Free Futures Trading Course for Beginners: Explore How to Trade Futures with CScalp

The CScalp team has prepared a free futures trading course focused on how to trade futures on cryptocurrency exchanges. The course is aimed at beginner traders and consists of eight videos. The goal of this course is to introduce novice traders to the basic concepts of futures trading, leading them to their first meaningful trades on crypto exchanges.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

About the Free Futures Trading Course

The free futures trading course by the CScalp team is designed for beginners in the cryptocurrency market. Throughout the videos, you will watch an active trader explain what futures trading is, how to trade futures (long and short positions), how to use leverage and different margin modes, how to identify trading opportunities, and what trading strategies can be applied.

The free futures trading course shows the Bybit exchange as an example. The mechanics of futures trading on cryptocurrency exchanges are similar. Therefore, the course is suitable for traders trading on Binance, Bybit, OKX, HTX (Huobi), and other exchanges.

The practical part of the futures trading course is based on the CScalp trading terminal. It is a free terminal for scalping and intraday trading. CScalp works with Binance, Bybit, OKX, HTX, and other cryptocurrency exchanges.

The CScalp license is distributed for free. To start using the terminal, leave your email in the form below. You will receive an email with the installation file and a license key.

Futures Trading Course: Open an Account on Bybit

If you don’t have an account on Bybit yet, register on the exchange through the CScalp team’s Bybit referral link. Registering through a referral link allows you to receive a welcome bonus from Bybit of up to $30,000.

More information on how to get a welcome bonus from the exchange can be found in our “Bybit Referral Code” article.

Lesson 1. Basics of Futures Trading

The first video of the course is called “Learn the Basics of Futures Trading.” In this introductory lesson, the trader explains what futures in cryptocurrency are and examines the key differences between futures contracts and perpetual contracts.

Futures is a trading instrument based on some underlying asset. On Bybit and other cryptocurrency exchanges, the underlying asset is cryptocurrency.

BTC/USDT (Bitcoin / USDT) futures are shown on the Bybit exchange

Bybit offers both futures contracts with expiration dates and perpetual futures contracts.

Futures Contracts with Expiration Dates

These contracts have a specific date when the contract is settled. Futures contracts with expiration dates are divided into settlement and delivery contracts. If it’s a settlement contract, then on the expiration date, the contract is automatically settled for its value (for example, in USDT). If it’s a delivery contract, on “day X,” the contract is settled for the underlying asset (the amount of assets received is specified in the contract rules).

Perpetual Futures

Perpetual futures contracts do not have an expiration date. A position in a perpetual contract can be held indefinitely (of course, unless liquidated). Such contracts are the most sought-after instrument for active traders on cryptocurrency exchanges. Perpetual futures contracts are traded on Bybit, Binance, OKX, HTX, and other cryptocurrency platforms.

Lesson 2. Perpetual Futures Trading

In the second video of the futures trading course, we delve into perpetual futures. The trader explains the types of contracts available for trading on Bybit.

Types of Futures Available on Bybit

- Perpetual USDT futures: The “classic” on the cryptocurrency market. Such contracts are traded on Bybit, Binance, OKX, Huobi, and most other platforms. Settlements are in USDT (Tether). Bybit offers trading with over 100 USDT contracts.

- Perpetual USDC futures and USDC futures: These futures are structured similarly to USDT contracts, but settled in the USDC stablecoin.

- Perpetual futures and inverse futures: These contracts are traded in the underlying cryptocurrency, but the price is quoted in USD. The margin is deposited in the base asset of the futures contract. For example, to trade an inverse BTCUSD (Bitcoin / USD) contract, you need to have Bitcoin in your account. All settlements are also conducted in BTC.

The trading rules for futures on Bybit depend on the type of account the trader has. In a Unified Trading Account (UTA), you can use any cryptocurrency to collateralize a futures position, not just USDT or USDC.

Lesson 3. How to Trade Long and Short

In the third lesson, the trader explains how to open long positions and how to sell futures short. The mechanics of trading are illustrated using the CScalp free trading terminal.

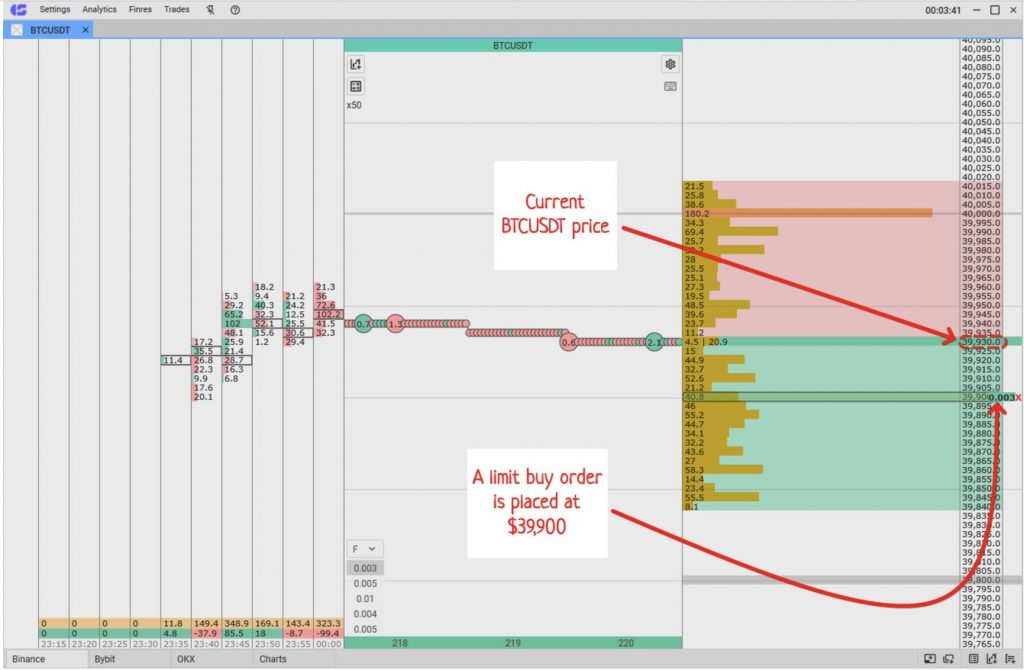

How to Open a Position with CScalp

Positions in CScalp can be opened with a single click, so working volumes are configured in advance. To buy (open a long position), click the left mouse button (LMB) on the desired price in the green zone (limit order) or in the red zone (market order).

A limit order to buy BTCUSDT is placed in the CScalp terminal

Selling (short position) is done with a right mouse button (RMB) click. Click RMB in the green zone to open a position with a limit order. In the red zone, to open a position with a market order.

Detailed instructions on placing orders in CScalp can be found in the article “How to Make Your First Trade in CScalp.”

In addition to using limit and market orders when trading on Bybit through CScalp, it is possible to place Stop-Loss and Take-Profit orders.

Lesson 4. How to Choose Margin Modes

The fourth lesson of the futures trading course focuses on margin modes available on Bybit and other cryptocurrency exchanges. The trader explains how to trade futures on Bybit in cross-margin and isolated-margin modes.

Margin trading is an option that allows trading cryptocurrencies using borrowed assets. The term “margin” has also extended to the futures market. Margin refers to the collateral you deposit when opening positions with leverage.

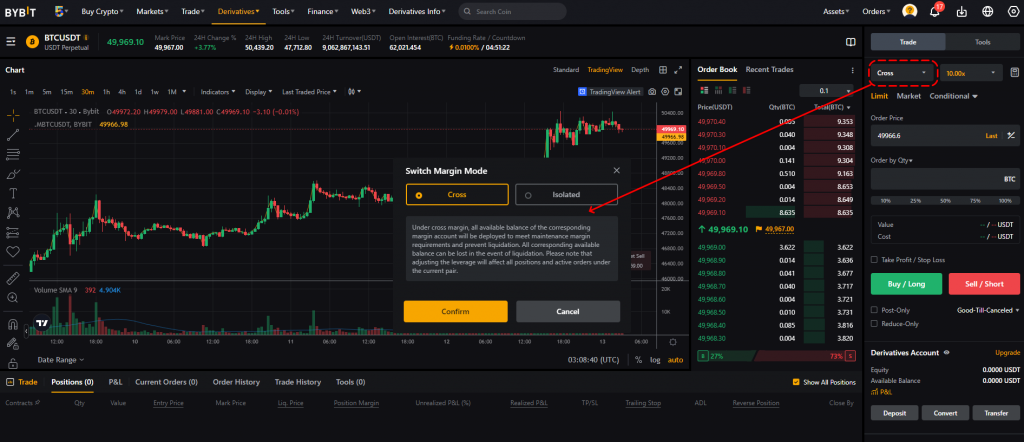

Bybit margin modes

Important! Isolated margin is a safer trading option, suitable for beginners. Cross-margin requires more skills in market assessment and risk management.

Two Margin Trading Modes

On cryptocurrency exchanges, you can use two modes of futures trading:

- Cross-margin: all assets placed in the account are utilized. For example, if you have an open position with a current loss of $10, the system will take these funds from other positions or free funds in the account to cover the loss and support the position.

- Isolated margin: Each position has its own margin balance. The exchange only considers the collateral you have deposited for the position.

A special feature of the Unified Trading Account Bybit is the “Portfolio Margin” mode. In this mode, the available margin is calculated taking into account the entire portfolio, including assets not used in positions. Additionally, in “Portfolio Margin” mode, positions can be hedged using derivatives and Spot pairs.

Lesson 5. How to Use Leverage in Trading

The fifth part of the course is dedicated to trading with leverage. The trader explains what leverage is and how to adjust it in the CScalp terminal. He also analyses the examples of leveraged trades.

Leverage is a tool for increasing the size of a position. It artificially amplifies your position, allowing us to exponentially increase potential profits.

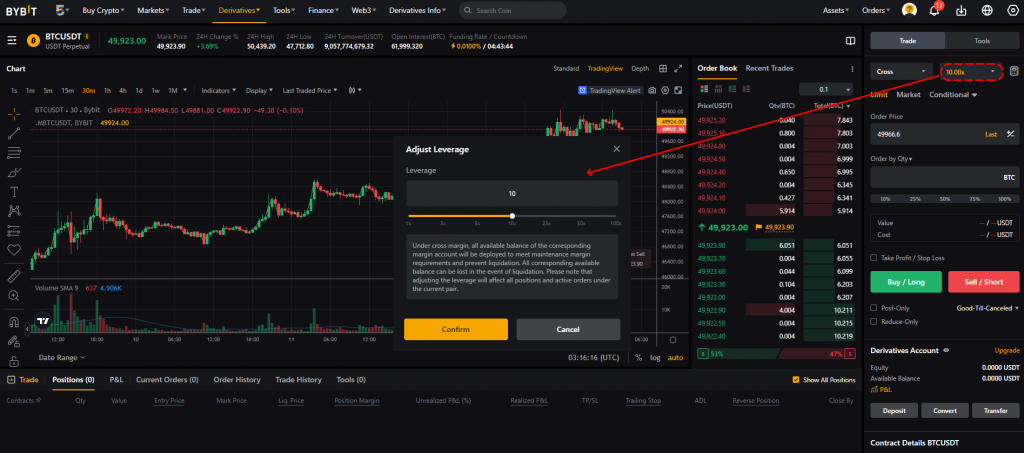

Leverage toggle switch on the Bybit exchange

Trading with Leverage: Example

Let’s look into an example. You want to open a $100 position. If you use 2x leverage, the size of the position will double to $200. If you use 5x leverage, it will increase fivefold to $500. Each instrument has its own maximum leverage ratio, and the size of leverage also depends on the specific exchange.

The “trick” of leverage is the ability to quickly boost your deposit. It allows you to trade with more funds than you actually have, which is why active traders often use it. However, it’s important to consider that leverage also exponentially increases potential losses. Therefore, it’s crucial to use leverage carefully and with a clear head. In the video above, the trader discusses what leverage can be considered optimal for futures trading.

How to Adjust Leverage on a Crypto Exchange

Leverage is adjusted on the exchange website. In the Bybit web interface, you open the futures section and set the leverage parameters (as shown in the screenshot above). Now you can switch to the terminal for trading with leverage. When you open a position for an amount greater than what you have, leverage will automatically come into effect.

For instance, if you have $100 in your account, and you open a $300 position, the terminal will automatically apply 3x leverage on the exchange. To avoid confusion in calculations, you can pre-set working volumes in dollars in the CScalp trading terminal, with or without leverage.

Lesson 6. How to Manage Risks in Futures Trading

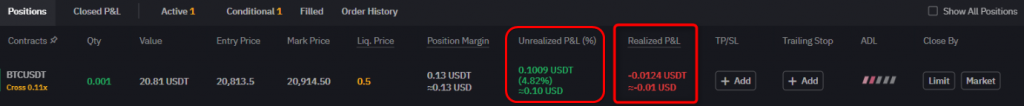

The sixth lesson of the futures trading course focuses on risk management in futures trading. The trader explains what liquidation is and how to avoid it, as well as how to properly calculate profits and losses on a position.

The main risk in futures trading is incorrectly predicting price movements. If the market moves against your position, and you fail to close it in time (even at a loss), your margin may be “burned,” resulting in liquidation. During liquidation, the position is closed at a loss, and you lose all funds allocated as collateral.

A position’s Profit and Loss (P&L) on Bybit exchange

Liquidation Example

Liquidation happens when you no longer have funds to support the position. For example, if you open a position with 5x leverage and deposit $10. The position size is $50, and our share in it is 20%. If the position declines, our collateral will be “burned” first. With 5x leverage, the position will “survive” until the drawdown exceeds 20%. If the loss reaches 20% and we haven’t added additional margin, the exchange will close the position and fix our loss at $10.

Experienced traders know that risk-free trading is impossible when learning how to trade futures. To profit from futures, you need to learn to control and minimize risks. More information about risk management can be found in our “Risk Management in Trading” guide.

Lesson 7. How to Identify Trading Opportunities

In the seventh lesson, the trader explains how and where to identify opportunities for profitable trades. He also explains when one should trade and when it’s better to refrain from opening a position.

It’s not necessary to wander around the exchange in search of a trade. This is a lengthy process. You can select trading opportunities using an algorithm that allows filtering out unnecessary information and focus on promising instruments.

Free cryptocurrency screener by CScalp

Free Crypto Screener by CScalp

The first step is to analyze data in a cryptocurrency screener. Screeners allow you to quickly find futures with high volatility and large trading volumes. For scalpers, such contracts are the most favorable. Higher volumes mean higher liquidity. And greater volatility provides more trading opportunities.

Some screeners show when funding will occur for contracts. Such an option is available in the CScalp free crypto screener. You can try out the screener here.

How to Analyze Charts

Next, analyze the charts of selected contracts. You can view volumes using the “LazyScalp Board” indicator on TradingView. Your goal is to assess the likelihood of a rebound/breakout, sharp dynamics, and increased volatility.

Use Free Trading Signals

Trading opportunities can be identified using trading signals. A signal is not a guarantee of a profitable trade. Rather, it’s an indicator that helps understand where other traders are looking and what they have noticed. Signal data can be added to the information collected using the screener and charts.

In the course, the trader examines examples of signals from CScalp’s Discord server and Telegram channel. Learn more about “Free trading signals” by CScalp.

Lesson 8. Futures Trading Strategies

The final video of the free futures trading course is dedicated to futures trading strategies. The trader explains breakout and rebound trading strategies.

How to Identify Support and Resistance Levels

Both futures trading strategies are based on the principle of “the simpler, the better.” To trade breakouts and rebounds, you don’t need to use complex indicators and make long calculations. It’s enough to analyze the chart and identify support and resistance levels.

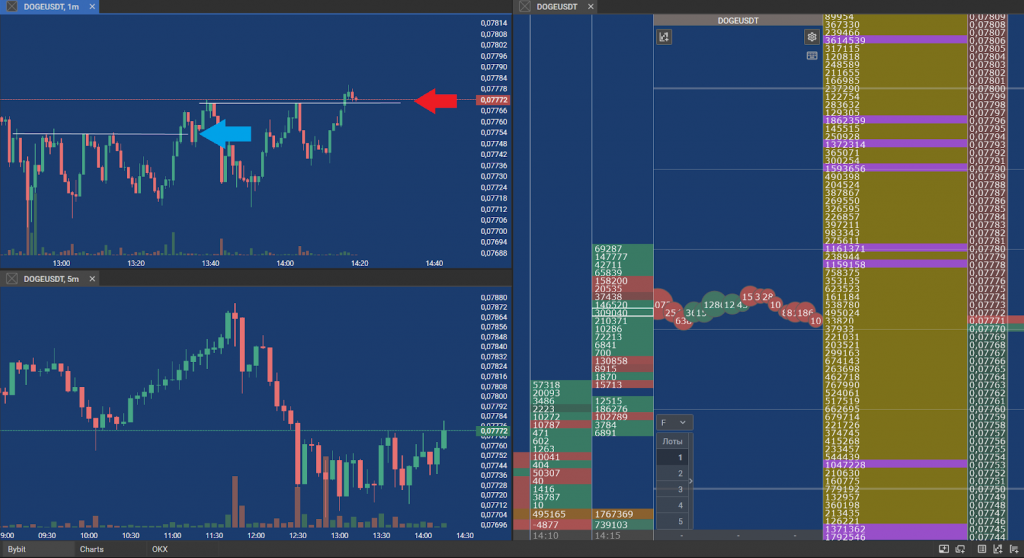

Support and resistance levels are marked on the chart in the CScalp terminal

The Easiest Futures Trading Strategy

The easiest futures trading strategy can be executed if the chart shows an obvious level and “touches” it at least three times. The setup should be clear to the market. It’s important to choose “hot” coins with high trading volumes.

Wait for the moment when the candlestick chart attempts to break the level. A signal for a breakout could be an “active” order book. You open the corresponding position: long if the resistance is broken, and short if the support level is broken.

After the level is broken, you can expect a rebound. This is a situation where a sharply rising/falling price hits the order book density. Look for density in the order book. For the bounce to work, the density should be at least $300,000 and be located outside our level.

More about the art of scalping strategies can be found in our Cryptocurrency Scalping Strategies article.

Futures Trading Course: What’s Next?

After completing the course, don’t stop learning. Always continue your education. Familiarize yourself with our main educational program: Free Cryptocurrency Scalping Course.

The order book is the main tool for scalpers and intraday traders. Therefore, we pay more attention to it.

Professional traders regularly host streams on the CScalp YouTube channel. You can also find educational materials as well as market overview briefings. Subscribe today to stay updated on newly released videos and further your crypto trading education.

Related article: What Is the Futures Market: Learn Trading Futures Contracts with CScalp

FAQs: Frequently Asked Questions about Futures Trading Courses

How Can Beginners Learn to Trade Futures, and What Futures Trading Courses or Tutorials Are Available?

Beginners interested in futures trading can start by exploring courses on free platforms like CScalp or through educational content provided by Udemy, CME Group, and Tradepro Academy. These resources offer comprehensive insights into trading futures, including market trading mechanisms, trading strategy development, and technical analysis. Social media, blogs, and news outlets RSS feed also serve as valuable platforms for continuous learning and updates. Do not forget to also watch a weekly webinar on CScalp’s YouTube channel.

Can You Explain the Importance of Technical Analysis and Trading Strategies in Crypto Futures Trading?

Technical analysis is crucial in understanding market trends and price movements by examining past market data, including price and volume. Trading strategies, from options trading to identifying pullback opportunities, help traders make informed decisions. Applying these methods in cryptocurrency futures trading enhances the ability to forecast market movements and make money. Remember that it is essential to combine your experience, effective decision-making, and risk management in any market.

What Resources Are Available on Social Media and Blogs for Cryptocurrency Futures Day Trading Education?

Platforms like CScalp and Benzinga and social media channels offer rich resources for futures trading education, including articles on commodities markets, trading futures, and futures markets analysis. At your fingertips, you will find tutorials, webinars, and lectures covering a range of topics from the basics of futures contracts to advanced trading strategies and market analysis techniques.

How Does Futures Trading Contribute to Efficient Market Functioning?

Futures trading is vital for efficient market functioning, providing a mechanism for price discovery. It allows traders and investors to hedge against price volatility in crypto, commodity, and stock market (as well as other markets), contributing to economic stability. Through futures contracts, market participants can lock in prices for future transactions, which helps in forecasting and managing potential pricing risks.

What Are the Implications of Information Security and Privacy on Online Trading Platforms Like OKX and Binance?

Information security and privacy are paramount for online trading platforms like OKX and Binance, ensuring traders’ data is protected against unauthorized access and cyber threats. These platforms implement robust infosec policies to safeguard personal and transactional information, ensuring a secure trading environment. A futures trader should be aware of these policies and understand how their data is used and protected.

How Do Global Economic Factors and Market Sentiment Influence Futures Trading and Market Courses?

Global economic factors, such as interest rates, inflation (CPI), and geopolitical events influence futures trading and market sentiment. Futures traders must stay informed through news, data science analysis, and pass CScalp’s futures trader course to navigate the futures market effectively. Understanding the impact of these factors on cryptocurrency and commodity prices as well as stock indices is crucial for making informed trading decisions.

In What Ways Do Futures Trading Courses Integrate Knowledge from Humanities, Social Sciences, and Computer Science?

Futures trading courses integrate interdisciplinary knowledge, including principles from humanities, social sciences, and computer science, to provide a well-rounded education. The knowledge of mathematics is also required. Topics such as behavioral economics (from humanities and social sciences) and algorithmic trading (from computer science) are important for traders and offer insights into trading psychology, market dynamics, and the technological aspects of trading platforms.

What Are Commodity Futures, and How Do They Play a Role in Risk Management and Price Discovery in the Futures Market?

Commodity futures are contracts to buy or sell a specific commodity, like natural gas or silver, at a predetermined price on a future date. They are central to risk management, allowing traders to hedge against price volatility. Commodity futures trading facilitates price discovery by reflecting market expectations of future supply and demand mechanics, essential for commodities markets and financial markets at large.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT