Risk Management in Trading: Learn Financial Risk Analysis with CScalp

Effective risk management in trading, understanding its importance, and implementing key strategies is essential for day traders. CScalp explores various aspects of trading risk management in cryptocurrency markets, including stop-loss order usage, portfolio diversification, as well as the role of performing correct technical and fundamental analysis.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Understanding Risk Management in Trading Cryptocurrencies

In the world of cryptocurrency trading, it is important to have a deep understanding of risk management. By using trade risk management, you can protect your capital and maximize your chances of success in the long run. Let’s explore the importance of risk management in trading and highlight key concepts that every cryptocurrency trader should be aware of.

Importance of Risk Management in Trading

Managing risk is imperative to safeguard investments and mitigate potential losses. No matter how experienced or successful you are, there is always a risk of losing money in every transaction. Therefore, having a robust risk management strategy is vital to minimize losses and protect oneself from adverse events.

Learn more: Create a Solid Crypto Trading Plan: A Complete Guide

Effective risk management helps maintain discipline in trading activities and avoid impulsive decisions driven by fear or greed. It allows you to make informed and calculated decisions based on proper risk assessment, rather than relying on emotions.

Key Risk Management Concepts

When exploring key concepts in risk management, especially in the context of cryptocurrency risk trading, you should consider several critical strategies to safeguard your investments and optimize returns:

Position Sizing to Manage Risk in Trading

This involves determining the appropriate amount of capital you should risk on each trade. It’s essential to consider your risk tolerance and the size of your account. Position sizing helps you decide how much to invest in a particular cryptocurrency, ensuring you don’t overexpose yourself to undue risk. You can also try simulator trading or open small positions to get familiar with the market.

Managing Risk With Stop-Loss Orders

You should place automatic orders that trigger a sale of your cryptocurrency if its price reaches a predetermined level. This practice limits potential losses by automatically exiting a trade when it moves against your expectations. It’s a form of damage control, preventing small losses from turning into substantial financial setbacks.

Portfolio Diversification

To reduce the impact of any single investment on your overall portfolio, you should spread your investments across different cryptocurrencies or assets (currencies (Forex), bonds, stock market, commodities, etc.). Diversification is a fundamental risk management strategy that helps mitigate the risk associated with the high volatility of individual cryptocurrencies.

Risk-Reward Ratio for Day Traders

Before entering a trade, it’s crucial to assess the potential profit against the potential loss. Aim for a positive risk-reward ratio, where the potential rewards of a trade are higher than its potential risks. This assessment helps you in making informed decisions about which positions are worth opening. This includes high frequency trading.

Volatility Assessment of Cryptocurrencies

Different cryptocurrencies exhibit varying levels of volatility. By evaluating this volatility, you can adjust your trading strategies to either capitalize on large price movements or avoid overly volatile assets that don’t match your risk tolerance. Understanding and adapting to the volatility of cryptocurrencies is key to successful trading. Day traders and scalpers usually work with highly volatile cryptocurrencies that they find with CScalp’s free crypto screener.

Each of these concepts plays a role in developing a robust risk management strategy for cryptocurrency trading. By applying them, you’re better equipped to navigate the complexities and uncertainties of the crypto market, ultimately leading to more informed and potentially profitable trading decisions.

Enhancing Risk Management with CScalp: A Free Trading Platform

CScalp is a powerful and user-friendly trading platform that offers professional tools to enhance your trading experience, including risk management.

With CScalp, you can set up Stop-Loss and Take-Profit orders (manually or automatically), effectively managing risk by automating the process of closing positions when predetermined price levels (of Bitcoin, for example) are reached. This feature helps to protect profits and limit potential losses, according to the daily loss percentage you input.

CScalp also provides real-time market data, ticker tape, and advanced charting capabilities, allowing you to make informed decisions based on accurate information. The platform offers technical analysis tools, empowering you to identify potential opportunities, risks, and trends (short squeeze and more) in the market.

One of the standout features of CScalp is its intuitive interface, which is designed to simplify the trading process. Easily navigate through the platform, execute trades with one click, and monitor your positions effectively.

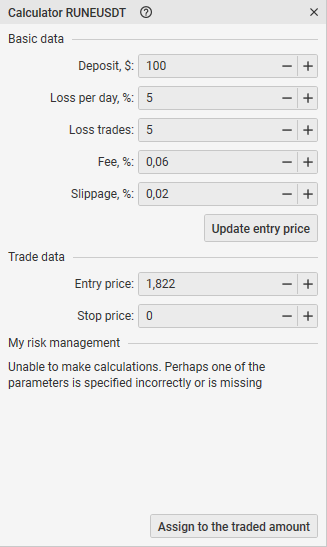

The CScalp team has also added a risk calculator (money management tool) to the free terminal.

CScalp risk calculator for day traders

Exploring Different Risk Management Options in Cryptocurrency Trading

When it comes to participating in the cryptocurrency market, it is crucial to consider trade management options to safeguard your positions. Here are some strategies to explore:

Mitigating Risks and Liabilities in Day Trading

Day trading cryptocurrencies can be a high-risk endeavor, but with the right strategies in place, you can minimize potential losses and maximize your chances of success. Here are some key considerations to keep in mind when performing an evaluation of your risks and liabilities:

Set Clear Stop-Loss and Take-Profit Levels

Establishing predetermined levels for exiting a trade can help limit potential losses and secure profits. These levels should be based on your risk tolerance and analysis of market trends.

- Use Proper Position Sizing: Calculating the appropriate position size based on your account balance and risk tolerance is crucial. Avoid risking too much of your capital on a single trade, as it can lead to significant losses. Use the CScalp’s risk calculator to do so.

- Diversify Your Portfolio: Spreading your investments across different cryptocurrencies or other assets can help mitigate the risk of substantial losses. Never forget about portfolio management.

- Stay Informed and React to Market Conditions: Monitor market trends, news, and events that may impact cryptocurrency prices. Being aware of market conditions will allow you to make informed decisions and adjust your trading strategy accordingly.

- Use Technical Analysis Tools: Leverage technical analysis tools, such as charts, trend lines, and indicators, to identify potential entry and exit points. This analysis can provide valuable insights into market patterns and help you make more informed trading decisions. Learn more about these tools by visiting our webinar on CScalp’s YouTube channel.

- Practice Proper Risk Management: Discipline and sticking to your risk management plan are crucial in day trading.

- Avoid emotional decision-making: Be prepared to cut losses and move on to the next opportunity. This advice is particularly practical for day traders.

By implementing these risk mitigation strategies, you can enhance your day trading experience. Remember that thorough research, continuous learning (check our blog), and the use of reliable trading platforms like CScalp can further support your risk management efforts. Stay proactive and adapt your approach as the cryptocurrency market evolves.

Analyzing Trading Rates and Risk in Cryptocurrency Markets

Analyzing trading rates and risk is crucial in making informed decisions. By studying the rates at which cryptocurrencies are being bought and sold, traders can identify trends and patterns that can help them predict future price movements.

One important aspect of analyzing trading rates is examining the volatility of cryptocurrencies. Volatility refers to the degree of price fluctuation over a given period. High volatility can offer opportunities for significant profits but also comes with increased risk.

Also, consider liquidity when analyzing trading rates. Liquidity refers to the ease with which a cryptocurrency can be bought or sold without impacting its price. More liquid cryptocurrencies tend to have narrower bid-ask spreads, making it easier to execute trades.

Examining the trading volume of a cryptocurrency is another critical factor. Trading volume represents the total number of coins or tokens being traded within a specific timeframe. Higher trading volume indicates a more active market, providing better opportunities for entering and exiting trades.

Additionally, it’s vital to analyze risk when you interact with cryptocurrency markets. Evaluate factors such as market trends, regulatory developments, and news events that can significantly impact the price and overall market sentiment.

Technical analysis plays a significant role in assessing risk. By analyzing price charts and using various technical indicators, you can identify potential support and resistance levels, trend reversals, and other patterns that may indicate future price movements.

CScalp, a free trading platform, can greatly assist in analyzing trading rates and managing risk. With its user-friendly interface and advanced charting tools, you can effectively analyze market data and make informed trading decisions:

- Examine trading rates and trends

- Analyze cryptocurrency volatility and liquidity

- Consider trading volume and market activity

- Assess risk factors (stress test) and market sentiment

- Utilize technical analysis for price prediction

- Use CScalp for comprehensive market analysis and trading in general

The Role of Technical and Fundamental Analysis in Risk Management

Technical analysis plays a crucial role in effectively managing risk when trading cryptocurrencies. By analyzing historical price data and patterns, you can gain insights into potential future price movements and make informed decisions.

One important aspect of technical analysis is identifying support and resistance levels. These levels indicate price levels at which an asset is likely to experience buying or selling pressure. By recognizing these levels, traders can set appropriate Stop-Loss orders to limit potential losses and Take-Profit orders to secure profits.

Another key tool in technical analysis is the use of indicators. These mathematical calculations are applied to price and volume data to provide additional information about the market’s strength, momentum, and potential turning points. Common indicators used in cryptocurrency trading include moving averages, relative strength index (RSI), and MACD.

Additionally, chart patterns are valuable tools for risk management. Patterns like head and shoulders, double tops, and descending triangles can indicate potential trend reversals or continuation. Traders can use these patterns to identify entry and exit points and adjust their risk exposure accordingly.

Furthermore, technical analysis helps in assessing market sentiment. By studying sentiment indicators such as sentiment analysis platforms, social media sentiment, or market news sentiment, you can gauge the overall market sentiment towards a particular cryptocurrency. This information can assist in making risk management decisions and adjusting trading strategies accordingly.

However, it is essential to note that technical analysis is not foolproof and does not guarantee accurate predictions. It is just one tool among many (including fundamental analysis) to manage risk effectively. It should be combined with other risk management strategies, such as position sizing, Stop-Loss orders, and diversification, to mitigate potential losses.

Implementing Risk Management Strategies in Options Trading

In options trading, you have a valuable tool for managing risk in cryptocurrency trading. By utilizing options contracts, you can protect your investments and limit potential losses. Consider these key strategies:

Hedging

A primary benefit of options trading is your ability to hedge against potential losses. By purchasing put options, you can protect your positions from significant downturns in the market.

Portfolio Diversification

Spread out your options contracts across different cryptocurrencies or other assets, including leveraged products. This strategy reduces the impact of a single asset’s performance on your overall portfolio, helping mitigate risk and limit potential losses.

Setting Stop-Loss Orders

You have to establish predetermined stop losses for your options trades. This approach helps to limit losses if the trade does not go in the desired direction. Stick to these levels and avoid making emotional decisions.

Managing Position Sizes

Controlling the size of your options positions is crucial for risk management. You should assess your risk tolerance and allocate capital accordingly, which can help protect your portfolio from significant losses.

Monitoring Market Volatility

Volatility significantly impacts options trading. Stay informed about market conditions and adjust your strategies accordingly. Be aware that higher volatility often leads to wider bid-ask spreads and increased option premiums, which can affect the profitability and risk of your trades.

Implementing these risk management strategies in options trading can help safeguard your assets and improve your overall trading performance. Offering flexibility and potential profitability, options trading can be a valuable addition to your risk management toolbox.

Mastering Risk Management in Trading with CScalp

From understanding the volatility of digital assets to implementing practical tools like the CScalp risk calculator, you are equipped with the knowledge to navigate this often unpredictable market.

Key takeaways from our exploration include the necessity of diversification, the prudent use of Stop Loss orders, and the value of technical and fundamental analysis in forecasting market trends. These strategies are not just theoretical concepts, but practical tools that can significantly impact your success and longevity in the cryptocurrency market.

The role of free trading platforms like CScalp cannot be overstated in this context. Providing real-time market data, advanced charting capabilities, and a user-friendly interface, it is indispensable in assisting traders to make informed, strategic decisions.

While the cryptocurrency market presents an array of challenges, it also offers unprecedented opportunities for those willing to invest time in understanding and implementing effective risk management strategies. With the right tools and knowledge, confidently approach the market, armed with strategies to mitigate risks and maximize returns. Remember, in cryptocurrency trading, knowledge is not just power – it’s your most valuable asset.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT