Spot trading crypto course: understanding the spot market to trade cryptocurrencies

The CScalp team has prepared a free Spot trading crypto course. The educational program consists of eight videos – from an introduction to the Spot market to choosing a trading style and making the first trades on the exchange. The course is aimed at beginner traders. Its goal is to help newcomers take their first steps in trading, grasp basic terminology, and learn to work on the cryptocurrency Spot market exchange through the CScalp trading terminal.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

About the Free Spot Trading Crypto Course

The Spot trading crypto course is based on the Binance cryptocurrency exchange. Since the mechanics of the Spot market on crypto exchanges are universal, the course program will be suitable for traders using Bybit, OKX, HTX, and other platforms.

The practical part of the course is based on the Binance web terminal and the CScalp free professional trading terminal. To get CScalp, leave your email in the form below. You will receive an email with the installation file and license key.

Note that the CScalp license is distributed for free. There are no in-app purchases or subscriptions. Instructions for launching the terminal can be found here: “How to Download and Install CScalp.“

Open an Account on the Exchange

The Spot trading course consists of theoretical and practical parts. To start trading, register on a cryptocurrency exchange. You can open an account through the CScalp team’s referral link to receive a welcome bonus from the exchange.

Click the link to register an account through the referral link:

- Up to 20% Discount on Binance Trading Fees

- Up to $30,000 Bonus on Bybit

- 20% Discount on OKX Trading Fees

More details about the conditions for receiving bonuses can be found in the articles “Bybit Referral Code,” “OKX Referral Link,” and “Binance Referral Code.”

Lesson 1. Introduction to Spot Trading

The first video of the course is dedicated to the theory of trading on the Spot market. The professional trader explains how Spot trading works and how to trade on the Spot in long and short positions without borrowed funds. The author also demonstrates how to track Spot trades in the CScalp terminal.

The Spot market is where cryptocurrencies are bought and sold. For example, in Spot trading, you buy Bitcoin (BTC) for USDT or sell Ethereum (ETH) for USDT. Spot trading in its purest form implies trading with your own funds.

Some cryptocurrency exchanges offer margin trading on the Spot market. In margin mode, you can borrow funds from the exchange to open short or long positions. Typically, margin borrowing is used for short trading. In this course, we consider “pure” Spot trading without the use of borrowed funds.

The Spot market is significantly different from the futures market. Futures are derivative instruments tied to the price of a particular underlying asset, such as BTC. When trading futures, we are not buying or selling cryptocurrency itself. We are betting on whether the cryptocurrency price will rise (long) or fall (short). To learn more, consult our free futures trading course.

In Spot trading, trading without borrowed funds in long and short positions is conditional. In fact, when buying or selling cryptocurrency, you do not open a position. The “long” and “short” directions exist in our minds. Buying cryptocurrency means opening a long position. Selling cryptocurrency to buy it back after a price drop means opening a short position. For the exchange, our actions do not appear as opening or closing a position.

Lesson 2. How to Complete Verification and Deposit Funds on the Exchange

The second video of the course focuses on formal aspects. The trader explains how to open an account on the exchange, why verification is necessary, and how to deposit funds to the exchange balance via blockchain transfer and through the P2P market.

The video covers how to open and deposit funds to an account on the Binance exchange. This procedure is similar on other trading platforms.

Remember that without identity verification, you cannot deposit funds and start trading on most major cryptocurrency exchanges, including Bybit, OKX, and Binance.

Lesson 3. How to Work in the Exchange’s Web Terminal

The third lesson of the free Spot trading crypto course is dedicated to exploring the Binance web terminal. The trader explains what trading and analytical options for Spot market trading the exchange offers.

A web terminal is a trading interface integrated into the exchange’s official website. A web terminal is available on any cryptocurrency platform, including Binance, Bybit, OKX, HTX, BingX, Bitget, etc. Exchanges offer a universal trading workspace with a basic set of functions.

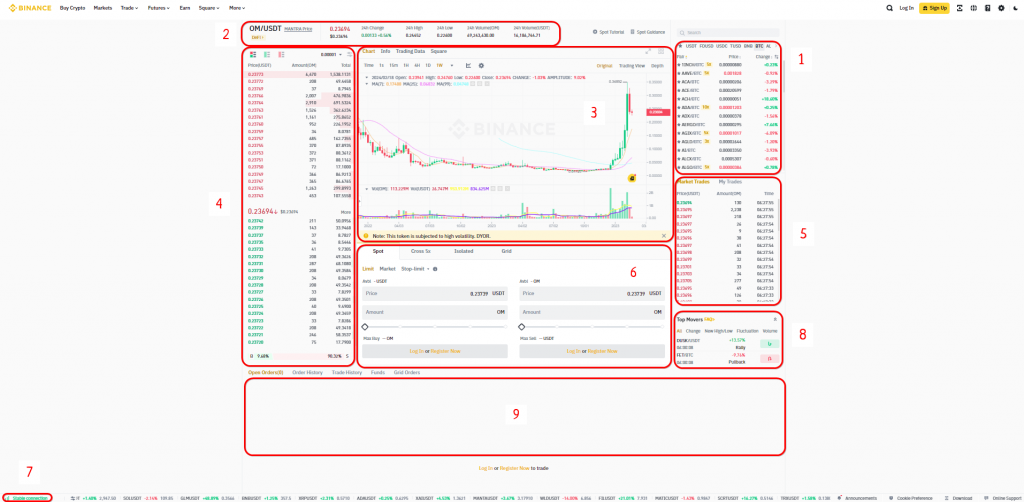

Conditionally, the workspace can be divided into nine zones (see screenshot). In the center is the instrument chart (3). To the right, you will find the windows for selecting a cryptocurrency pair with price dynamics (1) and trade history (5). To the left is the order book (4). Below is the order placement module (6). In the video of the free spot trading course, a professional trader thoroughly explains all the zones of the web terminal workspace in the video.

Typically, web terminals of different exchanges are identical to each other in trading and analytical tools. Only cosmetic differences are possible. The feature of a web terminal is that it is available to the trader immediately after registration. It is intuitive, universal, and offers all the basic functions: you can analyze the chart and order book, as well as place an order to buy or sell cryptocurrency.

A web terminal is a tool to make the first steps on the exchange when a novice is still unfamiliar with the interface and market mechanics. But this is a starting tool. Traders who work on the exchange full-time trade through specialized trading terminals. For example, scalpers and intraday traders use scalping terminals (CScalp, TigerTrade, EasyScalp), swing traders use platforms for medium-term trading (ATAS, QuanTower), algo traders use terminals that allow creating, testing, and launching bots (3commas, Moonbot), and so on.

Learn more about different crypto trading terminals.

Lesson 4. How to Make the First Trade on the Spot Market

The fourth video of the Spot trading crypto course is dedicated to making the first trade on the exchange. The professional trader explains how to place buy and sell orders for cryptocurrencies through the exchange’s web terminal and the CScalp terminal.

You can buy and sell cryptocurrency with limit or market orders. Let’s look at the difference. When placing a limit order, you set the execution price and order volume (amount of coins) yourself. When using a market order, you only specify the volume – after placing the order, it is executed at the best current market price. Typically, traders use limit orders to avoid slippage. By placing a limit order, traders know that the order will be executed at the price they set.

Placing orders in the exchange’s web terminal is intuitive: go to the trading module, choose the direction of the trade, order type, enter the amount (for limit orders), and volume. Click the button and the order is placed.

The CScalp free professional trading terminal interface is optimized for one-click trading. Sometimes, it can be difficult for beginners to understand what needs to be done to place an order. In the video lesson, the trader thoroughly explains how limit and market orders can be placed in the web terminal and CScalp. We have also prepared material on How to Make Your First Trade in CScalp.

Lesson 5. How to Choose an Approach to Trading on the Spot Market

The fifth video of the course is devoted to analyzing various trading approaches. The professional trader discusses the characteristics of short-term and medium-term strategies and explains why they prefer scalping and intraday positional trading.

Choosing an approach to trading is a key moment at the beginning of your journey on the exchange. “From the outside,” trading is homogeneous: you buy, sell, and earn. “Inside,” everything is a bit more complicated. Conditionally, short-term strategies (scalping, intraday trading), medium-term strategies (swing trading), and long-term strategies (closer to investing) can be distinguished.

Approaches to trading differ in several aspects: choice of timeframes, frequency of trading, frequency and volume of transactions, set of analytical tools, etc. For example, scalpers trade on the exchange every day, conducting about 10 trades (some less, some more) within a day. Positions are not held overnight: open today, close today.

Scalpers operate on lower time frames (from 1m to 1D) because they work on short-term price movements up or down. Their tool set includes the order book, trade history, and clusters. Additionally, they analyze charts with volume indicators. Classical technical indicators – RSI, MACD, Fibonacci, etc. – are used much less frequently by scalpers than by medium-term traders. This is because all indicators work on historical data and can generate a lot of useless noise in lower time frames.

The world of a medium-term trader looks different – trades are less frequent, deposits are larger, and charts and technical indicators take precedence over the order book and trade history.

Lesson 6. How to Start Working in CScalp

The sixth video of the Spot trading crypto course is dedicated to getting started with CScalp. The trader shows how to download, install, and connect the terminal to the exchange. He explains how to properly configure the terminal for trading on the Spot market and repeats how to place limit and market orders to buy and sell cryptocurrencies.

Watch the video carefully and understand the specifics of terminal configuration. If you plan to make trading a source of steady income, the terminal will become your main tool. Learn to engage with it. The quality of your work depends on it.

Remember how to place limit and market orders to buy and sell. Initially, it may feel unfamiliar, but over time, you will get used to it. Start trading with small working volumes to minimize risks and losses at the beginning of your trading journey.

Lesson 7. How to Work with Risks

In the seventh video, the trader talks about managing risks in the Spot market. In this video, you will learn about daily drawdown, the cognitive biases traders face in trading, and why and how to conduct risk management.

Effective risk management is the foundation upon which traders build their trading strategy. Without risk management, nothing will work. No matter how talented novice traders may be or how much profit they make, without risk management, their accounts will become empty (if they don’t stop in time).

In the video lesson, the professional trader mentions that learning to trade can only be achieved by going through certain psychological tests by the market and undergoing trials by market phase changes. This takes time. The task for beginners is to make this learning period as cost-effective as possible.

All traders sometimes experience losses and this is normal. Even professionals make mistakes: they can close individual trades and entire trading sessions at a loss. To avoid depleting the account due to a series of losing trades, a strict and well-structured risk management approach is needed.

In scalping and intraday trading, risk management involves setting an acceptable drawdown (loss level) per trade, per day, per week, and per month. Limiting risks allows you to preserve your account even during a long losing streak.

Let’s explore risk management using an example. You are a beginner trader and entered the market with a $5,000 deposit. Opening trades immediately with $5,000 or even $1,000 is a bad decision. You don’t know anything yet, and you will likely lose funds within a week. To avoid this, plan an acceptable drawdown and your trading schedule.

You decide that $500 is the amount you are willing to risk over the course of a month. You will trade for 20 days a month with a 5/2 schedule. You divide $500 by 20 and get $25 per day. You assume that you will not conduct more than 10 trades per day. Then the drawdown per trade is $2.5.

In summary, if your position incurs a $2.5 drawdown, you close it. If you lose $25 during the day, you close the terminal and take a break. The workday is over.

In theory, this sounds easy. In practice, beginners may succumb to uncontrolled trading due to emotional impulses. It will be almost impossible to restrain yourself and stop. Therefore, the daily drawdown amount should be small enough that its loss does not evoke strong emotions.

Lesson 8. How to Identify Trading Opportunities

In the final video of the Spot trading crypto course, the trader explains how to identify trading opportunities. The analysis of the order book, trade history, clusters, charts, and indicators is considered. Additionally, the trader explains how to identify trading opportunities using cryptocurrency screeners and signals.

The order book is the main tool for scalpers. It shows limit orders for buying and selling an instrument. In the order book, you can analyze densities and identify at which price level there are more buyers or sellers.

Market orders for the instrument pass through the transaction tape. The transaction tape allows you to quickly assess how actively trading is occurring for the instrument and which orders are more prevalent – buy or sell orders. Clusters show historical data and allow you to “look inside” each candle.

In addition to terminal analytical tools, the professional trader also explained how cryptocurrency screeners work. The screener operation is demonstrated using TradersDiaries.com as an example – an online trading journal for storing and analyzing trading history that integrates a cryptocurrency futures screener. With the TradersDiaries.com screener, you can track the price dynamics of perpetual futures on Bybit, OKX, and Binance. Since futures prices are tied to the prices of underlying assets (cryptocurrencies on the Spot market), the screener can also be used to analyze the dynamics of cryptocurrency prices on the Spot market.

Learn more in our article about the free crypto screener.

Additionally, the last lesson of the free Spot trading crypto course covers the analysis of free trading signals. To receive crypto signals, join the CScalp’s Discord server.

Trading signals are market indicators. It is unnecessary (and even harmful) to blindly follow every signal that comes your way. If you see a promising signal, open the instrument chart, analyze it, and draw your own conclusions about the signal author’s idea. Analyzing signals, including historical ones, allows for a better understanding of how the market works in the short term, how to correctly analyze price movements, and what mistakes traders often make.

What’s Next?

After completing the free Spot trading crypto course, explore other educational programs from the CScalp team: the Free Cryptocurrency Scalping Course and the Free Futures Trading Course.

CScalp terminal is the main working tool for active traders. In the terminal, they analyze the market and trade. Other tools – signals, screeners, and indicators – are supporting tools. The quality of trading depends on how well you know the terminal and how proficient you are in working with it. To thoroughly understand CScalp, study the technical instructions in the Help Center.

We also invite you to subscribe to the CScalp team’s YouTube channel. The channel regularly features educational materials, hosts streams with professional traders, and releases market reviews.

Remember, the best learning is regular practice. Good luck!

Related article: What Is Spot Trading in Crypto: A Beginner’s Guide to Understanding the Basics

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT