default). The message “Stop-Loss/Take-Profit” will be shown at the bottom of the order book (you should enable the SL/TP setup mode). Do the left click on the price at which the closing order will be triggered.

Pay attention: Stop-loss placed in CScalp terminal will be taken off in case of the connection problems or terminal’s shut down. Stop-loss opened in the market servers will be activated and is ready to be executed even in case of the connection problems or terminal’s shut down. Pay attention please! If the trader wants to leave a workplace and keep the position opened, you would be better to use the market exchange stop-loss.

Pay attention: Both stop-loss and take profit don’t even exist without an opened position. If the position has been closed by the trader, thereafter stop-loss and take-profit will be taken off automatically.

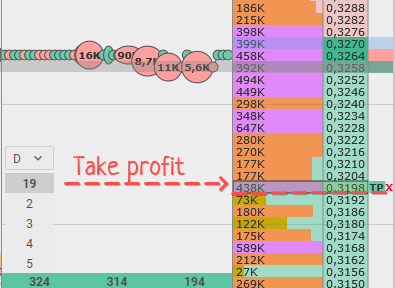

Take-profit

Take-Profit limit order can be a useful tool to lock in profit at specified price levels and related to the opened position.

Take-profit can be placed if you have a current open position. Take-profit may be placed on the market serves as well as in CScalp Terminal. The position of the order depends on the settings. Take-Profit is placed in the CScalp terminal by default.

If take-profit is placed on the market exchange servers, meaning that operation will be closed by market order when the order is called. The position will certainly be closed.

If take-profit is placed in the CScalp terminal, that means the terminal will close your position by the limit order. Limit order will be sent on the edge of the orders book, thereafter your position will be closed immediately.

In order to set the Take-Profit, hover the cursor over the order book and hold down the hotkey C(by default). The message “Stop-Loss/Take-Profit” will be shown at the bottom of the order book (if you turn on the SL/TP setup mode). Do the left-click on the price at which the order will be triggered to close the position.

Pay attention: Take-profit placed in CScalp terminal will be taken off in case of the connection problems or terminals shut down. Take-profit opened in the market servers will be activated and is ready to be executed even in case of the connection problems or terminals shut down. Pay attention please! If the trader wants to leave a workplace and keep the position opened, you would be better to use the market exchange take-profit.

Pay attention: Both stop-loss and take profit don’t even exist without an opened position. If the position has been closed by the trader, thereafter stop-loss and take-profit will be taken off automatically.

Limit stop-orders

Not related to the position Binance stop-orders (limit stop-orders) divided into 4 types:

- buy-stop buying order placed in the seller’s zone (making a buy if the price is going up in specified level);

- sell-stop – selling order placed in the buyer’s zone (making a sell if the price is falling in specified level);

- buy-limit – buying order placed in the buyer’s zone (making a buy if the price is falling in specified level);

- sell-limit – selling order placed in the seller’s zone (making a sell if the price is going up in specified level).

Limit stop-orders are outlined on the market exchange servers and can be fulfilled if occurs under the condition of the specified price. If the orders on the orders book reach the limit stop-order level, but there are not any trade, therefore the limit stop-orders will not execute.

In order to place a limit stop-order, hover the mouse over the order book and hold down the hotkey V (default). The message “Stop order” will be shown at the bottom of the order book (if you turn on the stop order setting mode). Click on the price using the left or right mouse button, at which the deferred order should be triggered.

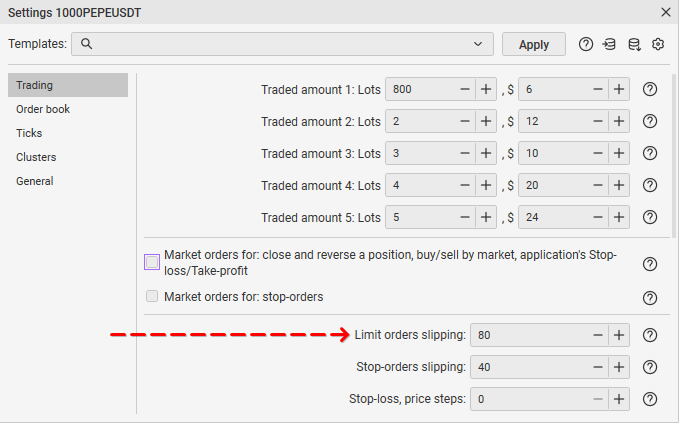

In the implementation, limit stop-order will be transformed to the limit order. These such of orders are implemented by the price of the limit stop-order, with “the limit and stop orders slipping”. Settings of the limit and the stop orders slipping adjusted by default (by 0). This means limit stop-order will be transformed to the limit order and will be implemented as the market order.

Limit and stop orders slipping referred to the step price. That means, if the step price is 1 cent, a limit order will be placed by the “deferred” price plus and 1 cent. Scaling of orders book doesn’t affect this parameter.

Pay attention: In case of any connection problem or quitting CScalp, limit stop-orders will be implemented because they placed on the market exchange servers.

Important! CScalp features the simultaneous cancelation of limit stop-orders on Binance. Hotkeys to simultaneously cancel all orders (by default):

“RightAlt“: Cancels stop orders throughout the entire application.

“B“: Cancels stop orders in one order book.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT