Arbitrage Trading Strategy: Explanation and Definition of Arbitrage Trading

Arbitrage trading is a strategy employed by traders to capitalize on price disparities in various financial markets. CScalp delves into the world of arbitrage trading, exploring its different aspects (including crypto arbitrage trading), and providing valuable insights to help you navigate this lucrative, yet complex terrain.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

What Is Arbitrage Trading?

Arbitrage trading is a strategy employed by traders to exploit price disparities for the same asset or security in distinct markets or exchanges.

The fundamental principle is simple: buy an asset at a lower price in one market and swiftly sell it at a higher price in another. The resulting profit stems from the price differential.

The definition of this strategy hinges on the market hypothesis, asserting that asset prices should be uniform across all markets. In an ideal scenario, there should be no room for arbitrage opportunities. However, in the real world, market imperfections and occasional delays can introduce discrepancies, creating fertile ground for arbitrageurs.

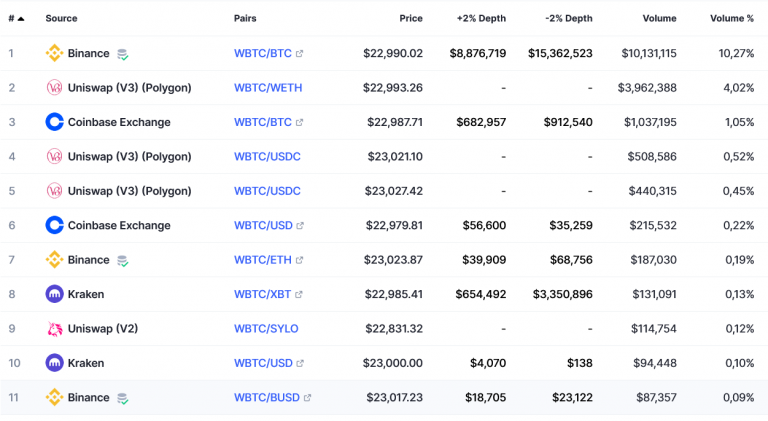

Let’s look at the Bitcoin price comparison on CEX and DEX exchanges:

Comparison of the Bitcoin price on CEX and DEX exchanges

Arbitrage trading transcends geographical boundaries, making it a versatile approach that traders employ across a range of assets and markets. It can be used in Forex markets (currency trading), crypto, ETFs and day trading, as well as on the stock market. By leveraging these disparities and executing rapid, well-timed transactions, arbitrage traders can secure gains and receive payment with minimal risk exposure.

The formula for successful arbitrage trading lies in meticulous monitoring of market conditions, swift execution of trades, and a keen eye for detecting price differentials. It’s a practice that demands precision, agility, and a deep understanding of the assets being traded. In the following sections, we will provide an explanation of various types of arbitrage strategies and the components that contribute to a prosperous arbitrage trade.

Types of Arbitrage Strategies

Arbitrage – as trading or alternative investment – comes in various forms, each with its own set of rules and considerations. Let’s delve into the most common types, such as merger arbitrage, fixed income arbitrage, and currency arbitrage. Understanding these strategies is crucial for identifying potential arbitrage opportunities and managing risk effectively.

This style of trading is a multifaceted field, offering a spectrum of strategies, each tailored to specific market conditions and asset classes. Below, we’ll delve into some of the most prevalent arbitrage strategies, shedding light on their distinct characteristics and considerations. Familiarizing yourself with these strategies is instrumental in recognizing arbitrage prospects and implementing risk-mitigation measures (calculation of transaction costs, for instance) effectively.

Merger Arbitrage

This strategy revolves around capitalizing on price disparities that emerge when two companies announce a merger or acquisition. Merger arbitrageurs seek to exploit the gap between the target company’s stock price and the acquiring company’s offer price. Successful execution hinges on predicting the likelihood of the merger’s completion and assessing associated risks.

Fixed Income Arbitrage

In the fixed income arbitrage arena, traders aim to receive payment from discrepancies in bond prices. This strategy can involve trading in government bonds, corporate bonds, or other fixed-income securities. By identifying temporary mispricings, fixed-income arbitrageurs can generate returns without taking significant market direction risk.

Statistical Arbitrage

Statistical arbitrage relies on quantitative models and statistical analysis to identify mispricings in correlated assets. Traders utilize mathematical algorithms to pinpoint trading opportunities. This strategy requires a robust understanding of statistical modeling and sophisticated trading systems.

Risk Arbitrage

Also known as “special situations” arbitrage, this approach focuses on capitalizing on events that can affect an asset’s price, such as mergers, acquisitions, or corporate restructurings. Risk arbitrageurs assess the potential impact of these events on asset prices and take positions accordingly.

Triangular Arbitrage

This strategy applies primarily to currency markets. Traders look for inconsistencies in currency exchange rates to profit from three-way currency conversions. By carefully executing a series of trades, arbitrage traders can lock in gains resulting from these discrepancies.

Interest Rate Arbitrage

Investors use interest rate arbitrage to take advantage of the difference between currencies based on the economic health of a country. Covered interest arbitrage, the most frequent type, happens when exchange rate risk is mitigated using a forward contract.

Understanding the nuances of these arbitrage strategies is pivotal for discerning potential opportunities and effectively managing the associated risks.

Comparing the value of Apple stocks on exchanges in Frankfurt (in blue) and Milan (in orange). Each divergence in the charts represents an opportunity for an arbitrage trade.

Crypto Arbitrage Trading

The cryptocurrency market is a convenient space for “arbitrageurs.” Crypto arbitrage between exchanges is simpler because the platforms operate around the clock, are more accessible, and don’t require intermediaries like brokers.

Stock broker instruments are usually quoted in local currencies, while on crypto platforms, they are quoted in USD, BTC, or stablecoins. Therefore, there are fewer risks on crypto exchanges (accounting for the transaction and withdrawal in the same currency). Crypto asset trading is more standardized because the principles of trading and asset withdrawal are the same. This makes it easier to calculate transaction costs.

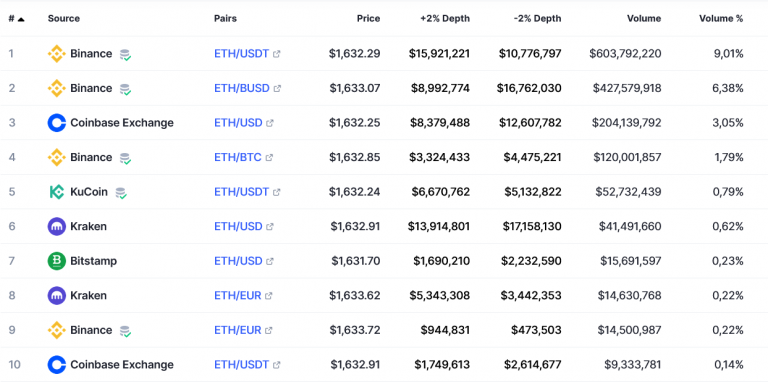

Cryptocurrency arbitrage is implemented similarly to the arbitrage in the stock market. Let’s look at a real-life example:

We noticed that ETH/EUR is trading at $1633.62 on Kraken and at $1633.72 on Binance. We need to buy ETH/EUR on Kraken, transfer it to Binance, and sell it for a higher price. Then we make a profit of 10 cents (1633.72–1633.62 = 0.10), not accounting for transaction and transfer fees between exchanges.

The price of stablecoins is not always equal to $1, which presents opportunities for crypto arbitrage strategies. The small profit from a single transaction piles up as the transaction amount grows

Cryptocurrency P2P Arbitrage

P2P arbitrage is a trading strategy based on P2P trading (off-exchange buying/selling between two users). In the P2P market, prices are set by participants at their discretion (though they are guided by the market value). Consequently, the price spread here is higher, which is convenient for arbitrage trading.

P2P transactions are conducted on specialized websites (such as LocalBitcoins) and major crypto exchanges. For example, in the P2P section on Binance, you will find the “Buy” tab with traders’ offers. The best one is 1 BTC for $23,517. In the “Sell” tab, sellers’ offers are posted. The highest price is $23,607. An “arbitrageur” can buy BTC for $23,517 and immediately resell it for $23,607. The difference of $90 is the profit you will receive from the operation (excluding exchange and payment system commissions).

Key Components of a Successful Arbitrage Trade

Achieving success in arbitrage trading requires a meticulous approach and a firm grasp of the fundamental components that underpin every profitable trade.

- Pricing Accuracy: At the heart of arbitrage trading lies the quest for pricing discrepancies. To seize opportunities effectively, you must possess a sense of pricing accuracy. This involves monitoring asset prices across multiple markets. Traders employ real-time data feeds, advanced algorithms, and analytical tools to ensure accurate pricing information. Even the slightest deviation in pricing can impact the profitability of a trade, making precision a paramount consideration.

- Execution Speed: The speed at which you execute arbitrage trades is a determining factor in making money. Rapid execution is crucial because price disparities can be short-lived. A delay of mere milliseconds can render an arbitrage opportunity obsolete. Traders often employ high-frequency trading (HFT) systems and co-location services to minimize execution latency and gain a competitive edge.

- Risk Management Techniques: Arbitrage trading is not without risks. Market conditions can change rapidly, and unexpected events can disrupt your strategies. Effective risk management is essential to safeguard your capital and profits.

- Technology Infrastructure: Your trading setup plays a pivotal role in arbitrage success. A robust technology infrastructure is vital, including high-speed Internet connections, reliable trading platforms, and redundancy systems to prevent downtime. Additionally, utilizing co-location services co-located with exchange servers can further enhance execution speed and reliability.

- Market Monitoring: Continuous monitoring of markets and assets is a core aspect of arbitrage trading. Traders must keep a watchful eye on various markets and stay informed about relevant news and events. Automated monitoring tools can assist in tracking price differentials and signaling trading opportunities.

- Capital Adequacy: Adequate capital is essential for arbitrage trading, as it allows you to take advantage of opportunities when they arise. Trading with insufficient capital can limit your ability to execute trades and capitalize on pricing disparities. Assessing your risk tolerance and ensuring sufficient funding is available is critical.

Legal and Regulatory Compliance: Arbitrage traders must adhere to legal and regulatory requirements in the markets they operate. Understanding the rules, regulations, and tax implications of different markets is crucial to avoid legal issues that could jeopardize your trading activities.

Risks and Challenges in Arbitrage Trading

Arbitrage trading, while promising profit opportunities, is not devoid of inherent risks and challenges. Understanding and addressing these factors are paramount for achieving consistent success in this trading strategy.

Market Volatility

Market volatility poses a significant risk in arbitrage trading. Sudden price fluctuations can disrupt pricing differentials and create unexpected losses. Arbitrage traders must be prepared to adapt to changing market conditions and implement risk mitigation strategies.

Liquidity Issues

Liquidity is a critical factor. Illiquid markets can make it challenging to execute large trades without significantly impacting prices. Traders must assess market liquidity before entering positions to ensure they can exit trades when needed.

Technology Constraints

Technology constraints encompass factors like execution speed and system reliability. Failures in trading infrastructure, network disruptions, or software glitches can result in missed opportunities or losses. Maintaining a robust technology setup is essential.

Regulatory Compliance

Navigating the regulatory landscape is crucial. Regulatory compliance varies across markets and can significantly impact trading activities. Arbitrageurs must stay informed about relevant regulations and ensure adherence to avoid legal issues.

Counterparty Risk

In some arbitrage trades, particularly those involving P2P platforms, counterparty risk exists. Traders must assess the creditworthiness and reliability of counterparties to minimize the risk of default.

Competition

Arbitrage trading is highly competitive. Other market participants are also seeking pricing disparities, and competition can impact the availability and profitability of arbitrage opportunities. Staying ahead of the competition requires continuous monitoring and adaptation.

Execution Slippage

Execution slippage occurs when trades are not executed at the expected prices due to market fluctuations. This can erode potential profits. Traders should implement strategies to minimize slippage, such as using limit orders.

Strategy Risk

Each arbitrage strategy carries its own set of risks. Understanding the specific risks associated with the chosen strategy, whether it’s merger arbitrage, fixed income arbitrage, or others, is essential for effective risk management.

Psychological Challenges

Arbitrage trading can be mentally demanding. Handling rapid decision-making, dealing with losses, and maintaining discipline during market turbulence can be psychologically challenging. Traders must cultivate emotional resilience.

Real-World Examples of Arbitrage Opportunities

To grasp the tangible benefits of arbitrage trading, let’s delve into real-world scenarios where astute traders have capitalized on pricing disparities. These case studies serve as illuminating examples of arbitrage in action, offering valuable insights into the potential rewards and strategies involved.

Crypto Arbitrage Trading

Cryptocurrency markets are known for their price volatility, creating ample arbitrage opportunities. Traders monitor multiple exchanges, searching for price disparities among digital assets like Bitcoin and Ethereum.

By purchasing assets at lower prices on one exchange and selling them at higher prices on another, arbitrage traders generate profits. These opportunities often appear fleetingly but can be highly lucrative when executed swiftly.

Learn more in our blog: 5 Best Crypto Arbitrage Screeners

Pairs Trading Success

Statistical arbitrage relies on quantitative analysis to identify mispricings. In this case, traders employ a pairs trading strategy, targeting two correlated stocks within the same industry. They observe that while the stocks typically move in tandem, occasional divergences occur.

Arbitrageurs go long on the underperforming stock and short on the outperforming one, expecting the prices to revert to their historical relationship. As the stocks realign, traders secure profits from the convergence.

These real-world examples highlight the versatility of arbitrage trading, spanning mergers and acquisitions, fixed-income markets, cryptos, and statistical analysis. They underscore the importance of meticulous market observation, swift execution, and a deep understanding of the chosen strategy.

Technology Is the Best Tool for Arbitrage Trading

To navigate the arbitrage trading environment, arbitrage traders rely on an arsenal of tools, software solutions, and trading platforms. In this section, we will explore the essential technological components that empower arbitrage traders to execute their strategies with precision and efficiency.

Real-Time Data Feeds

Real-time data feeds are the lifeblood of arbitrage trading. These feeds provide traders with instantaneous access to critical market information, including price quotes, order book data, and trade executions. By leveraging these feeds, arbitrageurs can monitor asset prices across multiple exchanges in real-time, allowing them to identify pricing disparities as they emerge.

Algorithmic Trading Software

Algorithmic trading software is a cornerstone of arbitrage strategies. These programs enable traders to automate trade execution based on predefined criteria. By implementing algorithms, arbitrageurs can execute trades with split-second precision, ensuring that pricing differentials are captured swiftly and accurately.

Connectivity Solutions

Robust connectivity solutions are essential for seamless access to multiple markets and exchanges. These solutions encompass high-speed Internet connections, redundant network setups, and low-latency connectivity to trading venues. Reliability and redundancy are crucial to ensure uninterrupted trading operations.

Trading Platforms

Arbitrage traders often leverage trading platforms provided by exchanges or brokerage firms. These platforms offer user-friendly interfaces for executing trades and accessing market data. Choosing the right trading platform that aligns with your strategy and asset preferences is pivotal.

Risk Management Tools

Effective risk management is fundamental to arbitrage trading. Specialized risk management tools help traders monitor and control risk exposure.

Tips for Novice Arbitrage Traders

Embarking on your journey as a novice arbitrage trader can be both exciting and challenging. To help you navigate this competitive arena, we’ve assembled a set of practical tips that will serve as a valuable foundation for your arbitrage trading endeavors.

- Understand the Basics: Before diving into arbitrage trading, ensure you have a solid understanding of the underlying concepts, including pricing disparities, market inefficiencies, and the specific arbitrage trading strategy you plan to employ. A strong foundation is key to making informed decisions.

- Start with a Clear Strategy: Select a specific arbitrage trading strategy that aligns with your goals and risk tolerance. Whether it’s merger arbitrage, fixed income arbitrage, or another approach discussed above, having a clear strategy will help you focus your efforts and resources effectively.

- Research and Data Analysis: Arbitrage opportunities often hinge on meticulous research and data analysis. Stay informed about market trends, news, and relevant finance or web3 events that can impact asset prices. Utilize research tools and historical data to identify potential disparities.

- Practice Patience and Discipline: Arbitrage trading requires patience. Opportunities may not present themselves frequently, and sometimes it’s best to wait for the right moment. Discipline is equally crucial; avoid impulsive decisions and stick to your predefined trading plan.

- Continuous Monitoring: Stay vigilant by continuously monitoring relevant markets and asset prices. Real-time data feeds and automated alerts can be invaluable in capturing fleeting arbitrage opportunities.

- Execution Speed Matters: In arbitrage trading, speed is of the essence. Invest in a reliable execution platform and a high-speed Internet connection to ensure your trades are executed swiftly and accurately.

- Paper Trading for Practice: Consider starting with paper trading or a demo account to practice your trading strategy without risking real capital. This will allow you to gain experience and confidence before committing actual funds.

- Stay Informed About Regulations: Be aware of the regulatory environment in the markets you trade in. Compliance with relevant laws and regulations is essential to avoid legal issues.

- Learn from Experience: Arbitrage trading comes with its own learning curve. Keep a trading journal to document your trades, strategies, and outcomes. Analyze your successes and losses to refine your approach over time.

- Seek Knowledge and Mentorship: Continuous learning is vital. Explore educational resources, attend webinars, and consider seeking mentorship from experienced traders. Learning from those who have experienced wins and losses through arbitrage trading can be invaluable.

- Embrace Adaptability: Markets evolve, and therefore, strategies may need adjustments over time. Be adaptable and willing to refine your approach as market conditions change.

- Start Small and Gradually Scale Up: Begin with a modest capital allocation and gradually scale up as you gain experience and confidence. Avoid overextending yourself in the early stages of your venture into arbitrage trading.

- Maintain Emotional Control: Emotions can be detrimental to trading. Maintain emotional control and avoid making impulsive decisions based on fear or greed. Stick to your predefined plan.

- Track Your Progress: Regularly assess your progress and goals. Set achievable milestones and adjust your trading plan accordingly.

If you’re looking for a supportive trading community, don’t hesitate to join the CScalp Discord server, where you can connect with like-minded traders, share insights, and expand your knowledge.

Unlocking Profit Opportunities with Arbitrage Trading: Your Path to Success

Armed with the right knowledge, advanced tools, and well-defined strategies, arbitrage trades can unlock a world of profit opportunities across diverse financial markets. Whether your interests lie in merger arbitrage, fixed income arbitrage, or any other facet of arbitrage trading, we hope this comprehensive guide can help serve as your compass to navigate the intricate terrain of this trading approach.

By immersing yourself in the nuances of pricing disparities, mastering the art of swift and precise execution, and embracing sound risk management principles, you can put yourself on the path to joining the ranks of successful arbitrageurs. The world of arbitrage trading offers a realm of possibilities, where meticulous observation and adaptability pave the way to consistent profits.

As you embark on your arbitrage trading journey, remember that continuous learning, discipline, and a supportive community can be your greatest assets. Seek knowledge from educational resources and blogs, attend informative webinars, and consider joining the CScalp trading community. Here, you can connect with experienced traders, share insights, and collectively enhance your trading prowess.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT