Exploring the Best Day Trading Software: A Comprehensive Guide

In the dynamic world of financial markets, day trading has emerged as a prominent strategy for traders seeking short-term gains by capitalizing on intraday price movements. Day trading involves buying and selling financial instruments within the same trading day, with the goal of profiting from rapid market fluctuations. This fast-paced approach requires not only a solid understanding of market dynamics but also the right tools and platforms to execute trades effectively. In this article, we will explore the best day trading software that will help you to succeed in the financial markets.

The Importance of Choosing the Best Day Trading Software

Day trading and scalping go beyond a pastime; they are serious professions. The trading platform becomes a scalper’s arena, the central hub for intricate market moves. With eight daily hours huddled before screens, a scalper navigates swift trades, emphasizing the crucial choice of a fitting tool. The chosen platform must surpass utility, providing both comfort and seamless alignment with the profession’s demands.

The trading platform serves as the virtual gateway to the market, providing access to real-time data, advanced charting tools, order execution capabilities, and more. Just as skilled craftsman requires quality tools to excel in their labor, a day trader’s performance hinges on the features and functionality offered by their chosen trading platform.

In this comprehensive guide, we delve into the world of day trading platforms, with a specific focus on CScalp. As one of the platforms highlighted by industry experts in the realm of day trading, it offers a range of features designed to empower you in your pursuit of intraday profits. Throughout this guide, we will explore the key facets that make each day trading software stand out, shedding light on its capabilities, advantages, and potential limitations.

Important Factors to Understand Day Trading Software

Day trading software plays a pivotal role in day-to-day operations, providing tools and environment necessary to seize fleeting market opportunities. This section delves into the core concepts of day trading platforms and their significance.

Defining Day Trading Software

Day trading software, such as CScalp, are specialized programs that enable traders to execute rapid buy and sell transactions within the same trading day. These platforms are designed to accommodate the unique needs of day traders, who aim to profit from intraday price movements. CScalp, in particular, is tailored to provide traders with real-time data, advanced charting capabilities, swift order execution, and other tools crucial for seizing quick market shifts.

The Role of Day Trading Softwares

In day trading, timing is everything. Day trading platforms act as the virtual bridge between traders and the financial markets, offering direct access to real-time market data and facilitating the execution of trades with minimal delay. For platforms like CScalp, this translates to rapid order execution that aligns with the fast-paced nature of day trading. Traders on CScalp can swiftly respond to market movements, helping them make informed decisions in split seconds.

Key Features to Look for in a Day Trading Software

Day trading requires precision, speed, and access to crucial information. The choice of a day trading platform can significantly impact your success. This section outlines the essential features that day traders, including those considering CScalp, should prioritize when evaluating platforms.

Real-Time Data and Charts

In the fast-paced world of day trading, up-to-the-moment data is non-negotiable. Day trading softwares like CScalp provide real-time data feeds and dynamic charts, enabling traders to monitor price movements and make split-second decisions.

Order Execution Speed and Reliability

The swiftness and reliability of order execution can make or break a day trader’s profitability. CScalp’s high-speed order execution ensures that traders can capitalize on market opportunities without suffering from slippage or delays.

Technical Indicators and Analysis Tools

CScalp, along with other robust platforms, equips day traders with an array of analysis tools. These tools empower traders to make informed decisions by spotting trends, patterns, and potential entry and exit points.

Customizability and Interface Intuitiveness

Each day trader has a unique style. CScalp’s customizable interface allows traders to tailor their workspace to suit their preferences and strategies, ensuring that critical information and tools are readily accessible.

CScalp Terminal Review: Crypto Scalping Software Suitable for Day Trading

CScalp is a cutting-edge crypto scalping terminal designed specifically for day trading enthusiasts. This free terminal provides a user-friendly experience, allowing traders to engage in rapid and precise trading actions across leading cryptocurrency exchanges. With over 12.000 active traders from 50 countries utilizing the terminal daily, CScalp has established itself as a preferred choice when speed and efficiency in trading decisions are paramount.

Unique Trading Software Features

Simultaneous Connection

CScalp allows traders to connect to multiple trading platforms concurrently, enhancing flexibility and access to various markets.

View Mode

The terminal supports a quotation view mode that facilitates real-time market monitoring without executing trading operations.

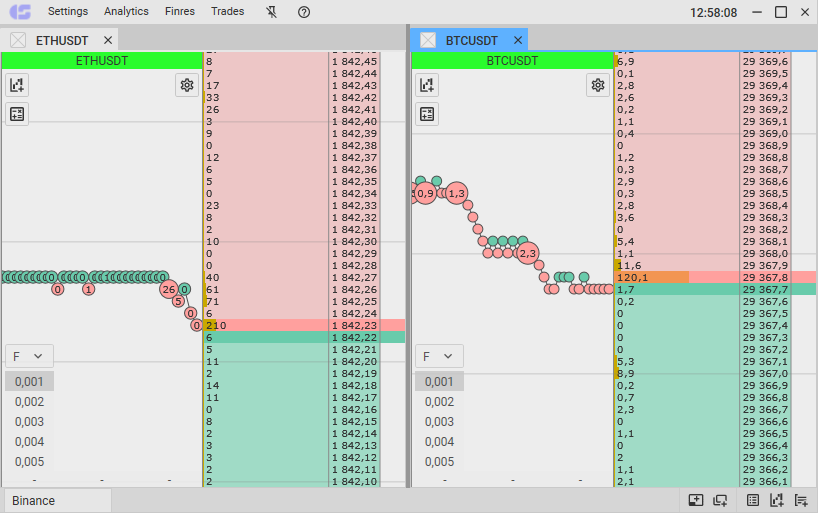

Customizable Order Books

Traders can personalize their order books, displaying tickers for any trading platform, including Binance, Bybit, OKX, Huobi, Phemex, BitMEX, Bitfinex, dYdx, and more.

Multi-Instrument Trading

CScalp enables traders to engage in simultaneous trading of up to 40 instruments.

One-Click Trading

The platform streamlines trading execution by providing one-click order placement and canceling.

Customizable Market Data

Traders can fine-tune incoming market data to suit their preferences.

Advanced Analysis Tools

CScalp offers features like DOM-style dynamic market rate display, tick charts for past deals, cluster analysis, and more.

Comprehensive Insights

Traders can customize their financial results and track the history of executed deals with additional free software called Trading Diary.

Technical Analysis Tools

The terminal includes tools such as trend line drawing, price level marking, and multiple timeframes for chart analysis.

Trading Tools and User Interface

Optimized Interface

CScalp’s interface is optimized for crypto scalping, which involves making rapid trading decisions to capitalize on short-term price movements. The layout prioritizes the information needed for quick decision-making, including real-time order book data, recent deals, and clusters.

Order Book and Order Flow

The terminal provides a detailed order book that displays buy and sell orders along with their corresponding quantities and prices. This allows traders to assess the market depth and liquidity efficiently. Additionally, the order flow showcases recent trades, aiding traders in understanding recent market activity.

To learn more, read our article: “Order Book: The Best Day Trading Tool.”

Cluster Analysis

CScalp’s cluster analysis empowers traders to identify patterns in order flow and market sentiment. This analysis is essential for making informed trading decisions, especially in the context of short-term scalping strategies.

Hotkeys

CScalp includes customizable hotkeys, allowing traders to navigate and use the terminal quickly and efficiently. Hotkeys are particularly useful for executing trades and managing orders with speed.

Cscalp Is a Free Professional Day Trading Software

Understanding the costs associated with using the platform is essential for making informed decisions. Here’s a comprehensive overview of the fees and account minimums associated with using CScalp:

Terminal Usage Fee: CScalp provides a free terminal for traders, allowing them to access its range of tools and features without any payment. This approach democratizes access to the platform, making it suitable for traders of varying levels of experience.

Exchange Fees: It’s important to note that while CScalp provides its terminal free of charge, traders may still incur trading fees imposed by the exchanges they trade on.

Account Minimums: CScalp does not impose any specific account minimums to start using the platform. This is particularly beneficial for traders who are just starting and may not have substantial capital to begin trading. The absence of account minimums aligns with CScalp’s user-friendly and inclusive approach.

Trading Software-Specific Benefits

- Optimized Interface for Scalping: CScalp’s interface is meticulously designed for the art of crypto scalping. It prioritizes the order book, order flow, clusters, and charts, ensuring rapid decision-making for short-term trading strategies.

- Collaborative Elements: The inclusion of a Trading Diary and a dedicated Discord community fosters collaboration. Traders can reflect on their actions, learn from their experiences, and engage with others to share insights and advice.

- Signals and Scalping Community: CScalp provides a free Telegram channel for trading signals and tips from the community. This resource supports scalpers in staying informed and exploring new strategies.

Day Trading Software Review: 3Commas

3Commas is a comprehensive cryptocurrency trading platform that has gained popularity for its advanced trading bots, portfolio management tools, and automation features. Let’s take an in-depth look at this platform to learn more about its strengths, weaknesses, user experiences, pros, and cons.

Unique Features and Trading Tools

3Commas stands out for its focus on automation and algorithmic trading. The platform offers a range of unique features and trading tools designed to enhance users’ trading strategies:

Smart Trade Terminal

3Commas provides a unified interface, allowing users to execute trades across multiple exchanges from a single platform. This streamlines portfolio management and trade execution, saving time and effort.

Trading Bots

One of 3Commas’ main strengths is its trading bot functionality. The platform offers various types of bots, including Simple Bots, Composite Bots, and Advanced Bots. These bots enable users to automate trading strategies based on predefined conditions, indicators, and market movements. The Advanced Bots, in particular, allow for more sophisticated strategies.

TradingView Custom Signals Integration

3Commas integrates with TradingView’s powerful technical analysis tools, allowing users to create custom trading signals based on their analysis. These signals can be automated to execute trades on the platform, eliminating the need for manual monitoring.

Portfolio Management

The platform provides a portfolio management feature that enables users to manage multiple crypto accounts from a single dashboard.

User Interface and Experience

3Commas offers a user-friendly and intuitive interface. The trading terminal is well-designed, making it easy for both beginners and experienced traders to navigate the platform’s features. The integration of TradingView’s charts enhances the overall trading experience, allowing users to perform technical analysis directly on the platform.

Fees and Pricing

3Commas offers different pricing plans to cater to varying trading needs. The Starter plan is priced at $29 per month, the Advanced plan at $49 per month, and the Pro plan at $99 per month. The platform also provides a free trial version that allows users to experience the features of all plans for a 7-day period.

Account Minimums

There is no specific account minimum required to use 3Commas. Traders can choose a plan based on their preferences and trading requirements.

Platform-Specific Benefits

Automation: 3Commas’ primary strength lies in its trading bot functionality, enabling users to automate their trading strategies.

Custom Signals: The integration with TradingView’s Custom Signals empowers users to create and automate trading strategies based on technical analysis.

Portfolio Management: The platform’s portfolio management feature is beneficial for traders with diversified crypto holdings.

Ease of Use: The user-friendly interface and integration with TradingView enhance the overall trading experience.

Strengths

- Advanced trading bot options for various levels of traders.

- Integration with TradingView for in-depth technical analysis.

- Portfolio management tools for diversified traders.

- User-friendly interface is suitable for both beginners and experienced traders.

Weaknesses

- The reliance on automated trading might not suit traders who prefer manual decision-making.

- The fee structure may be seen as a drawback for traders on a tight budget.

Who Does 3Commas Cater To?

3Commas is ideal for traders who want to leverage automation and algorithmic trading strategies. It’s useful for those with varying levels of experience, as the platform offers different bot options that cater to different skill levels. Traders who want to manage multiple accounts and execute trades across various exchanges from a unified interface will also find value in 3Commas’ features.

Day Trading Software Review: MetaTrader 4 (MT4)

MetaTrader 4 (MT4) remains a cornerstone in the world of online trading, offering traders a comprehensive suite of features and tools. This review will delve into the strengths, weaknesses, user experiences, pros, and cons of MT4, based on the provided information.

Unique Features and Trading Tools

MT4’s unique features and trading tools make it a reliable choice for traders seeking diverse functionalities:

Expert Advisors (EAs)

MT4’s support for automated trading through Expert Advisors stands out. Traders can create or utilize EAs to automate trading strategies, enabling execution without constant monitoring.

Rich Indicator Library

MT4 boasts an extensive array of technical indicators, making it a haven for technical analysis enthusiasts. Customizable charts, graphical tools, and diverse timeframes empower traders with in-depth analysis capabilities.

Marketplace and Third-Party Tools

MT4’s marketplace offers third-party indicators, EAs, and scripts. This ecosystem lets traders enhance functionality and explore new strategies.

User-Friendly Interface

MT4’s interface, though visually dated, is user-friendly and accessible. It caters to traders of varying experience levels and simplifies navigation.

Algorithmic Trading

The platform’s automated trading features, including backtesting and optimizing strategies, are invaluable for algorithmic traders.

User Interface and Experience

MT4 offers an intuitive and user-friendly experience, whether on desktop, web, or mobile. The platform’s design, though not modern, provides accessibility and navigational ease.

Strengths

- Comprehensive Technical Analysis: MT4’s array of indicators and customizable charts make it a paradise for technical analysts.

- Expert Advisors and Automation: The support for algorithmic trading and Expert Advisors streamlines strategy execution.

- Marketplace for Enhancements: The marketplace offers third-party tools, expanding the platform’s capabilities and catering to diverse strategies.

- User-Friendly Interface: MT4’s interface, though dated, is easy to navigate, suiting traders at all levels.

Weaknesses

- Outdated Visual Design: The platform’s interface, though user-friendly, might not be visually appealing when compared to more modern platforms.

- Limited Order Types: MT4 lacks some advanced order types available in other platforms.

MT4 is Suitable for a Range of Traders

- Technical Analysis Enthusiasts: With its extensive indicator library, customizable charts, and graphical tools, MT4 caters to traders focused on technical analysis.

- Algorithmic Traders: The platform’s support for algorithmic trading through Expert Advisors enables the automation of complex strategies.

Fees and Minimums

MT4 day trading software is provided for free. Fees, commissions, and minimums depend on your chosen broker.

Trading Software-Specific Benefits

Advanced Charting: MT4’s robust charting tools and extensive indicator library facilitate detailed technical analysis.

Expert Advisors: MT4’s support for automated trading through Expert Advisors empowers traders with algorithmic strategies.

Marketplace: The marketplace offers third-party tools, enhancing MT4’s capabilities for traders.

MetaTrader 4 is a strong choice for traders due to its comprehensive features, technical analysis tools, and accessibility. Despite its dated interface, MT4’s strengths in technical analysis, automation, and user-friendliness make it a reliable platform for traders at all stages of their journey.

Day Trading Software Review: Tiger.Trade

Tiger.Trade is a multi-asset trading platform that offers both self-directed trading through its platform and the option to follow the trades of professional investors through its copy trading app. Here’s a detailed review of Tiger.Trade, covering its unique features, trading tools, user interface, fees, and suitability for different types of traders.

Unique Trading Software Features

Copy Trading App

One of the standout features of Tiger.Trade is its copy trading app. This app allows users to replicate the trades of experienced and successful traders. This is particularly advantageous for beginner traders who may lack the expertise to make informed trading decisions.

Regulation

Tiger.Trade is regulated by the Swiss Financial Market Supervisory Authority (FINMA), which provides a level of trust and credibility. This regulatory oversight ensures that the platform complies with Swiss regulations, which can be reassuring for traders concerned about the legitimacy of the platform.

Diverse Market Access

Tiger.Trade offers access to a wide range of markets, including cryptocurrencies, Forex, stocks, and futures. This is beneficial for traders who want to diversify their portfolios across different asset classes.

Risk Management Alerts

The platform offers risk management alerts that can help traders minimize potential losses and manage risk effectively.

Trading Tools and User Interface

Copy Trader App

The copy trading app provides an intuitive and user-friendly interface for both novice and experienced traders. Users can easily browse and select professional traders to copy, view their performance history, and set risk parameters.

Advanced Charts

The platform’s advanced charting tools are available on the fully functional Windows version. This feature-rich charting helps traders analyze price trends and make informed trading decisions.

Depth of Market Analysis

For those who prefer in-depth market analysis, Tiger.Trade provides the depth of market data through charts, allowing traders to analyze supply and demand dynamics.

Fees and Account Minimums

Copy Trader App Fees

Traders using the copy trading app pay a commission, usually around 10% of profitable trades. There’s also a withdrawal fee of $3.20 for the copy trading app.

Windows App Tiers

The Windows app is available in different tiers, including a free cryptocurrency trading version. There are also subscription-based options with varying pricing plans: monthly ($55), 3 months ($124), annual ($399), and lifetime ($1500).

Trading Software-Specific Benefits

- Full-Featured Windows App: The fully functional Windows app offers a comprehensive trading experience with advanced charting, depth of market data, and access to various exchanges.

- Copy Trading Beginners: The copy trading app is ideal for beginners who want to enter the trading world without a steep learning curve. They can learn from successful traders while their portfolios are managed automatically.

- Intermediate to Advanced Traders: The fully functional Windows app is well-suited for traders with more experience who want access to advanced charting tools and in-depth market analysis. The app’s flexibility and customizability cater to their trading preferences.

Pros

- Swiss-regulated, offering a sense of security and trust.

- Copy trading app benefits beginners and traders with less experience.

- Diverse market access across cryptocurrencies, Forex, stocks, and futures.

- Risk management tools and advanced charting features.

- History Player service offers a demo-like experience for testing strategies.

Cons

- Copy trading commissions and withdrawal fees impact profitability.

- Limited chart settings and indicators on the iOS app.

- Relatively new platform with limited user reviews and feedback.

- No sign-up bonuses or promotions.

Tiger.Trade presents an enticing option for traders looking to access various markets and engage in both self-directed trading and copy trading. With Swiss regulation, a diverse range of markets, risk management features, and the History Player demo account, the platform offers a variety of tools for traders at different skill levels.

The copy trading app is particularly suitable for beginners, while the fully featured Windows app caters to more experienced traders seeking advanced analysis and customization options.

Risk Management and Psychology in Day Trading

Successful day trading involves more than just technical expertise. It requires adept risk management and emotional resilience. As you embark on your day trading journey, keep the following points in mind:

Risk Management: Implement a clear risk management strategy to protect your capital. Use tools like Stop-Loss and Take-Profit orders to minimize losses and secure gains.

Psychological Challenges: Day trading can be emotionally taxing due to the rapid nature of decision-making. Overconfidence, fear, and impulsiveness are common pitfalls. Be aware of these emotions and work on maintaining discipline.

Trading Software’s Role: The right day trading platform can assist in managing emotions. Features like risk management tools and real-time data can help you make informed decisions without succumbing to emotional pressures.

Embarking on Your Trading Journey: The Crucial Choice of a Day Trading Software

In summary, the journey through this guide has illuminated critical aspects of day trading platforms. We’ve delved into the unique features of platforms like CScalp, Tiger.Trade, MetaTrader 4, and 3Commas, deciphering their strengths and specializations.

Undoubtedly, the selection of an apt day trading platform holds immense weight. It is not just a choice but a foundation upon which your trading success is built. By aligning the platform with your trading style, instruments, and goals, you enhance your potential for profitability.

Remember, haste rarely befits the decision-making process. The significance of selecting the right platform cannot be overstated. Take the time to meticulously research and consider your options. Delve into platform reviews, user feedback, and your own requirements. This deliberate approach ensures that the platform you choose is a harmonious extension of your trading endeavors.

With these insights, you’re empowered to embark on your day trading journey equipped with the knowledge to make a decision that optimally serves your aspirations. As you navigate the dynamic world of day trading platforms, remember that informed choices are the bedrock of successful trading.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT