Unveiling the Power of cTrader: A Comprehensive Trading Platform Review

cTrader is a platform for trading on the stock market and Forex. The terminal provides functionality for independent trading and algorithmic trading. The desktop version of cTrader is supported only on Windows OS. However, there are web and mobile versions available for iOS and Android.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Functionality of the cTrader Platform

The cTrader platform is designed for medium and long-term trading. Sometimes, cTrader is positioned as a terminal for short-term trading. However, scalping strategies are intended for professional intraday trading. Available markets include Forex, stocks, metals, indexes, and cryptocurrencies.

The cTrader terminal has a simplified, user-friendly interface. Orders can be placed through the order book or chart. The platform features functions for market depth analysis, an automated pattern recognition tool for technical analysis, a volatility calendar, and a news feed. Integrated tools for analyzing and configuring investment portfolios are also available.

cTrader’s architecture is built on the FIX API protocol, allowing customization of the terminal for large companies. Market access is possible through brokers like FxPro, Fondex, IC Markets, Pepperstone, and others.

cTrader Trading Instruments

The cTrader platform offers a standard set of orders: limit, market, stop order, stop limit, and Stop Loss / Take Profit. The use of leverage is also available. cTrader includes a built-in notification system where a mark is set on the chart when a certain level is breached. The terminal also allows trading with CFDs when opening an ECN account through a partner broker.

Algorithmic Trading with cTrader

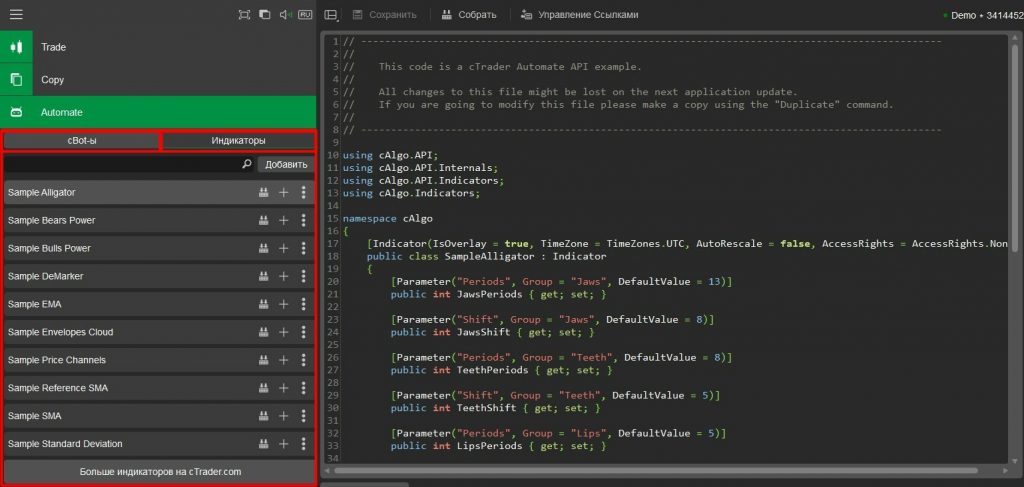

The cTrader team has developed the cAlgo plugin for creating trading robots and technical analysis indicators using the #C programming language.

Positions can be opened from the menu of the selected algorithm. By default, the cTrader interface provides access to 12 bots and 10 automated indicators. Custom indicators and bots can be downloaded from the official cTrader website in the Algorithms section.

cTrader Charts and Technical Analysis

In addition to the standard line chart, cTrader offers tick charts, Renko charts, and Range charts. Their display can be customized as Japanese candlesticks, bars, points, or lines. The charts have eight scaling options and a wide range of timeframes, from 10 minutes up to 1 month.

cTrader integrates over 50 technical indicators for conducting technical analysis. They are divided into 6 categories: trend, oscillators, volatility, volume, miscellaneous, and custom indicators.

cTrader Customization Options

cTrader empowers traders with a plethora of customization options, allowing them to tailor their trading experience to suit their unique preferences and strategies.

Chart Setups

Traders can personalize their charts by customizing various technical indicators, overlays, and drawing tools. Whether it’s a simple moving average or complex Fibonacci retracements, cTrader offers a wide range of indicators to analyze market trends and make informed decisions.

Color Schemes

Personalizing the platform’s color schemes can have a significant impact on a trader’s overall experience. cTrader provides a variety of pre-set color themes to choose from, catering to different preferences and ensuring optimal visibility of crucial data points on the charts.

Templates

With cTrader’s template feature, traders can create and save their preferred chart setups, indicators, and drawings. This saves time and effort, allowing you to switch between different trading strategies seamlessly.

One-Click Trading

cTrader enables traders to customize their one-click trading preferences, giving them greater control over order execution. You can set default parameters for stop-loss, take-profit, and position size, streamlining the trading process for quicker decision-making.

Timeframes and Periodicity

cTrader caters to traders of all styles, allowing them to choose from various timeframes and periodicity options. Whether scalping on lower time frames or swing trading on higher ones, the platform accommodates different trading preferences.

Language Selection

Multilingual support in cTrader ensures that traders from different regions can use the platform comfortably, making it more accessible to a diverse user base.

Risk Management Preferences

The platform allows traders to set their risk management parameters, such as maximum exposure per trade or per day, helping them stay in control of their risk levels.

cTrader’s extensive customization options empower traders to create a personalized trading environment that aligns perfectly with their trading style and preferences. This adaptability enhances their overall trading experience and enables them to make well-informed decisions in the dynamic financial markets.

cTrader Cost of Usage

To trade through cTrader, it is necessary to open an account with one of the platform’s partner brokers. A complete list of available brokers can be found on the official cTrader website.

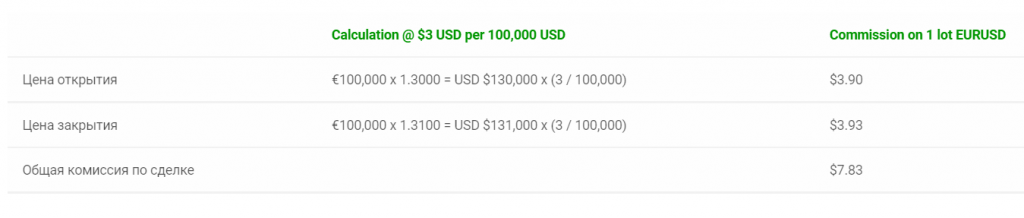

The broker charges a commission for trading transactions on the platform. For example, IC Markets company charges a commission of $3 USD per every $100,000 USD of a mini-lot for opening and closing a trade.

To familiarize yourself with the cTrader terminal, it is possible to open a demo account.

Empower Your Trading with cTrader

cTrader stands out as a compelling alternative to MetaTrader, offering traders a host of advantages. One of its key strengths lies in the absence of fixed commissions, making it a cost-effective choice for traders of all levels. With its user-friendly interface and seamless algorithmic trading capabilities, cTrader caters to both beginner medium-term traders and seasoned professionals who seek to develop and deploy their custom trading strategies. Embrace the versatility of cTrader and embark on a rewarding trading journey with enhanced control and efficiency.

Related article: “cTrader Platform vs. CScalp: Which Suits Your Trading Style?”

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT