Is Binance in Trouble? The Lawsuit Could Shape the Future of Financial Technology

The biggest cryptocurrency exchange has faced a flurry of challenges that have raised eyebrows and sparked numerous questions, including “Is Binance in trouble?” In this article, prepared by the CScalp crypto trading platform team, we will delve into these developments and address key concerns surrounding Binance, including the SEC’s lawsuit, regulation, and more.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Binance’s Crypto Innovation and Regulatory Challenges

Binance is the biggest cryptocurrency exchange that provides a plethora of services for crypto investors and traders. However, amidst the many strengths of Binance, it is facing regulatory challenges that raise questions about its compliance and legal standing. One of those questions is, “Is Binance in trouble?”

To understand if the exchange is in trouble, we have to go back to 2018. In that year, Binance’s Chief Compliance Officer Samuel Lim made an admission, confirming non-compliance with U.S. securities regulations. And that revelation continues to shape discussions about the exchange’s future.

“We are operating as an unlicensed securities exchange in the USA, bro,” the former COO said.

This short sentence, uncovered in internal communications during a U.S. government investigation, highlighted Binance’s non-compliance with U.S. securities regulations and brought consequences that the exchange is still battling with today.

Non-Compliance Consequences for Binance: Lawsuit and More

The acknowledgment came merely a year after Binance’s launch, implying that the exchange may have been involved in questionable practices from an early stage.

That is why in June 2023, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit in Washington, D.C. against Binance, the leading cryptocurrency exchange, claiming it operated deceptively. The suit alleges that Binance’s founder and Chief Executive Officer, Changpeng Zhao, and its former CCO misused customer accounts for personal benefit and avoided U.S. regulatory compliance.

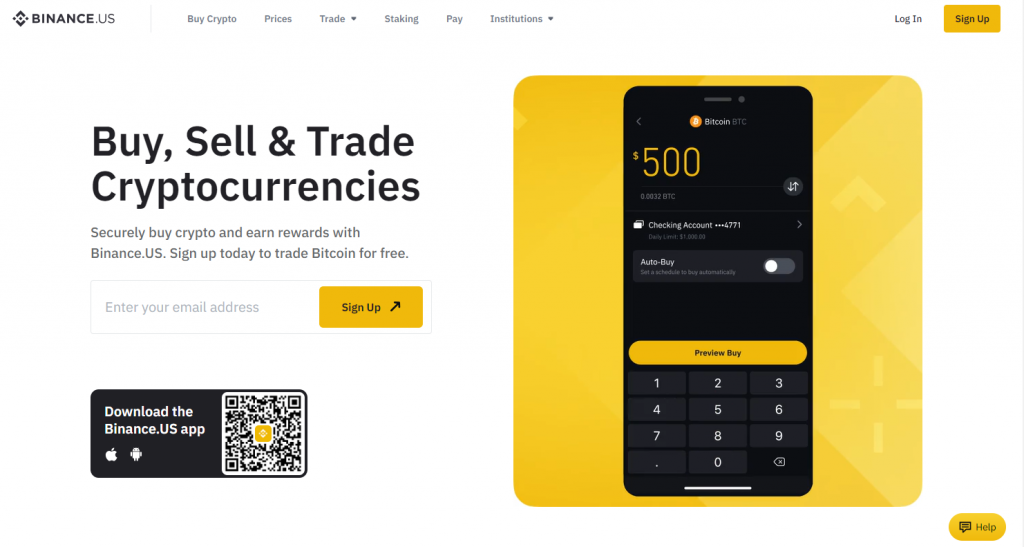

The SEC alleges that Binance’s establishment of a U.S. trading branch, intended for American users and U.S. compliance, was deceptive. The lawsuit suggests that Binance still permitted U.S. users to trade on less-regulated foreign exchanges, bypassing U.S. regulatory standards.

The consequences of the lawsuit have been significant. Binance has faced reduced access, being denied entry to certain markets, operational restrictions, and reluctance from governments and financial institutions to engage with the cryptocurrency exchange and its partners. These challenges have added to the uncertainty surrounding Binance’s future.

Read more: Why Is Binance Being Sued? SEC Allegations Explained

Binance’s Liquidity and Regulatory Challenges

Liquidity Concerns

One of the burning questions in the cryptocurrency world is whether Binance has enough liquidity to meet its obligations. Some experts have speculated that the cryptocurrency exchange might crumble into bankruptcy, but the reality is quite different. Binance faces no liquidity problems. Despite the hurdles it faces, the exchange continues to provide a robust trading platform for users worldwide.

Regulatory Scrutiny

The Binance DeFi Wallet, an extension of the Binance mobile wallet, is tailored for the world of decentralized finance (DeFi). This specialized wallet empowers users to securely store and withdraw DeFi tokens while processing decentralized applications (DApps). Whether you’re engaging with DeFi assets or exploring the decentralized ecosystem, the Binance DeFi Wallet is your gateway to this exciting realm.

Binance Wallet: The Noncustodial Solution

Federal regulators have sued Binance, and financial watchdogs have accused Binance of illegally serving American customers. These actions have led to increased regulatory scrutiny. While these challenges are significant, Binance remains committed to addressing regulatory concerns and maintaining compliance with evolving laws.

Regulatory Scrutiny

Federal regulators have sued Binance, and financial watchdogs have accused Binance of illegally serving American customers. These actions have led to increased regulatory scrutiny. While these challenges are significant, Binance remains committed to addressing regulatory concerns and maintaining compliance with evolving laws.

Executive Departures

In addition to its legal woes, Binance has seen a significant exodus of key executives in 2023. Legal troubles and workforce cuts have left the exchange grappling with uncertainty. This staffing shake-up has raised questions about the crypto exchange’s future leadership and stability.

SEC Allegations

The SEC accuses Binance of engaging in unregistered securities offerings. This allegation has further fueled discussions about the exchange’s compliance with securities regulations. The exchange, represented by its Chief Executive Officer and Chief Legal Officer, is actively addressing these concerns as part of its commitment to transparency.

Other Legal Challenges

Multiple government lawsuits indicate potential violations of laws or regulations by Binance, including allegations of mishandling customer funds. These legal challenges add to the complex landscape Binance currently navigates. However, the exchange continues to defend its position and work toward a resolution.

Binance’s Non-Compliance Impact on Users

Binance and its associated platforms are confronted with a host of challenges amid ongoing regulatory scrutiny and legal troubles. Let’s take a look at how it could impact traders and investors.

- Increased Scrutiny: The SEC’s focus on the risks and transparency issues linked to these platforms raises concerns about the heightened scrutiny Binance operations may face. Users should anticipate closer regulatory oversight.

- Potential Service Disruptions: Users risk experiencing disruptions in services provided by Binance as the exchange grapples with legal and regulatory pressures. These disruptions may affect trading activities and access to funds.

- Withdrawal Halt/Pause: The possibility of withdrawal halts or pauses looms over users. Regulatory actions or legal proceedings could lead to limitations on withdrawing assets from the platform, potentially affecting liquidity.

- Enhanced KYC Requirements: To fulfill withdrawal requests, Binance may impose stricter Know Your Customer (KYC) requirements. This could involve additional identity verification steps and documentation, potentially causing delays for users.

- Legal and Financial Consequences: Binance’s legal challenges have raised concerns about potential legal and financial consequences for the exchange. Thus users may face uncertainties regarding the safety of their assets and the stability of the platform.

- Liquidity Concerns: The ongoing legal disputes and regulatory actions may contribute to a significant loss of liquidity on the platform, impacting trading opportunities and asset valuations.

Key Takeaways for Binance Users

Traders and investors should remain vigilant and informed about the evolving situation surrounding Binance. Here are the main takeaways to keep in mind:

Serious Legal Concerns

Multiple government lawsuits have pointed to potential violations by Binance, encompassing issues such as fraud, wash trading, and money laundering. These legal concerns are critical for users to consider.

Transparency and Regulatory Risks

The lack of transparency and regulatory risks associated with crypto trading platforms should be acknowledged. Users should assess the impact of these risks on their investments.

The Leading Cryptocurrency Exchange’s Background

Binance, established in 2017 by founder and Chief Executive Officer Changpeng Zhao, commonly known as CZ, stands as the world’s largest cryptocurrency exchange. This renowned platform has played a pivotal role in shaping the cryptocurrency industry since its inception.

Binance: A Comprehensive Platform

Binance offers a diverse range of features, catering to the needs of both novice and experienced cryptocurrency enthusiasts. Users flock to Binance to engage in a multitude of activities, including:

- Spot Trading: Spot trading serves as the foundation of Binance’s platform, allowing users to trade various cryptocurrencies in real-time. It provides a simple and effective way to buy and sell digital assets.

- Futures Trading: For those seeking more advanced strategies and risk, Binance also offers futures trading. This feature empowers traders to speculate on the future price of cryptocurrencies, enabling potential profit opportunities through leverage.

- Options Trading: Options trading adds another layer of sophistication to Binance’s platform. It allows traders to hedge their positions or engage in more complex strategies, harnessing the power of cryptocurrency options.

- Margin Trading: Margin trading offers users the ability to borrow funds to amplify their trading positions. Binance provides access to a wide array of cryptocurrencies for margin trading, enabling traders to diversify their portfolios and explore new opportunities.

Cryptocurrency Crossroads: Is Binance in Trouble?

So, is Binance in trouble? While the biggest cryptocurrency exchange navigates a turbulent legal landscape and changes in its structure and personnel, Binance continues to operate with a focus on addressing regulatory concerns. Despite the danger it faces, the exchange remains a prominent player in the cryptocurrency space. Users closely monitor these developments, awaiting further clarity on Binance’s path forward.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT