CScalp Review: The Best Scalping Terminal for Beginners and Professional Traders

We’ve prepared a comprehensive CScalp review, a free trading platform designed for scalping and intraday trading. We’ll explore trading and analytical features of one of the best scalping trading platforms, discuss which exchanges CScalp works with, and explain how to obtain and start using the terminal. Additionally, you will learn how to configure the terminal for comfortable trading.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

What Is CScalp?

CScalp is a free trading terminal for scalping and intraday trading. The platform works with cryptocurrency exchanges. It is designed for active intraday trading—scalping and intraday trading. As a result, the terminal’s interface and tools are optimized for quick market analysis, one-click order placement, and position closure. CScalp allows traders to operate across multiple exchanges and trade different instruments (stocks, cryptocurrencies, futures) within a single interface.

The CScalp terminal is built for Windows x64. It is possible to install the program on Linux or MacOS by using an emulator.

CScalp Features

Let’s take a closer look at the trading and analytical features offered by the CScalp terminal.

CScalp Trading Features

Order Placement:

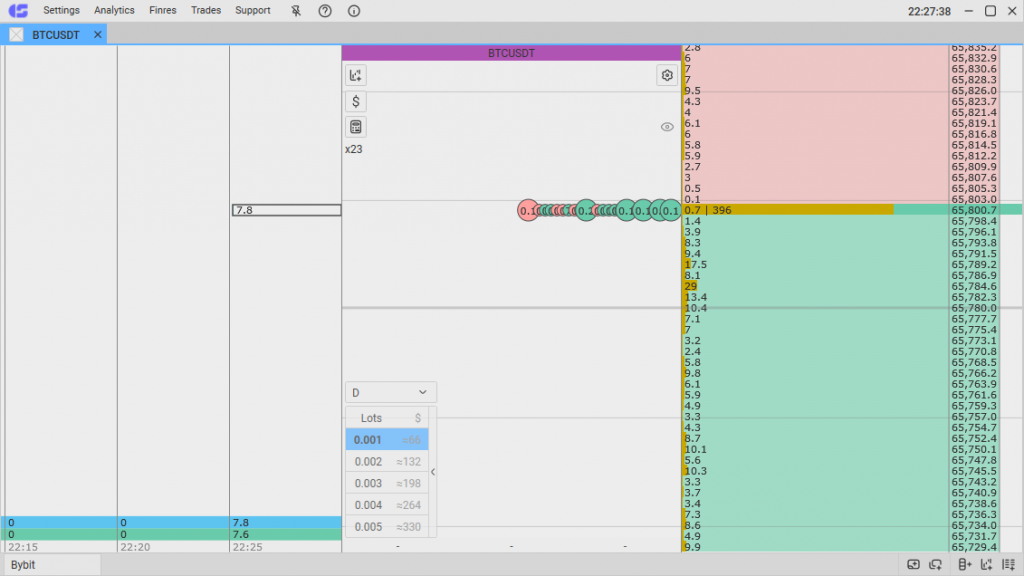

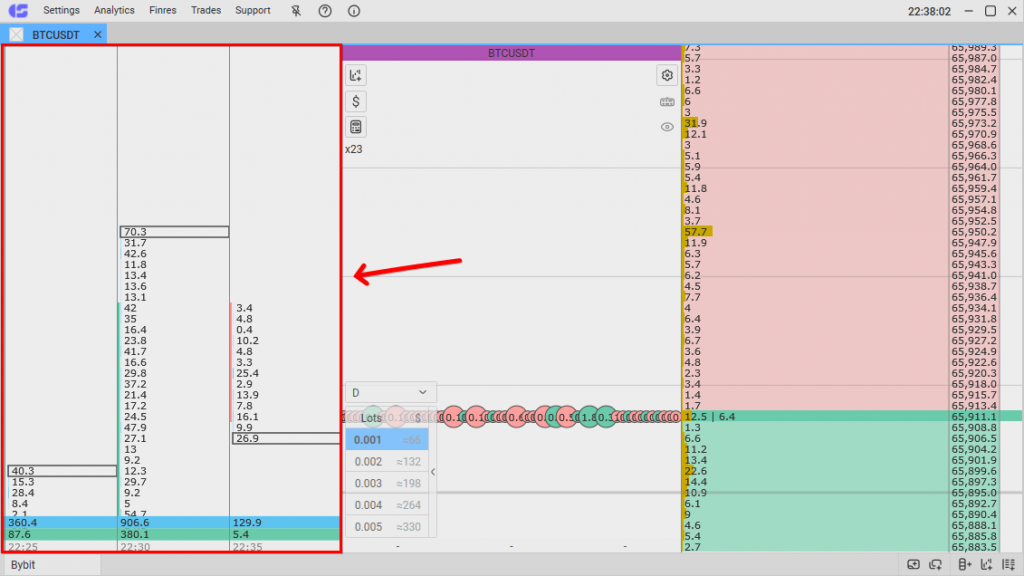

Orders in CScalp are placed through the order book, following a “one-click” principle. Before making a trade, the trader sets the working volumes or traded amounts—defining how many lots will be in each order sent through the order book. Up to five working volumes can be set. On some connections, traded amounts can be configured in USD.

The order book displays price levels and limit orders placed by other traders at those levels. To execute a trade in CScalp, there’s no need to enter the price—simply click on a price from the order book. Left-click to buy, open a long position. Right-click to sell, open short positions. Sellers’ orders are highlighted in red, and buyers’ orders in green (the trader can adjust the color scheme to their preference).

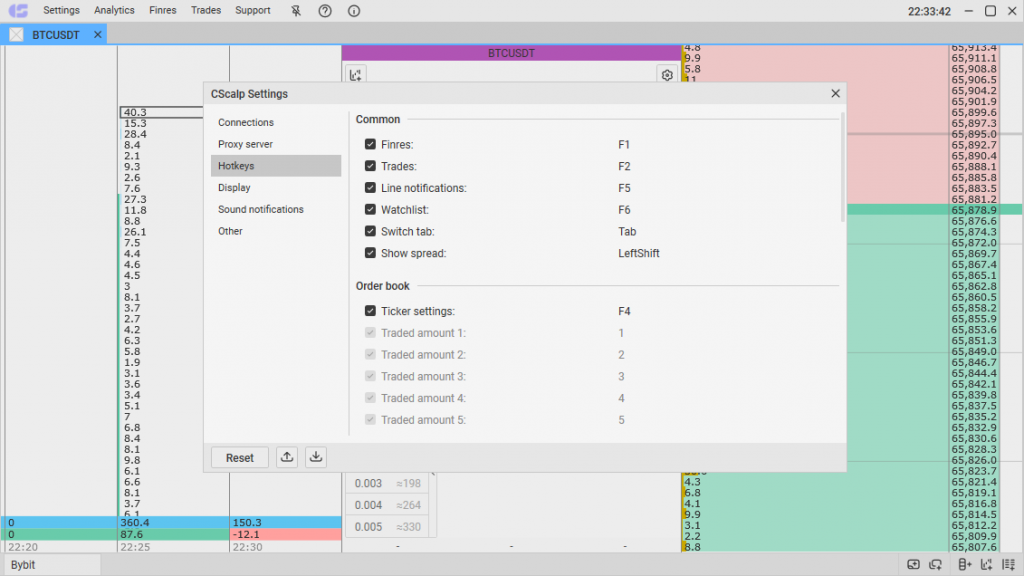

Hotkeys

Hotkeys allow you to manage trades and additional terminal functions. With hotkeys, you can set traded amounts, call up the Watchlist, close positions at market, cancel limit orders, set Stop-Loss/Take-Profit, and more. The purpose of hotkeys is to maximize the trader’s efficiency by reducing unnecessary clicks. Hotkeys are divided by function—some apply to all tabs, while others work only in the active order book.

Hotkeys are customizable. Traders can assign functions to specific buttons or disable certain functions altogether.

Types of Orders

CScalp allows traders to place limit, market, and stop orders (both closing and independent orders). Closing orders include Stop-Loss and Take-Profit, while independent orders include Buy-Stop, Sell-Stop, Buy-Limit, and Sell-Limit.

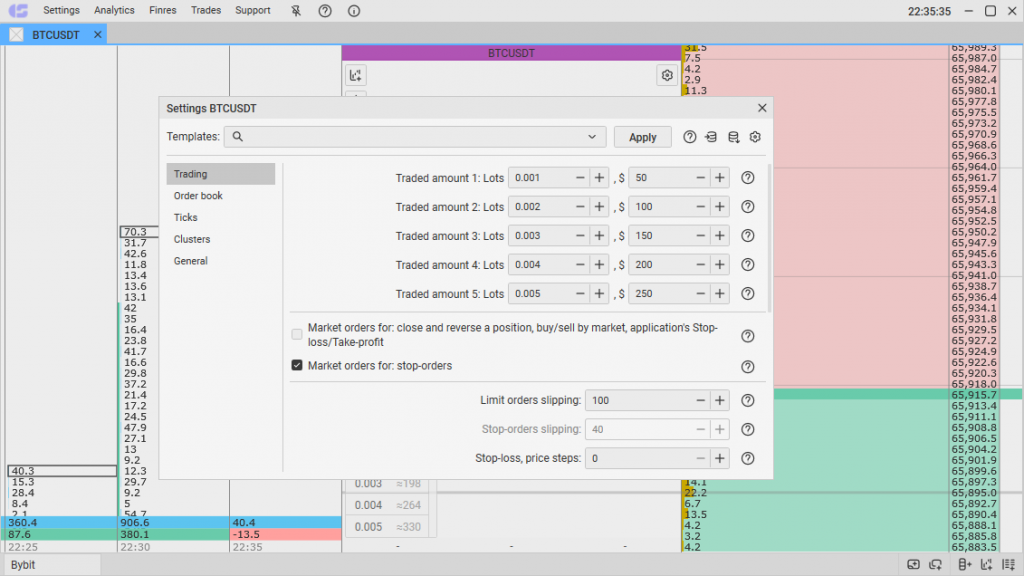

Trading Settings

A separate section in CScalp’s settings—”Trades“—allows users to configure parameters for trading positions. This includes setting the size of traded amounts (the number of contracts in lots), order slip distance for limit orders (price step from the spread to the limit order), order slip distance for stop orders (price step from the stop order to the order that closes the position when SL or TP is triggered), and separate parameters for SL and TP.

Users can also configure the average price calculation method, enable trade notifications, and choose the profit display format (points, percentages).

CScalp’s Analytical Tools

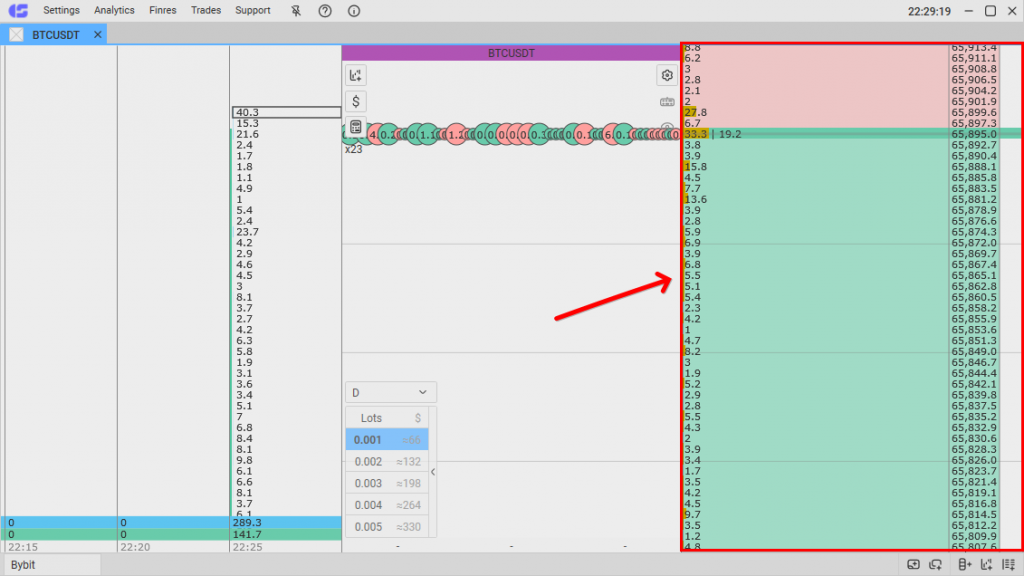

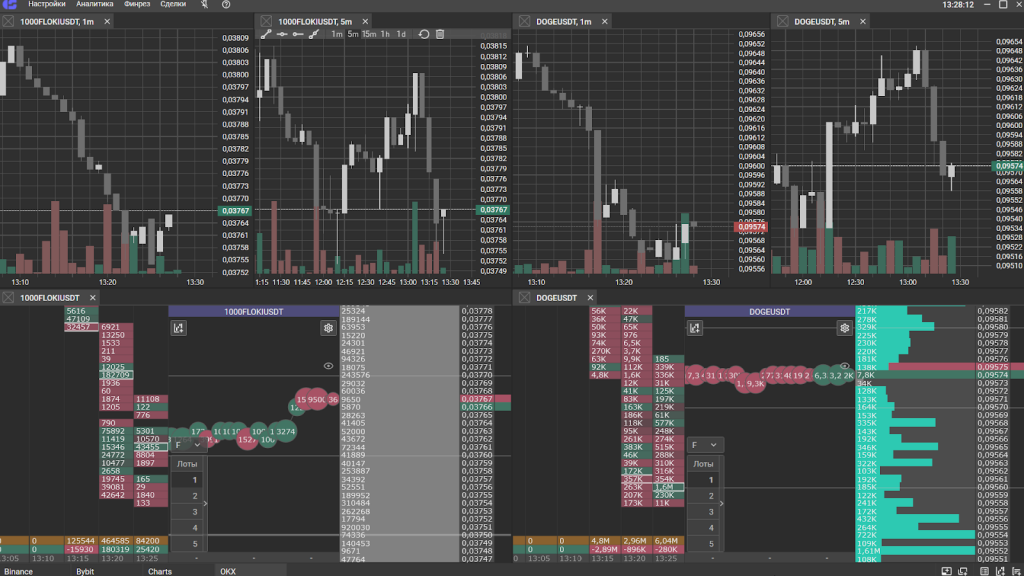

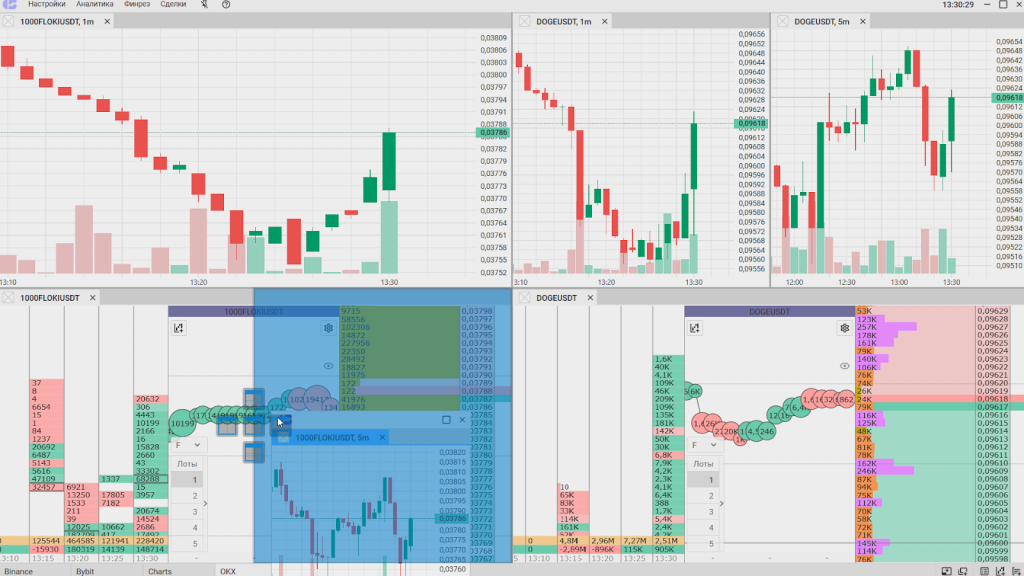

Order Book in CScalp

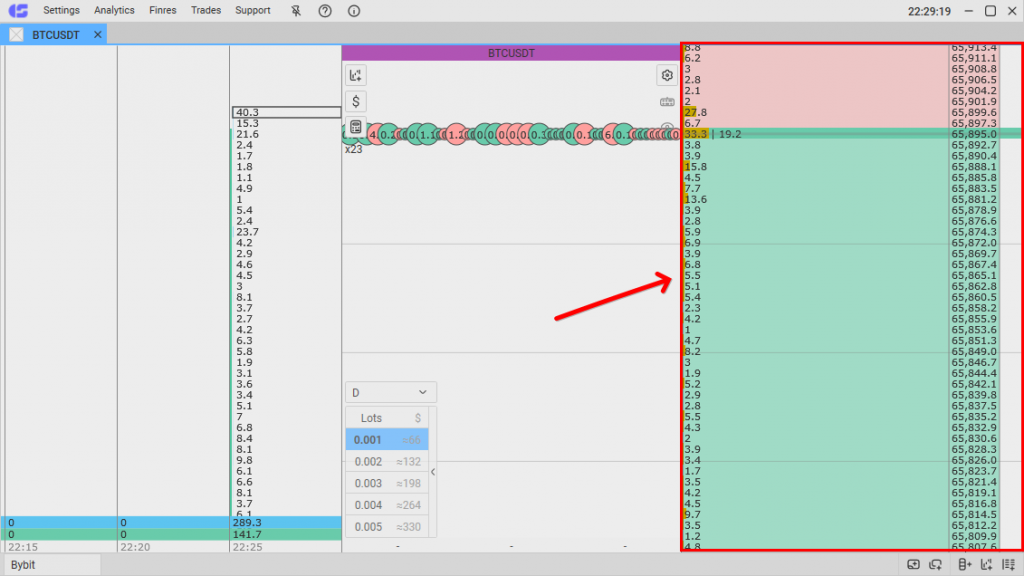

The order book is the central feature of CScalp, allowing traders to quickly place orders. It also serves as an analytical tool. Each row in the order book represents a price level, and the volumes of limit orders placed by other traders are displayed within those rows. Seeing volumes is crucial for scalping.

In addition, the rows contain scales—the longer the scale, the larger the volume of orders at that price. This helps traders quickly assess the balance of power in the order book, identify dense areas, and spot prices of market interest. The color of the scales is customizable. There is also an option to “Reduce Amounts from a Thousand,” which abbreviates the volumes in the order book (e.g., 15K instead of 15,000).

The CScalp order book is highly customizable. Users can adjust the centering method (by best prices or trades). When hovering over a price in the order book, a ruler appears, showing the percentage change from the nearest best price in either percentages or points. The ruler can be enabled or disabled as needed. The order book settings also allow users to set alerts for signal levels or large volumes.

Trade Tape

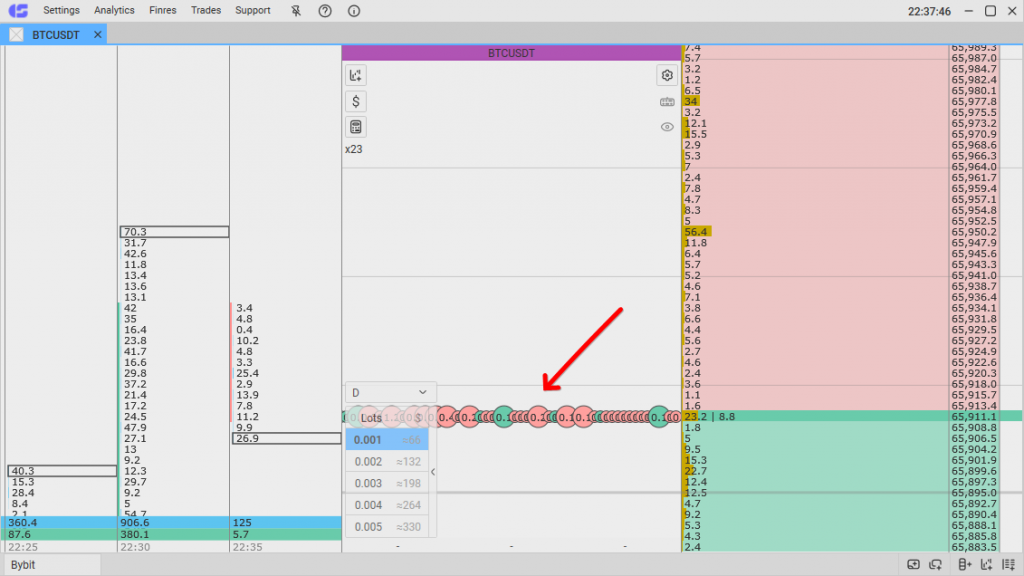

The Trade Tape (ticks) is one of the key analytical modules in CScalp. It is an indicator that displays market orders passing through the market in real-time.

The tape is displayed in the form of circles. The more trades at a certain price level, the wider the circle. If there were more purchases during the formation of the circle, the tick will be green. If sellers “took” the price, it will be red. This visual scheme simplifies the perception of information and allows traders to quickly assess who currently dominates the market. The appearance of the tape can be customized, and the tick volume (the number needed to form a circle) is also adjustable.

Clusters

CScalp includes tools for cluster analysis. A cluster is a price level that displays the number of contracts traded at that level. Cluster analysis helps traders understand who is dominating the market—buyers or sellers.

Users can set the volume value for clusters. If purchases predominate, the cluster is green; if sales predominate, it is red. CScalp allows cluster analysis across various timeframes. To make cluster analysis by specific price levels easier, a cluster analysis line is implemented. Each cluster column ends with two rows of total volume per candle. The lower row shows the difference between buyers and sellers, while the upper row shows the total number of contracts.

Charts

CScalp features its own charts, allowing quick analysis of trades for each instrument. The chart can be opened in a standard format or a simplified one, showing only the most essential information. The charts come with a toolbar where traders can select a timeframe or drawing tool. Additional features include a magnet, the “Min/Max for 2 days” indicator, a ruler showing percentage price changes, and more.

In simplified mode, CScalp charts display the asset’s price, the percentage change of the candle, and the buy and sell lines for the instrument. Traders can set the default chart window to open in simplified mode, or have the standard interface open by default.

You can open up to 40 charts simultaneously. The workspace can accommodate multiple charts of the same instrument across different timeframes.

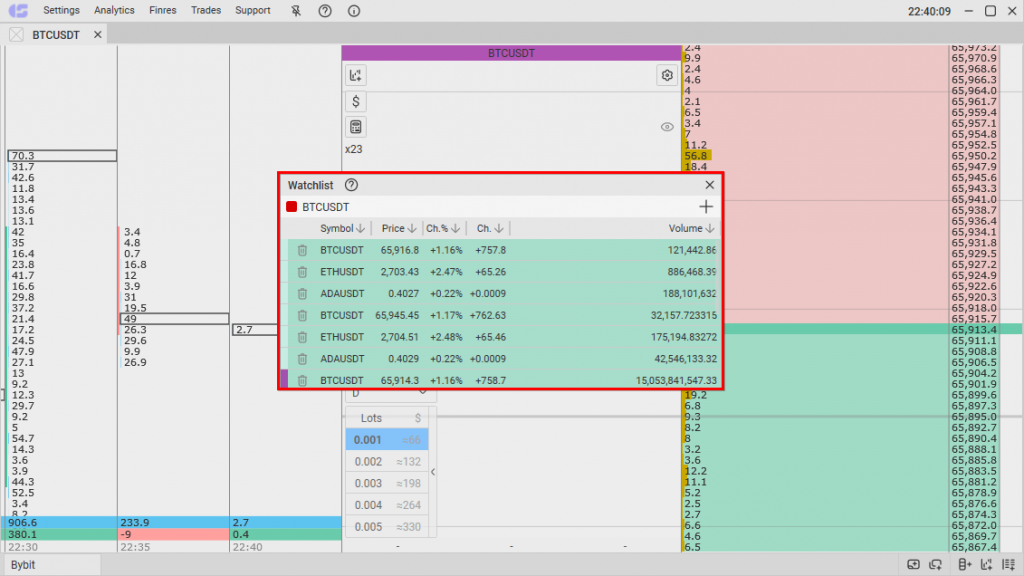

Watchlist

The Watchlist is a module in table format where you can add favorite trading instruments. The Watchlist simplifies tracking price dynamics and volumes for selected instruments.

The instruments in the module can be sorted by columns, linked together, and color-coded for quick access.

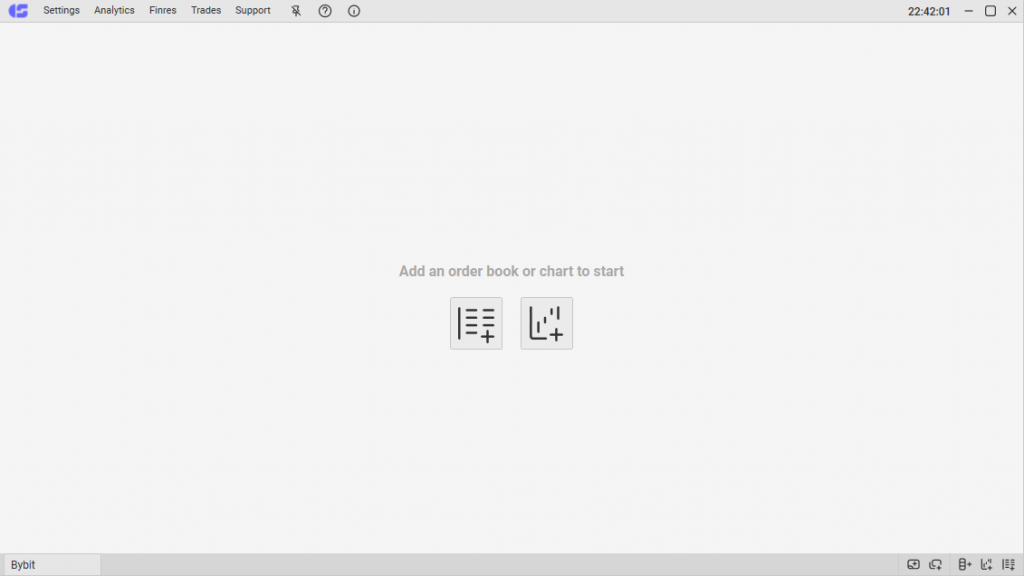

Workspaces

At the bottom of the CScalp window is a context menu where you can quickly and conveniently open a new tab, order book, chart, or workspace. Workspaces are additional independent spaces with their own tabs, order books, and charts.

This feature allows you to set up a separate workspace for each monitor (i you have more than one). It can also be used to reduce the load on the computer. For example, 20 windows across two workspaces will render faster than 40 windows in one workspace. To avoid confusion, each workspace and its associated tabs, order books, and charts are marked with a colored indicator (next to the CScalp logo).

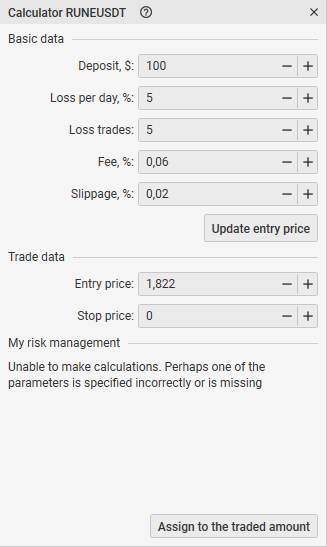

Risk Calculator

CScalp integrates a risk calculator, available for trading perpetual futures on Binance. In the “Basic Data” block, you need to specify your deposit, allowable daily drawdown percentage, loss trade limit, exchange commission, and allowable slippage percentage.

When you click “Update Entry Price,” the “Entry Price” will appear in the “Trade Data” block—this is the average value of the instrument’s spread. The “Entry Price” is the planned entry point for the position, and the “Stop Price” is the exit point. The “My Risk Management” block will show the calculation of acceptable losses and data for entering the trade. The “Assign to the Traded Amount” button transfers the calculations to the traded amount, helping you trade with pre-planned risk management.

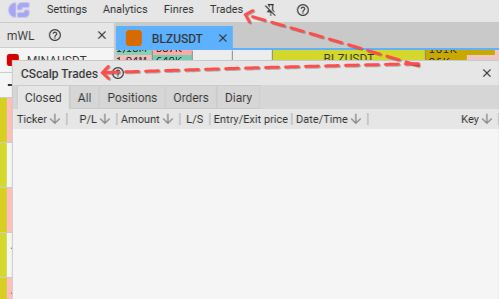

Trades Window

The Trade button opens a statistical tool for tracking trades.

Information is stored across five tabs:

- “Closed” – completed trades and closed positions

- “All” – a list of all the trader’s trades

- “Positions” – a list of open positions

- “Orders” – a table of active orders

- “Diary” – settings for connecting to the “Trader’s Journal” tool

The Trades window allows traders to monitor active orders, analyze completed trades, and generate a statement.

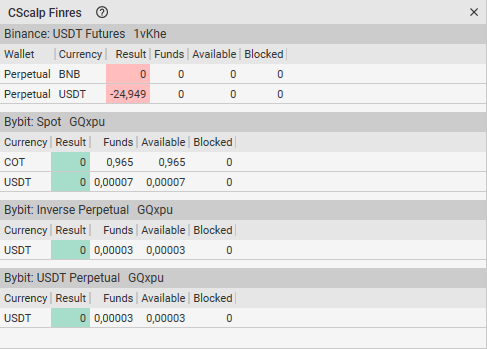

Financial Results (Finres)

Finrez is a module for tracking balances on connected exchanges. It shows how much is available in the trader’s account.

It’s presented in table format. Finres on crypto exchanges consists of 7 columns:

- Wallet – names of connected wallets

- Currency – cryptocurrency or fiat funds on the account

- Result – balance changes since the connection (this statistic can be reset)

- Fee – the amount of fees paid on the exchange

- Funds – the trader’s total balance on the exchange

- Available – free funds

- Blocked – funds tied up in open positions or limit orders

Other CScalp Features

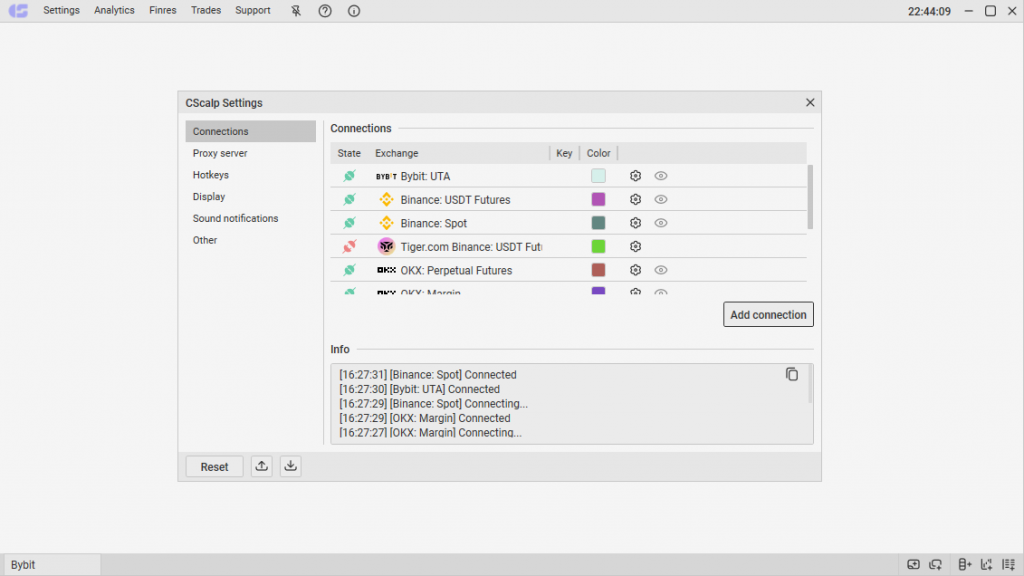

Multiple Accounts

CScalp supports the multiple accounts feature, allowing multiple trading accounts on different exchanges to be connected to the terminal.

For example, you can connect two trading accounts on Bybit and trade on both simultaneously in one workspace, eliminating the need to set up the terminal on two computers.

Docking

Docking simplifies workspace customization and allows you to combine windows (order books and charts), effectively utilizing workspace. In the terminal, windows “snap” together, automatically filling the available space.

CScalp Exchanges

CScalp supports connections to exchanges including Binance, Bybit (including Bybit ETA), OKX, HTX (Huobi), Phemex, BitMEX, Bitfinex, and Bitget.

How to Get CScalp

The CScalp scalping terminal is available for free to all traders. To download CScalp, enter your email in the form at the top or bottom of this page.

You’ll receive an email with a download link, license key (attached), and a video installation guide.

How to Start Trading in CScalp

To begin, download the CScalp terminal from the official website—it’s free and quick. Then, install it on a computer running Windows OS.

To connect to a cryptocurrency exchange, create API keys and enter them into CScalp.

Check the ping. If necessary, configure the proxy and select the market data servers. Execute your first trade. If you encounter any questions, answers can always be found in the CScalp Help Center. You can also contact CScalp support for assistance.

How to Configure CScalp

CScalp offers flexible configuration options, allowing the terminal to be tailored to the trader’s style, the instruments being used, and the technical setup (monitors, PC). A complete configuration guide is available in the video below.

CScalp Community

A key component of the CScalp terminal is its community. To assist beginners, the CScalp team has created free educational courses covering trading on cryptocurrency exchanges, futures, and spot trading. The courses are presented as video tutorials on YouTube, with regular updates and improvements.

CScalp YouTube Channel

The CScalp TV YouTube channel is not just for CScalp users, but for all traders interested in trading on stock and cryptocurrency exchanges.

The channel features educational videos, live trading streams, market analysis briefings, and other content.

CScalp Telegram Groups

The CScalp Telegram community is divided into three groups:

- CScalp News EN – where updates on terminal development, new features, and more are posted

- CScalp Traders EN – an English-language chat for cryptocurrency traders to discuss news, strategies, personal experiences, and more

- CScalp Bot – a bot from the CScalp team that simplifies interactions with the terminal, Trader’s Journal, and other products

In addition, we have launched trading signals channels on Telegram.

Related Products

Trading Diary

TradersDiaries is a free service for tracking trader statistics and saving trades. The trading diary connects to a trader’s account via API, recording positions, orders, and sorting the collected information into tables. The journal is a useful tool for self-analysis, calculating results, and identifying strengths and weaknesses in your strategy.

In trade history, you can view parameters such as trade time, financial results, trade direction, entry and exit prices, and commissions. You can add comments and specify the reason for entering a trade. The journal automatically creates a top list of best trades and displays the data in charts. You can share results with other journal users, via email, or on Telegram.

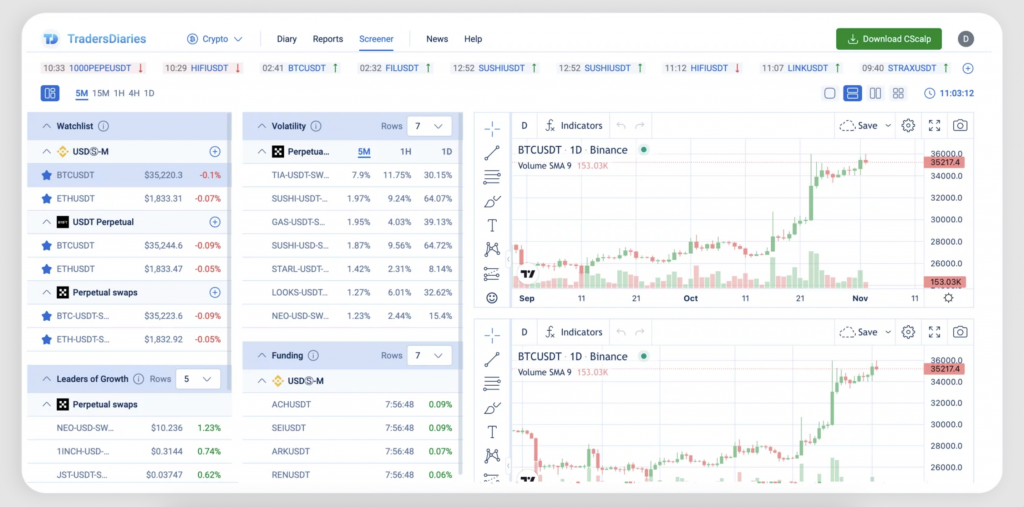

Screener

The Screener is part of the Trading Diary. The crypto screener helps track volatile perpetual futures suitable for scalping. It is also a convenient tool for monitoring trading instruments of interest.

Trading Signals

The CScalp Telegram community includes a channel with trading ideas from traders:

- Trader Signals – signals for traders trading cryptocurrencies and futures on Binance, Bybit, and other exchanges

The channel is public. There are no paid subscriptions, “closed groups,” or extended access.

Trader CScalp Reviews

CScalp has numerous reviews and comments on trading platforms, especially on YouTube.

Users note the ease of using the terminal, its quick setup, and how simple it is to start. Key advantages of CScalp include the fact that it’s free and works with nearly all popular cryptocurrency exchanges.

CScalp Review – Conclusion

CScalp is a terminal suitable for both beginners and professional traders. It is optimized for scalping, and the trader’s attention is not distracted by unnecessary “decorative” elements. CScalp provides all the essential tools for professional trading.

Detailed instructions, videos, and blog articles help beginners understand the terminal’s features. CScalp’s trading and analytical capabilities are further enhanced by additional tools, Telegram channels with signals, and an active community.

Interested in other trading terminals? Read our article: “EasyScalp Review: A Detailed Look at Vataga EasyScalp Cryptocurrency Scalping Terminal”

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT