Huobi crypto exchange: overview for traders

Here we’ve prepared a review of the Huobi cryptocurrency exchange. In the article, you’ll find out about the main features of the platform, its markets, trading fees, and methods of deposit and withdrawal of funds.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Huobi’s Main Features

Huobi, a Chinese cryptocurrency exchange, was founded in 2013. At the moment of writing, it’s one of the world’s biggest crypto exchanges. Huobi supports 914 trading pairs and ranks among the top 10 exchanges in terms of trading volume on the spot and futures markets (according to CoinMarketCap and CoinGecko ratings). The platform has its own ERC-20 token called the Huobi Token (HT).

Huobi offers a fiat exchange, a spot market with the support of margin trading, a futures market, and P2P trading. The futures market is divided into the perpetual futures markets of USDT-M and COIN-M. USDT-margined futures contracts are both denominated and settled in USDT, while COIN-margin contracts are denominated and settled in the underlying currency (in this case, in USD). In addition, Huobi also supports options contracts.

The official Huobi website is available in 19 languages.

Huobi Markets

The Huobi spot market supports margin trading with leverage of up to 3x (depending on the chosen trading pair). There are 2 margin trading modes:

- Cross Margin is shared across open positions and uses all the funds in the Available Balance. If one position is at risk of liquidation, margin can be added from other positions.

- Isolated Margin is allocated to one outstanding position only, with a fixed collateral amount. This one position can’t use margin from other positions, so there’s a higher risk of liquidation, but the potential amount of overall loss is lower.

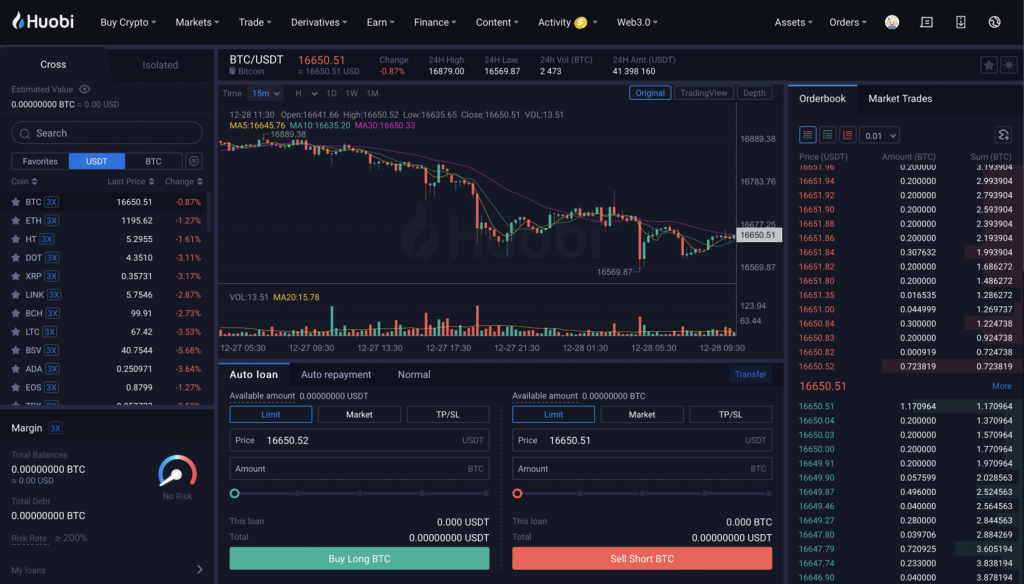

The Huobi trading interface

The Huobi futures market offers perpetual USDT-M and COIN-M futures, perpetual COIN-margined swaps (similar to perpetual futures), and options. The maximum leverage for perpetual COIN-M swaps is 125x. Leverage up to 75x is available for other instruments. Futures trading can also be done in the cross-margin or isolated margin modes.

Options trading on Huobi is available on the BTCUSD and ETHUSD trading pairs. In terms of the expiration date, options can be weekly, biweekly, and quarterly.

Huobi Trading Fees

The Huobi trading fees are calculated according to the Maker-Taker fee structure. The tiered fee system has been developed separately for the spot and futures markets.

The spot market fee takes into account:

- “Point Card”: bonus assets on the user’s card, which are are used to pay the fees;

- HT (Huobi’s native token) balance on the user’s account: there’s a 7-level bonus system for HT holders;

- Trading volume in BTC: a 9-level rating system. There are 2 types of VIP programs according to the user’s monthly BTC trading volume and HT holdings: Gold, Diamond, and Black Diamond. Each type is entitled to particular privileges.

The futures markets fee also depends on the user’s level:

- Normal user – monthly trading volume is less than $30 million;

- Professional trader – monthly trading volume is $30 million or more.

The spot market base fee is 0.2% Maker and Taker.

The base fee for futures markets is 0.02% Maker and 0.05% Taker. If the monthly trading volume exceeds $30 million, the fee changes: Maker 0,015%, and Taker 0,03%.

Deposit and Withdrawal of Funds on Huobi

You can deposit funds into your Huobi trading account via a bank card, a digital payment service, P2P trading, or a cryptocurrency wallet.

Withdrawals are only available to verified Huobi users. You can withdraw funds to your crypto wallet or via P2P trading. There’s also the “Fast Withdrawal” option, which enables crypto transfers directly to another Huobi user account. Internal transfers on Huobi are free.

Huobi Reviews

According to CoinGecko, the Huobi exchange has a reliability rating of 10/10. The platform is suitable for a broad audience of traders, as it provides various trading tools. Over its almost 10 years of existence, Huobi has served tens of millions of users worldwide.

Conclusion

The Huobi exchange serves various categories of traders. Thanks to its high liquidity, it’s suitable for day trading and scalping. The platform offers a wide range of crypto tools for both novices and professionals. People new to trading usually use the spot market, P2P trading, and fiat exchanges, while experienced traders might be interested in margin trading, trading with leverage, perpetual futures, and options, etc.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT