What is Historical Data: Strategic Planning and Insight

What is historical data? Historical data consists of records, statistics, and information. This data helps you understand patterns and trends, for example, when developing a support and resistance trading strategy. CScalp delves into the importance of historical data in crypto trading.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Understanding Historical Data in Crypto Trading

Historical data records past price movements, trading volumes, and market trends. By analyzing this data, traders can gain valuable insights that enhance decision-making and strategy development.

Significance of Past Data: What is Historical Data?

Historical data plays a crucial role in crypto trading by enabling traders to analyze past market trends and identify recurring patterns. Recognizing these patterns helps traders make informed decisions about when to buy or sell cryptocurrencies. By examining how certain cryptocurrencies have performed over time, traders can develop strategies that align with market behavior, ultimately guiding future trading decisions.

Traders rely on past data to predict future market movements. By analyzing historical price trends and market reactions to various events, traders can anticipate potential price fluctuations and adjust their strategies accordingly. This approach allows traders to minimize risks and optimize their investment outcomes.

Furthermore, understanding historical data helps traders identify areas for improvement in their trading strategies. By analyzing past trades and market conditions, traders can pinpoint what worked well and what didn’t, enabling them to refine their strategies for better performance. This iterative process is vital for long-term success in the volatile cryptocurrency market.

Application in Cryptocurrency

Historical data is a powerful tool for analyzing market behavior in the cryptocurrency space. By studying past market activities, traders gain insights into market dynamics and the factors that influence cryptocurrency prices. This analysis reveals how different variables, such as market sentiment, regulatory changes, and technological developments, impact the crypto market.

Traders use historical data to predict price movements by examining past price trends and patterns. These predictions help traders make informed decisions about when to enter or exit trades. Many traders utilize websites and platforms that provide detailed forecasts for various cryptocurrencies. For instance, websites like CryptoPredictions use sophisticated algorithms and historical data to project prices for over 2,500 coins, offering predictions up to three years in advance.

To take full advantage of historical data, try the professional trading platform CScalp by leaving your email in the form above. With the free terminal, you will be able to connect to your preferred exchange and place orders with one click, as well as automatically manage your risks.

Key Facts About Historical Data

Historical data plays a pivotal role in forecasting future trends and understanding market dynamics. It provides a wealth of information that helps businesses and traders make informed decisions. By delving into historical data, organizations can gain valuable insights into market behavior and customer preferences, forming a solid foundation for strategic planning and decision-making.

Importance of Data Accuracy

The accuracy of data is of paramount importance in historical data analysis. Accurate data ensures that the insights derived from it are trustworthy and reliable. When data is precise, it enables traders, analysts, and businesses to make informed decisions with confidence. Precision in data collection helps avoid misleading conclusions that could lead to costly mistakes.

To ensure data accuracy, rigorous validation processes are necessary. This includes implementing regular audits and checks to maintain the integrity of historical data. By minimizing errors, organizations can improve the reliability of their analyses and forecasts. Errors in historical data can lead to incorrect predictions and poor decision-making, highlighting the need for robust data management practices. Automated systems play a crucial role in detecting and correcting inaccuracies, ensuring consistent error minimization. Reliable data forms the backbone of effective analysis and strategy development, allowing businesses to navigate complex markets with greater assurance.

Diversity in Data Sources

Incorporating diverse data sources enriches historical data analysis by providing a comprehensive and multidimensional view. Utilizing data from multiple channels allows organizations to capture a wide range of perspectives, enhancing the depth of insights gained. Common sources include surveys, financial records, market reports, social media analytics, and customer feedback. Each source offers unique insights into different aspects of market behavior, enabling a more holistic understanding.

Combining these diverse sources helps in evaluating and comparing various scenarios, leading to more accurate forecasts. A multi-channel approach is essential for understanding complex market dynamics and anticipating shifts in consumer behavior. When historical data is combined with real-time data captures, it provides invaluable insights into past, present, and future trajectories. This enhanced understanding enables better strategic planning and decision-making, giving businesses a competitive edge in the marketplace.

Practical Business Applications

Historical data is a powerful tool for improving decision-making in business. Managers and decision-makers use past records to track performance, identify trends, and evaluate different scenarios. This analysis aids in making informed decisions that align with strategic objectives. By relying on historical data, businesses can predict future outcomes with greater accuracy, leading to more effective strategic choices.

In addition to strategic planning, historical data plays a key role in enhancing customer relations. By analyzing past customer interactions and behaviors, businesses can gain insights into customer preferences and needs. This analysis allows companies to tailor their products and services to meet customer expectations, ultimately improving the customer experience. Recognizing patterns in customer behavior enables businesses to offer personalized experiences, fostering increased loyalty and satisfaction. Improved customer relations lead to stronger brand loyalty and a more positive reputation in the market.

Definitions and Related Terms

Data mining involves extracting valuable information from large datasets. This process uses algorithms to identify patterns and relationships within the data. Analysts apply various techniques such as clustering, classification, and regression. These methods help uncover hidden insights that inform decision-making. Data mining transforms raw data into meaningful knowledge.

Historical data serves as the foundation for data mining. Records provide the raw material for analysis. By examining historical data, analysts can identify trends and patterns over time. This relationship enhances the accuracy of predictions and forecasts. Data mining leverages historical data to improve business strategies and outcomes.

Big data refers to extremely large datasets that require advanced tools for analysis. These datasets often include structured and unstructured data. Characteristics of big data include volume, velocity, and variety. Volume refers to the vast amount of data generated daily. Velocity indicates the speed at which new data is produced. Variety encompasses the different types of data sources.

Historical data plays a crucial role in big data analytics. Records contribute to the volume and variety of big data. Analysts use historical data to validate assumptions and refine models. This integration provides valuable context for understanding current trends. Historical data enhances the depth and accuracy of big data analysis. Businesses leverage this combination to make well-informed decisions.

Leveraging Historical Data on Crypto Trading

Statistical models help traders analyze historical data. These models identify patterns and trends in cryptocurrency markets.

Implementing Data Analysis Techniques

Traders use these insights to predict future price movements. Accurate predictions improve trading strategies. Statistical models include regression analysis and time-series forecasting. These methods enhance the reliability of market predictions.

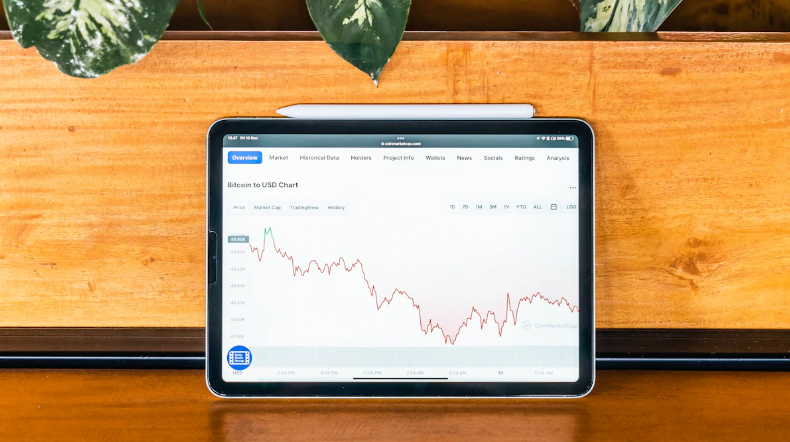

Data visualization tools transform complex data into visual formats. Charts and graphs make historical data easier to understand. Traders use these tools to spot trends and anomalies quickly. Visual representations provide a clear picture of market behavior. Effective data visualization aids in making informed decisions. Tools like Tableau and Power BI are popular choices for traders.

Optimizing Trading Strategies

Backtesting involves testing trading algorithms using historical data. This process evaluates the effectiveness of trading strategies. Traders apply past data to simulate real-market conditions. Successful backtesting indicates a robust trading strategy. Adjustments based on backtesting results improve future performance. This method reduces the risk of losses in live trading.

Risk management measures protect investments in volatile markets. Historical data helps identify potential risks. Traders develop strategies to mitigate these risks. Stop-loss orders and position sizing are common risk management techniques. Historical data provides a basis for setting appropriate risk levels. Effective risk management ensures long-term profitability.

Enhancing Market Predictions

Market cycles refer to recurring phases in financial markets. Historical data reveals these cycles in cryptocurrency markets. Traders study past cycles to predict future market phases. Identifying market cycles helps in timing trades effectively. This knowledge enhances the accuracy of market predictions. Successful traders leverage this information for strategic advantage.

Volatility patterns indicate the degree of price fluctuations in the market. Historical data shows how volatility affects cryptocurrency prices. Traders analyze these patterns to anticipate market movements. Understanding volatility helps in managing risks better. Accurate analysis leads to more stable trading outcomes. Tools like Bollinger Bands assist in analyzing volatility patterns.

Challenges and Future Directions

Historical data holds immense value across various domains. By analyzing records, you can discern patterns and make informed predictions. Accurate historical data enhances decision-making and minimizes risks.

Challenges in Capturing Historical Data

Data quality issues pose significant challenges. Inaccurate data can lead to misleading conclusions. Ensuring high-quality data requires rigorous validation processes. Regular audits help maintain data integrity. Analysts must verify the accuracy of data sources. Quality control measures reduce errors and enhance reliability.

Integrating data from various sources presents difficulties. Different formats complicate the integration process. Consistency issues arise when merging datasets. Standardizing data formats helps address these challenges. Automated tools assist in data integration. Effective integration ensures comprehensive analysis.

Future Trends in Historical Data

Emerging technologies transform historical data analysis. Artificial intelligence (AI) enhances data processing capabilities. Machine learning algorithms identify patterns more efficiently. Blockchain technology ensures data security and transparency. These advancements improve the accuracy of predictions. Businesses leverage these technologies for strategic advantage.

Predictive analytics uses historical data to forecast future trends. Advanced algorithms analyze past records to make accurate predictions. This approach helps businesses anticipate market changes. Improved forecasting techniques enhance decision-making. Predictive analytics provides valuable insights into customer behavior. Companies use these insights to tailor their strategies.

Historical Data in Support and Resistance Crypto Trading Strategy

By analyzing past price movements, traders can identify key levels where the price has historically reacted, providing essential insights for future trading decisions.

Understanding Support and Resistance Levels

Support and resistance levels are fundamental concepts in technical analysis. These levels are price points where the cryptocurrency has historically experienced buying (support) or selling (resistance) pressure.

- Support Levels: These are price points where the asset has historically found buying interest, causing the price to stop declining and potentially reverse upward. Traders look for areas on the chart where the price has consistently bounced off a particular level, indicating strong support.

- Resistance Levels: These are price points where selling pressure has historically increased, causing the price to stop rising and potentially reverse downward. Resistance levels are identified by observing where the price has repeatedly struggled to advance.

The Role of Historical Data

By examining past price action, traders can determine where significant price movements have occurred and where the market has shown repeated patterns of behavior.

- Trend Analysis: Historical data helps traders identify overall trends in the market, whether bullish or bearish. Understanding these trends allows traders to place support and resistance levels within the context of the broader market direction.

- Pattern Recognition: Traders use historical data to recognize chart patterns that often precede significant price moves. These patterns, such as head and shoulders, double tops, and bottoms, help predict future movements based on past behavior.

- Volume Analysis: Historical trading volumes provide additional context to support and resistance levels. High trading volumes at these levels indicate strong market interest and reinforce the validity of these price points as significant barriers.

Practical Application

- Setting Entry and Exit Points: Traders use historical support and resistance levels to determine optimal entry and exit points. Buying near support levels and selling near resistance levels can maximize profit potential while minimizing risk.

- Stop-Loss Placement: Historical data informs traders where to place stop-loss orders to protect against adverse price movements. Placing stop-loss orders just below support levels or above resistance levels provides a safety net against unexpected market volatility.

- Breakout and Reversal Strategies: By analyzing historical price action around support and resistance levels, traders can develop strategies to trade breakouts or reversals. For instance, a breakout above a historical resistance level may indicate a potential upward trend, while a breakdown below support suggests a possible downtrend.

- Backtesting Strategies: Historical data allows traders to backtest their strategies against past market conditions. By simulating trades using historical support and resistance levels, traders can assess the effectiveness of their strategies and make necessary adjustments before applying them in real-time.

What is Historical Data – Conclusion

Historical data is an indispensable tool that empowers traders and analysts to make informed decisions. By offering a comprehensive view of past price movements, trading volumes, and market trends, historical data serves as the foundation for various analytical techniques, including trend analysis, volatility assessment, and the identification of support and resistance levels.

The ability to backtest trading strategies using historical data provides traders with invaluable insights into the potential success of their approaches before deploying them in live markets. This process not only helps in refining strategies but also in managing risks more effectively.

Moreover, to answer the question ‘What is historical data?’, it is a tool that offers a window into market sentiment and behavioral patterns, allowing traders to anticipate how similar future events might unfold. By understanding the past, market participants can better navigate the complexities of financial markets and enhance their chances of success.

To learn about pending orders, check out our article: “Pending Orders in Trading: Understanding Order Execution and Types.”

CScalp has created a free online Trading Diary which will help you keep track of your cryptocurrency trading results. This online tool allows you to review trade history and correct your trading strategy.

Frequently Asked Questions: FAQs About What Is Historical Data

What is Historical Data?

Historical data refers to past records and information about specific variables, such as financial markets, customer behavior, or business operations. This data is used to analyze trends, forecast future outcomes, and make informed decisions.

How Can Historical Data Be Used in Strategy Development?

Historical data helps organizations develop effective strategies by providing insights into past performance, market trends, and customer preferences. By analyzing this data, companies can identify opportunities for growth, optimize resource allocation, and enhance competitive advantage.

What Role Does Historical Data Play in Analysis?

Historical data is critical for analysis as it enables researchers and analysts to identify patterns, trends, and correlations. By examining past data, analysts can make data-driven decisions, predict future scenarios, and improve overall accuracy in their assessments.

How Can Businesses Gain Insight from Historical Data?

Businesses can gain valuable insights from historical data by employing data analytics tools and techniques. These insights can reveal customer behavior, market trends, and operational efficiencies, helping businesses make informed decisions and improve performance.

Where is Historical Data Stored?

Historical data is typically stored in databases, data warehouses, or cloud storage solutions. The choice of storage depends on the volume of data, accessibility requirements, and the need for data security and compliance.

What Are Compliance Considerations When Handling Historical Data?

Compliance with data protection regulations, such as GDPR or HIPAA, is essential when handling historical data. Organizations must ensure that data is stored securely, accessed only by authorized personnel, and processed in accordance with legal requirements to protect privacy and confidentiality.

How Does Cloud Technology Facilitate Leveraging Historical Data?

Cloud technology enables organizations to store and process large volumes of historical data efficiently. By leveraging cloud services, businesses can access scalable resources, advanced analytics tools, and collaborative platforms to derive insights from historical data and make informed decisions.

What Are the Best Practices for Handling and Tracking Historical Data?

Best practices for handling and tracking historical data include ensuring data accuracy, maintaining data integrity, implementing robust security measures, and regularly updating data storage systems. Organizations should also establish clear data governance policies and use data visualization tools to monitor and track data effectively.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT