CScalp vs. 3Commas: Which One to Choose?

In the dynamic world of cryptocurrency trading, choosing a trading platform can significantly impact your success. Among the array of options, CScalp and 3Commas emerged as popular contenders, each offering unique tools and features to enhance trading strategies and maximize profits. Understanding the nuances of these platforms is crucial to making an informed decision. Let’s dive in.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Key Features of 3Commas and CScalp

Both platforms are among the best trading apps, with their main difference lying in their intended purposes: scalping and algotrading. To better understand this difference, let’s look at the particularities of each trading style and the distinctive elements that each platform has.

Scalping with CScalp

Scalping is a trading strategy that involves making numerous small trades within a short period to capitalize on tiny price movements in the market. Scalpers aim to take advantage of fleeting opportunities and secure small profits, which can accumulate to significant gains over time. This fast-paced approach requires traders to make quick decisions, often within seconds or minutes, and engage in multiple transactions throughout the trading day.

Scalpers typically focus on liquid markets with high trading volumes, as this ensures that there are sufficient price movements to exploit. They rely on technical analysis, using various indicators and chart patterns, to identify short-term trends and potential entry and exit points. Due to the frequency of trades, scalpers aim to minimize trading costs, such as spreads and commissions, as these can significantly impact overall profitability.

To effectively execute scalping strategies, traders need a platform that offers lightning-fast order execution, real-time market data, and customizable charting tools. CScalp, with its specialized interface optimized for swift movements and analysis, proves to be an ideal platform for traders embracing the scalping approach.

Benefits of trading with CScalp include:

- Order Book Trading: Its interface, optimized for swift movements, allows you to execute transactions with a single click.

- Cluster Analysis: Easily identify dominant market players, sellers, or buyers.

- Customizable Charts: Observe price movements and draw levels based on your preferences.

- Workspace Customization: Organize order books and charts according to your comfort, create isolated workspaces and more.

- Trading Journal: Use this free tool to save your trade history, analyze it, and improve your strategies.

To see in detail all the functions and how to use them, you can consult our YouTube channel CScalp TV.

Algotrading with 3Commas

Algotrading, short for algorithmic trading, is a strategy that relies on pre-programmed algorithms to automate trade execution. Unlike human traders, algorithms can analyze vast amounts of data instantaneously, identify patterns, and execute trades with precision, making them highly efficient and eliminating the impact of emotions on trading decisions.

Algotrading encompasses various types of trading algorithms, each designed for specific market conditions and objectives. Some popular types of algorithms include trend-following algorithms, mean-reversion algorithms, and statistical arbitrage algorithms. These algorithms can be based on technical indicators, fundamental data, or a combination of both.

The process of developing a trading algorithm involves backtesting, where historical data is used to assess the algorithm’s performance. After fine-tuning the algorithm to achieve desired results, it is deployed in real-time trading scenarios.

Platforms like 3Commas, with their focus on automation and trading bots, cater to traders interested in exploring algotrading. 3Commas offers an array of bots with varying strategies, providing traders the flexibility to choose algorithms that align with their risk tolerance and market outlook.

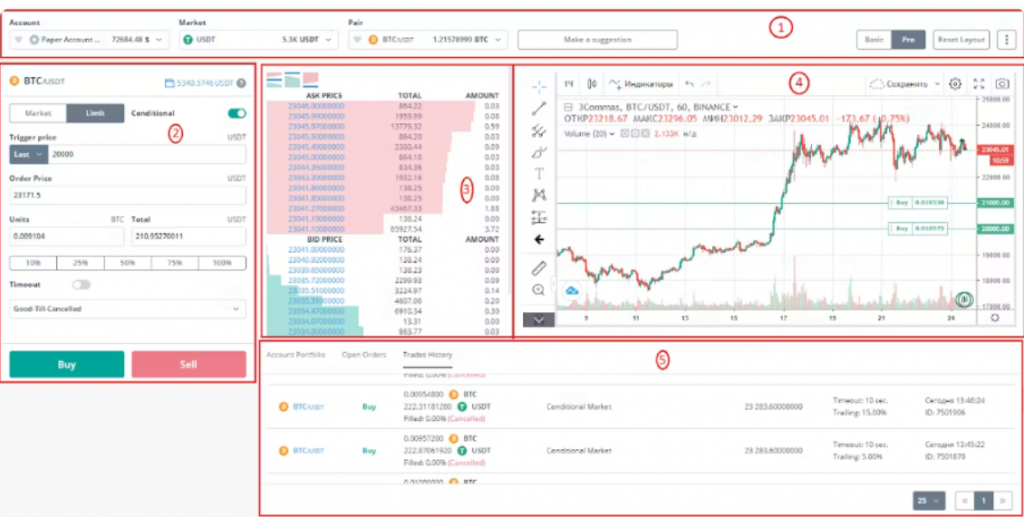

Notable features include:

- Smart Trading: Works as an intelligent terminal, allowing you to expand the types of orders to program on exchanges, with a wide range of features and indicators for beginners and advanced traders.

- Trading Bots: These are its distinctive elements, enabling you to automate your strategies and avoid constant market monitoring. Three types of bots are offered: Gordon Bot (for QFL strategies, buying low and selling high), Grid Bot (for moments of undefined trends), and Advanced Bot (for advanced traders seeking detailed settings).

If you want to learn more about how bots work, read our article: “These Are the Benefits of Using the 3Commas Crypto Bot.”

Comparison Between CScalp and 3Commas

Now that we know what both platforms offer, let’s compare some other important points to consider when deciding which one to trade with:

Costs and Commissions

In terms of costs, CScalp stands out as a completely free platform, making it highly accessible regardless of your budget. 3Commas offers different subscription plans varying in price and features, especially in the type and quantity of bots available for use, allowing you to choose the plan that best suits your needs.

Market Availability

Regarding the markets available for trading, both CScalp and 3Commas offer a wide range of options. CScalp focuses on the cryptocurrency market, while 3Commas allows traders to operate in various markets, including cryptocurrencies, stocks, and Forex.

Support Service

Both platforms offer robust support services. CScalp has a support team that can be contacted through their website, as well as an excellent community of traders on Telegram willing to assist you. 3Commas provides support through live chat and email with a human representative, as well as a bot offering tutorials according to your needs.

CScalp vs. 3Commas: The Final Assessment

In the ever-evolving world of cryptocurrency trading, the use of advanced tools and platforms can make all the difference in achieving success. As we compared CScalp and 3Commas, it became evident that each platform offers unique strengths tailored to specific trading strategies. Your ultimate choice between the two will largely depend on your individual approach to trading and your desired level of involvement in the process.

The choice between CScalp and 3Commas will largely depend on your trading strategy. If you are a scalping-focused trader, CScalp may be the best option due to its fast and efficient interface and tools. However, if you prefer to automate your trades and don’t have time for constant market monitoring, 3Commas may be the ideal choice. Its customizable trading bots enable you to automate your trading strategies and maximize profits.

We hope this article has been helpful in understanding the differences between the platforms and allows you to choose the one that best suits your trading needs. Remember to keep yourself informed about different available platforms and options. Successful trading!

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT