A review of TSLab, a multi-market algorithmic trading platform

TSLab is a platform for creating trading bots. It allows for portfolio management and seamless interaction with several stock brokers at once. The terminal offers access to MOEX (via QUIK, Transaq, etc.) and also deals with brokers (AMP Global Clearing, NinjaTrader, etc.) directly, without intermediaries. It also enables trading on crypto exchanges such as Binance, Deribit, etc.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

TSLab functionality

The TSLab platform is designed for setting up, backtesting and launching trading bots. Creating trading algorithms on the platform does not require any special skills — strategies are created entirely using the TSLab toolkit.

The TSLAB trading environment offers the following:

- Development of user’s own infinitely complex algorithms;

- Integration with its own indicators and charts;

- Visual blocks with technical indicators.

The platform has all the key functions you would expect to see in a broker terminal: the option to view quotes, chart building, graphical tools, technical analysis indicators, and more.

The broker terminal

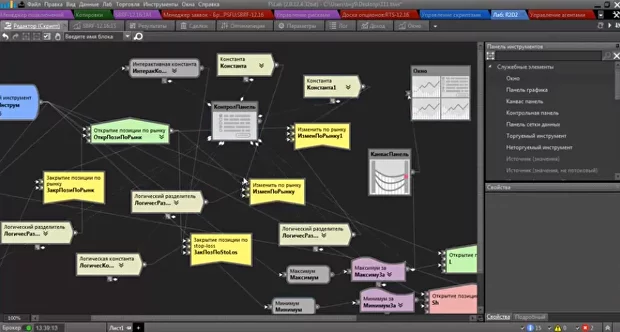

Visual editor

This is the key feature of the service allowing you to build TSLab trading bots out of blocks. The blocks are interconnected and exchange important information with each other. If there are not enough pre-set blocks, you can add and modify them any way you like, creating infinitely complex trading algorithms as a result.

Visual editor: module blocks

The optimization module built into the platform allows you to backtest your newly-built strategies. With it, you can tweak and optimize your bots retrospectively, achieving the best performance before actually launching them.

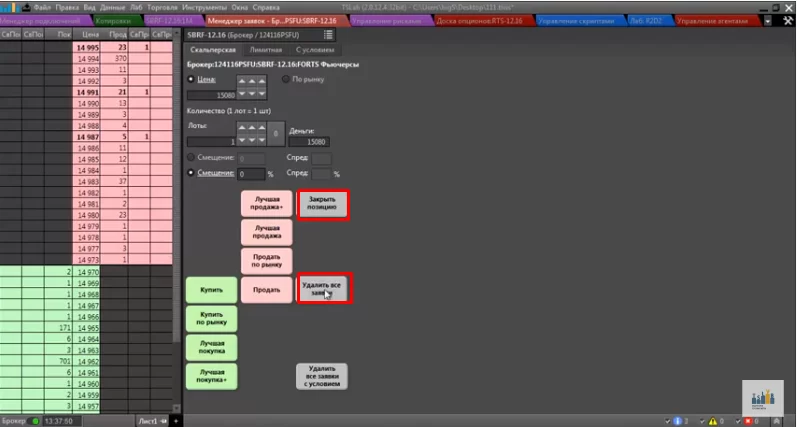

Application Manager

This tool will be most useful for scalpers, as it implies dealing with a depth chart. In this module, you work directly with incoming deals by opening and closing several positions at once. The extra buttons here allow you to quickly make critical trading decisions.

(Application) manager

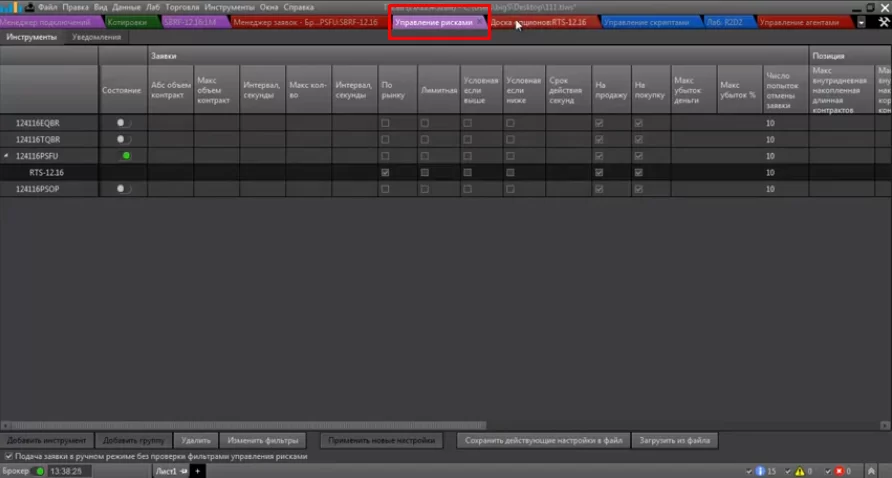

Risk manager

Another useful feature of TSLab is the risk manager — a complex filter module with dozens of different settings. It’ll be most helpful in checking how well your trades comply with the pre-set requirements before they are placed on the exchange. An order will not be executed if it doesn’t pass this test.

You can install the risk module right on your trading bot or on other scripted containers. Each trading strategy has its own unique combination of filters. However, due to frequent lags, this module is inadvisable to use for scalping.

Risk manager

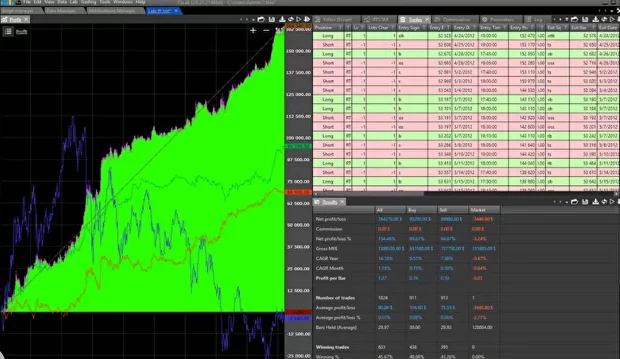

Algorithmic Trading Control Center

All bots created with TSLab can be used either automatically or semi-automatically. The control module lets you apply them on several trading platforms at once and manage them with precision. There are no restrictions as to the number of concurrent scripts. You can view the trading history of each bot either as a table or as a graph.

Bot history: graph & chart view

Cryptocurrency trading system

On TSLab, along with traditional instruments and options, you can also trade cryptocurrency. You can connect the terminal to multiple crypto exchanges and manage multiple accounts at the same time, thus greatly reducing your risks.

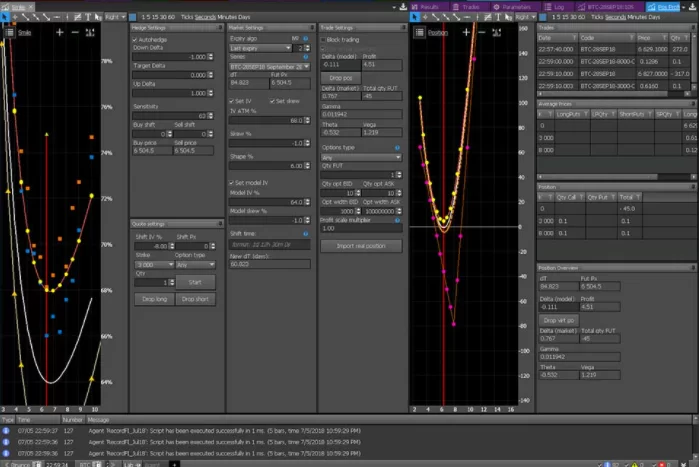

In addition to spot trading, there are also Bitcoin futures and options available to trade on the Deribit exchange.

Note: TSLab is equipped with scripts that are specially fitted for options trading.

Bitcoin options and futures

TSLab Connections

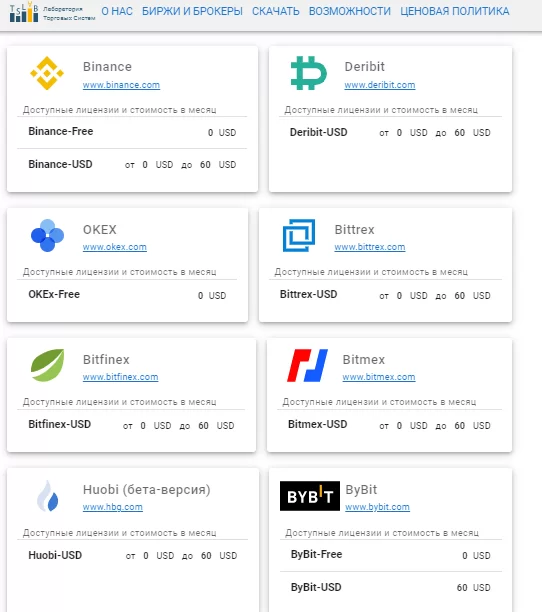

TSLab can connect to 8 crypto exchanges: Binance, Deribit, OKEX, Bittrex, Bitfinex, Bitmex, Huobi (currently in beta), and ByBit.

To get a discount, you must first create an account.

The price of using TSLab

TSLab has a pay-per-connection subscription system with two plans:

- International brokers. 90 USD/Month for each broker;

- Crypto Exchange. Up to 60 USD/Month for each exchange.

A one-time discount is offered for pre-paying several months of subscription.

Conclusion

The TSLab service will cater to the needs of most algorithmic traders and users who want to design their own bots. Beginners should first brush up on their trending basics before (and after) approaching the terminal.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT