Best Trading Platforms: 2024 Top Software for Day Trading

The best trading platforms for day trading that make our ranking list offer advanced features, fast execution, a large selection of research, low or zero costs, as well as mobile apps for day trading on the go. Below you will find our picks for the best day trading platforms in different trading categories. Don’t forget to check out the professional trading platform CScalp, the best trading terminal in our ranking.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

The Best Trading Platforms: Top Day Trading Software Picks

The official Binance apIn recent years, best trading platforms and brokers have reduced or eliminated stock trading commissions and other fees. Others added cryptocurrencies to the list of the supported assets. Some of our best day trading software picks even offer free professional trading platforms. That is why comparing best trading platform core features is so important, as trading platforms can be a true differentiator for many traders and brokers.

Below, our team of professional traders and experts have created a list of the best day trading platforms and brokers that will allow you to choose one based on your priorities. Our best trading platforms picks include:

- Best free trading platform: CScalp

- Best trading platform for advanced traders: Interactive Brokers

- Best day trading platform for new or intermediate traders: Webull

What Is a Trading Platform

A trading platform is software used for market analysis and trading on the exchange. Trading platforms can be divided into two general categories:

- Trading platforms – software for transmitting orders to a broker or exchange. Most terminals fall under this category, where the priority is functional trading capabilities. The analytical features vary depending on the specific program. Some platforms allow traders to study the market in great detail, while others offer just the basic tools.

- Analytical platforms – software focused on deep market analysis, without trading options. These programs are designed for technical, cluster, and fundamental analysis. The toolkit includes a wide range of technical indicators, charts, drawing tools, pattern recognition, footprints, and other aids. Analytical platforms are often supplemented with news feeds, signals, and reports, but they rarely include trading options.

Some sources on the Internet mistakenly equate the terms “trading platform” and “exchange.” An exchange is a marketplace where trades take place – where buyers and sellers’ orders meet, prices are determined, and assets are exchanged. A trading platform is software, a trader’s working tool. Best trading platforms do not organize trading; they simply transmit the trader’s commands to the exchange. Additionally, day trading platforms can work with multiple exchanges simultaneously. In metaphorical terms, an exchange is like a street market, and a trading platform is the taxi that takes the trader to the market.

Using trading software is not mandatory. Day trading software is essential for traders who engage with the market daily or regularly. For instance, scalpers and day traders “trade from dawn to dusk.” Using exchange-provided day trading software can be inconvenient for them due to a lack of tools, so they opt for specialized trading terminals. If a trader visits the exchange once a month, the exchange interface might suffice. The choice of software depends on the trader’s style, goals, and strategy.

What to Look for in the Best Day Trading Platform

When it comes to picking the best trading platform, traders have plenty of choices—mobile apps, web-based tools, and desktop trading software. The best day trading software stands out by offering easy access to premium research, fast trade execution, and a user-friendly interface. Top platform for trading should also provide innovative tools for building strategies and analyzing the market.

How We Test Brokers and Review the Best Online Trading Platforms

At CScalp, we take a deep dive into each day trading platform to give you a clear picture of what you can expect from each trading platform. First, our professional traders and experts test broker’s execution speed, the quality of third-party research tools. We also investigate whether the broker uses payment for order flow (PFOF = payment for order flow), which can cut trading costs but might affect how well trades are executed.

Next, our reviewers start testing features of the day trading platforms like real users. We add funds to the accounts, make trades, and dig into the platform’s analytical tools to see how they perform. This gives us a complete view of how the best day trading software works in practice.

Our reviews cover both the technical features of the professional trading platform and how smooth the overall experience is. A broker might have the best trading terminal on paper, but if it’s slow or hard to use, or if opening an account is a hassle, that’s going to impact the score. Ultimately, the best trading platforms should make the process seamless for traders.

Best Trading Platforms: 2024 Top Software for Day Trading

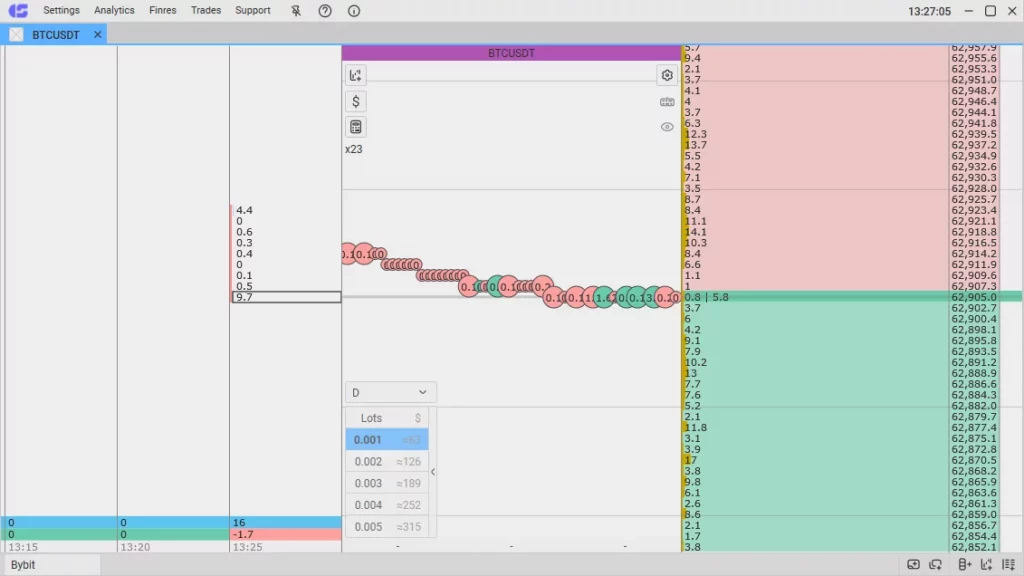

CScalp

Our Rating: 5/5

CScalp official website

Cost: Free

Fees: $0 terminal fees, varies by exchange

Account Minimum: No minimum

Why We Like the CScalp Professional Trading Software

CScalp is the best trading platform designed for day traders and scalpers who need fast, responsive day trading software. This free professional trading platform supports multiple cryptocurrency exchanges such as Binance, Bybit, and OKX, allowing traders to place orders with a single click. CScalp offers features like Stop-Loss/Take-Profit settings and customizable trade volumes. Its dynamic order books, advanced charts, and trade feeds make it one of the best trading platforms for traders who need quick execution and detailed market insights.

Pros:

- Seamless integration with several crypto exchanges

- One-click order placement

- Customizable interface

- Advanced analytical tools

- Highly responsive interface

Cons:

- Limited to cryptocurrency markets

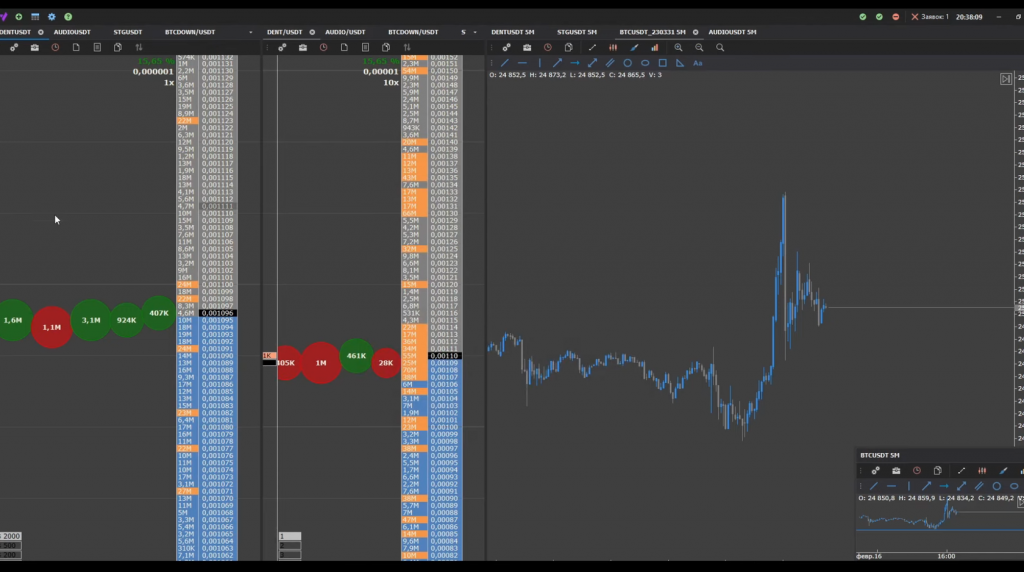

EasyScalp

Our Rating: 4.5/5

EasyScalp official website

Cost: Free

Fees: Varies by exchange

Account Minimum: No minimum

What Is Special About the EasyScalp Trading Platform

EasyScalp is tailored for crypto scalpers. It is a fast, responsive day trading software with a strong focus on efficiency. It connects directly to Binance via API and provides advanced market analysis tools like order books, clusters, and price feeds. EasyScalp also allows easy management of Stop-Loss and Take-Profit.

Pros:

- Direct API connection to Binance

- Real-time market data

- Easy management of Stop-Loss/Take-Profit

- Customizable clusters and order books

Cons:

- Limited to cryptocurrency trading

- Only works with Binance

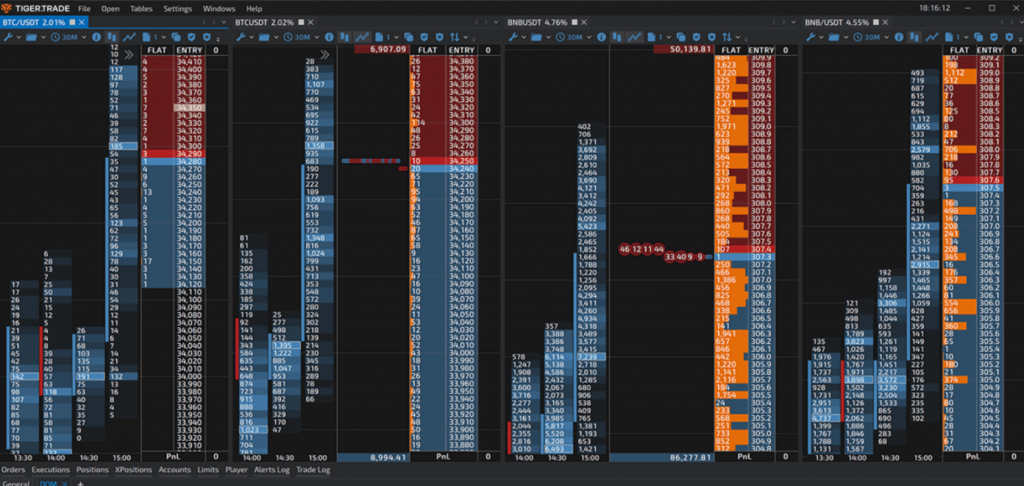

TigerTrade

Our Rating: 4.7/5

TigerTrade official website

Cost: Free (crypto trading), $1500 (lifetime price for all connections)

Fees: Varies by exchange

Account Minimum: No minimum

What Is Special About the TigerTrade Day Trading Software

TigerTrade is a trading terminal for traders across both the cryptocurrency and stock markets. It offers market analysis tools, including candlestick and cluster charts, along with dynamic order books. One standout feature is the replay functionality, which allows users to simulate past market sessions to test strategies, making it one of the best trading platforms for those who value data-driven analysis and strategy refinement.

Pros:

- Advanced candlestick and cluster charts

- Replay functionality for strategy testing

- Supports both cryptocurrency and stock markets

- Dynamic order book

Cons:

- Slightly more complex for beginners

Learn more in our TigerTrade review.

QuanTower

Our Rating: 4.6/5

QuanTower official website

Cost: $1590 (lifetime)

Fees: Varies by exchange

Account Minimum: No minimum

What Is Special About the QuanTower Professional Trading Platform

QuanTower is a powerful and versatile trading platform that integrates advanced trading tools and features for cryptocurrency and stock markets. The platform includes customizable order books, detailed volume histograms, and high-level charting tools, making it one of the best day trading platforms for traders who need to closely track market movements. QuanTower also features historical trade data, perfect for traders who need to analyze past market behavior.

Pros:

- Advanced order book tracking

- Detailed volume histograms

- Customizable trading terminal

- Historical trade data

Cons:

- More suitable for advanced traders

Learn more in our QuanTower review.

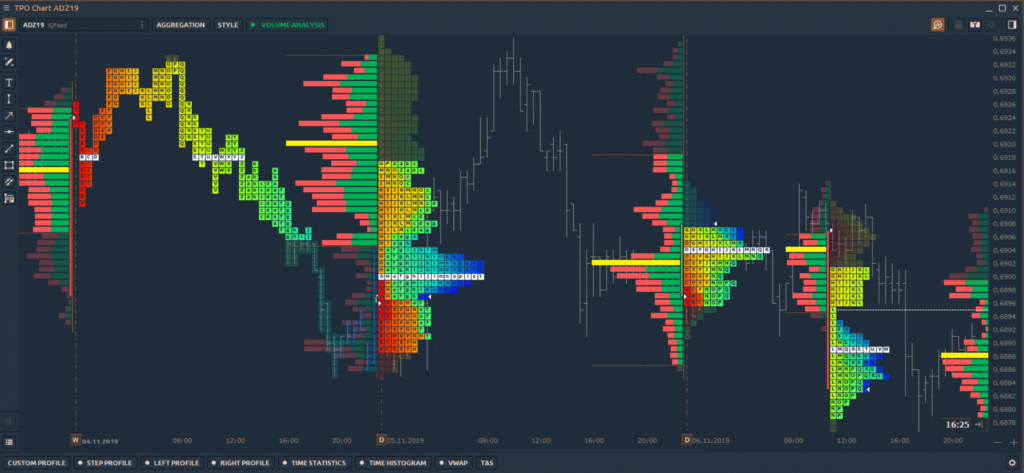

ATAS

Our Rating: 4.8/5

ATAS official website

Cost: $1997 (lifetime)

Fees: Varies by exchange

Account Minimum: No minimum

What Is Special About the ATAS Trading Platform

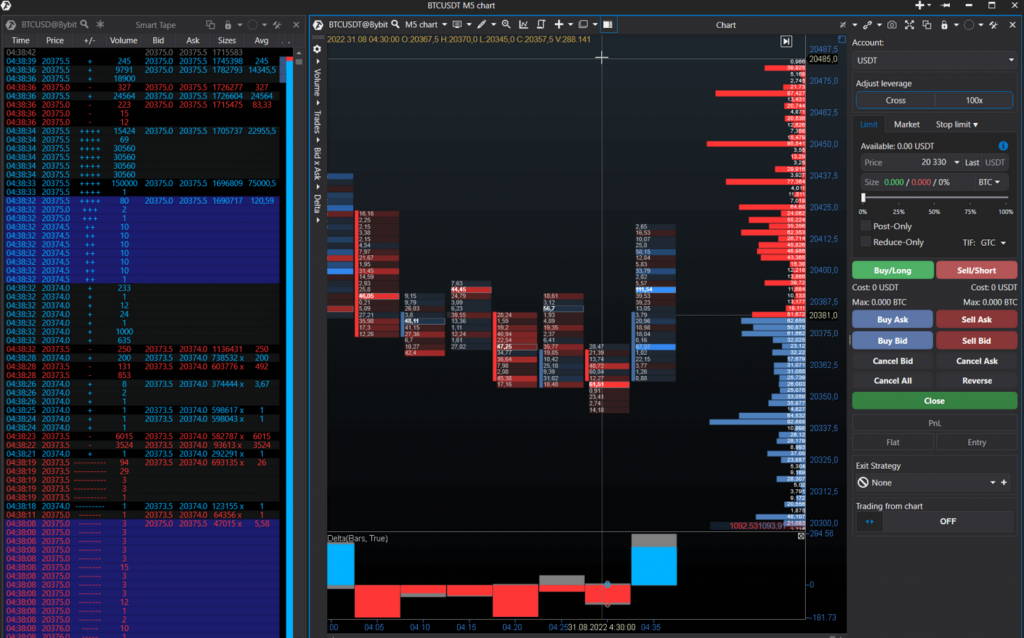

ATAS is a professional trading platform that integrates advanced charting and trading features into a single, user-friendly interface. It allows users to trade directly from charts, with features like Fibonacci overlays, drawing tools, and Smart Tape for grouping order flows. This makes ATAS one of the best trading platforms for chart-based analysis and technical traders who value precision and ease of execution.

Pros:

- Trade directly from customizable charts

- Advanced technical analysis tools

- Smart Tape for order flow management

- Intuitive interface

Cons:

- Can be overwhelming for new traders

Learn more in our ATAS review.

3commas

Our Rating: 4.6/5

3commas official website

Cost: $59/month (annual plan)

Fees: Depends on exchange and plan

Account Minimum: No minimum

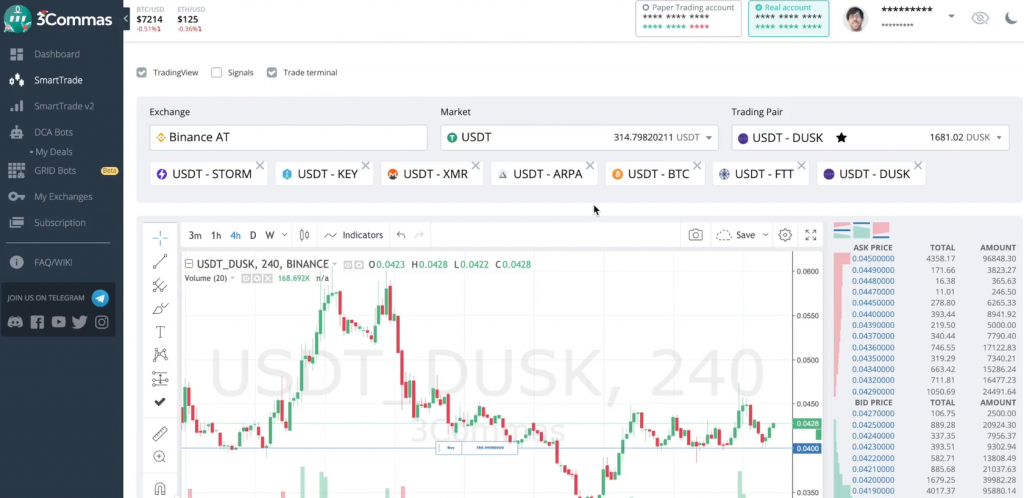

What Is Special About the 3commas Trading Platform

3commas offers both manual and automated trading options, making it one of the best trading platforms for traders seeking flexibility. Its Smart Trade feature stands out, allowing users to manage trades with tools like Stop-Loss, Take-Profit, and Trailing Stop orders. The platform is connected to major cryptocurrency exchanges and supports both live and paper trading, allowing traders to practice strategies risk-free before going live.

Pros:

- Smart Trade management tools

- Paper trading for strategy testing

- Manual and automated trading support

- Direct integration with major crypto exchanges

Cons:

- Primarily focused on cryptocurrency trading

Learn more in our 3Commas review.

Charles Schwab

Our Rating: 4.9/5

Charles Schwab official website

Fees: $0 per online equity trade

Account Minimum: $0

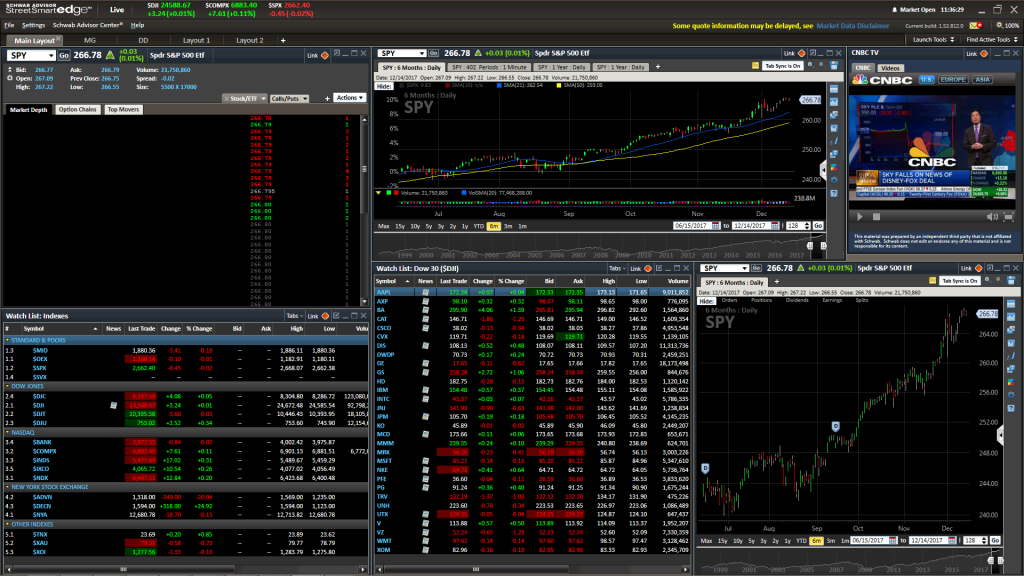

What Is Special About the Charles Schwab Trading Platform

Charles Schwab is recognized for offering some of the best day trading software available today, providing a range of platforms that cater to both beginners and advanced traders. Its standout desktop trading software, StreetSmart Edge, and the highly regarded thinkorswim platform (acquired from TD Ameritrade) are considered some of the best trading terminals in the industry. These platforms support real-time monitoring, customizable charts, and extensive research tools, making them ideal for active day traders and long-term investors alike. Schwab’s mobile app also offers seamless navigation, making it easy to switch between research and trading without hassle. For those looking for a professional trading platform with powerful features, Schwab is a top pick.

Pros:

- Customizable and professional trading platforms

- Extensive research tools

- Seamless mobile app experience

- Commission-free trading

Cons:

- Low interest on uninvested cash

E*TRADE

Our Rating: 4.4/5

E*TRADE official website

Fees: $0 per trade (other fees may apply)

Account Minimum: $0

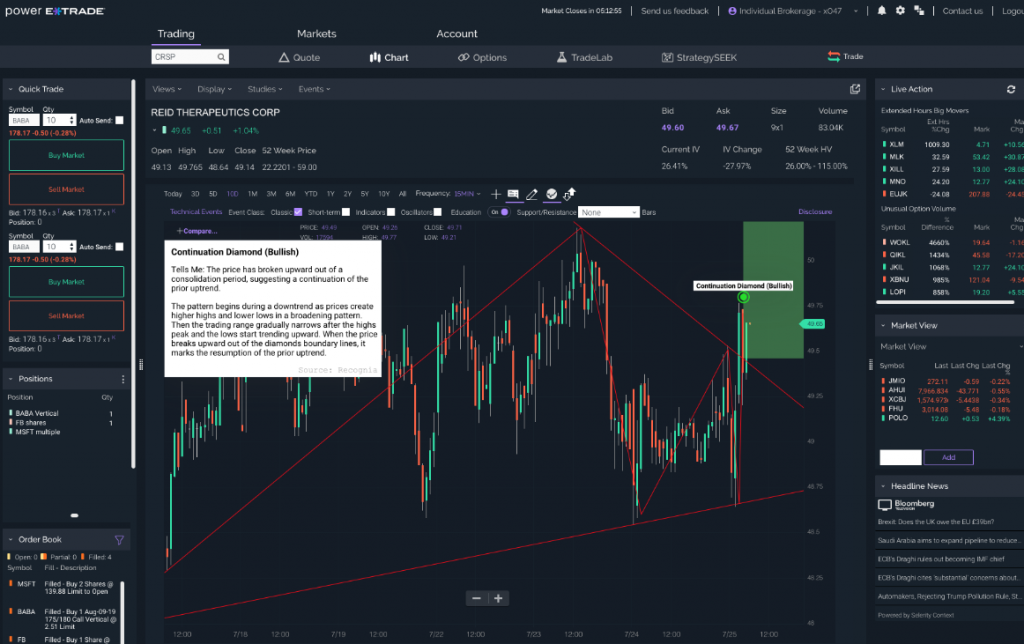

What Is Special About the E*TRADE Trading Platform

ETRADE shines with its highly regarded Power ETRADE platform, considered one of the best trading platforms for active traders. This day trading software provides real-time data, advanced charting with over 100 technical studies, and customizable options chains. E*TRADE offers flexibility through its extended market hours, giving users more opportunities to execute trades. Additionally, its mobile app provides a user-friendly experience, while the platform’s robust tools help traders make fast, informed decisions. It’s a powerful platform for trading, especially for those looking for both advanced features and ease of use.

Pros:

- Advanced mobile app

- Real-time data and analysis tools

- Extended market hours for trading flexibility

- No account minimums

Cons:

- Website can be challenging to navigate

Webull

Our Rating: 5.0/5

Webull official website

Fees: $0 per trade

Account Minimum: $0

What Is Special About the Webull Trading Platform

Webull is one of the best day trading platforms for beginners and intermediate traders, offering a clean, intuitive design that doesn’t sacrifice functionality. As a commission-free platform, Webull supports trading across multiple assets, including stocks, ETFs, options, and cryptocurrencies, making it a versatile option for those seeking flexibility. Its desktop trading software and mobile platform offer access to real-time data, and the ability to trade IPOs—a feature that’s still relatively rare among brokers. Webull’s combination of a user-friendly interface and advanced trading tools make it a top contender for traders looking for the best day trading software that grows with their skills.

Pros:

- Commission-free trading across multiple asset classes

- User-friendly and easy-to-navigate interface

- Access to IPOs and cryptocurrencies

- High-quality trade execution

Cons:

- No support for mutual funds

- Limited educational resources

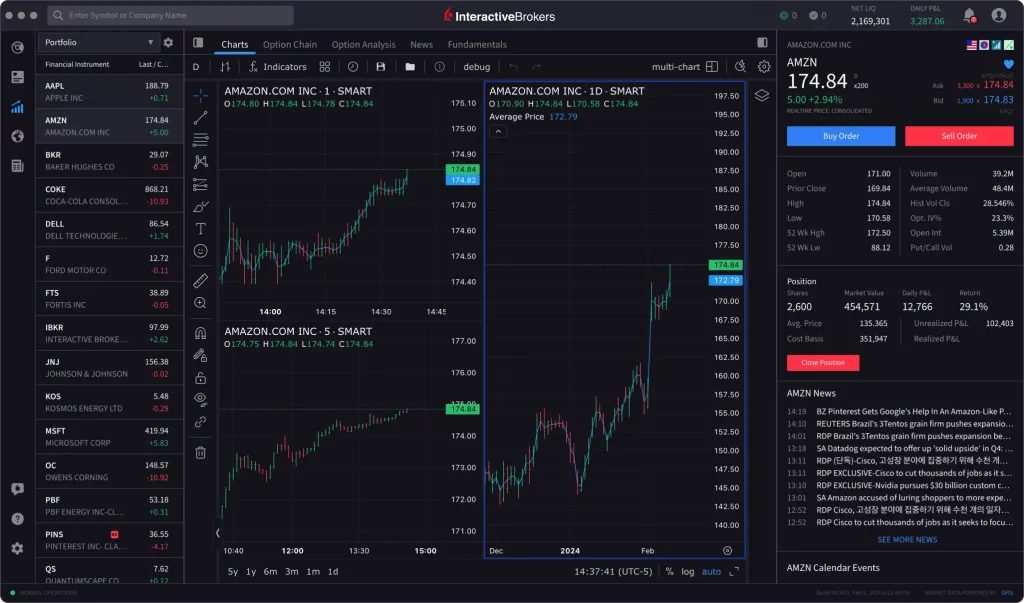

Interactive Brokers (IBKR Pro)

Our Rating: 5.0/5

Interactive Brokers official website

Fees: $0.005 per share; volume discounts available

Account Minimum: $0

What Is Special About the Interactive Brokers (IBKR Pro) Trading Platform

Interactive Brokers is renowned for its Trader Workstation (TWS), one of the most advanced professional trading platforms available. As a desktop trading software, TWS offers real-time monitoring, customizable dashboards, and advanced charting features that cater to serious day traders and investors. It also includes an options strategy lab and volatility lab, offering detailed tools for options trading and market analysis. With a wide range of tools and features like heat maps and paper trading for strategy testing, Interactive Brokers delivers one of the best day trading software experiences for advanced users.

Pros:

- Advanced charting and analytical tools

- Volume discounts for active traders

- Real-time monitoring and customizable interface

- Powerful desktop trading platform

Cons:

- Complex pricing structure

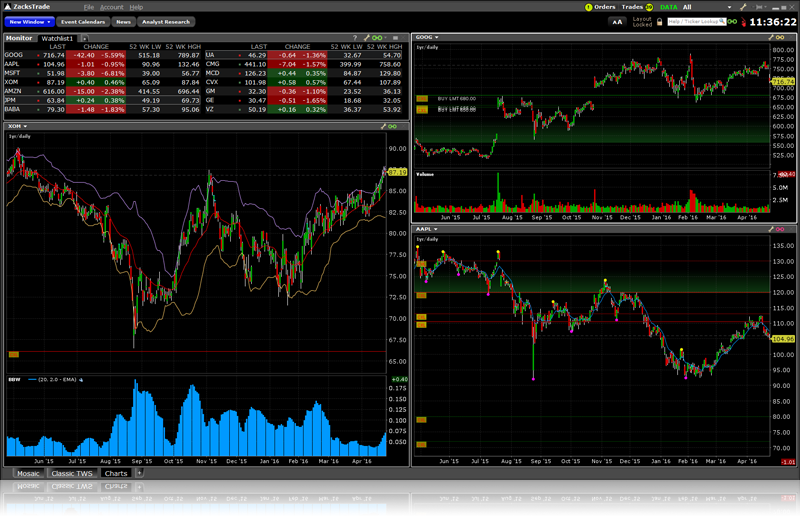

Zacks Trade

Our Rating: 3.5/5

Zacks Trade official website

Fees: $0.01 per share

Account Minimum: $250

What Is Special About the Zacks Trade Platform

Zacks Trade offers a high-level professional trading platform, Zacks Trade Pro, known for its advanced charting capabilities and customization options. It provides access to over 120 technical indicators, making it one of the best trading terminals for experienced traders who require in-depth market analysis. Zacks Trade also excels in offering access to international exchanges and OTC markets, although it does come with higher fees. Its real-time data and robust analytical tools make it a solid choice for traders focused on niche markets and looking for a professional-level platform for trading.

Pros:

- Access to international and OTC markets

- Advanced charting and analytical tools

- Real-time data for quick market insights

- Highly customizable platform

Cons:

- Higher fees for trades

- Low interest rates on uninvested cash

Best Trading Platforms Rating Methodology

At CScalp, we take a comprehensive approach to evaluating each trading platform to provide traders with an in-depth understanding of its performance. Our process begins with professional traders and experts testing essential features such as execution speed, the accuracy of third-party research tools, and any use of payment for order flow (PFOF).

Once we have gathered this data, our reviewers dive into hands-on testing of the trading platforms. They fund accounts, place trades, and explore the platform’s analytical tools to see how they perform under real trading conditions. This approach gives us a clear picture of how the best day trading software works in practice, from trade execution to the usability of charting tools and market analysis features.

Our reviews focus not only on the technical features of a professional trading platform but also on the overall user experience. It’s important for day trading platforms to not only provide robust tools but also ensure a seamless and user-friendly process. Even if a platform has the best trading terminal on paper, if it’s slow, hard to use, or cumbersome when setting up accounts, these issues will impact its overall score.

At CScalp, we believe that the best trading platforms should combine powerful analytical and trading tools with a smooth user experience. Whether you’re looking for professional desktop trading software or a fast, intuitive day trading platform, our methodology ensures that you’ll have the information you need to make the right choice.

Full list of brokerage accounts considered for this list: Tradestation, Zacks Trade, Ally Invest, Charles Schwab, Interactive Brokers, Firstrade, Fidelity, Merrill Edge, Vanguard, Robinhood, SoFi Active Investing, JP Morgan Self-Directed Investing, Webull, Axos Self-Directed Trading, M1 Finance, Public. Additional trading platforms reviewed include TradingView, GoCharting, SBPro, XTick, ScalpStation, VolFix, and more.

CScalp’s Best Trading Platforms: 2024 Top Software for Day Trading Rating

- CScalp: Best for overall trading platform

- Charles Schwab: Best for Variety of User-Friendly Platforms

- E*TRADE: Best for Extended Trading Hours

- Webull: Best for New Traders

- Interactive Brokers IBKR Pro: Best for Advanced Traders

- TradeStation: Best for Paper Trading

- Zacks Trade: Best for Over-the-Counter Access

- Fidelity: Best for Comprehensive Research and Low-Cost Trading

What Is the Best Platform for Day Trading?

The best platform for day trading is CScalp. Specifically designed for active traders, CScalp free professional platform stands out as the best day trading software, offering incredibly fast execution speeds and an intuitive interface. As a professional trading platform, it provides advanced tools such as customizable order books, dynamic charting, and real-time data analysis. These features make it the top choice for traders who need reliable and responsive software for day trading. Other platforms, like those from larger brokers such as Interactive Brokers and Fidelity, also provide good options, but CScalp is widely regarded as the best trading terminal for active traders looking for precision and speed.

What Are the Best Day Trading Apps?

The best day trading platforms often come with mobile applications that complement their desktop trading software. While desktop trading software typically provides more detailed charting and analytical tools, having access to a day trading platform through a mobile app is crucial for traders who need to act quickly. Many platforms from our ranking offer mobile apps that allow users to perform quick analysis and execute trades without missing any market opportunities.

How Important Is Execution Quality on a Trading Platform?

Execution quality is one of the most critical factors when choosing a day trading platform. With the best trading platforms from the list, traders can expect some of the fastest execution speeds available. Fast, reliable trade execution is essential for any day trading software, as it ensures that trades are completed at the best possible price. In day trading, where small price movements can have significant impacts, having a platform for trading that prioritizes fast order routing and execution is key to success.

What Is the Best Desktop Trading Software for Day Trading?

The best desktop trading software for day trading is CScalp. It provides advanced features for real-time data analysis, order execution, and risk management. As a professional trading platform, CScalp offers customizable charts, dynamic order books, and precise trade execution, making it one of the best day trading software options for active traders who require a robust, reliable platform. Its desktop version delivers enhanced functionality, giving traders all the tools they need for efficient market analysis and execution.

What Makes a Trading Platform the Best for Scalping?

The best trading platform for scalping needs to offer order book trading, cluster analysis, fast execution speeds, low latency, and additional detailed real-time data. CScalp is the best free scalping platform. It provides advanced day trading software with one-click order placement and real-time market depth analysis.

Can a Professional Trading Platform Improve Your Trading Success?

Yes, using a professional trading platform can significantly enhance your trading success by providing advanced tools, fast execution, and real-time market data. The best trading platforms are designed to help traders analyze market movements and execute trades at the most opportune times. The availability of desktop trading software with professional features allows traders to make informed decisions quickly, which is crucial for success in fast-paced day trading environments.

How Does CScalp Compare to Other Day Trading Platforms?

Compared to other day trading platforms, CScalp stands out for its fast execution, user-friendly interface, and advanced analytical tools. It is specifically designed for day traders and scalpers, providing real-time data, customizable order books, and professional-grade charting features. Unlike other trading platforms that may cater to a broader audience, CScalp focuses entirely on delivering the best day trading software for active traders who need high performance and precision.

Why Is a Customizable Interface Important in a Day Trading Platform?

A customizable interface is crucial in a day trading platform because it allows traders to set up their workspace according to their specific strategies and preferences. This flexibility enhances efficiency, enabling traders to focus on the most relevant market data and tools for their trading style, which is vital for success in fast-paced environments.

What Is the Best Trading Terminal for Cryptocurrency Day Trading?

CScalp is considered one of the best trading terminals for cryptocurrency day trading due to its advanced features tailored for fast, efficient crypto trades. It connects to major cryptocurrency exchanges, offering real-time data and quick execution, which are critical for day traders in volatile markets.

How Does Day Trading Software Help with Risk Management?

Day trading software offers built-in risk management tools, such as Stop-Loss and Take-Profit orders, which are essential for minimizing losses and locking in gains. The best day trading software will also provide features like margin management, real-time monitoring, and customizable alerts.

What Features Should You Look for in the Best Day Trading Software?

The best day trading software should offer fast execution, real-time data, customizable charts, and advanced order types.

Can Desktop Trading Software Be Better Than Web-Based Platforms?

Desktop trading software is often superior to web-based platforms for day traders because it offers more stability, better performance, and more advanced features. Desktop platforms offer more in-depth tools and faster data processing, which is crucial for day trading where every second counts.

Is It Bad If a Trading Platform Accepts Payment for Order Flow?

Payment for order flow (PFOF, payment for order flow) can affect execution quality on some trading platforms. While it can reduce trading costs, it may cause your trades to be routed to a market maker that doesn’t offer the best price.

What Is the Best Trading Platform for Beginner or New Investors?

For beginner traders, CScalp is not only the best day trading software but also one of the most user-friendly platforms available. It combines professional-level tools with a simple, easy-to-navigate interface. Beginners can benefit from features like CScalp’s customizable charts, practice accounts, and paper trading options, allowing them to build confidence before committing real funds. The platform offers everything a new trader needs to start, including educational resources on how to use the software for day trading, making it the best trading platform for those new to active trading.

What Is Pattern Day Trading?

Pattern day trading refers to making four or more day trades within five business days in a margin account, with those trades accounting for more than 6% of the account’s total trades in that period. The best day trading platforms can help you manage this by tracking your trade frequency and alerting you if you’re approaching pattern day trading status. Pattern day traders are subject to specific regulations, including maintaining at least $25,000 in equity in their margin accounts. For those who day trade frequently, it’s crucial to use a platform that helps them stay compliant with these rules.

What Stocks Are Best for Day Trading on a Platform?

When using a day trading platform, certain stocks are better suited for active trading. Stocks with high liquidity, significant trading volume, and volatility are typically the best choices.

What Is Trading Platform Margin?

A margin account allows traders to borrow funds from their broker to increase their buying power. Margin trading is often used by professional traders to leverage larger positions, magnifying both gains and potential losses.

How Much Money Do You Need to Use The Best Trading Platforms?

Most day trading platforms do not require a minimum account balance to get started. For those new to day trading, starting with just $10 for learning purposes is a good way to avoid losses and mitigate risk.

Is It Risky to Use a Day Trading Platform?

Using a trading platform is not inherently risky, but day trading itself can involve substantial risks. Best platforms for trading help mitigate risks with features like Stop-Loss and Take-Profit orders, real-time data analysis, and advanced risk management tools. Day trading requires constant market monitoring and quick decisions, and while the best day trading software provides traders with the best tools for success, it’s important to be aware of the risks involved. Many traders choose to use a portion of their capital for day trading while keeping the majority invested in long-term, diversified assets.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT