How To Start Day Trading Crypto. Day Trading Tips for Beginners

One of the known investment strategies in cryptocurrency is day trading. This means entering and exiting a market position within one day. It’s important to understand that this type of trading involves high risk, so it is not preferable to traditional buy-and-hold traders looking for long-term results. Day traders seek out ways to make a profit within a day

Day trading is based on Technical Analysis.

Foundations of Technical Analysis

Technical analysis is about studying technical aspects of price movements. These include historical lows and highs, volumes, local and global trends, and so on. TA is a scientific approach to price analysis: it involves amassing as much market data as possible and then making predictions based on this data.

Technical analysis is not to be confused with Fundamental analysis. The latter implies studying macro factors and is primarily needed by investors and long-term traders.

Day traders rely on stock screening and special trading software that allows for analyzing price action, volumes, graphic patterns, and other indicators. TA seeks to forecast even the smallest of market movements to identify entry and exit points. Getting up-to-date information in real-time is essential to a successful day trading.

Main steps to start day trading crypto

Know your approach

Day trading requires a lot of confidence in understanding how cryptocurrency works. You need to have a crypto exchange account, know what coins you’re going to trade (and why), and also what strategies you’re going to use. To practice your trading risk-free, you can try “paper trading”. Paper trading allows you to trade in the real market using simulated funds. With it, you can learn to create your own trading systems without risking real money.

Determine your trading style

A big part of understanding how day trading works is creating and testing your own strategies. It may take a lot of time to develop a successful style, which must be backed by research and thorough planning. You must have a clear vision of how you’re going to enter and exit positions, and how you’re going to manage risks.

You can use the aid of ready-made signals and strategies, e.g. on Telegram channels or on some paid websites. However, be warned that no signal or strategy is ever guaranteed to work out. Every signal is based on what has happened, not on what is going to happen. Always complement other trader’s ideas with your own analysis before putting them into action.

Choose the right platform

The first step for day traders is to decide which platforms to use. For newbies, the amount of options to choose from may get overwhelming. However, the search becomes easier with a few things in mind.

Here are the key aspects which will help you choose the right trading platform:

- Age and reputation: The longer the exchange has been around, the more reliable it is.

- Choice of coins: Day traders mostly trade altcoins and are more interested in exchanges with the largest number of supported crypto pairs.

- Liquidity: An exchange’s liquidity is how quickly it can transform one asset into another without affecting its price. In other words, how actively it’s being traded. If the exchange is highly liquid, you can buy or sell assets on it immediately and with minimal spreads. And vice versa – illiquid markets take longer to fill each separate order, and often have slippage because of high spreads.

- Fees: Day trading involves making more deals than swing and mid-term trading, so it’s a lot more fee-heavy. Most day traders choose their brokers based on the ratio of the fees and the number of traders they’re going to make.

- Payment methods: Almost all exchanges allow bank transfers, but not all exchanges work with credit cards, PayPal or similar payment systems. Before choosing an exchange for day trading, you should make sure its payment methods are convenient for you.

- KYC aka identity verification: for many hardcore crypto lovers, KYC (know-your-customer) is a no-no. However, platforms that require you to verify your identity are often the largest and offer an extended set of pairs to trade and other options to make money.

How much money do you need to start day trading crypto?

The most common amount to start trading is from $500 to $1000. However, you can trade more if you stick to risk management.

Day trading cryptocurrency can be very profitable, but there are a few things to remember before you start. This type of trading is complex and demanding; it requires quick reflexes and the ability to think on the fly. It also should be treated as a full-time job rather than a hobby – you’ll have to spend long hours in front of the computer, doing intense market analysis and making multiple deals.

Day trading tips for beginners

Train your discipline

The most challenging thing about day trading is that there’s no guarantee of a stable profit. You’ll have to learn and adjust yourself on the fly, sometimes having to embrace losses. With thousands of new cryptocurrencies emerging on exchanges and trading platforms, the volatility and speculative nature of the market must also be taken into account. Day trading implies not only consistency but also a willingness to take risks.

Day traders do not resort to fundamental analysis (FA), preferring technical analysis (TA) to it. Fundamental analysis studies macro factors of an asset and its emittent, whereas TA specializes on in-the-moment price movements and their types. That’s why, before setting off on your day trading journey, you must first familiarize yourself with the basics of TA. While doing your analysis, you should also be up to date with the news about the cryptos you’re trading – ‘trading the news’ can give massive gains within one day.

Cut losses with Limit orders

Day traders need to learn to limit potential losses. To do this, they can use stop-limit orders to get out of the market in time.

A stop-limit order has two prices: the stop price and the limit price. Stop-limit orders are also called “stop-losses” and their goal is to prevent losses by emergency-closing a position once it’s made a slight loss. Since the market price may not reach the set limit order price, the order is not executed immediately or may not be executed at all. The fee for a limit order is not as high as for a market order and is charged as a maker.

Avoid unstable crypto

Day traders seek to capitalize on volatility – the wider the price swings, the better. However, efficient day trading also calls for high volumes and high liquidity on an instrument. This is especially important if you’re exiting a position. Large slippage can wreck a trader’s account in one deal. This is why day traders usually seek out trading pairs that are both volatile and liquid.

Day trading styles and strategies

Scalping

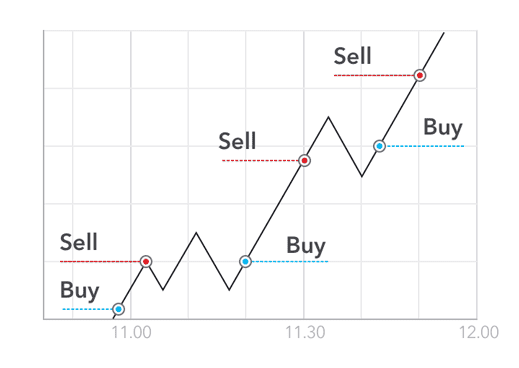

Scalping Graph

One of the most profitable strategies is scalping. Scalping day traders try to profit off small price movements by making multiple deals. Transactions, in this case, usually bring minute profits. Scalpers open multiple positions at once to ensure cumulative returns at the end of the day.

This type of trading is also fairly low-risk, if you’re sticking to your risk management rules. If done right, scalping can X your deposit with a session. However, if risk-management is neglected, you’ll drain your deposit before you know it. Scalping positions are short-lived and, once a deal is closed, a scalper needs to move on and instantly look for the next entry point. At the end, tiny gains over multiple quick deals amount to more or less tangible profits.

Arbitrage

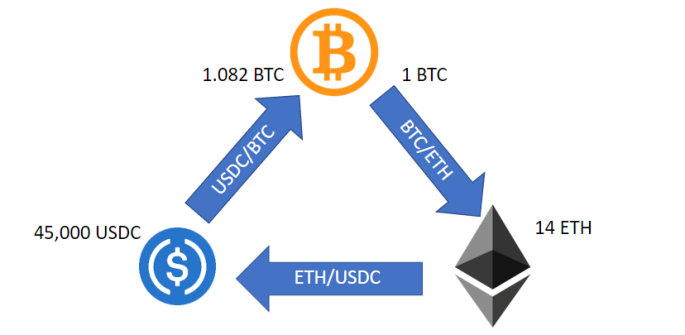

Arbitrage Triangular

Arbitrage is one of the most popular strategies in crypto trading. The process involves buying a coin on one platform and immediately selling it on another, leveraging price discrepancies for the asset between the two platforms. Similarly to scalping, arbitrage brings fairly small profits in one deal, but the deals are usually repeated, and the profits eventually stack up.

The cost differences can be particularly noticeable when trading a little-known altcoin and Bitcoin. Day traders can use this strategy to build up potential profit even more.

Range trading

Range Trading

While cryptocurrencies are traded within a specific range, in some cases, large players can manipulate the price of a coin. Day traders can notice these patterns and take advantage of them. In this case, the trader seeks to follow the overbought and oversold zones.

For example, if the price is stuck in a range between support and resistance, a day trader can buy an asset at the support level and sell at the resistance level. And vice versa: you can short out by entering a position at the level of resistance, and exit the deal around support.

This strategy is possible with technical indicators – most often including the Stochastic Oscillator and the Relative Strength Index (RSI).

Without indicators, it’s near-impossible to spot these zones.

Algorithmic trading

A trading bot is an algorithm that allows investors to buy and sell financial instruments at a predefined time or under certain circumstances to optimize profits. Cryptocurrency bots are designed to increase profits while reducing losses and risks.

Cryptocurrency bots for day trading can speed up the process of analyzing price changes, exchange commissions, and potential benefits in the short run. Stock brokerage companies have used software for trading bots for decades. Traders familiar with the software, developers, and APIs may use this knowledge to their advantage in day trading.

However, keep in mind that a bot only does what it is programmed to do. It can never think for the trader, it can only open and close deals on the trader’s behalf.

High-Frequency Trading

High-Frequency Trading is making multiple deals in a very short time span. This strategy is quantitative, meaning that it’s the total gains from all deals that count, not just profit from one deal. Separate HFT deals may not seem like a lot, but eventually they stack up to significant profits.

This strategy relies heavily on trading bots. Based on a large amount of data, bots perform a technical analysis, coming up with signals that are often impossible to spot for a human. Usually, the lifespan of an HFT deal is no more than 5 minutes and can often last as little as a few milliseconds.

Conclusion

The key skills in day trading are understanding the market and the ability to work with large amounts of incoming data in real-time. A day trader needs to keep an eye out for price movements, news, and incoming signals. The exact strategy used depends on the trader and must reflect their needs and individual approach to processing data. However, all day traders must be able to work in the moment and instantly react to changes in the market. This makes day trading more intense, more profitable, and more risky than other types of trading.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT