Get started with a free futures trading simulation to enhance your crypto futures trading skills. Explore functions, analyze market data and test strategies. In this article, CScalp will help you discover the power of historical data and research tools for consistent results.

Getting Started with Futures Trading Simulator

A futures trading simulator can be an invaluable tool. It allows you to practice and sharpen your trading skills in a risk-free environment. With a free futures trading simulator, you can explore the ins and outs of the market without worrying about financial losses. It provides a simulated trading experience where you can develop and test various strategies before venturing into live trading.

How to Start Using Free Crypto Futures Trading Simulator

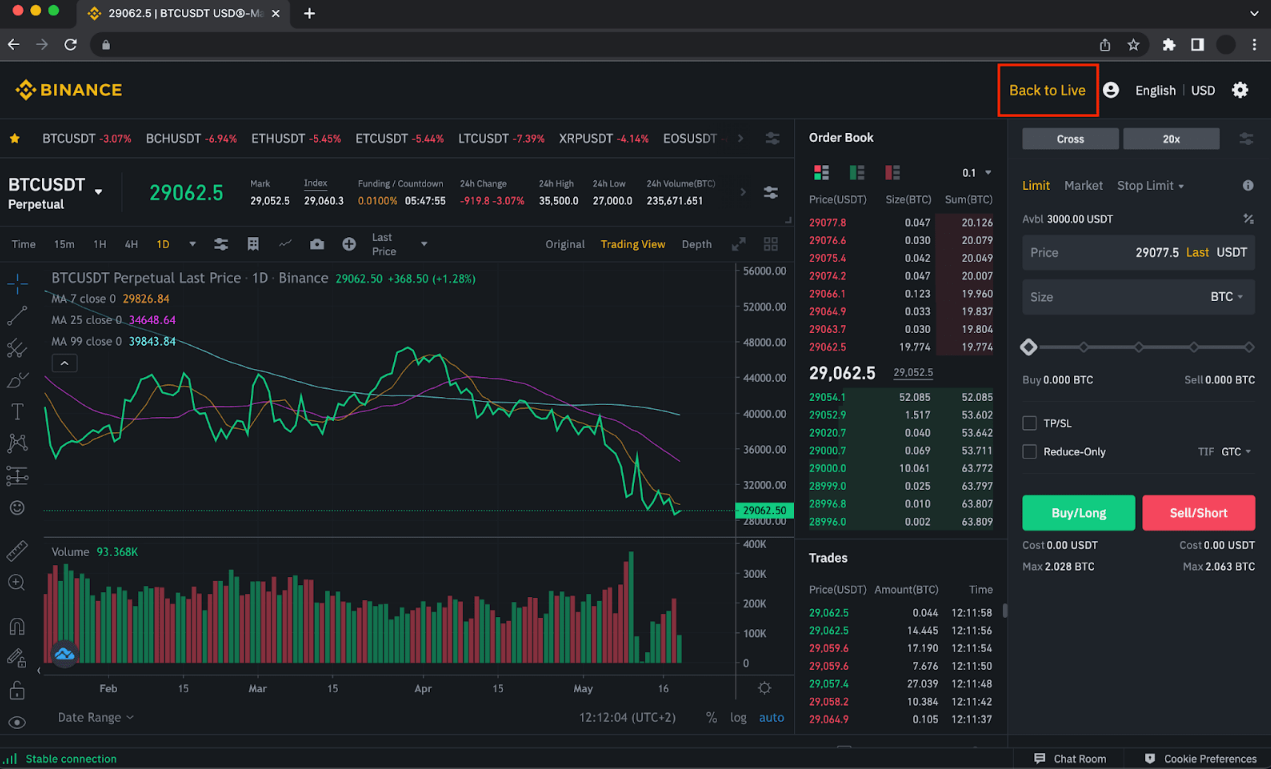

Getting started with a futures trading simulator is straightforward. Simply sign up for an account, for example, on Binance Futures’ Mock Trading. Once you're in, you'll have access to various features, including real-time market data, analysis tools, and charting capabilities.

Start by familiarizing yourself with the platform's functions. Discover how to analyze market data, test order strategies, and utilize advanced tools for technical analysis. Take advantage of mobile apps to keep up with the market on the go. Whether you're a beginner or an experienced trader, a futures trading simulator can help you refine your skills and gain confidence before diving into live trading.

With a futures trading simulator, you have the opportunity to learn, grow, and improve as a trader. Take advantage of this powerful tool to enhance your understanding of the market, refine your strategies, and prepare yourself for success in the fast-paced world of crypto futures trading.

How to Access Binance Futures’ Mock Trading

Binance Futures offers a Mock Trading feature for users to practice cryptocurrency trading without risking real capital. Here’s a step-by-step guide to accessing this feature:

- Visit Binance Futures and either log in or create a new account

- Click on 'Profile' and select 'Mock Trading' in the top-right corner of the Futures trading interface.

- Click 'Continue' to create a Binance Futures testnet account using the credentials of your main account.

- Start with a risk-free balance of 3,000 USDT to experience Binance Futures features.

- Use 'Faucet' to add testnet funds, select a coin, and add assets.

- You can switch back to live trading at any time.

Note: Candlestick chart and price in the Mock Trading environment on Binance may differ from the market value.

Benefits of a Free Futures Trading Simulator

With a simulation platform, you can engage in risk-free practice and gain valuable experience without risking real money. You can test different strategies and analyze their performance by simulating real-time market conditions. This allows you to refine your trading techniques and develop a deeper understanding of the intricacies of futures trading.

A free futures trading simulator provides a realistic trading environment where you can explore various functions and features. You can analyze market data, access historical information, and simulate order strategies to evaluate their effectiveness.

Mastering Crypto Futures Trading with Simulation

By utilizing a futures trading simulator, you can immerse yourself in a simulated trading environment that replicates real-time market conditions.

Simulation allows you to test and refine your trading strategies without risking actual capital. This is particularly valuable in the volatile world of cryptocurrency futures, where precise timing and analysis are paramount. By gaining experience and confidence through simulated trading, you can make more informed decisions and mitigate potential risks when you venture into live trading.

A trading simulator will provide you with access to real-time market data, allowing you to analyze price movements, liquidity, and market trends specific to the cryptocurrency futures market. It empowers you to explore different trading approaches, experiment with order types, and observe the impact of various factors on your trading performance.

Moreover, simulation will enable you to validate your strategies and refine your risk management skills. By observing the outcomes of your simulated trades, you can identify strengths and weaknesses, adapt your approach, and continuously improve your ability to navigate the crypto market.

Analyzing Market Data in a Simulated Trading Environment

When it comes to trading futures in a simulated environment, one of the key aspects to focus on is analyzing market data. In this simulated trading environment, you can evaluate and interpret real-time market data without any financial risk.

By studying the market data provided by the simulation platform, you can gain valuable insights into the price movements, trends, and patterns of different cryptocurrencies. This information can be used to develop effective trading strategies and make informed decisions.

- Monitor real-time price fluctuations of various cryptocurrencies

- Analyze volume and liquidity levels to gauge market interest

- Identify support and resistance levels for potential entry and exit points

- Study technical indicators to assess the market momentum

- Observe order flow and depth of the market to understand the sentiment

Remember, while simulated trading provides a risk-free environment, it is crucial to approach the market data with the same attention to detail and analysis as you would in real trading. This will help you develop skills and insights that can be translated into successful trading in live markets.

Testing Trading Strategies and Analyzing Performance

One of the key benefits of using a futures trading simulator is the ability to test strategies and analyze their performance. By simulating trades in a risk-free environment, you can evaluate different order types, such as market orders, limit orders, and stop orders, to determine which strategies work best for your trading style.

With a futures trading simulator, you can execute trades based on your chosen strategy and observe how they perform in real time. This allows you to assess the effectiveness of your strategy and make any necessary adjustments before risking real capital in live trading.

Additionally, futures trading simulation provides valuable performance analysis tools to help you evaluate the success of your transactions. You can review metrics such as profit/loss, win rate, average holding period, and risk-to-reward ratio to gauge the overall performance of your strategy.

Using a futures trading simulator to test order strategies and analyze their performance, you can refine your trading approach and increase your chances of success when trading futures in live markets. It allows you to gain valuable insights and make data-driven decisions based on the results of your simulated trades.

Remember, it's important to continuously assess and adapt your order strategies based on market conditions and ongoing analysis. A futures trading simulator provides you with a controlled environment to refine your skills and confidently trade futures in real time.

Utilizing Mobile Apps for Simulated Trading on the Go

Take your simulated trading experience to the next level with the convenience of mobile apps. You can now access your trading simulator anytime and anywhere, allowing you to stay connected to the market even when you're not in front of your PC.

Mobile apps offer a range of features that enable you to execute trades, monitor market conditions, and analyze real-time data directly from your smartphone or tablet. Whether you're commuting, traveling, or simply prefer the flexibility of trading from your mobile device, these apps provide a seamless and user-friendly experience.

- Execute trades: Place trades with ease, adjust order parameters, and manage your positions, all from the convenience of your mobile device.

- Real-time market data: Stay updated with streaming market data, charts, and indicators that provide valuable insights for your trading decisions.

- Portfolio management: Monitor and analyze your simulated portfolio, track performance, and make informed adjustments on the go.

- Customizable alerts: Set personalized alerts to notify you of market events, price movements, and other trading opportunities.

By utilizing mobile apps for simulated trading, you can make the most of every available trading opportunity and adapt to market conditions in real time. Stay connected, informed, and in control of your trading activities, regardless of your location or schedule.

Leveraging Charting and Technical Analysis in Futures Trading Simulation

One of the advantages of using a futures trading simulation is the ability to leverage charting and technical analysis tools. In a simulated trading environment, you can explore different charting techniques and indicators to analyze market trends and make informed trading decisions.

By utilizing charting features such as candlestick patterns, moving averages, and trend lines, you can identify potential entry and exit points for your trades. Technical analysis tools enable you to evaluate market volatility, support and resistance levels, and other crucial factors that can impact your trading strategy.

With a futures trading simulator, you can experiment with different charting styles and indicators without risking real money. This allows you to fine-tune your technical analysis skills and gain confidence in your trading approach. By analyzing historical data and studying patterns, you can develop a deeper understanding of market dynamics and improve your ability to predict future price movements.

In addition to charting tools, many simulation platforms offer advanced technical analysis features, such as customizable studies and drawing tools. These tools allow you to conduct in-depth analysis and create personalized trading strategies based on your unique trading style.

Understanding the Importance of Risk Management in Simulation

In the world of futures trading simulation, one key aspect that traders need to grasp is the importance of risk management. When engaging in simulated trading, it's crucial to have a clear understanding of the potential risks involved and to implement strategies to mitigate them.

Risk management involves assessing the potential losses that may occur during trading activities and taking actions to minimize those risks. In a simulated trading environment, it provides an opportunity to practice risk management techniques without risking real money.

Here are a few key points to consider:

- Define your risk tolerance level: Before entering any trade, determine the maximum amount of risk you are willing to take. This will help you manage your positions more effectively.

- Set Stop-Loss orders: Use Stop-Loss orders to automatically exit a trade if it reaches a predetermined price level. This can help limit your losses in case the trade goes against you.

- Diversify your portfolio: Spread your investments across different cryptocurrencies to reduce the impact of potential losses.

- Monitor market conditions: Stay informed about the latest market trends and news that may affect your trading positions. This will enable you to make more informed decisions and adjust your risk management strategies accordingly.

- Evaluate and adjust your risk management plan: Regularly review and assess your risk management plan based on your performance in simulated trading. Identify areas for improvement and make necessary adjustments.

By understanding and implementing effective risk management techniques, you can better navigate the challenges of futures trading simulation and increase your chances of long-term success.

Exploring the Limitations of Simulated Trading

While a futures trading simulator can be a valuable tool for gaining experience and testing strategies, it's important to recognize its limitations.

- Emotional Impact: Simulated trading does not replicate the emotions and psychological pressures involved in real-life trading situations.

- Market Realism: While futures trading simulators aim to reflect real market conditions, they may not perfectly replicate the complexities and nuances of live trading.

- Execution Speed: Simulators may not accurately capture the speed of order execution in real-time markets, potentially affecting trade outcomes.

- Limited Impact of Slippage: Slippage, the difference between intended and actual execution prices, may not be fully accounted for in simulations.

- Lack of Live Market Factors: Simulated trading may not consider key market factors, such as liquidity, news events, and unexpected price movements.

- Behavioral Biases: Simulated trading cannot replicate the behavioral biases that you may experience in live trading, impacting decision-making.

While simulators provide a risk-free environment to practice and refine trading skills, it's crucial to transition to live trading with caution and adapt to the realities of the market. Complement simulator training with ongoing education, market research, and strategies tailored to real-time trading conditions to maximize success.

Strategies for Achieving Consistent Results in Simulated Futures Trading

Consistency is key when it comes to successful simulated trading. Here are some strategies to help you achieve consistent results:

- Stick to a Trading Plan: Develop a well-defined trading plan and stick to it. This should include entry and exit points, risk management guidelines, and profit targets.

- Use Proper Risk Management: Implement risk management techniques such as setting Stop-Loss orders and managing position sizes to protect your capital.

- Analyze and Learn: Regularly review your simulated trades and analyze the outcomes. Identify patterns and trends to learn from your mistakes and refine your strategies.

- Diversify Your Portfolio: Spread your trades across different asset types and markets to reduce the impact of any single trade on your overall portfolio.

- Stay Disciplined: Avoid impulsive decisions or chasing after losses. Stick to your trading plan and avoid emotional trading.

- Test and Refine Strategies: Use the simulated trading environment to test new strategies and refine existing ones. This will help you identify which strategies work best for you.

- Keep Track of Market News: Stay updated on market news and events that may impact your trades. This will help you make informed decisions.

- Set Realistic Goals: Set realistic expectations and goals for your simulated trading. This will help you stay focused and avoid unnecessary risks.

By following these strategies, you can increase your chances of achieving consistent results in simulated trading. Remember to treat the simulated environment as if it were real, and embrace continuous learning and improvement. Remember, it is crucial to continuously adapt and refine your strategy based on changing market conditions. Stay tuned, and don’t forget to join the CScalp community on Discord for more insights.

Applying Futures Trading Simulation Results to Real-Time Trading

Once you have honed your trading skills through simulation, it's time to apply those results to real-time trading. This transition allows you to put your strategies to the test in a live market environment. Effectively applying your simulation results can maximize your chances of success and minimize potential losses.

Here are some key considerations when applying simulation results to real-time trading:

- Use a reliable trading platform: Try out the free CScalp trading terminal by leaving your email in the form below. Download the software and connect it to your preferred cryptocurrency exchange through API keys.

- Implementing your proven strategies: Take the strategies that have shown consistently positive results in simulation and apply them in real-time trading. Stick to your predefined rules and avoid impulsive decisions.

- Managing risk: Utilize risk management techniques learned during simulation to safeguard your capital. Set Stop-Loss levels and determine your risk tolerance for each trade.

- Monitoring market dynamics: Stay updated on real-time market data and adapt your trading strategies accordingly. Continuously analyze market trends and adjust your positions as needed.

- Evaluating performance: Regularly assess and analyze your performance in real-time trading. Compare it with your simulation results to identify areas for improvement and adjust your strategies accordingly.

Remember, real-time trading introduces factors such as emotions and market volatility that may differ from simulation. It's essential to stay disciplined, stick to your proven strategies, and adjust as necessary based on real-time market conditions. By leveraging your simulation results effectively, you can enhance your real-time trading performance and strive for consistent profitability.

Related article: Best Crypto Futures Trading Hours: Optimal Times for Trading