Cryptohopper algotrading platform review

Cryptohopper is a web platform for creating and running trading bots on cryptocurrency exchanges. Cryptohopper implements a test environment, an interface for creating strategies and technical indicators, and a marketplace. Beside algorithmic trading, manual trading is possible.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Cryptohopper features

The Cryptohopper service is a set of trading automation tools. Focused on trading with bots: four customizable strategies are available. No programming skills are required to configure Cryptohopper bots: the parameters are set via the interface. Available to create templates and save bot settings.

Cryptohopper basic account users can run up to 20 bots at the same time. It is also possible to place orders directly through the order book.

Cryptohopper implements connection to 15 cryptocurrency exchanges via API keys. The statistics could be shawn via TradingView service.

Additional Cryptohopper tools: account statistics, elaboration of signals and strategies, testing on historical data in Paper Trading mode. Cryptohopper marketplace provides custom signals, bots with preset configurations and the connection of Mirror Trading which means a ready-made trading model of traders.

Trading with bots

Cryptohopper trading bots are called «Hopper». A bot can be created using three algorithms:

- Automatic trading – classic bot with the ability to customize parameters, sell, buy, Stop Loss and Take Profit;

- Arbitrage – bot that trades between different exchanges and makes a profit due to the difference in rates;

- Market maker – bot analyses order book and trades that were made. It allows to trade through the spread.

The market maker and arbitrage at Cryptohopper is only available with a paid subscription. Algorithmic Intelligence (AI) can be connected to an active bot, which will automatically generate buy and sell signals. AI could be “trained” and configured in a test environment before the launching.

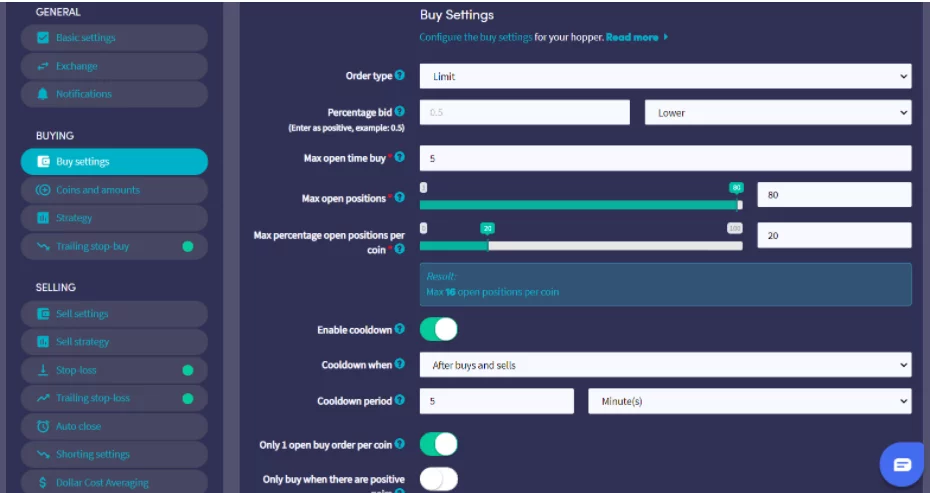

Cryptohopper interface: bots setiings

The standard types of orders are used in trading: by market, limit, stop-limit, Stop Loss / Take Profit system. The Stop-Trailing protocol is available to manage risks and reduce losses during correction.

Strategy creation

A trading strategy is a set of technical indicators and patterns used by a robot to determine buy and sell signals. More than 30 indicators and about 100 trading patterns are available in Cryptohopper. Advanced algorithmic traders can use the JSON programming language for in-depth strategy customization.

Bot testing

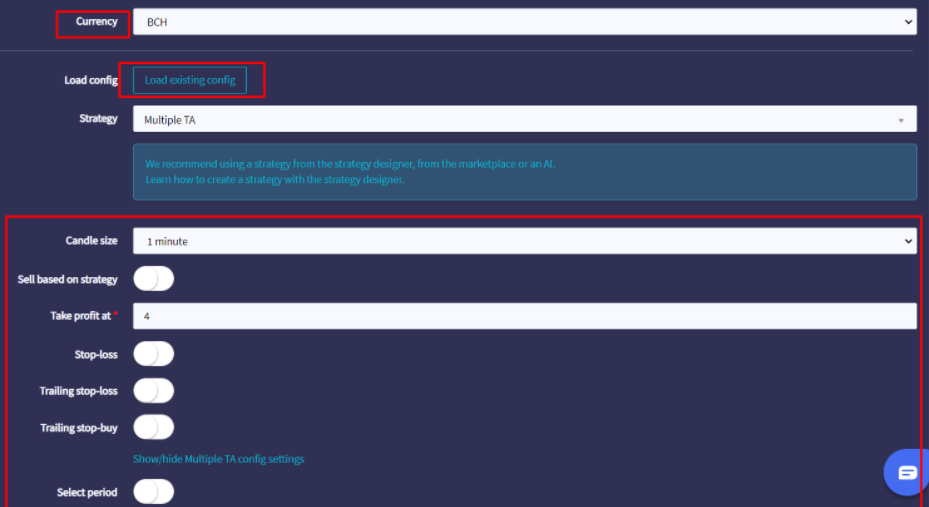

In the “Backtesting” section, you can test the strategy on historical data. There are 8 cryptocurrencies: BCH, BNB, BTC, EOS, ETH, LTC, XRP, XTZ. In order to load the bot settings, you need to click “Load existing config” or configure the setting and algorithm manually, through the panel.

Cryptohopper interface: bots testing

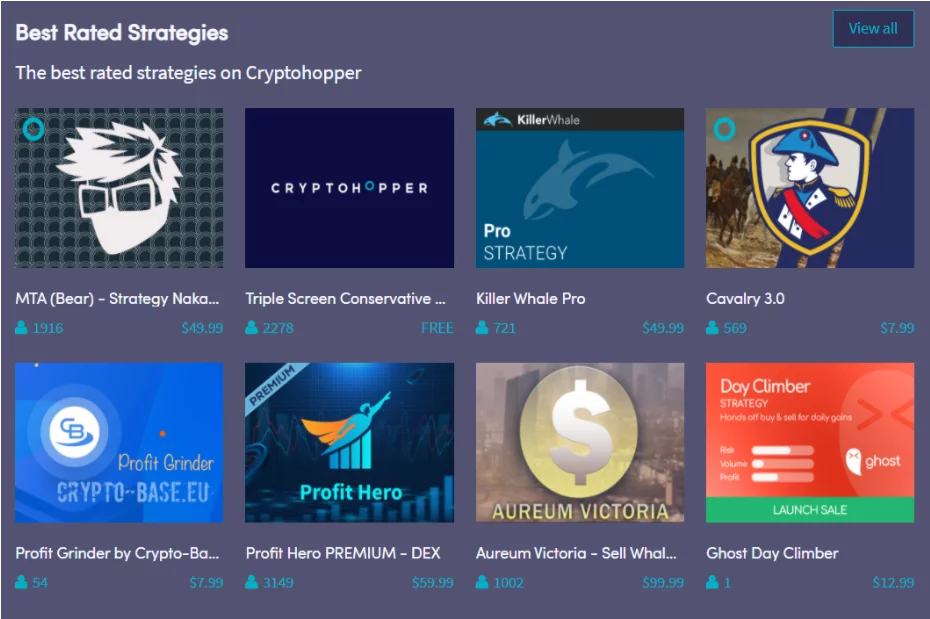

Marketplace

There are 4 types of products available in the Cryptohopper marketplace: ready-made templates, signals, strategies and trading programs. There is free software. The list contains information about the number of buyers and the cost of the product, and when you go to the page of a specific product, detailed information about the configurations.

Cryptohopper interface: marketplace

Connections and pricing

Cryptohopper implements connection to Binance, OKX, EXMO, Huobi, Bitfinex, KuCoin, Bittrex, Kraken, Poloniex, Coinbase and others.

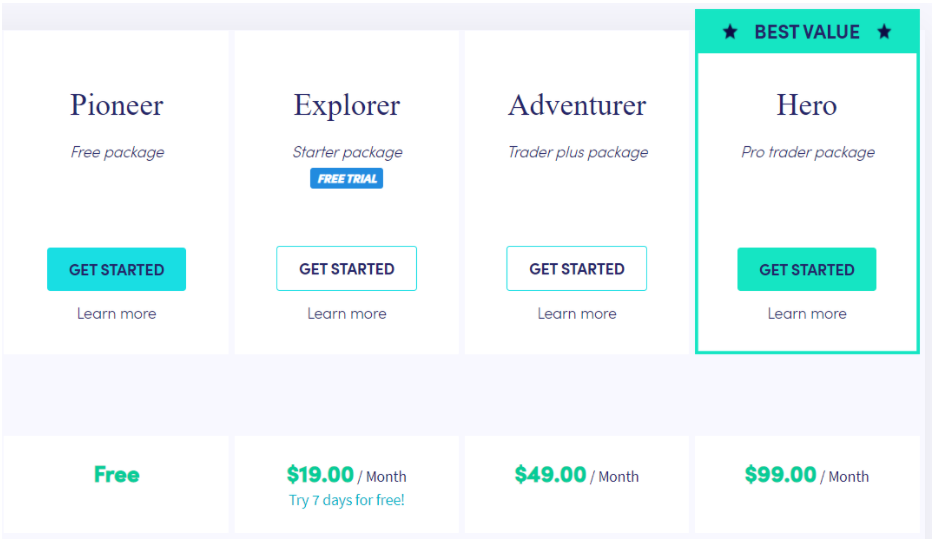

Cryptohopper plans:

- Pioneer – up to 20 open positions without the possibility of setting an order, all connected exchanges are available.

- Explorer – up to 15 tradable coins simultaneously and up to 80 customizable orders in the markets.

- Adventurer – up to 200 orders with the possibility of additional customization, as well as access to the arbitrage trading bot.

- Hero – access to all Cryptohopper features, including a market maker and an arbitrage bot.

Cryptohopper interface: plans

A trial period is provided to get acquainted with the Explorer plan for 7 days.

Conclusion

The Cryptohopper service is aimed at traders who want to automate trading and have no programming experience. The platform has the ability to customize the bot. Therefore, the service is suitable for users with experience in trading on the exchange.

We recommend that newbies algorithmic traders read our article – Cryptocurrency trading bots: beginners guide.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT