MetaScalp Review: How the MetaScalp Scalping Terminal Works

We have prepared a MetaScalp scalping terminal review. Learn about the trading and analytical tools offered by this scalping trading platform, examine available connections and usage conditions, and analyze traders’ feedback on MetaScalp.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

What Is MetaScalp?

MetaScalp is a classic cryptocurrency scalping terminal. Its trading and analytical options largely replicate the functionalities of terminals like CScalp, QScalp, and EasyScalp.

This scalping trading platform was developed by an anonymous team. There is no information regarding its licensing or registration on the official website. Let’s take a closer look at MetaScalp’s features.

Learn more: “EasyScalp Review: A Detailed Look at Vataga EasyScalp Cryptocurrency Scalping Terminal”

MetaScalp Features

The terminal is centered around the order book, trade tape, and clusters. Orders are placed through the order book with one click. There are several slots for working volumes. Price analysis is conducted using a standard candlestick chart. Favorite instruments can be added to the Watchlist. Analytical modules for trading history include financial results and trade statistics. Let’s explore MetaScalp’s trading and analytical functionalities in more detail.

MetaScalp Trading Features

Order Book

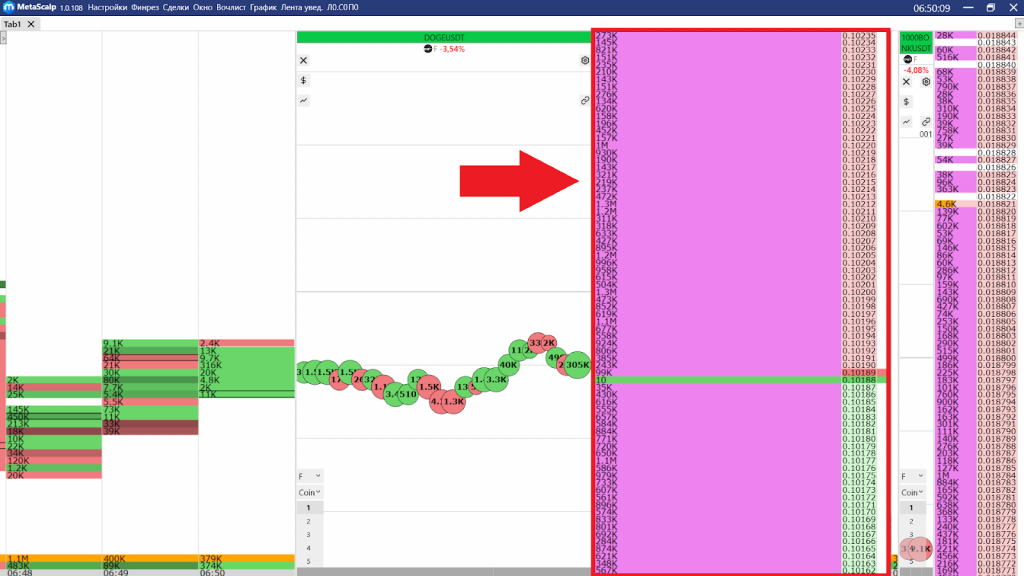

The MetaScalp order book shows the current limit orders for a trading instrument. Like other similar terminals, the order book is vertical: above are the ask orders (for selling), and below are the bid orders (for buying). The spread is located between ask and bid orders.

Volumes of orders are displayed as a vertical histogram. Each row shows the volume of a limit order. The larger the volume, the more space it occupies within the row. Large volumes (densities) are highlighted in a specific color, which can be customized in the settings.

Limit orders are placed with a single click on the price row in the order book. Market orders can be opened with a hotkey or by clicking on the price in the respective zone: 1) LMB (left mouse button) on ask orders to buy at the market price, 2) RMB (right mouse button) on bid orders to sell at the market price.

After opening a position, a panel with key data appears at the bottom of the order book window: average position price, number of coins bought/sold, and PnL. If the trade is profitable, the panel turns green; if it’s losing, it turns red.

Order Book Settings

The MetaScalp order book is customizable. For example, density criteria can be set—there are two slots for large volumes. Notifications can be enabled to detect large volumes. Multipliers for main and intermediate levels can also be configured.

Each order book can be saved as a template, allowing quick loading without having to reconfigure parameters.

A template consists of: the exchange name, instrument type, ticker, and the first five characters of the API connection.

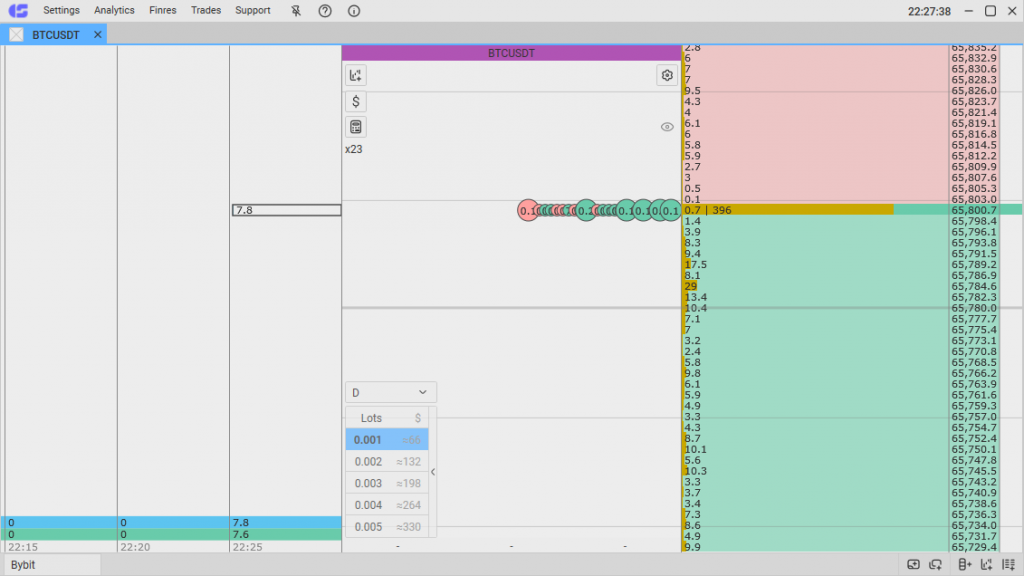

Trading Settings

In the trading settings of the order book, up to five working volumes can be set for quick trade execution. Amounts can be specified in USD or cryptocurrency. There are five slots for working amounts in cryptocurrency and five for USD amounts. USD-equivalent display for cryptocurrency amounts can be toggled on or off. An intuitive module located in the center of the workspace (below the trade tape) is used for switching between working amounts.

Stop order settings include % deviation for Stop-Loss and Take-Profit. SL/TP placement can be set either on the server side or the terminal side. Styles for profit/loss display and the method of average price calculation can also be configured.

MetaScalp Analytical Features

Chart

MetaScalp provides a candlestick chart with minimal functionality: Japanese candlesticks and a volume indicator. Available timeframes are 1m, 5m, 15m, 1h, 4h, and 1D. Basic drawing tools are embedded: lines, rays, and rectangles.

Basic display options can be adjusted for the chart: grid, daily highs, current market price, detailed breakdown for each candlestick, etc. A volume histogram display can also be customized.

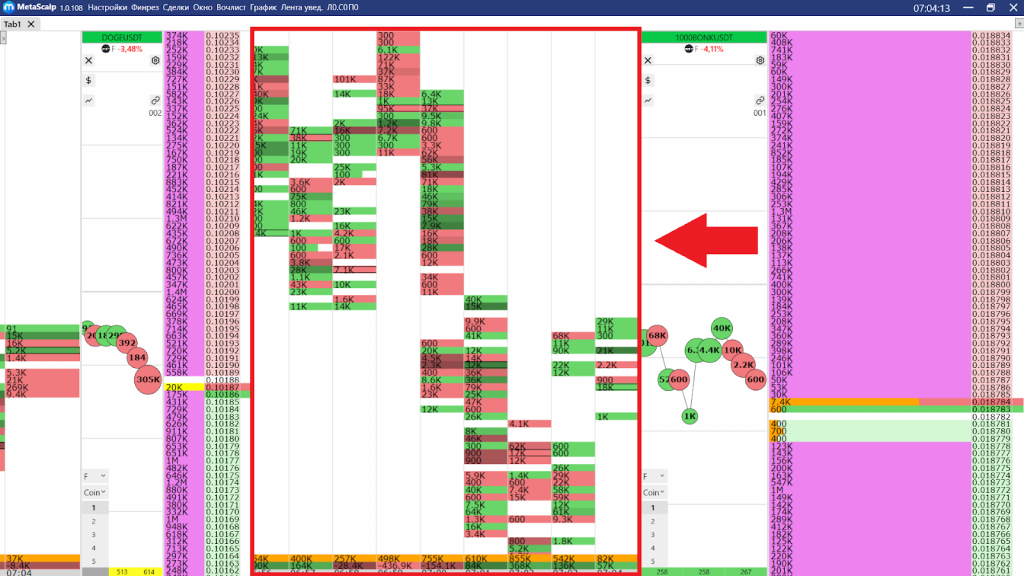

Clusters

Clusters show working volumes over a specified period. As in other scalping terminals, MetaScalp implements them as columns with horizontal cells. Each column is a candlestick on the selected timeframe. Each row represents a price level. The numbers within the rows show traded volumes at that price level for the given timeframe. Available timeframes are 1m, 5m, 10m, 15m, 30m, 1h, and 1D.

The cluster panel consists of three standard elements: an orange cell representing total volume over the period, a green or red cell showing the difference between buy and sell volumes (delta), with green indicating more buys and red indicating more sells, and a gray cell indicating the cluster’s closing time.

The cluster panel and timeframe display can be adjusted. Full scale volume and its equivalent in USD can also be set.

Trade Tape

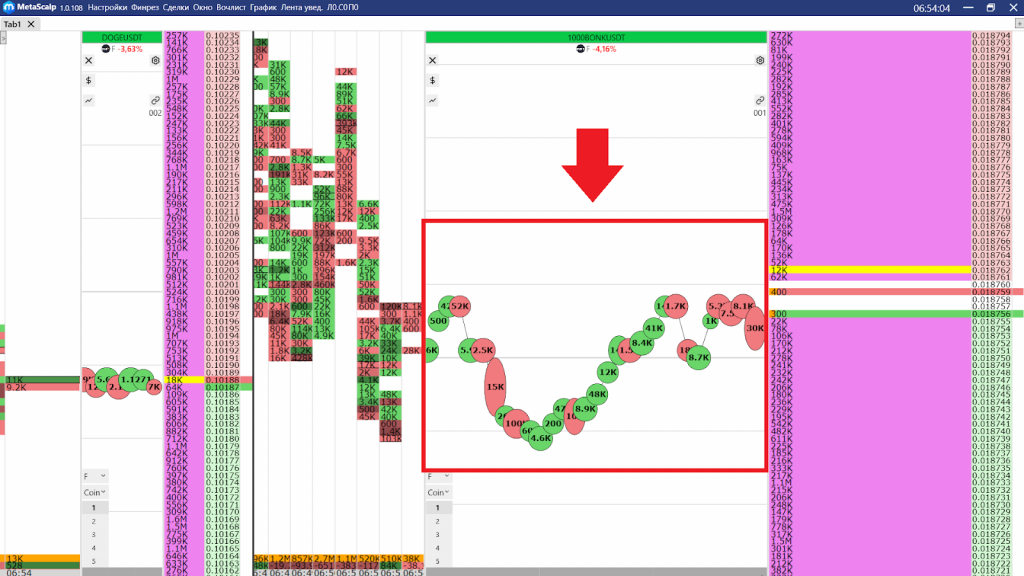

The trade tape is a crucial analytical tool in scalping. It shows market orders in real-time, with a standard visual design: orders are displayed as circles, with green representing buys and red representing sells. A ping panel displays the terminal’s connection quality with the server. Ping is important to know how quickly an order reaches the exchange and how fast a response is received.

In MetaScalp, the volume of ticks can be set for the trade tape. Volumes below the specified amount can be hidden or displayed. Large volume thresholds and tick display styles can also be customized.

Watchlist

In MetaScalp’s Watchlist, favorite instruments from different connections can be added. Instruments are sorted by ticker, percentage price change, and volume.

Financial Results and Trades

The “Your Trades” window displays trades from the current trading session. Each row represents a full or partial exit from an open position. For example, if you open a position for 30 lots and then close it in two parts of 15 lots, two rows will appear in the list.

The data format for trades is as follows: Connection / Instrument Ticker / Trade Direction / Volume / Volume in USD / Opening Price / Closing Price / Price Difference / Profit / Commission / Closing Time.

The “Financial Results” column shows the PnL for the selected coin, including commission, available and “blocked” funds.

MetaScalp Connections

MetaScalp works exclusively with cryptocurrency exchanges:

- Binance – Spot market and USDT futures

- Gate – Spot market and futures

- Bybit – Spot market, USDC, and USDT futures

- KuCoin – Spot market and USDT futures

- OKX – Spot market and futures

- Bitget – Spot market and futures

- MEXC – Spot market and futures

- BingX – Spot market and futures

Connection to exchanges is implemented via API keys.

How to Get MetaScalp

MetaScalp is available for free on the official website of the project. The terminal can be installed as a regular application and runs only on Windows x64. Installation, launch, and terminal setup instructions are available in the “Knowledge Base” section of the website.

Trader Feedback on MetaScalp

MetaScalp does not yet have a large user base, so reviews are scarce. However, the existing reviews tend to be negative. Many note the lack of information about the developer and legal address.

Some users report that support services are limited. A help section is available on the website, along with support via Telegram. MetaScalp has a Telegram chat with around 2,000 members (as of this writing), where users share results, issues, and solutions. The development team also runs a YouTube channel.

Many traders point out that MetaScalp’s interface and features are nearly identical to those of CScalp, with only minor differences.

MetaScalp Alternatives

Functionally, MetaScalp largely replicates CScalp. Both terminals offer an order book, trade tape, and cluster module. Both feature a minimalist candlestick chart with a volume indicator. CScalp and MetaScalp share a similar visual design. The workspace is customizable, including window arrangement, linking, and color scheme.

The differences lie in age, number of settings, connections, and support. CScalp is developed by the team behind Privod Bondar, which has been around since 2009. They offer a broader range of products, including the CScalp terminal, Privod Bondar for prop traders, and the online diary TradersDiaries.com.

CScalp offers more settings than MetaScalp. For example, CScalp allows users to configure alerts for iceberg orders. To compare functional differences, you can install both terminals and explore them.

CScalp can be connected to your accounts on Binance, Bybit, OKX, Bitget, HTX (Huobi), Phemex, Bitfinex, Bitmex, and EXMO.

CScalp support operates regularly and addresses all user inquiries. Support can be contacted via the official Telegram bot (@CScalp_support_bot).

As CScalp has been on the market for several years, a large community has formed around it, including a YouTube channel, Telegram, Discord, and more. Educational materials and live trading streams are regularly released on the YouTube channel.

Learn more: “TigerTrade Review: Tiger.Com Scalping Terminal User Experience and Interface.”

MetaScalp Review – Conclusion

MetaScalp offers a standard set of tools for scalping on cryptocurrency exchanges: order book, trade tape, clusters, charts, and customizable instruments. Its weaknesses include a lack of information about the team and poor customer support (according to some users). Overall, MetaScalp resembles a “minimalistic” version of CScalp. Therefore, it is recommended to install both terminals (both are free) and compare them based on personal experience to determine which better suits your needs for scalping and intraday trading.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT