Scalping strategy | How to pick crypto for scalping

There are dozens of crypto-assets available for futures trading today. It has become simply impossible to keep track of all the instruments at the market. But how to pick the best instruments for intraday crypto scalping?

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Let’s start with the most important factor determining successful scalping, namely volatility.

Volatility is the degree of variation of a trading price series over time. The more volatility is, the more potential profit you can get (Subject to following the trading strategy and risk management).

In order to figure out which instruments have shown the most volatility over the past 24 hours, we can do the following:

Binance main menu

Visit the main page of Binance. Chose “Markets” section in the main menu.

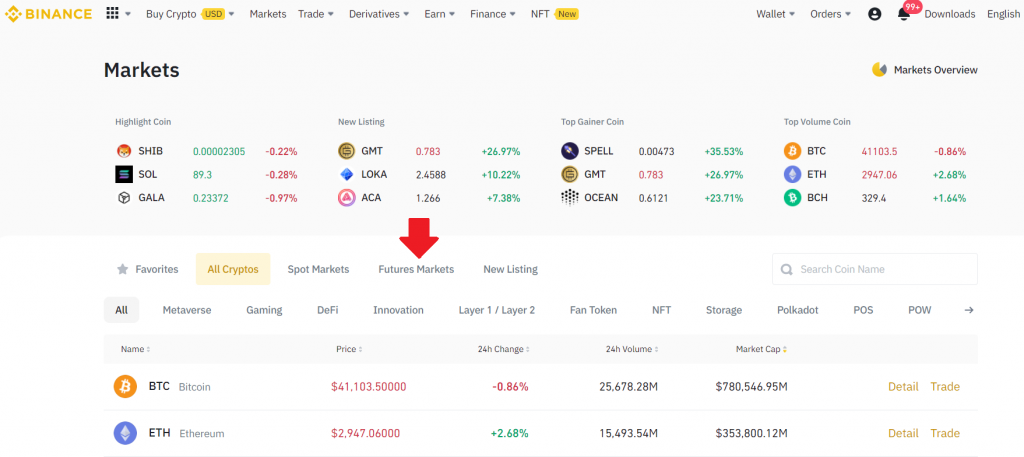

Markets page

In the column “24h Volume” we can see the instruments sorted by volatility from the most volatile to less volatile. We recommend choosing the first 10 instruments for scalping. The top 10 instruments filtered out by maximum volume allows you to avoid situations when the instrument lacks liquidity, being stuck in a range or narrow diapason that complicates scalping.

Why are less volatile instruments not recommended to trade?

Foremost, trading with no volatility means that there is a lack of market participants and, in particular, liquidity providers.

The greatest risks are borne by traders with large deposits, who need sufficient liquidity in the market for closing their positions. Thus, there is a risk that large positions in low-liquid instruments can be closed with a large time lag, which usually leads to significant losses due to closing the position at very unfavorable prices.

Another risk is the long and narrow price range where your position will be stuck for a long time before going breakeven or profit.

The list of instruments sorted by volatility is changing rapidly due to migration of capitals shifting from one to another instrument.

How to filter out instruments for intraday scalping using CScalp trading platform?

As far as, the most important factor in selecting the instruments for trading is volatility, we can identify the volatile instruments by following:

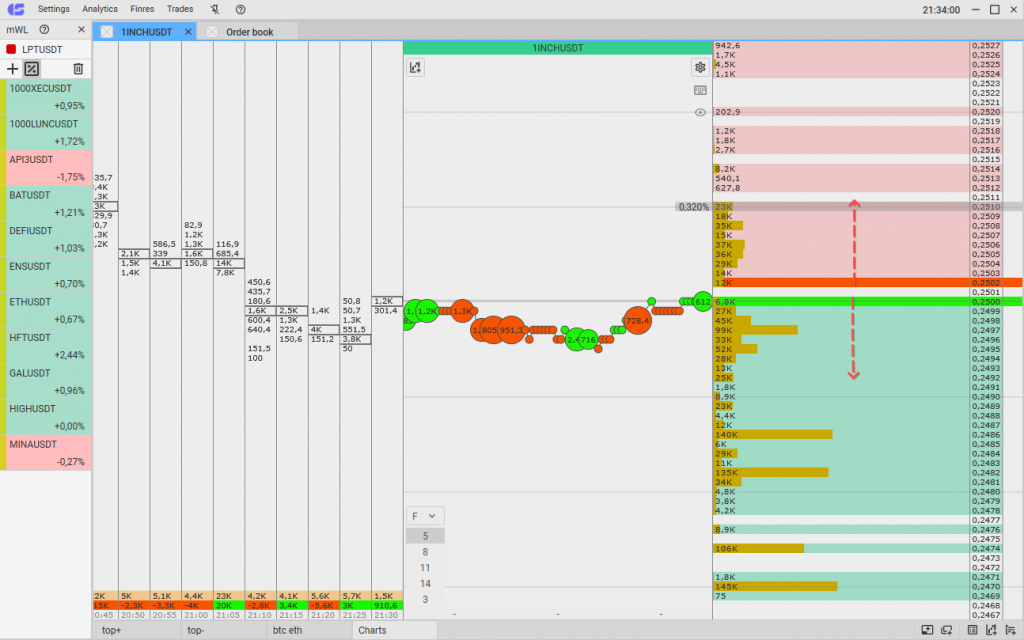

CScalp trading platform

Price movement

Rapid character of price movement with immediate execution of limit orders of 50-100 000$ is the first sign of the participants` high engagement in the instrument. Such volatility sometimes can reach the pump or dump character of price volatility that is relevant for scalping.

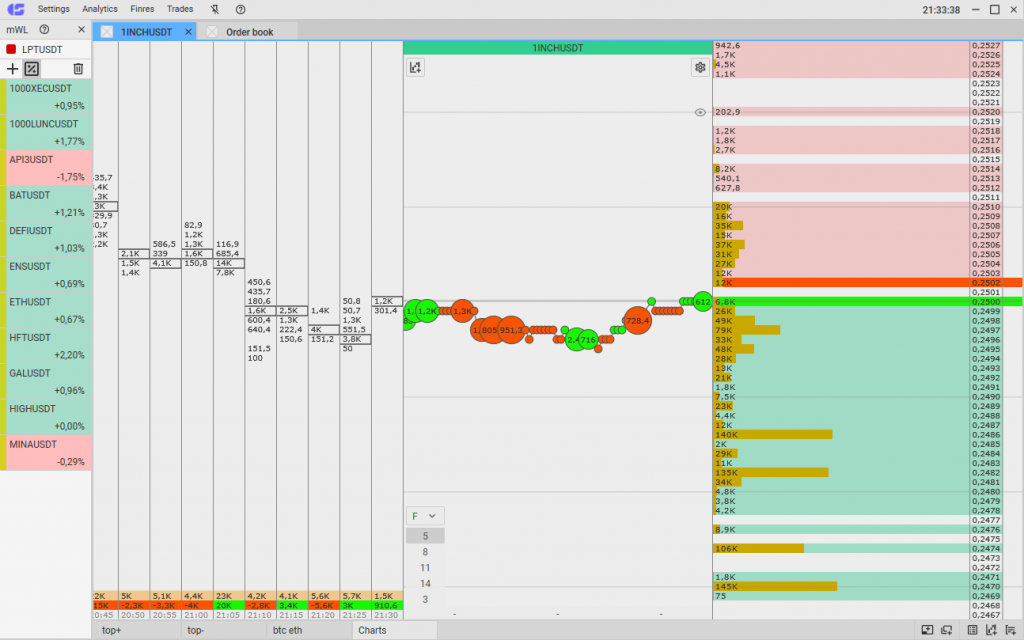

CScalp trading platform

Tick activity in the market trades history

The faster and more actively new ticks appear in the market trade history, the higher the volatility of the instrument. Pay attention to the market trades history that reflects the market orders execution in the real time.

Conclusion

Volatility of the instrument is the main factor you should pay attention while selecting instruments for scalping.

There are three main ways to identify high volatility: “Futures markets” page on the Binance website, where you can filter out the instruments by the 24h trade volume, price movement and tics activity in the CScalp trading platform. Be careful and follow your risk management to stay in profit!

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT