What Do Professional Traders Use: Key Tools and Platforms Used by Professional Traders

Understanding what professional traders use can influence your approach to cryptocurrency trading. Professional traders deploy a mix of analytical tools and strategies to navigate the highly volatile crypto markets. CScalp reveals the best tools and platforms for professional trading.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Tools That Professional Traders Use

To thrive in cryptocurrency trading, you need the right toolkit. The CScalp team has created a specialized set of tools designed to meet the needs of professional traders.

Free Trading Terminal

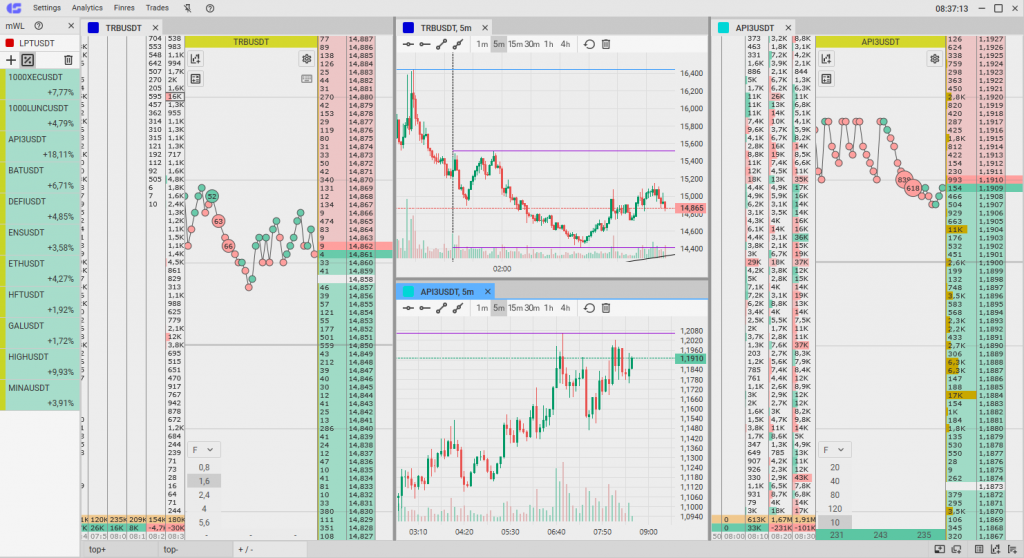

CScalp is a free professional trading terminal that provides real-time data and analytics that are crucial for making informed trading decisions. The software includes quick order entry features, execution alerts, and order book analysis to help you keep up with the fast-paced crypto market.

Why Is CScalp the Best Tool for Trading?

CScalp has a highly customizable interface that adapts to your trading style. Its efficient design allows for swift navigation between different trading pairs and exchanges, offering a streamlined trading experience.

Learn more: Professional Crypto Trading Software: Unveiling the Best Crypto Trading Platform

CScalp’s Free Screener

Use CScalp’s free screener to filter through digital assets. You can set custom criteria based on price movements, volume changes, or other technical indicators, thus enabling you to identify promising trading opportunities quickly.

CScalp’s Free Trading Signals

CScalp’s free trading signals give you actionable advice informed by comprehensive market analysis. Look for signals that match your strategy, including entry points, stop losses, and take profits, to pinpoint optimal trade setups.

CScalp’s Free Trading Diary

The trading journal created by CScalp allows you to automatically record your trades and evaluate performance. Review your past trades to identify success patterns or mistakes, ensuring continuous improvement in your trading tactics.

CScalp’s Free Crypto Trading Courses

Education is vital, and CScalp’s free crypto trading courses provide in-depth knowledge tailored to traders of all experience levels. By taking these courses, you get insights that can help refine your trading approach for better outcomes in the volatile crypto markets.

Technical Analysis Tools and Indicators for Professional Traders

In the world of cryptocurrency trading, you need reliable analytical tools and indicators to make informed decisions.

Moving Averages (SMA/EMA)

Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) are foundational tools you use to smooth out price data over a specified period. SMA is calculated by averaging the closing prices of an asset over several time periods. For a more current price focus, you would use EMA, which gives greater weight to the most recent prices. These moving averages help you identify the direction of the trend and potential support or resistance levels in cryptocurrency markets.

Bollinger Bands and Volatility

Bollinger Bands consists of a set of three lines: the middle line is an SMA of the cryptocurrency’s price, and the two outer lines measure volatility. These bands widen during periods of increased volatility, which often occur just before market moves, and contract during times of decreased volatility, corresponding to quieter market conditions. As a cryptocurrency trader, you can use Bollinger Bands to gauge market volatility and potential price breakouts.

Price Action and Chart Patterns

Price action refers to the movement of a cryptocurrency’s price plotted over time. Rather than relying solely on technical indicators, you would analyze the price history to make trading decisions. Identifying chart patterns, such as triangles and flags, can offer insights into market sentiment and potential future movements. By understanding price action, you become attuned to the subtle shifts in market momentum and trader behavior within the cryptocurrency markets.

Trading Strategies and Styles

Selecting the right strategy and style is important. Your success hinges on the approach you take to the market, whether it’s the rapid pace of day trading or the patience of swing trading.

Day Trading

Day trading in cryptocurrencies is about opening and closing positions within the same trading day. Speed and precision are your allies here, as you’ll capitalize on short-term price movements. Remember to set tight Stop-Loss orders to minimize potential losses.

Scalping

The scalping strategy requires you to perform a high volume of trades seeking small profit margins. This approach demands constant market monitoring and quick decision-making.

Swing Trading

Swing trading is suited for those who can commit to holding positions for several days or weeks to benefit from anticipated market moves. It involves a mixture of fundamental and technical analyses to identify potential price ‘swings.’

Breakout Strategy

Breakout trading hinges on spotting early signs of a major price move. You’ll look for consolidations within the market and enter a position as soon as the asset breaks through those levels, often using volume as a confirmation indicator.

Learn more: How to Become a Professional Trader: Learn Trading Basics and Develop Trading Experience

Trading Plan: Risk Management and Psychology

In the realm of cryptocurrency trading, your success hinges on managing risks and maintaining psychological discipline. Let’s explore how you can balance risk and reward, maintain emotional discipline, and set strategic Stop-Loss and alerts to safeguard your assets.

Risk and Reward Balance

To become a professional trader, understanding the interplay between risk and reward is crucial. Here’s a simple formula to remember:

Risk/Reward Ratio = (Target profit – Entry price) / (Entry price – Stop-Loss price)

High volatility in crypto markets introduces significant risks, and your focus should be on the consistent application of proper risk management techniques. This might involve only risking a small percentage of your portfolio on a single trade or diversifying among different cryptocurrencies to spread risk.

Emotional Discipline is the Holy Grail of Professional Trading

The psychological aspect of trading crypto involves developing a strong sense of emotional discipline. FOMO (Fear of Missing Out) and panic selling often lead to impulsive reactions and substantial losses. Here are some tips:

- Maintain a trading journal to document your emotional state during trades.

- Reflect on successful and unsuccessful trades to better understand your emotional triggers.

Through these practices, you cultivate the discipline needed to make informed decisions, rather than being swayed by market sentiment.

Set Stop-Loss Orders and Alerts

For effective risk management in crypto trading, you must use Stop-Loss orders and alerts to protect against significant losses. It’s wise to set Stop-Loss orders at a price level that represents an acceptable loss, relative to your entry price and expected profit. For instance:

- Stop-Loss Order: Activates a sale if your crypto falls to a set price, limiting your loss.

- Price Alert: Notifies you when your crypto reaches a specific price or changes by a certain percentage.

These tools keep you informed and in control, allowing you to react swiftly to sudden market changes and protect your portfolio from unexpected downturns.

Trading Platforms and Execution

When it comes to cryptocurrency trading, selecting the right platform and ensuring prompt order execution is pivotal for your success as a professional trader.

Choosing the Right Platform

Your choice of trading platform has a significant impact on your trading activities. CScalp is a specialized day trading software that you need to integrate with a larger trading platform. Binance, OKX, Bybit, and HTX are reputable platforms that facilitate online trading with varying degrees of compatibility with CScalp. When determining the right platform for your needs, you should consider:

- Security: The platform’s ability to protect your digital assets.

- Liquidity: The depth of the market and the platform’s volume, impact your ability to execute trades quickly and at desired prices.

- User Interface: A clean, intuitive UI helps you navigate and make decisions swiftly.

Order Execution Speed

Fast order execution is crucial in the fast-paced world of cryptocurrency trading. When using CScalp, it’s essential to:

- Connectivity: Ensure the platform you choose has robust infrastructure and server connectivity to prevent delays.

- Technology: The platform must have advanced technology to handle rapid order executions.

Your trading platform’s ability to quickly execute orders directly affects your trading performance, particularly when trading volatile cryptocurrencies.

Professional Trader Mindset

Mindset often distinguishes amateur traders from their professional counterparts. This difference is seen in terms of continuous learning and the ability to adapt to ever-changing market conditions.

Continuous Learning and Mentorship

As a professional cryptocurrency trader, you must embrace a culture of continuous learning. The crypto market is always evolving, so it’s crucial to stay informed about the latest strategies, technologies, and regulatory developments. Engage with resources like the CScalp blog to fine-tune your approach and expand your knowledge base. Mentorship can be invaluable; working with a mentor not only accelerates your learning curve but also helps you to internalize critical trading disciplines from experienced professionals.

- Follow current events and emerging tech in the crypto sphere.

- Enroll in CScalp trading courses to systematically enhance your expertise.

Adapting to Market Conditions

Your ability to adapt to market conditions is pivotal. Cryptocurrency markets are known for their volatility and unpredictability. Develop a trading plan and establish trading rules that are flexible enough to adjust to market swings yet disciplined to prevent impulsive decisions. Focus on maintaining a balance between rigid strategy adherence and the agility to capitalize on new opportunities.

- Discipline: Stick to your trading plan, but be prepared to make tactical adjustments.

- Focus: Stay alert to market trends and signals that may necessitate a strategic pivot.

By dedicating yourself to ongoing education and skillful adaptation, you equip yourself with the foundational mindset characteristics of professional cryptocurrency traders.

Frequently Asked Questions: FAQs About How to Become a Professional Trader

In this section, you’ll find some of the most important questions about what tools do professional traders use.

What Software Tools Are Essential for Professional Traders?

Your success in crypto trading may depend heavily on the software tools you use. Tools like CScalp, which is a specialized terminal designed for convenience in scalping and day trading, are vital for real-time data analysis and execution of trades.

What Indicators Are Most Commonly Used by Professional Traders?

When trading cryptocurrencies, professional traders rely on technical indicators like Moving Averages, Relative Strength Index (RSI), and Bollinger Bands to analyze market trends and make decisions based on price action and volume.

What Are Widely-Recognized Strategies Employed by Professional Day Traders?

In the crypto market, day traders often use strategies such as scalping to make profits from small price movements and swing trading to capture gains in a market moving in a significant upward or downward trend.

How Do Professional Traders Approach Risk Management in the Cryptocurrency Market?

Traders minimize risk by setting strict Stop-Loss orders, diversifying their portfolio across various digital assets, and never investing more than a set percentage of their capital in a single trade.

What Resources Do Professional Crypto Traders Use to Inform Their Trades?

Professional traders utilize resources such as crypto-specific news outlets, analytical platforms for on-chain data, and social sentiment tools to stay informed and forecast market movements more accurately.

What Are the Core Disciplinary Practices Adopted by Successful Traders?

Consistency and discipline are key, meaning maintaining a trading journal for reviewing strategies and outcomes, adhering to a tested trading plan, and continuously learning to stay ahead in the dynamic crypto landscape.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT