Crypto Trading Strategies: Identify Market Trends and Learn Effective Risk Management

If you are looking to participate in the cryptocurrency market, it is important to learn effective crypto trading strategies. From range trading to using moving averages and the relative strength index (RSI), the strategies featured in this article will help you navigate the volatile world of digital assets. CScalp explores popular crypto trading strategies, highlights their benefits, as well as the importance of managing risks.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Crypto Trading Strategies

Crypto trading strategies are essential for those looking to navigate the volatile world of cryptocurrency trading. Within this realm, there are different approaches that you can take to maximize your potential returns. It is crucial to comprehend the benefits and risks associated with these strategies before diving into the market.

Different Types of Crypto Trading

- Day Trading: Some traders engage in frequent buying and selling of cryptocurrencies within a single day, taking advantage of short-term price movements. CScalp professional terminal is a great tool for this type of trading.

- Swing Trading: This strategy involves holding your position open for a few days or weeks, capitalizing on medium-term price fluctuations.

- Long-term Investment: Other traders opt for a buy-and-hold strategy, aiming to profit from the long-term appreciation of cryptocurrencies they believe in.

Benefits and Risks of Crypto Trading Strategies

Implementing effective crypto trading strategies can offer several benefits:

- Increased Profit Potential: Well-executed crypto trading strategies can lead to significant returns on investment.

- Opportunity to Diversify: Crypto trading allows you to diversify the portfolio beyond traditional assets.

- Flexibility and Accessibility: Cryptocurrency markets operate 24/7, providing ample trading opportunities.

However, it is crucial to acknowledge the risks involved in cryptocurrency trading:

- Volatility: Digital assets are notoriously volatile, leading to rapid price fluctuations and potential losses.

- Lack of Regulation: The decentralized nature of cryptocurrencies means they are subject to different regulations than traditional financial markets.

- Market Manipulation: Due to the relatively small size of the crypto market, it is susceptible to manipulation and price manipulation schemes.

Understanding these benefits and risks will help you make informed decisions while devising your crypto trading strategies.

Popular Crypto Trading Strategies

When it comes to crypto trading, having the right strategies in place can greatly impact your success. Let’s explore several popular crypto trading strategies that can help you make trading decisions:

Range Trading: Profiting from Price Fluctuations

Range trading is a popular crypto trading strategy. It involves identifying the upper and lower boundaries of a price range and executing trades when the price reaches those levels. The idea is to profit from price fluctuations within a specific range, rather than predicting the overall market trend.

To successfully implement range trading, careful analysis of historical price data and market indicators is crucial. Look for patterns and trends that indicate when the price is likely to bounce off a support level or break through a resistance level.

Once the price reaches the predetermined limits, execute buy or sell orders. Set Stop-Loss orders to limit potential losses if the price moves against your expectations. Take-Profit orders are also established to secure profits when the price reaches a certain level within the range.

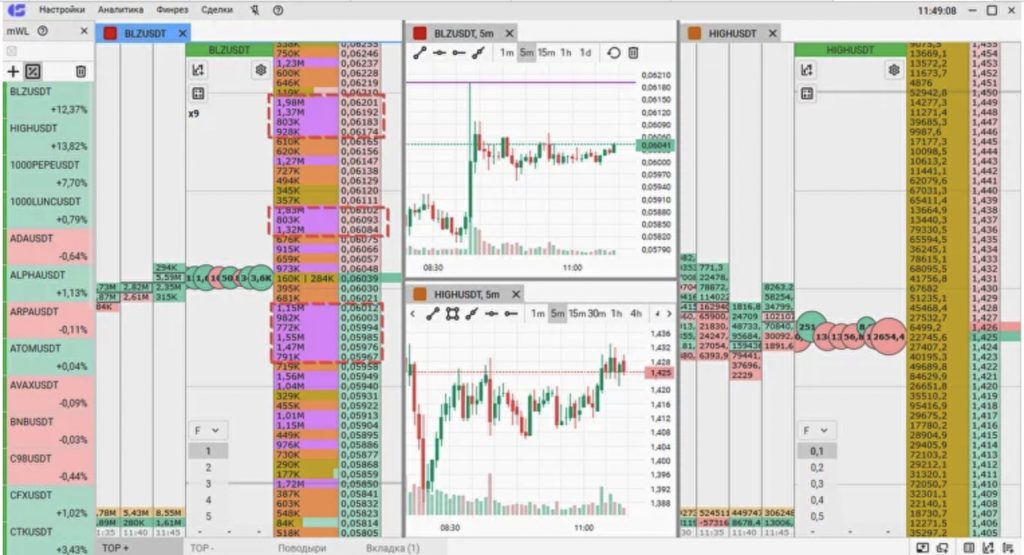

Price Action crypto trading strategy is displayed on the CScalp chart

Trading with Moving Averages: Identifying Trend Reversals

Another popular strategy is the use of moving averages. Moving averages help you identify trend reversals by smoothing out fluctuations in price data. It involves calculating the average price over a specified period, such as 50 or 200 days, and observing the crossover of different moving averages.

When a shorter-term moving average crosses above a longer-term moving average, it indicates a potential upward trend, signaling a buying opportunity. Conversely, when a shorter-term moving average crosses below a longer-term moving average, it suggests a potential downward trend, signaling a sell opportunity.

Simple Moving Average indicator on the TradingView chart

Relative Strength Index Trading: Timing Entry and Exit Points

The Relative Strength Index (RSI) is a widely used technical indicator in crypto trading. It helps identify the strength and overbought/oversold conditions of the market. The RSI ranges from 0 to 100, with values above 70 indicating overbought conditions and values below 30 indicating oversold conditions.

Utilize the RSI to identify potential trend reversals and determine optimal entry and exit points. When the RSI indicates overbought conditions, it may be an opportune time to sell. Conversely, when the RSI indicates oversold conditions, it may present a buying opportunity. However, we suggest you utilize several technical indicators to confirm your theories.

RSI indicator on the TradingView chart

Event-Based Trading: Capitalizing on News and Events

Event-based trading involves exploiting the impact of media coverage and specific events related to cryptos or cryptocurrency exchanges. This strategy requires staying up-to-date with the latest news and developments in the crypto space.

Closely monitor significant announcements, partnerships, regulatory changes, and other events that can trigger significant price movements. By capitalizing on these events, you can strategically enter or exit positions to potentially profit from the resulting price volatility.

X (former Twitter) thread shows opinions of celebrities on cryptocurrencies

These popular crypto trading strategies offer different approaches to enhance trading skills and make informed decisions. It’s essential to thoroughly research and understand each strategy, considering your risk tolerance and investment goals, before implementing them in your trading journey. Connect to our Discord server for more insights.

Remember, trading cryptocurrencies carries a high level of risk, and it’s important to only invest what you can afford to lose. Additionally, utilizing a reliable trading platform like CScalp can help you execute your crypto trades efficiently.

Managing Risks in Crypto Trading Strategies

Managing risks is crucial in crypto trading to protect your investments. Implementing effective risk management strategies can help limit potential losses and safeguard your portfolio. Let’s explore two important risk management techniques:

Setting Stop-Loss Orders

One way to manage risks in crypto trading is by utilizing Stop-Loss orders. A Stop-Loss order is a predetermined level at which you automatically close your position to limit your losses. By setting a Stop-Loss order, you can minimize the impact of adverse price movements.

Stop-Loss and Take-Profit orders are set in the order book displayed within the CScalp crypto trading terminal

When setting a Stop-Loss order, it is vital to consider the volatility and liquidity of the cryptocurrency. Placing the Stop-Loss order too close to the entry price may result in premature exits due to short-term price fluctuations. However, setting it too wide may expose your position to significant losses.

By carefully analyzing price trends, conducting technical analysis, and considering your risk tolerance, you can determine an appropriate Stop-Loss level for each trading position.

Diversifying Crypto Assets You Trade

Diversification is another effective risk management strategy. By making trades with different cryptocurrencies, you can reduce the impact of a single coin’s poor performance on your overall results.

When diversifying your crypto holdings, it’s important to consider various factors, such as market capitalization, liquidity, and project fundamentals. Allocating your investments among established cryptocurrencies with different use cases and goals can help mitigate risk and increase the potential for returns. To discover the perfect cryptocurrencies to trade, utilize our free CScalp crypto screener.

In addition to diversifying across various coins, you can also consider diversification within the crypto industry. This can include investing in crypto-related stocks, funds, or other blockchain-based assets, providing exposure to the broader digital asset ecosystem.

Remember, diversification does not eliminate risks, but it can help minimize the impact of unexpected events and market volatility.

By employing these risk management techniques, you can better navigate the volatile nature of the crypto market and protect your capital. Incorporating Stop-Loss orders and diversification into your trading strategy can help you become a more disciplined and resilient crypto trader.

Utilizing CScalp Free Trading Platform for Crypto Trading Strategies

Overview of CScalp Platform Features

The CScalp trading terminal is an excellent choice if you are seeking a user-friendly and intuitive platform. It offers a range of features designed to enhance your trading experience and maximize your potential profits.

The CScalp terminal is used by professional traders to implement crypto trading strategies

- Real-time market data: Access up-to-date and accurate market data to make informed trading decisions.

- Advanced charting tools: Utilize a wide range of technical indicators and drawing tools to analyze price patterns and trends.

- Order execution: Make trades with one click thanks to CScalp’s fast and reliable order execution system.

- Customizable interface: Personalize your trading workspace to suit your preferences and trading style.

- Risk management tools: Set Stop-Loss orders and Take-Profit levels to manage risks.

How to Execute Crypto Trades with CScalp

Trading cryptocurrencies on the CScalp platform is a straightforward process. Follow these steps to execute your crypto trades with ease:

- Create an account: Sign up for a free account on the exchange of your choice. For example, Binance, Bybit, OKX, Huobi, or other compatible platforms.

- Complete verification: Complete the necessary KYC verification steps to ensure the security of your account.

- Deposit funds: Deposit your desired amount of funds into your exchange trading account.

- Connect to CScalp: Download the free CScalp trading platform and connect it to the exchange by using API keys.

- Analyze the market: Use CScalp’s free screener and technical indicators to analyze the market and identify potential trading opportunities.

- Place your order: Enter the amount you want to trade with and make the left mouse button click on the entry price in the order book.

- Set risk management parameters: Set Stop-Loss and Take-Profit levels to manage your risks effectively.

- Monitor and manage your trade: Keep an eye on your trade’s progress and make any necessary adjustments.

- Close your trade: When you have reached your desired profit or if the market conditions change, close your trade to secure your gains or minimize losses.

- Withdraw your funds: Once you have successfully closed your trade, monitor your results through the free CScalp’s Trading Diary.

By following these steps and utilizing the features of the CScalp platform and our additional free products, you can streamline your crypto trading experience and increase your chances of success in the dynamic cryptocurrency market.

Embracing Crypto Trading Strategies

In crypto trading strategies, the key to success lies in a blend of knowledge, careful planning, and adaptability. Strategies like range trading, moving averages, and applying the Relative Strength Index (RSI) are instrumental in navigating the cryptocurrency market. These strategies offer an upper hand in predicting market trends, identifying potential buy and sell points, and capitalizing on price movements.

In a domain as unpredictable as cryptocurrency trading, employing strategies like setting Stop-Loss orders and diversifying crypto holdings is not just prudent but necessary. These risk management techniques buffer against the market’s volatility and unpredictability, safeguarding investments from unforeseen downturns.

Profitable crypto trading strategies are not just about recognizing opportunities, but also about managing risks and using the right tools. As you continue to explore this space, it is crucial to stay informed, use effective strategies, and approach each trade with enthusiasm and caution. With the right mix of expertise, risk management, and resourceful platforms like CScalp, you can look forward to potentially rewarding experiences in the crypto trading landscape.

Related article: Backtesting Trading Strategies: Boost Your Performance in the Cryptocurrency Market

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT