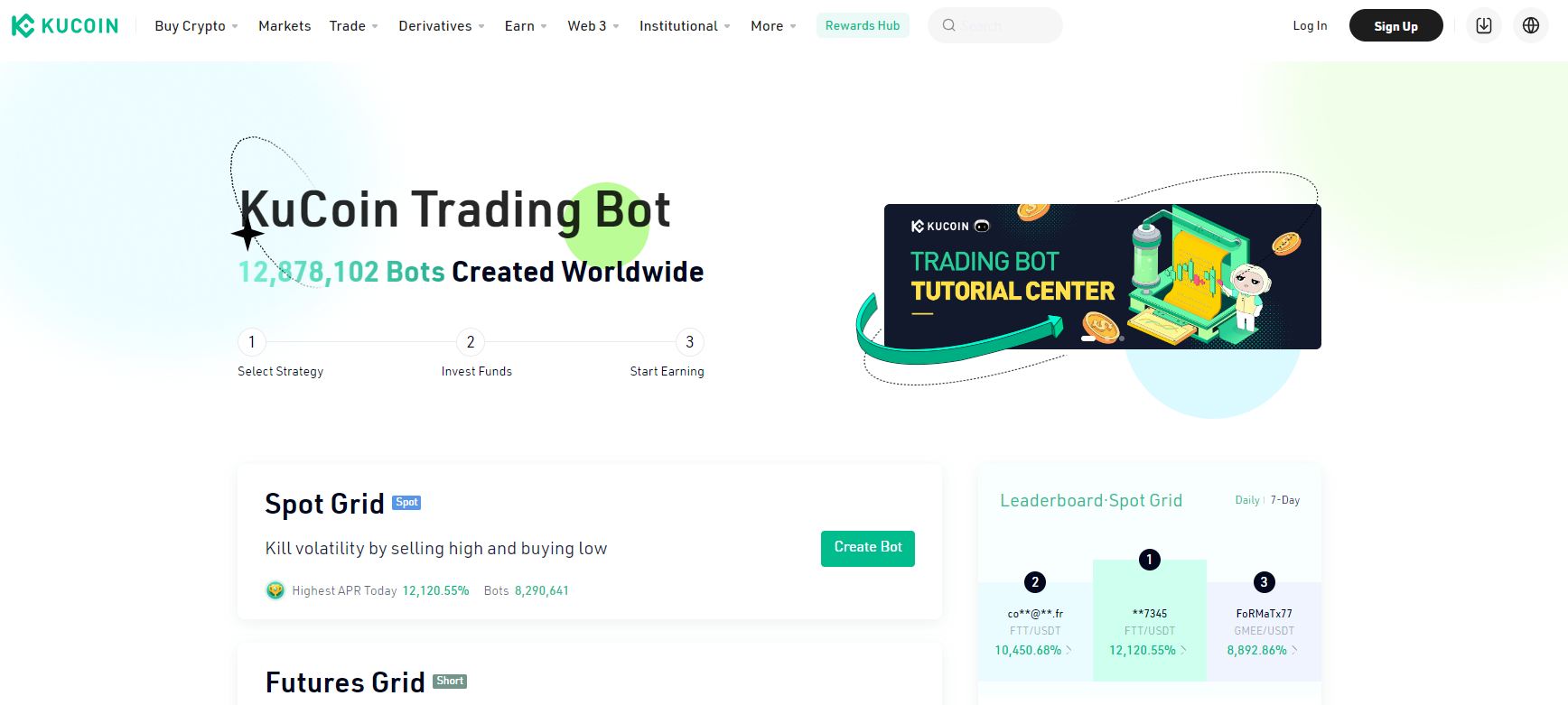

The KuCoin platform offers a crypto trading bot. It is an automated trading tool designed to take over some tasks, allowing you to trade efficiently even while you're asleep. This bot operates by executing trades based on pre-set conditions, thereby removing emotional factors from trading decisions. KuCoin's bot is known for its ability to replicate repetitive tasks, helping you catch trading opportunities that you might otherwise miss. CScalp explores how the KuCoin trading bot works and how to use it in your trading strategies.

How Does the KuCoin Trading Bot Work?

The KuCoin trading bot is a tool designed to enhance your trading experience. Let's delve deeper into its key strategies.

KuCoin Trading Bot Classic Grid Strategy

One of the most popular strategies offered by the KuCoin trading bot is the "Classic Grid." This strategy involves defining a range within which you want to trade. For instance, you might set the bot to sell in a specific upper price range (red box) and buy in a lower range (green box). This strategy is particularly effective in choppy market conditions and is customizable for both spot and futures trading.

Smart Rebalance for Long-Term Holders

The primary function of the KuCoin Smart Rebalance bot is to maintain a predetermined balance of assets in your portfolio. As a long-term investor, you might have a specific allocation strategy for your holdings, such as a certain percentage in Bitcoin (BTC), Ethereum (ETH), and other altcoins. Market fluctuations can alter these ratios, and that's where the Smart Rebalance bot comes into play.

This KuCoin trading bot continuously monitors your portfolio. When the actual percentage of an asset deviates from your set target – due to price changes in the market – the bot automatically executes trades to rebalance the portfolio. For instance, if the value of BTC increases significantly, it might comprise a larger portion of your portfolio than intended. The bot will then sell a portion of BTC and buy other assets to restore the original allocation ratios.

The theoretical advantage of this approach is that it capitalizes on the natural market volatility. By automatically selling assets that have increased in value and buying those that have decreased, the bot is essentially buying low and selling high. This can potentially lead to an increase in the total value of your holdings over time, although this is not guaranteed.

Humans have the unique ability to adapt their trading strategies in real-time, responding to sudden market shifts or unexpected events. While crypto bots follow set patterns and strategies, human traders can pivot quickly, taking advantage of opportunities as they arise. This flexibility is crucial in the volatile world of trading, where conditions can change in an instant.

This KuCoin trading bot continuously monitors your portfolio. When the actual percentage of an asset deviates from your set target – due to price changes in the market – the bot automatically executes trades to rebalance the portfolio. For instance, if the value of BTC increases significantly, it might comprise a larger portion of your portfolio than intended. The bot will then sell a portion of BTC and buy other assets to restore the original allocation ratios.

The theoretical advantage of this approach is that it capitalizes on the natural market volatility. By automatically selling assets that have increased in value and buying those that have decreased, the bot is essentially buying low and selling high. This can potentially lead to an increase in the total value of your holdings over time, although this is not guaranteed.

Humans have the unique ability to adapt their trading strategies in real-time, responding to sudden market shifts or unexpected events. While crypto bots follow set patterns and strategies, human traders can pivot quickly, taking advantage of opportunities as they arise. This flexibility is crucial in the volatile world of trading, where conditions can change in an instant.

Dollar-Cost Averaging KuCoin Trading Bot

Dollar-cost averaging (DCA) is an investment strategy where you invest a fixed amount of money into an asset at regular intervals, regardless of the asset's price. This strategy can reduce the impact of volatility on the overall purchase of the asset, as it averages out the buying price over time.

The KuCoin DCA Bot automates the DCA strategy for cryptocurrency investments. You can set it to buy a predetermined amount of a specific cryptocurrency at regular intervals. For example, you might configure the bot to purchase $250 worth of Bitcoin every Tuesday. This automation ensures that you adhere to your DCA strategy without the need to manually execute trades each time.

The KuCoin DCA Bot allows for customization in terms of the amount invested and the frequency of investment. This flexibility means you can tailor the bot to suit your financial situation and investment goals. Whether you want to invest weekly, bi-weekly, or monthly, the bot can accommodate your preferences.

Risk Considerations: While DCA can mitigate some risks, it's not a foolproof strategy. The success of DCA depends on the long-term performance of the asset. If the asset continuously declines in value, dollar-cost averaging will result in accumulating a depreciating asset. Therefore, it's crucial to combine DCA with thorough research and a clear understanding of the asset you're investing in.

The KuCoin DCA Bot automates the DCA strategy for cryptocurrency investments. You can set it to buy a predetermined amount of a specific cryptocurrency at regular intervals. For example, you might configure the bot to purchase $250 worth of Bitcoin every Tuesday. This automation ensures that you adhere to your DCA strategy without the need to manually execute trades each time.

The KuCoin DCA Bot allows for customization in terms of the amount invested and the frequency of investment. This flexibility means you can tailor the bot to suit your financial situation and investment goals. Whether you want to invest weekly, bi-weekly, or monthly, the bot can accommodate your preferences.

Risk Considerations: While DCA can mitigate some risks, it's not a foolproof strategy. The success of DCA depends on the long-term performance of the asset. If the asset continuously declines in value, dollar-cost averaging will result in accumulating a depreciating asset. Therefore, it's crucial to combine DCA with thorough research and a clear understanding of the asset you're investing in.

Tips for Using KuCoin Trading Bot

Understand the Bot's Mechanisms

Before you start using any of the KuCoin trading bot's features, it's crucial to understand how they work. Whether it's the Classic Grid, Smart Rebalance, or DCA Bot, each has its unique mechanisms and settings. Take time to learn about these features, how they react to market changes, and what settings are most appropriate for your trading style and goals. To know more about other crypto trading bots, check our Pionex trading bot review.

Advanced Risk Management Tools

Pionex's trading bots come equipped with risk management tools. These tools help you to manage and mitigate risks. By setting parameters such as stop-loss orders and take-profit points, you can protect your investments from significant market downturns.

Set Realistic Expectations

It's important to set realistic expectations when using trading bots. They are tools designed to assist with trading, not magic wands that guarantee profits. The effectiveness of a trading bot largely depends on the human factor behind the bot.

Regular Monitoring and Adjustment

While trading bots automate tasks, they don't eliminate the need for regular monitoring. Market conditions can change rapidly, and a strategy that works today might not be effective tomorrow. Regularly review the performance of your bot and be prepared to adjust its settings in response to changing market dynamics.

Use Bots as Part of a Diversified Strategy

Relying solely on trading bots can be risky. It's better to use them as part of a diversified trading strategy. Combine automated trading with manual trading strategies, and don't put all your capital into a bot strategy.

Educate Yourself on Market Analysis

A solid understanding of market analysis can greatly enhance the effectiveness of trading bots. Knowledge of technical analysis, market trends, and economic indicators can help you set more effective parameters for your bot and make better decisions when adjusting its settings.

Risk Management

Always incorporate risk management into your trading strategy. This includes setting Stop-Loss orders, only investing what you can afford to lose, and avoiding excessive leverage. Remember, high-reward strategies often come with high risks.

Test Strategies in Different Market Conditions

Experiment with your bot's settings in different market conditions. What works in a bull market may not work in a bear market, and vice versa. Testing helps you understand how your bot performs under various conditions and can guide you in making more informed adjustments.

KuCoin Trading Bot vs. Human Trading

We have explored the KuCoin trading bot, shedding light on various strategies like the Classic Grid, Smart Rebalance, and Dollar-Cost Averaging (DCA). Each strategy offers unique benefits, catering to different trading styles and objectives.

However, as with any trading tool, the KuCoin trading bot is not a silver bullet. Successful trading requires a blend of automated efficiency and human insight. Understanding the mechanisms of each bot strategy, setting realistic expectations, and regular monitoring are crucial steps in leveraging the bot's capabilities. Additionally, incorporating these tools into a diversified trading strategy, coupled with a solid foundation in market analysis and risk management, is paramount.

While crypto trading bots operate within the parameters set by their developers, human traders can make ethical decisions, considering the broader impact of their trading activities on the market and other participants. By intelligently integrating these automated strategies with human oversight and market knowledge, you can navigate through crypto with greater confidence and potential for success. Remember, the ultimate goal is to harness your trading journey.

To further enrich your experience, we invite you to join our Discord server. Your insights, questions, and discussions will be a valuable addition to our growing community.

Related article: The Best Coinbase Trading Bots.

However, as with any trading tool, the KuCoin trading bot is not a silver bullet. Successful trading requires a blend of automated efficiency and human insight. Understanding the mechanisms of each bot strategy, setting realistic expectations, and regular monitoring are crucial steps in leveraging the bot's capabilities. Additionally, incorporating these tools into a diversified trading strategy, coupled with a solid foundation in market analysis and risk management, is paramount.

While crypto trading bots operate within the parameters set by their developers, human traders can make ethical decisions, considering the broader impact of their trading activities on the market and other participants. By intelligently integrating these automated strategies with human oversight and market knowledge, you can navigate through crypto with greater confidence and potential for success. Remember, the ultimate goal is to harness your trading journey.

To further enrich your experience, we invite you to join our Discord server. Your insights, questions, and discussions will be a valuable addition to our growing community.

Related article: The Best Coinbase Trading Bots.