Free Crypto Spot Trading Signals Providers: The Best Crypto Signals on Discord and Telegram

Crypto Spot trading signals are essential tools for traders and investors looking to make profits in the digital coins markets. These Spot trading crypto signals are recommendations or alerts that suggest the optimal times for buying or selling a cryptocurrency based on technical analysis, market trends, and various other factors. CScalp highlights the features you should look for when selecting the best crypto trading signals provider.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

What Are Crypto Spot Trading Signals

Crypto Spot trading signals are tools designed to assist you in making informed decisions in cryptocurrency trading and investing. These signals provide insights into when it might be beneficial to buy or sell a specific cryptocurrency.

Crypto Spot trading signals can serve as your guide in the often unpredictable markets, where timely and strategic actions are crucial. Cryptocurrency trading signals offer an analysis of when a coin’s price is likely to move in a particular direction. Utilizing expert analysis, crypto trading signals can pinpoint entry and exit points for potential trades. This can increase your chances of capitalizing on market movements and reduce the guesswork.

As a trader or an investor aiming to maximize your profits, Spot trading signals in cryptocurrencies are valuable. They offer a concise interpretation of market data which ultimately aids in mitigating risks associated with the volatile nature of digital assets. With the proper utilization of Spot trading signals, you can potentially improve your trading performance by leveraging knowledge that is otherwise derived from extensive market research and analysis.

Learn more: What Is Spot Trading in Crypto: A Beginner’s Guide to Understanding the Basics

Cryptocurrency Signals Purpose

Crypto Spot trading signals are alerts that provide you with actionable information about potential trading opportunities in real time. A buy signal suggests that it’s advantageous to acquire a cryptocurrency, while a sell signal indicates a favorable moment to dispose of the asset. The purpose of these signals is to inform your trading strategy and help you maximize potential profits while minimizing risk.

The Best Free Cryptocurrency Trading Signals: CScalp’s Discord and Telegram

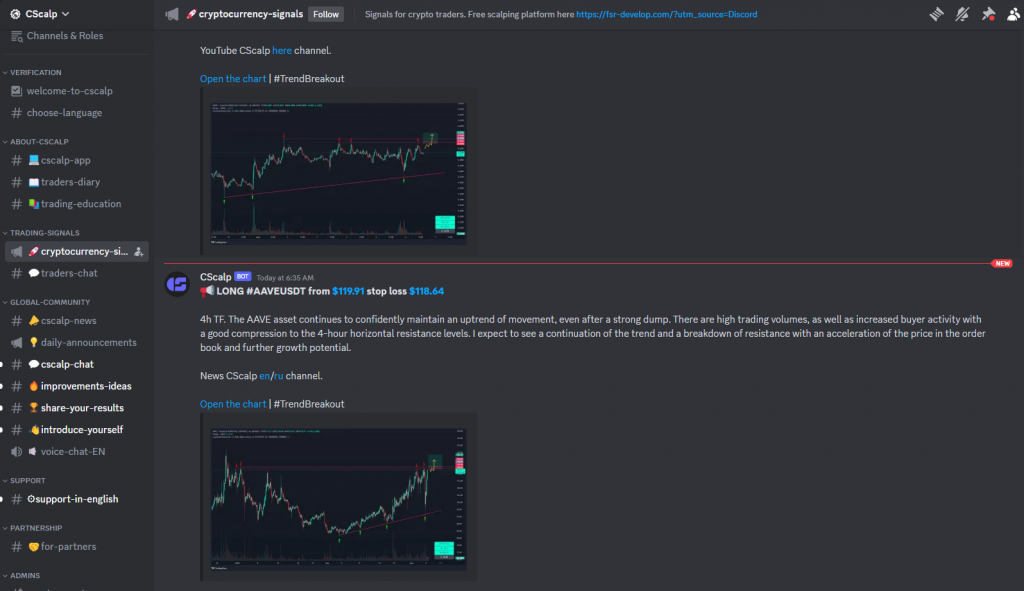

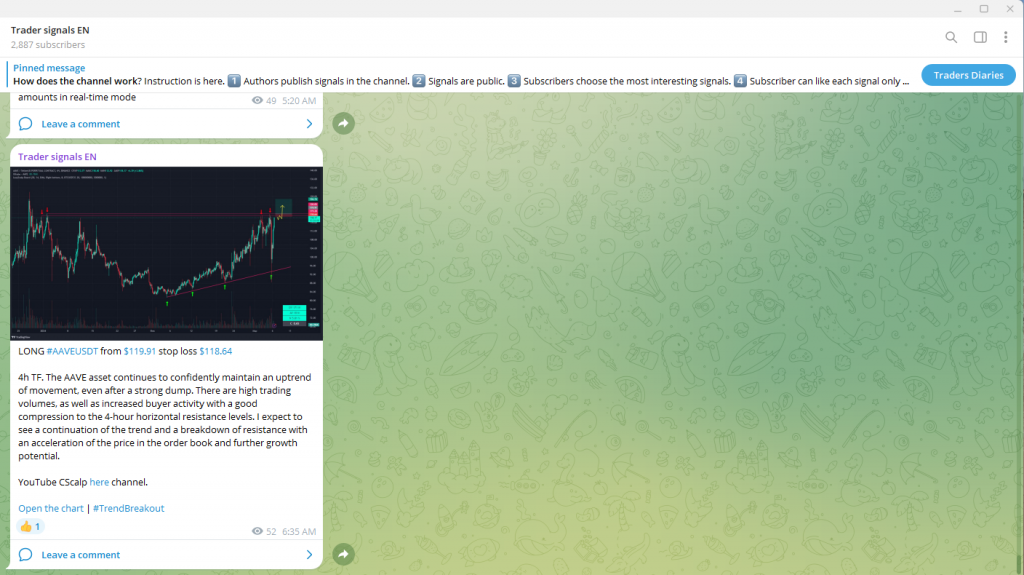

CScalp, a free professional crypto trading tool, offers free crypto trading signals within its Discord server and Telegram channel. These high-quality crypto signals are generated by experts through technical analysis and are accessible to traders looking for guidance without a subscription fee.

How Do the Best Crypto Signals Work

Detailed trading signals typically consist of:

- Entry Price: The suggested price at which to enter a trade.

- Target Price(s): The price level(s) at which you should consider taking profits.

- Stop-Loss: A recommended price level to place a stop loss, aiming to limit potential losses.

- Chart: CScalp offers signals that are visible in the cryptocurrency chart.

- Analysis: Our signals come with explanations from professional traders.

Significance of Timing in Trading

Timing is essential when utilizing crypto trading signals. The value in a signal lies in its immediacy and relevance to current market conditions. For buy or sell signals to be effective, they should be acted upon quickly, as the cryptocurrency markets can move swiftly, and opportunities can be fleeting. Always check the date and time of a signal (as well as instructions within the signal) to ensure its relevance.

Technical Analysis in the Best Crypto Trading Signals

Harnessing the power of technical analysis is crucial for interpreting cryptocurrency signals accurately and making informed decisions.

Analyzing Charts and Data

When you approach cryptocurrency Spot trading signals, a critical component is the examination of historical price charts and quantitative data. Charts on platforms like TradingView provide a visual representation of price movements over time, enabling you to spot trends and patterns. It’s essential to understand that, while past data isn’t a guaranteed forecast of future price actions, it serves as a valuable tool for predicting probable outcomes.

Understanding Market Sentiment

The market sentiment reflects the general attitude of investors toward a particular crypto asset and can profoundly influence its market price. To gauge sentiment, you might analyze the volume of trades and how price reacts to news events. Although not a traditional technical indicator, sentiment can complement your technical analysis by providing context to the numerical data and chart patterns you observe.

Fundamental Analysis for Spot Trading

Fundamental analysis in crypto Spot trading involves a study of market trends and economic indicators to make decisions.

Market Research and News

Your ability to gather comprehensive market research plays a crucial role in Spotting trading opportunities. Staying informed about the latest news can reveal potential market movements before they become public knowledge. For crypto investments:

- Project Updates: Track technical advancements and updates from the development team.

- Regulatory News: Watch for changes in regulations that might impact the prices.

- Industry Trends: Monitor broader tech trends, such as the adoption of blockchain.

It is vital to distinguish between news that will truly affect the market from the noise that will have short-lived or negligible impacts on prices.

Evaluating Economic Indicators

Economic indicators provide insights into the overall health and potential growth of cryptocurrency projects. In the realm of crypto, these might include:

- Network Activity: Number of transactions and active wallets.

- Tokenomics: Supply details, such as caps or burn mechanisms.

- Adoption Rates: How widely a cryptocurrency is being used or accepted.

By scrutinizing these indicators, you gain a clearer picture of the intrinsic value of crypto assets, which is integral to making informed decisions while engaging in Spot trading.

Find the Best Crypto Signals Providers

When diving into the realm of cryptocurrency trading, selecting a credible signal provider can significantly enhance your trading outcomes. You’ll be looking for signals that offer insight drawn from expert analysis, market trends, and various algorithms.

Why Crypto Traders Choose CScalp for Free Crypto Signals

CScalp stands out by offering:

- No Cost: Free signals make it accessible without initial investment.

- Trusted Analysis: Signals are derived from expert market analysis.

- Regular updates: CScalp posts several free crypto trading signals per day on its Discord server and Telegram group.

Comparison: Free vs. Paid Signals

Let’s explore the difference between free and paid crypto signals:

Free signals:

- Accessible, but can be less detailed and frequent.

Paid signals:

- Offer comprehensive analysis and support.

- Potentially higher profitability due to the dedication of professional traders.

CScalp free trading signals are created by professional traders and are then moderated by our dedicated team. Join our Discord server or Telegram channel to feel the full power of our crypto Spot trading signals.

Effective Risk Management Strategies for Spot Trading

When using the popular crypto signals, employing risk management strategies is crucial for capital preservation and optimizing your performance in the market.

Using Stop-Loss and Take-Profit Orders

Stop-Loss orders help you limit potential losses by automatically closing a position at a predetermined price level. This is a proactive step to ensure you don’t suffer more loss than you’re prepared to handle. Conversely, Take-Profit orders allow you to lock in profits by selling your crypto asset when it reaches a certain price threshold. Both orders function as tools for maintaining control over your trades, even when you’re not actively monitoring the market.

- Configure Stop-Loss orders by setting a Stop-Loss price, which should align with the level of risk you’re comfortable taking.

- Take-Profit orders should reflect realistic profit goals based on market analysis and the performance of the specific cryptocurrency you’re trading.

Remember that CScalp has implemented an automatic Stop-Loss and Take-Profit feature that you can use to protect your assets.

Understanding Leverage and Its Risks

Leverage can amplify your gains in the crypto market. However, with greater potential profit comes increased risk. Leverage allows you to control a larger position with a smaller amount of capital, but losses are also magnified should the market move against your position.

- Use leverage sparingly. Over-leveraging can lead to significant losses, particularly for inexperienced traders.

- Assess the risks carefully before entering leveraged positions, and always use leverage as a component of a comprehensive trading strategy that includes Stop-Loss and Take-Profit orders.

By implementing these risk management strategies and understanding the intricacies of Stop-Loss and Take-Profit orders, along with the judicious use of leverage, you’ll be equipped to navigate the dynamic nature of cryptocurrency markets. Remember, managing risk is just as important, if not more so, than seeking profits.

Platforms and Tools for Trading Signals

Cryptocurrency Spot trading requires precise and timely information. Below are key platforms and tools that facilitate trading signals, empowering you to make informed decisions in the volatile crypto market.

Spot Trading on Cryptocurrency Exchanges

Cryptocurrency exchanges like Binance and Bybit provide integrated platforms for Spot trading. You have access to real-time data and can execute trades manually or through automated systems. These exchanges also often support third-party integrations: both work with the free CScalp trading terminal.

CScalp Professional Trading Software

CScalp is a professional trading software tailored for Spot trading on various cryptocurrency exchanges. It provides a suite of features that includes one-click trading, quick scalping functions, and sophisticated chart analysis tools. CScalp harnesses the knowledge of expert traders to supply you with daily trading signals.

Using CScalp Free Trading Signals

For traders who prefer a community approach, CScalp offers free trading signals via social media channels such as Telegram group and Discord. By joining our Discord or Telegram, you will receive free signals and will become part of a community of like-minded traders.

Engagement and Community in Crypto Trading

Cryptocurrency trading does not occur in isolation. Your engagement with social media platforms and trading communities can influence your trading strategies and overall market understanding.

Role of Social Media Platforms

Social media platforms are pivotal in the landscape of cryptocurrency trading. Major platforms like Twitter, Reddit, and YouTube provide immediate access to market sentiment, trending discussions, and rapid news dissemination. You can also find CScalp on these platforms for:

- Real-time updates on market shifts

- Educational content from seasoned traders

- Discussions within the crypto inner circle may reveal insights not readily available elsewhere

Learning From Trading Communities

Joining a trading community offers you a valuable pool of knowledge. You can find CScalp communities on Discord and Telegram and receive:

- A chance to ask questions and receive guidance

- Shared experiences from various skill levels

- Access to educational content that can help you improve your trading decisions

Why Should You Join the CScalp Crypto Trading Community

CScalp is a trading community that focuses on providing members with detailed crypto market analysis. Reasons to join include:

- Networking opportunities with traders who are keen on sharing signal information

- Getting firsthand tips and strategies to improve your Spot trading performance

- Exposure to a broad range of perspectives, helping you to form a more complete view of the market

Choose the Best Crypto Signals Provider: Performance Metrics and Analytics

Traders should monitor and scrutinize crypto trading signal performance and market analytics to refine their strategies and enhance decision-making.

Tracking Trading Signal Effectiveness

To measure the effectiveness of trading signals, you should examine the accuracy of the signals in predicting market movements. The primary metrics for this assessment include:

- Percentage of Profitable Trades: The ratio of trades that resulted in profit versus those that did not.

- Profit Factor: The gross profit divided by the gross loss of all trades, indicating the signal’s ability to generate profits over losses.

In CScalp you can measure the effectiveness of trading signals by the number of “likes” they receive.

Interpreting Signal Analytics

When you are interpreting analytics from trading signals, consider the following aspects:

- Historical Performance: Look for consistency in the signal’s past success. Charts and data visualization tools can elucidate trends and patterns.

- Risk-Reward Ratio: This metric helps you understand the potential reward for every unit of risk taken.

Adapting to Market Changes

In the ever-evolving cryptocurrency market, your ability to adapt trading strategies based on real-time analytics is crucial. Consider the following to stay agile:

- Signal Frequency and Volatility: Signals should reflect the current market volatility. Higher volatility might require quicker adjustments.

- Market Trend Analysis: Use indicators to discern whether the market is bullish or bearish and adjust your strategy to align with the general trend.

By continuously aligning your strategy with the dynamic market opportunities, you maintain relevance and stand a better chance at sustained performance.

FAQs: Frequently Asked Questions About Crypto Spot Trading Signals

Cryptocurrency Spot trading signals provide insights and actionable trade recommendations for immediate execution. Your understanding of these signals is crucial for informed trading decisions.

What Are the Best Sources for Crypto Spot Trading Signals?

You can find crypto Spot trading signals through various online platforms, including specialized crypto signal websites, trading communities, and financial news sites that have a track record for accuracy and timeliness.

How Can I Find the Best Crypto Signals Telegram Group?

To receive crypto Spot trading signals on Telegram, you need to join specific crypto signal Telegram group. For example, CScalp. Look for groups managed by reputed analysts or organizations that provide real-time signal updates.

Which Platforms Offer the Most Accurate Crypto Trading Signals for Free?

Free platforms providing the most accurate crypto trading signals include Discord servers, Telegram channels or groups, as well as forums like Reddit. You can also follow the Twitter accounts of experienced traders and analysts. However, the quality and accuracy can vary, so exercise discretion.

Who Are the Most Reliable Providers of Crypto Spot Trading Signals?

Reliable providers of crypto Spot trading signals like CScalp usually have layers of expertise and feature the opinion of professional traders with a strong track record and comprehensive market analysis.

Is It Possible to Profit From Crypto Spot Trading Using Signals?

Yes, it is possible to profit from crypto Spot trading using signals, provided they are accurate and acted upon promptly. It is important, however, to combine signal recommendations with your own research and risk management strategies.

How Do I Choose the Best Cryptocurrency for Spot Trading Based on Signals?

To choose the best cryptocurrency for Spot trading based on signals, consider the asset’s liquidity, historical performance, and market sentiment. You can find the best assets by using CScalp’s free crypto screener.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT