Mastering Cryptocurrency Scalping Strategies: Unveiling Techniques for Success

Scalping strategies have gained significant traction within the cryptocurrency market due to the unique price volatility and 24/7 trading nature of cryptocurrencies. These strategies are meticulously designed to capitalize on rapid price fluctuations, making them a favorite among day traders and scalpers in the crypto space. Scalping strategies are based on order books, cluster analysis, volume, chart analysis, and densities. In this article, we will discuss the most common scalping strategies in cryptocurrency markets.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Why a Scalping Strategy is Essential in Cryptocurrency Trading

Effective scalping demands meticulous preparation. Diving into the market devoid of a well-defined strategy is akin to reckless gambling. While some scalpers adopt a blend of strategies, others fine-tune their approach over time. Novices are advised to commence with straightforward techniques before progressively integrating more intricate methods.

Crafting a robust scalping strategy involves several steps: cherry-picking the cryptocurrency of the day, utilizing market analysis tools, pinpointing entry and exit junctures, mastering risk management, and setting up Stop Loss and Take Profit parameters. In this article, our focus centers on demystifying the process of identifying optimal market entry and exit points.

As your dependable ally in the realm of cryptocurrencies, the CScalp team extends an invitation to embark on this expedition with us. Together, we will decipher the nuances of crypto technical analysis, furnishing you with insights that can hone your trading approaches and amplify your triumphs in this exhilarating and swiftly evolving domain.

Important! This article is about general principles for building scalping strategies. Implementing these principles is the personal decision of each trader. It is not a call to action and does not guarantee a successful trading session.

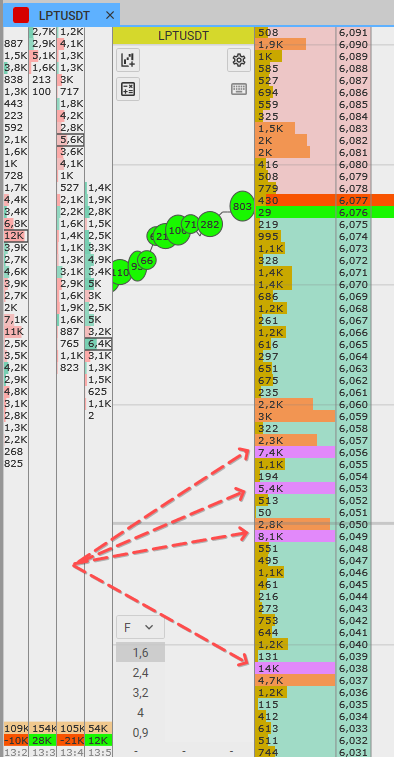

Enhancing Scalping Strategies: Leveraging Density within Order Books

Density within the trading sphere is epitomized by either a substantial limit order or an amalgamation of smaller orders. Yet, not all densities hold equal allure. As a fundamental guideline, a scalper’s attention gravitates toward densities stationed at pivotal support and resistance junctures.

The authenticity of the density is pivotal, constituting a key criterion. An enduring and frequently rounded numerical representation (such as 22500 or 49000) signifies a ‘real’ density. Only under these circumstances does it establish itself as a dependable foundation for entry. The affinity for round numbers among scalpers is driven by their simplicity. Equally divisible and easily calculable position sizes are preferred by all participants. A density being a round figure indicates calculated positioning, rather than a rash or unfounded endeavor.

There are also traders engaged in spoofing tactics. These market manipulators plant deceptive densities only to swiftly retract them. Their intent is to allure smaller participants and engineer price adjustments advantageous to their cause. Such densities hold ephemeral staying power. Frequently adopting odd numbers like 16,783, their analysis inherently proves fallacious. Pondering over these densities is warranted only if an assured interaction with the relevant level has been established

Unpacking Scalping Strategy Theories

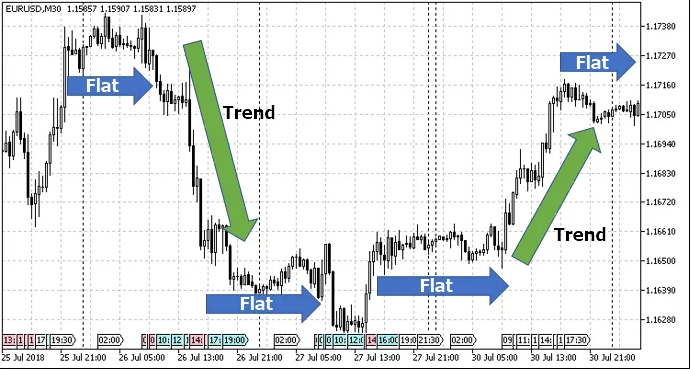

Let’s delve into the realm of theory, initiating our exploration with the fundamental phases that characterize the market: consolidation (often referred to as the accumulation zone) and movement (commonly known as the trend). Robust and precisely defined market movements naturally pave the way for subsequent consolidation phases. During these periods, a meticulous evaluation of novel support and resistance levels ensues. The market becomes ensnared within a span of prices, devoid of distinct upward or downward shifts.

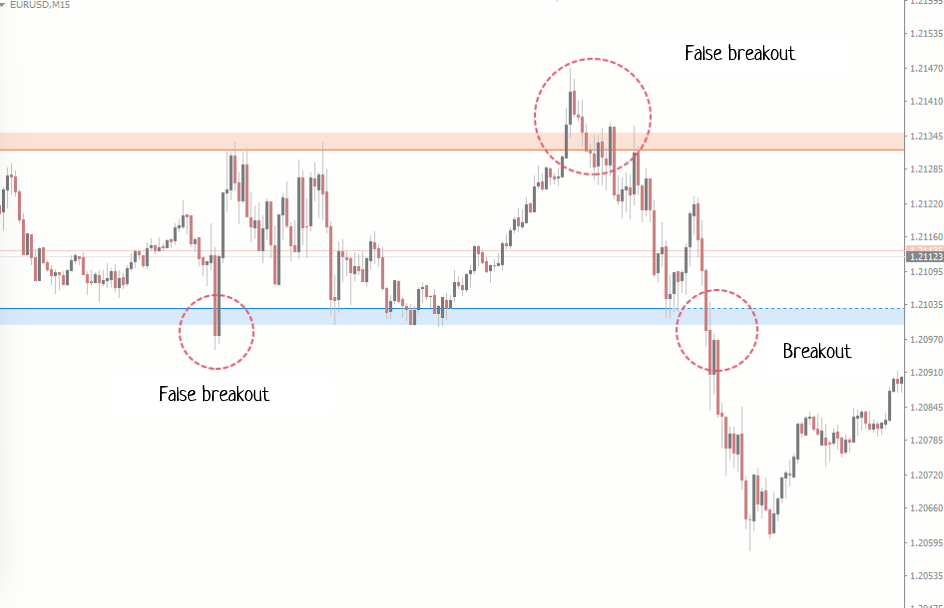

The market operates cyclically, with alternating cycles of movements and consolidations (flats). Within and between each of these phases, the price traverses across different zones. The transition from one phase to another is accompanied by a forceful price breakout, breaching the current price channel’s confines by a marginal percentage, either upwards or downwards. This phenomenon is aptly labeled a breakout. In contrast, a rebound denotes the inverse scenario, wherein the price grazes a level but refrains from eclipsing it, choosing instead to retract.

The dynamics at play behind these occurrences are intricately tied to density. This concept embodies a barrier that the market endeavors to surmount. Should the market exhibit adequate strength (often gauged by volume), it forges ahead, transcending the density obstacle. Conversely, when strength is lacking, a rebound results, manifesting as a price retracement.

In both scenarios, closely observing BTC or ETH movements proves pivotal. The cardinal tenet of density trading dictates that the guiding force, which is the price action, aligns harmoniously with the intended transaction’s direction. Even as the guiding force may traverse the accumulation zone, a movement counter to the proposed direction serves as a caution against entering a position.

Turning our attention to the fundamental tenets of breakout and rebound trading, these strategies are strategically attuned to densities entrenched at robust levels and their underlying dynamics.

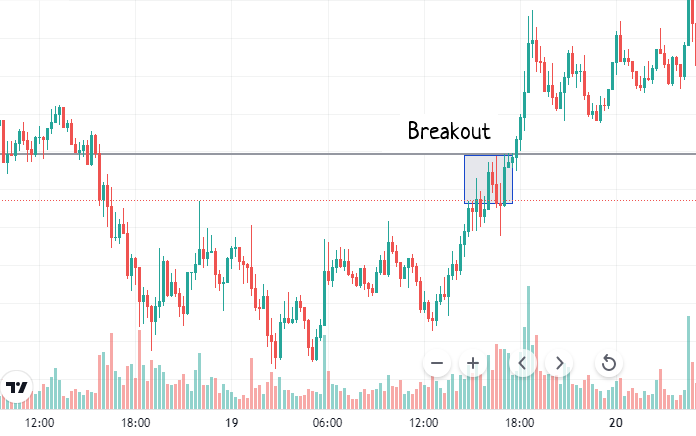

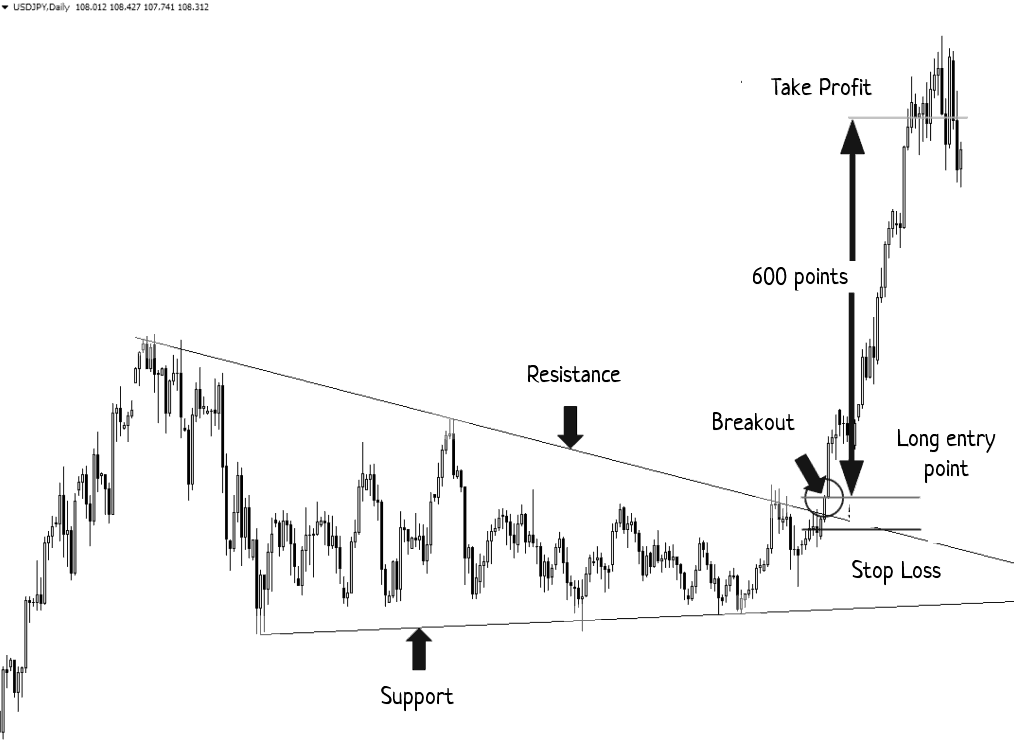

Mastering the Scalping Strategy: Breakout Trading

A breakout of density can be predicted to open a position. The goal is to guess the moment when there will be a “corrosion” of the density. In other words, when participants will start buying.

To predict a breakout, you need to find a strong level. The main criterion for measuring the strength of a level is the number of touches by the price. A strong level has 2-3 touches without “penetrations”. In some cases, there may be more touches with penetrations. The level touches should also show increased volumes.

The second criterion is the nature of the price approaching the level. It is believed that the closer the breakout is, the smoother and more measured the approach to the level will be.

When you find a level, pay attention to the density in the order book. If there are real densities at that price level, there is a possibility of a breakout. An additional argument for entry can be the “approach” of the price to the level: a gradual approach from the support level to the resistance level for an upward breakout, and an approach from the resistance to the support for a downward breakout. Often, during these moments, you can see the formation of chart patterns (flags and triangles).

Before the breakout, you should look for the moment of “corrosion” of the density, when there are sufficient volumes in the market to start buying. You should enter the position in parts during the “corrosion” or when there is a breakout and you should exit the position, also in parts, when the movement is implemented.

The Stop Loss is placed a few points away from the breakout level, “behind” the open trade.

It is important to consider that a breakout can be false. In such situations, the price goes beyond the level but due to lack of momentum, it fails to establish itself and retraces.

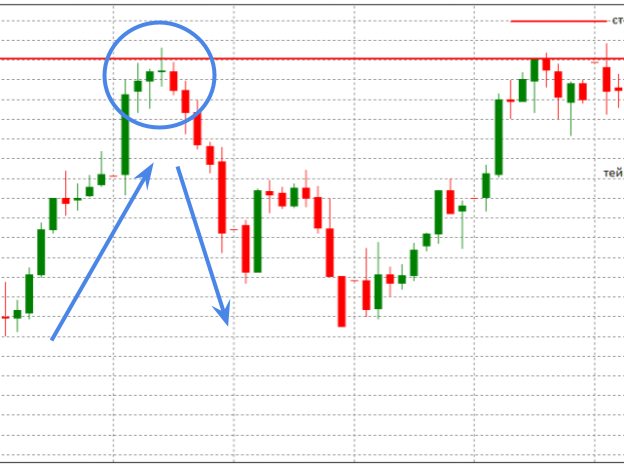

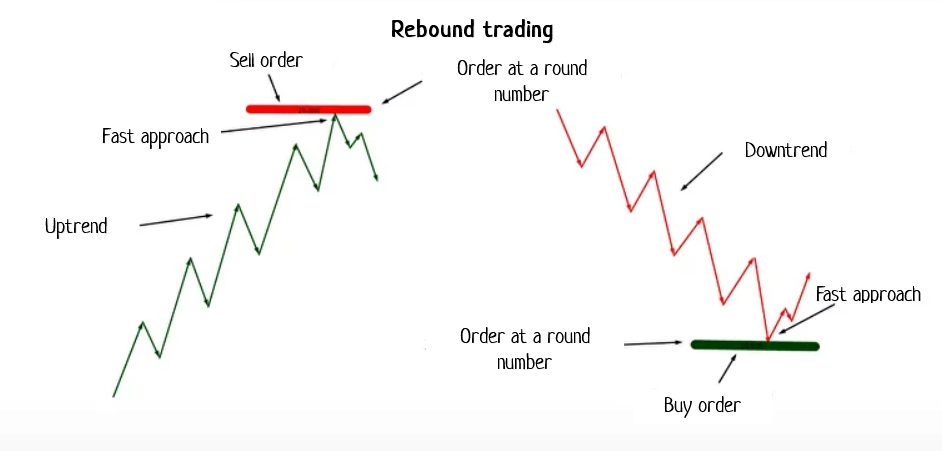

Rebound Strategy in Scalping

A rebound is the opposite of a breakout. When volumes in the market on the way to the level turn out to be lower than the density, a rebound occurs.

With rebound trading, the goal is to ensure that the density at the level is large enough that it cannot be “broken” at this stage. You also need to look at the price movement approaching the density. Generally, the price approaches the level sharply, without visible pullbacks or local accumulation zones.

Such a price movement means that the market is overbought/oversold and is moving out of inertness. It is likely that it does not have enough strength to break the density.

When meeting the breakout criteria, you should enter the position from the density itself in the counter-trend direction. That means if you expect a rebound in an uptrend, you go short. During a downtrend, you go long. Just like in breakout trading, you should enter and exit the position in parts. The Stop Loss is placed immediately after the density.

Trading from the Cryptocurrency Market Profile

The market profile is an indicator that shows the accumulated volume of an asset at each price level during a specified timeframe.

The longest horizontal line is the point of control or PoC. It is the price level that showed the most active trading during the selected period. Active participants, especially larger ones, show special interest in the point of control and its surrounding area.

The basis of the trading strategy from the market profile is the hypothesis that after a rebound from this point, it is likely that the price will return and experience another rebound. It is this movement that scalpers pursue.

Example: We use the “Fixed Volume Profile” tool in the “Measurement and Forecasting” tab of TradingView. It is placed on the chart from the lower edge of the zone to the level reached by the momentum. The red horizontal line of the indicator represents the point of control.

We need to use the point of control to find the accumulation zone where buyers (sellers) established their positions. After a large participant has established positions, the momentum pushes the price to the next level. In this case, we do not consider a return to a specific point, but to the entire zone. Before the rebound within this zone, there may be a test.

The key point of this strategy is that we only consider the first repeated movement toward the area of interest. Subsequent returns are not considered. The Stop Loss is placed just below the lower edge of the zone.

Scalping Strategy – Catching a Falling Knife

One of the most popular and risky scalping strategies is knife catching. It involves working with very large price drops. We do not recommend catching a falling knife if you don’t have much experience.

The strategy of knife catching is extremely risky, as it involves working with an almost vertical movement in the counter-trend direction. You should use this method only when you have a thorough understanding of the current market situation because there is no clear rule to establish a safe Stop Loss in this case.

Scalping Strategy – Spread Capture

Spread capture is one of the easiest scalping strategies and is recommended for developing mechanical skills in trading platforms. Additionally, working with spreads helps you “feel” the real-time price movement.

Let’s start with the theory. The spread is the difference between two prices, usually for the same asset. The spread varies slightly in different trading styles. In intraday trading and scalping, the so-called “bid-ask spread” is of interest. This refers to the difference between the current lowest bid and the highest ask.

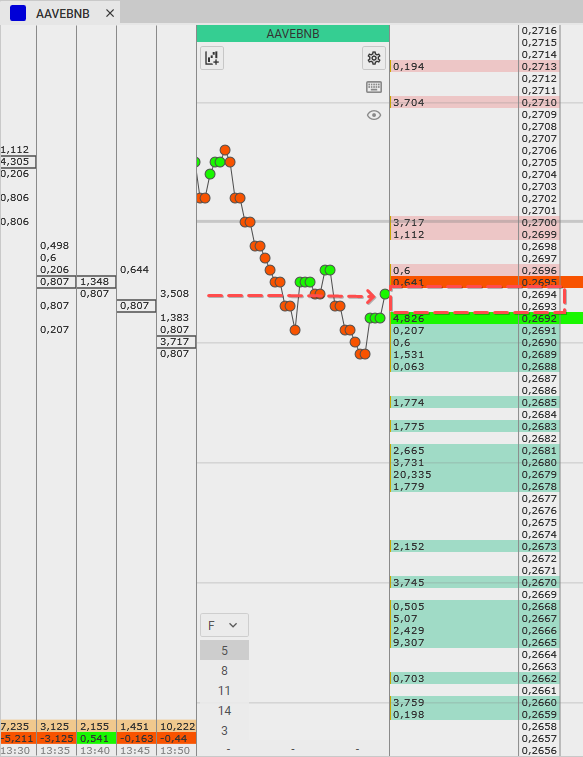

The screenshot above shows the gap between the buying and selling prices. That is the spread. Essentially, it represents the disagreement between sellers and buyers regarding the current market price. Buyers offer lower prices than sellers. For scalpers, it is a way to make small but quick profits.

Spread capture in scalping means trading within the bid-ask limits. By harvesting the spread, we buy near the lower limit and sell near the upper limit (and vice versa if we are shorting).

When capturing the spread, you should consider the following:

Spread Magnitude and Exchange Fees

The spread’s variability necessitates careful scrutiny. Opportunities to capitalize on spreads are often limited, generally staying below 1%, sometimes even dipping to 0.5% or less. It’s imperative to ascertain precise exchange commissions and identify cryptocurrencies with spreads that sufficiently offset these fees.

Spread Evolution Dynamics

Spreads tend to diminish over time. High-frequency scalpers often seek to exploit these spreads, contributing liquidity to the asset, which subsequently narrows the gap. If a cryptocurrency with a wide spread experiences substantial activity and/or sizable volumes, it implies active participants, (including automated bots) are at work. Consequently, the spread is likely to contract in the near future.

Liquidity’s Role in Spread Scalping Strategy

The likelihood and extent of spreads are inversely correlated with cryptocurrency liquidity. Higher liquidity corresponds to narrower spreads. Spread capture strategies thrive in the context of less liquid cryptocurrencies.

General Movement of Cryptocurrencies

You can observe the spread in any type of movement and at any market phase. If you buy at the bid price without “consulting” the chart, in the next second, the price may drop, leaving your trade in the red.

Densities at the Boundaries of the Spread

Spread capture strategies are most applicable in sideways or sloping channel markets where predictive movement is feasible. The presence of densities beyond spread boundaries affirms spread reliability. This signifies significant market players’ vested interest in maneuvering within the existing range, presenting a secure opportunity to work with the spread.

Trading Activity and its Importance for Scalping Strategies

Medium-low liquidity in assets with a large spread creates a problem with the frequency of potential trades. If liquidity is very low, you may wait a long time for orders to be filled or not be filled at all. When choosing how to capture the spread, it is important to look at the order book, order flow, and clusters. In all three elements, there should be at least some market activity. In the case of noticeable order flow movements, you can work with the spread.

Strategic Stop Loss Placement

Safety stop orders are placed individually, based on the combination of the spread size and personal drawdown limits. As a general rule, you can place them at 0.3%-0.5% of the spread channel boundaries.

Scalping Strategy: Bot-Assisted Cryptocurrency Trading

The world of scalping has taken an intriguing turn with the integration of bots, which can be tailor-made by algorithmic traders or harnessed through exchanges themselves. Scalpers predominantly align with exchange-based algorithms, focusing on their potential. Despite their prevalence, most bots remain virtually indistinguishable within the order book. Yet, a subset of these bots operates at magnified volume levels, steering price movements.

Bots closely mirror the actions of a major market participant deploying substantial limit orders. However, noteworthy disparities exist. Bots function with the distinct objective of harmonizing supply and demand equilibrium. Algorithms systematically execute tasks in uniform proportions and time intervals. The crux of differentiation lies in speed; bots execute actions dozens of times faster than human “live” participants.

Recognizing and deciphering bot behavior provides a unique opportunity for strategic alignment. By understnding the bot’s actions, one can effectively emulate its approach, potentially orchestrating synchronized market entries.

Summing Up Scalping Strategies

In the realm of scalping, no strategy boasts foolproof profitability. Relying solely on a singular algorithm across all market scenarios is a flawed premise. The way to triumph in trading hinges on unwavering consistency. Nurtured through consistent practice, vigilant observation, and an embrace of trial and error, you can develop and refine a unique strategy that produces consistently positive results.

For further enlightenment, exploring analysis and strategies from fellow traders is recommended. Our complimentary trading signals serve as an invaluable resource for this pursuit. Engage with our Discord server and leverage the online Trading Diary, empowering you to recognize and rectify missteps along the way. If you’re eager to delve even deeper into the world of scalping, don’t miss out on discovering the pros and cons of scalping trading strategies.

Scalping Strategies – Frequently Asked Questions

Welcome to the scalping strategies section of CScalp! Here you will find answers to the most frequently asked questions about strategies for scalping in the financial markets.

What is scalping?

Scalping is a trading technique that involves opening and closing positions in very short timeframes, seeking small profits from the price movements of a financial asset. The goal of scalping is to achieve small but consistent profits as the price of the financial asset moves.

Which markets can you scalp?

Scalping is a versatile strategy applicable across various financial markets, spanning the realms of the forex market, stocks, futures, and cryptocurrencies. Nevertheless, certain markets lend themselves better to scalping due to their heightened liquidity and volatility, with the cryptocurrency market standing out as a prime example.

How long is a position held in scalping?

In scalping, positions experience fleeting lifespans, often lasting mere seconds to a few minutes. The precise duration hinges on the specific scalping strategy employed and the prevailing dynamics of the market.

What is the objective of scalping?

The primary objective of scalping is to secure steady, albeit modest, profits by capitalizing on the price fluctuations of a financial asset. Through a series of rapid trades conducted within a single day, scalpers harness market movements to optimize their profit potential.

What are the essential tools for scalping?

TVital tools for effective scalping encompass swift access to a trading platform, a steadfast Internet connection, a robust trading plan, and a proficient risk management approach. Equally crucial is the utilization of technical indicators and charts to discern potential trading prospects.

Which indicators are used in scalping?

Scalping predominantly relies on oscillators, moving averages, and volume indicators as the bedrock tools. These indicators furnish insights into the trajectory and vigor of price movements pertaining to the financial asset.

What is spread and how does it affect scalping?

Spread signifies the divergence between a financial asset’s buying and selling prices. In the context of scalping, traders seek minimal spreads to optimize profit potential. A wide spread can curtail the profitability of scalping endeavors.

What are the best hours for scalping?

The prime hours for scalping align with periods of heightened market volatility, commonly found during the overlapping intervals of major financial markets. For instance, the forex market experiences heightened activity during the convergence of the Asian and European sessions, as well as the European and American sessions. Meanwhile, the cryptocurrency market’s volatility can manifest at any time, irrespective of the hour.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT