Binance Futures 2024 | Introduction to Binance Futures Trading

Cryptocurrency derivatives have revolutionized the trading landscape, offering you the opportunity to speculate on the price movements of digital assets without actually owning them. Binance Futures, one of the leading crypto derivatives exchanges, has emerged as a preferred platform for traders seeking to capitalize on the volatility of the market. In this article, we will explore the world of Binance Futures and provide you with the knowledge and tools to navigate this exciting market.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

What Are Future Contracts in the Cryptocurrency World?

If you’re new to the world of cryptocurrency trading, you might have heard about crypto futures but aren’t quite sure what they entail. Crypto futures are financial contracts that allow you to speculate on the future price of cryptocurrencies like Bitcoin, Ethereum, and others. These contracts are essentially agreements to buy or sell a specific amount of cryptocurrency at a predetermined price on a specified future date.

How Do Crypto Futures Work?

Crypto futures derive their value from an underlying cryptocurrency, and they are traded on specialized platforms known as futures exchanges. When you enter into a crypto futures contract, you’re not actually buying or selling the cryptocurrency itself. Instead, you’re making a bet on whether the price of the cryptocurrency will rise (going long) or fall (going short) by the contract’s expiration date.

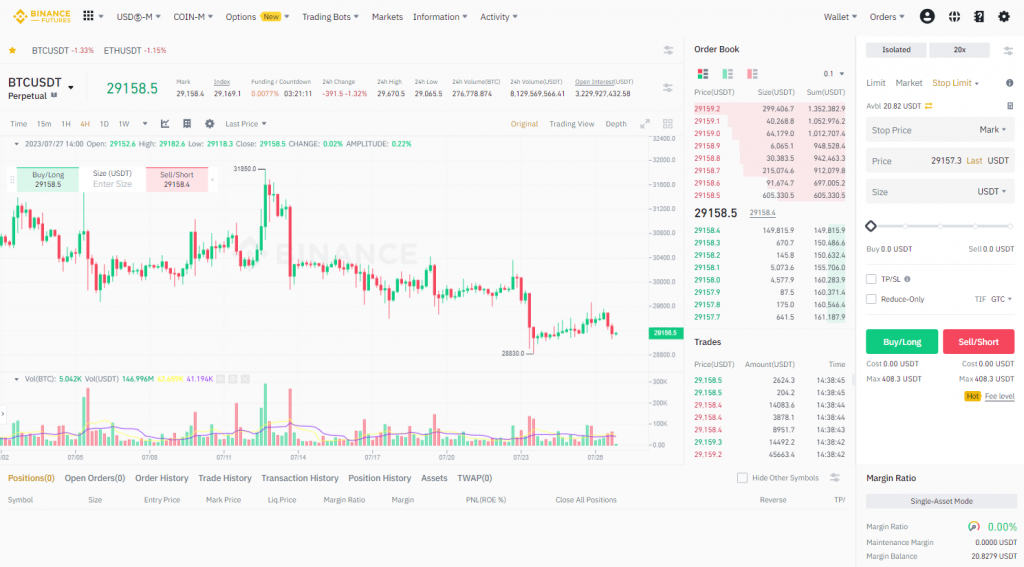

Futures are derivative instruments traded based on an underlying asset. A futures contract is tied to the price of the underlying asset in the spot market. For example, in the BTCUSDT contract, BTC is the underlying asset, and USDT is the quote currency. To buy the BTCUSDT contract, you need to have USDT in your wallet. Settlements for such contracts are also done in USDT.

Future contracts come in various types, including perpetual and fixed-term contracts. Perpetual contracts don’t have a set expiration date, allowing you to maintain your position indefinitely. While fixed-term contracts have specific expiry dates.

Binance

What Is Binance Futures Market?

Binance Futures is a cryptocurrency derivatives trading platform offered by Binance, one of the world’s largest and most reputable cryptocurrency exchanges. It allows you to speculate on the future price movements of various cryptocurrencies, all while using leverage to potentially amplify your gains.

Significance of Binance Futures in the Crypto Ecosystem

The Binance Futures platform plays a crucial role in the crypto ecosystem by providing traders with the tools and liquidity needed to engage in futures trading. Its extensive coverage of cryptocurrencies, instant execution, and leveraged trading options make it an attractive choice for both institutional and retail traders.

The Basics of Binance Futures

To start your journey with Binance Futures, it’s essential to grasp the fundamentals. Let’s explore the basics, including the different types of futures contracts available on the platform.

What are the Different Types of Futures on Binance?

Binance Futures can be divided into three markets:

- USDS-M Futures Market: Trading perpetual USDT futures, delivery-settled USDT futures, and perpetual BUSD futures.

- COIN-M Futures Market: Trading perpetual and delivery-settled COIN-M futures.

- Options Market: Trading options on BTC, ETH, and BNB.

Delivery-settled contracts have a specific lifespan and are settled by receiving the underlying asset upon expiration. Binance Futures offers quarterly delivery-settled futures that last three months before expiration.

Perpetual futures, on the other hand, have no expiration and do not involve the delivery of the asset. Perpetual futures are associated with a funding mechanism that keeps their price in line with the spot market price of the underlying asset, preventing divergences. When holding a position in a perpetual futures contract, traders may receive or pay funding depending on the market conditions. Funding also operates on Binance Futures, and some traders incorporate this mechanism into their strategies.

Binance Futures Contracts: Why Futures Contracts are Appealing

When exploring the world of financial trading, futures contracts often stand out as an attractive option. These contracts provide you with the opportunity to speculate on the future price of various crypto assets on Binance.

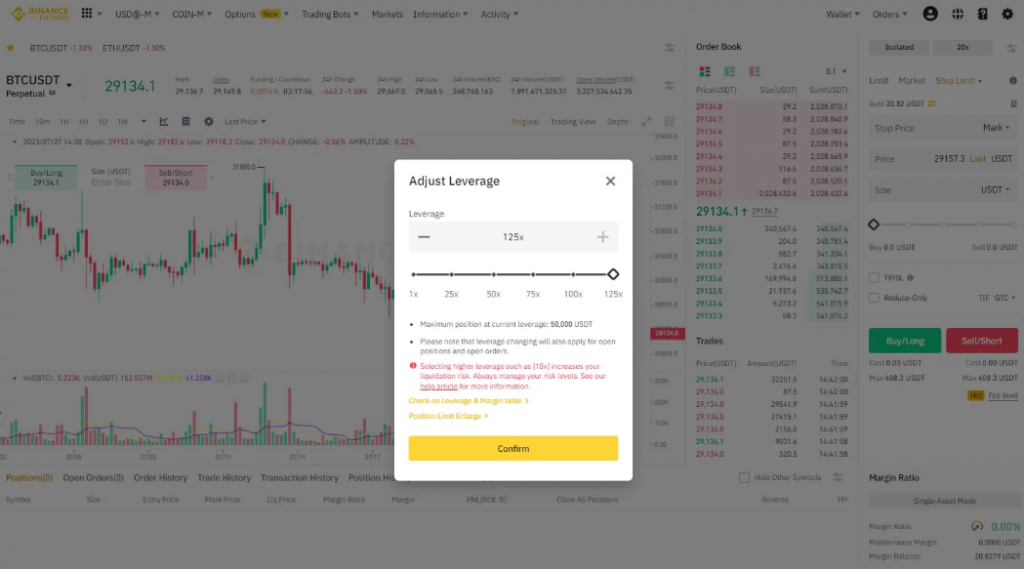

Leverage and Magnified Returns

One of the most appealing aspects of futures contracts is leverage. This means you can control a more substantial position in the market with a relatively small amount of capital. It’s like borrowing money to make a larger investment, potentially magnifying your returns if the market moves in your favor.

Liquidity

Liquidity is a key factor in any market, and futures markets are known for their high liquidity. This means you can typically enter and exit positions quickly without significant price fluctuations. However, we suggest conducting comprehensive research about a cryptocurrency you are interested in.

Understanding the Risks of Binance Futures Contracts

Binance Futures allows trading with leverage of up to 125x. Leverage increases potential profits but also magnifies risks. To use leverage, you need to deposit a margin. The required margin amount depends on the position size and the chosen leverage. The margin supports the position, and if the market moves against the future position, the margin will start to deplete. In extreme cases, liquidation occurs, and the exchange closes the position, resulting in a loss of the margin.

High Risk, High Reward

While leverage can amplify your gains, it can also magnify your losses. Futures trading is not for the faint-hearted, and it’s crucial to know that the potential for loss is significant. That is why risk management is essential.

Market Volatility

Cryptocurrency futures markets can be highly volatile, with prices subject to rapid and unpredictable fluctuations. If you’re not prepared for these price swings, they can lead to substantial losses.

Margin Calls

Trading on leverage means you’re borrowing capital, and if the market moves against your positions, you may receive margin calls, requiring you to deposit additional funds to cover potential losses.

Limited Time Horizon

Some futures contracts have expiration dates. You need to be aware of these dates and keep track of the cryptocurrency market.

Binance Futures Strategies for Success

The key to Binance Futures success lies in understanding both the potential rewards and the pitfalls, developing a robust trading strategy, and, most importantly, practicing responsible risk management. With the right approach, futures contracts can indeed be profitable and valuable.

Educate Yourself Continuously

Knowledge is your most valuable asset in the world of futures trading. Continuously educate yourself about the markets you’re interested in. This includes staying up-to-date with market news, economic indicators, and any events that could impact the assets you trade. By having a deep understanding of the factors that drive prices, you’ll be better equipped to make informed decisions.

Before trading futures, we recommend studying the Free Scalping Course by the CScalp team. The course is not designed to make you earn a fortune immediately after completing it. However, it will help you to enter the market more smoothly. Everyone makes mistakes, especially beginners. As you embark on your trading journey, your main task is to minimize the number of these mistakes.

Develop a Solid Trading Plan

A well-defined trading plan is the foundation of successful futures trading. Your plan should outline your trading goals, risk tolerance, entry and exit strategies, and position sizing. Stick to your plan religiously, and avoid making impulsive decisions driven by fear or greed. Successful traders are disciplined and consistent in their approach.

Implement Risk Management Strategies

Managing risk is arguably the most crucial aspect of profitable futures trading. Always set Stop-Loss orders to limit potential losses on each trade. Determine how much of your capital you’re willing to risk on a single trade, and never exceed that amount. Diversify your portfolio to spread risk across different assets. A well-managed risk strategy ensures that a few losing trades won’t wipe out your entire account.

Stay Informed and Adapt to the Market

Markets are dynamic, and conditions can change rapidly. Stay informed about economic, geopolitical, and cryptocurrency market-related developments that could impact your trading positions. Be flexible and willing to adapt your strategies when necessary. If new information emerges that contradicts your initial analysis, don’t hesitate to adjust your positions accordingly.

Start Small and Scale Up

If you’re new to Binance futures trading or trying out a new strategy, it’s wise to start with a small capital allocation. This allows you to gain experience and test your strategies without risking a significant portion of your funds. As you become more confident and consistently profitable, you can gradually increase your position sizes.

Practice Patience

Successful futures traders understand that patience is a virtue. Not every day or every trade will be profitable. Avoid the temptation to chase quick gains or revenge trade after a loss. Stick to your trading plan and wait for favorable opportunities that align with your strategy.

Continuous Learning and Improvement

The world of futures trading is constantly evolving. Embrace a mindset of continuous learning and improvement. Analyze your past trades, both winners and losers, to identify areas for improvement. Keep a trading journal – we recommend the free CScalp Trading Diary – to track your performance and emotions. Seek out educational resources, attend webinars, and learn from experienced traders.

Seek Guidance and Mentorship

Consider seeking guidance from experienced traders or even a mentor who can provide valuable insights and feedback. Learning from someone with a proven track record can significantly accelerate your learning curve and help you avoid common pitfalls. You can find expert opinions as well as free trading signals on our Discord server.

Getting Started with Binance Futures

Now that you understand the benefits of trading loans on Binance Futures, let’s dive into the process of getting started on the platform. To trade on Binance Futures, you need to register an account on Binance and open an account on Binance Futures. To open a future account, you will need to set up two-factor authentication and complete the Binance KYC process. To learn about the process in detail, read our article on how to open an account on Binance Futures: a step-by-step guide to your first trade.

Step 1: Sign Up and Open a Binance Account

If you don’t already have an account on Binance, you’ll need to sign up to access Binance Futures. Visit the Binance website and click on the “Register” button in the top right corner of the page. You can also use CScalp’s Binance referral code provided below to gain discounts on trading fees.

Step 2: Open a Binance Futures Account

To start trading loans on Binance Futures, you must open a separate futures account. Navigate to the Binance Futures platform and click on the “Open Account” button.

Step 3: Verify Your Account

To unlock all the features and benefits of Binance Futures, you’ll need to verify your identity. Visit your Binance profile and click on the “Identification” section

Step 4: Make Your First Deposit

Before you can start trading loans on Binance Futures, you’ll need to deposit funds into your account. Binance supports both fiat and cryptocurrency deposits.

Step 5: Transfer Funds to Your Binance Futures Wallet

After you’ve made your deposit, you’ll need to transfer funds from your Binance wallet to your Binance Futures wallet.

Step 6: Start Trading on Binance Futures

With funds in your Binance Futures wallet, you’re ready to start trading with leverage. Navigate to the Binance Futures platform and choose between USDS-M and COIN-M futures contracts.

Here you can learn how to connect CScalp to Binance (Futures).

Binance Futures Trading Fees

Binance Futures trading fees primarily consist of two components:

- Taker Fee: A taker fee is applied when you execute an order that “takes” liquidity from the order book, meaning your order is matched with an existing order on the exchange. Taker fees are typically slightly higher than maker fees, as they contribute to liquidity removal.

- Maker Fee: A maker fee, on the other hand, applies when your trade adds liquidity to the order book by placing an order that doesn’t immediately match an existing order. In some cases, exchanges offer rebates or lower fees for makers to incentivize liquidity provision.

Trading fees on Binance Futures are as follows:

- For USDT futures trades: maker 0.02%, taker 0.04%

- For BUSD futures trades: maker 0.012%, taker 0.03%

- For COIN-M futures trades: maker 0.01%, taker 0.05%

- For options trades: maker and taker 0.03%

You can reduce Binance Futures fees by participating in the exchange’s VIP program. You need to achieve certain monthly trading volumes and hold a specific amount of BNB in your account in order to participate in this program.

Alternatively, you can register on Binance through a referral link from the CScalp team, which grants a 10% discount on futures trades. To get the discount, click the “Register on Binance” button below.

Binance Futures – Start Your Trading Journey Today

Binance Futures is a powerful platform that opens doors to the world of cryptocurrency derivatives trading. Futures contracts offer many opportunities, but they come with their fair share of risks. The mechanics of derivative instruments are more complex than those of the spot market, where traders essentially exchange one asset for another. Futures trading has a history of speculation. It is crucial to have a deep understanding of how positions in short and long trades work, as well as isolated margin and cross margin. Additionally, one must keep in mind numerous other details. You can learn more about all the aspects of Binance Futures trading in our blog.

With the knowledge, strategies, risk management, and the right approach, you can harness the platform’s potential for profit while safeguarding your investments. Start your trading journey with Binance Futures today and explore the exciting opportunities it offers in the ever-evolving crypto market. Remember, responsible trading and continuous learning are keys to success in this dynamic ecosystem.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT