Scalping strategy | Risk Management

When we are talking about scalping strategy, we should understand what it is consisted of. The most important component of your strategy in futures trading is risk management, while strategy itself is secondary. Whatever strategy you use, all your attempts to get profit will fail without following risk management. Let’s consider trading strategy and risk management system separately.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Strategy for scalping. Breakout and Pullback.

The most reliable strategies in scalping of cryptocurrency futures are breakout of strong levels and pullback from such levels. How to use each of the strategies?

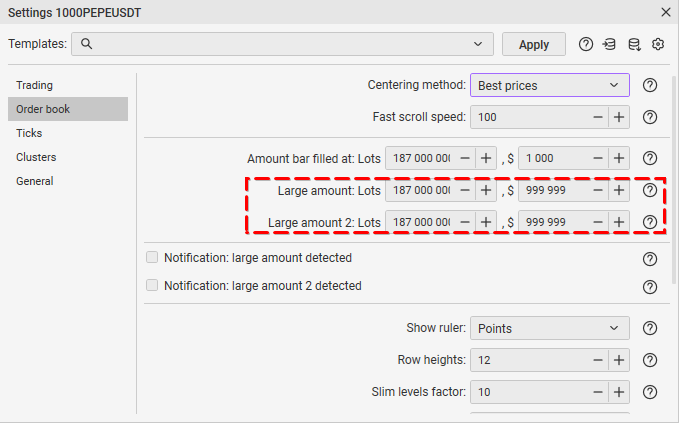

CScalp instrument settings

Foremost, you should set up your large amount 1 and large amount 2 properly as it shown above. The aim is to set a reliable amount that will show that an exact amount of limit orders to be huge enough as a significant resistance for price.

In dollar equivalent (price multiplied by the number of contracts), a limit order of $200-400k for the instruments not included in the top 100 by market capitalization is considered a reliable volume. For the instruments of the top 100 by market capitalization, $400-800k orders are considered reliable volumes.

Now, when we know what are huge amount of limit orders, lets see how to separate the strategies of breakout and pullback.

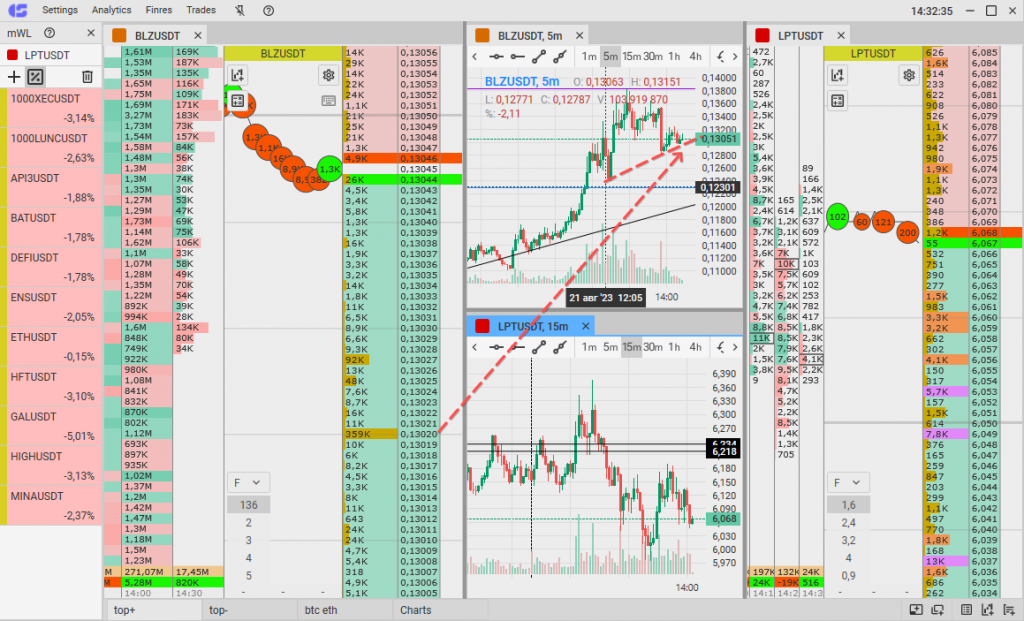

Breakout strategy

The first one implies extraordinary volatility of an instrument in front of a strong level of a round price. The price forms consolidation with the angle towards the continuation of the main movement. If there are huge amounts of limit orders in the order book (in spot preferable) situated at such levels, it is the main sign for us. If the volatility is strong enough and the price “attacks” the limit orders rapidly executing them, we enter the market along the movement and catch the impulse.

The main advantage of the strategy is very high potential profit (from 1% to 4-12%, depending on market conjuncture). The main risk is that there is no clear place for stop loss. The price could be dumped after several seconds of the breakout bringing you loses.

CScalp trading terminal

Main factors to use the strategy:

- Pumps or dumps of the instrument when price reaches a strong level on a round price

- BTC movement should coincide with your potential position direction

- High volatility. The huge limit orders will hardly be broken without high volatility, and there will no any impulse. Watch the activity of the order book and how fast ticks appear.

- Consolidation or triangle. The more the price has touched the level to break, the more chances that it will be broken.

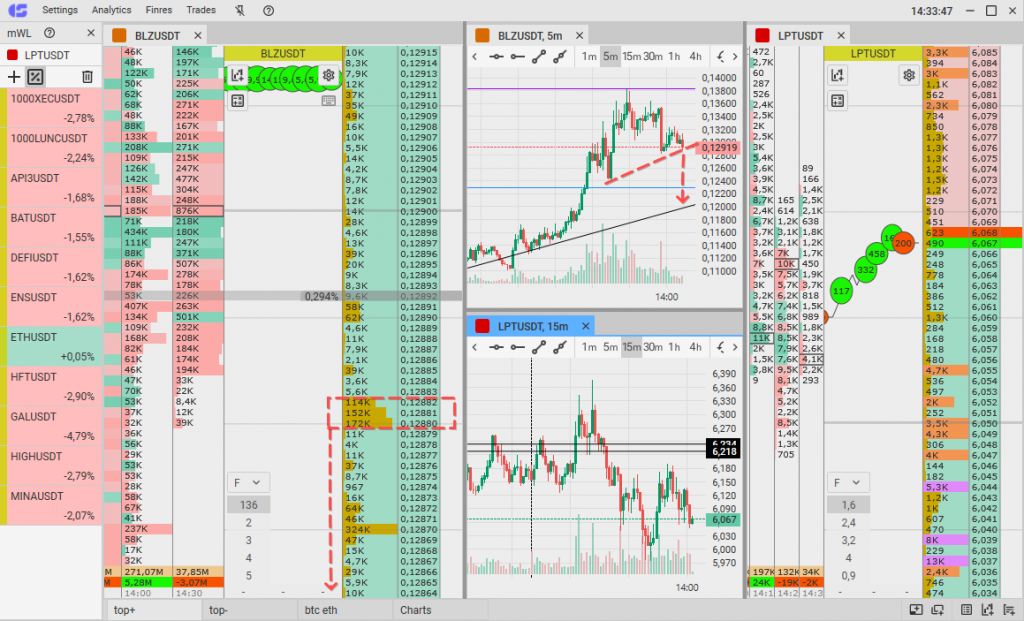

Pullback strategy

This strategy is opposite to the previous one. The strategy implies entering a market when price rebounds from a huge limit order and moves along the main trend. Opposite to previous strategy, there is a lack of participants for the breakout and being reversed from the huge amounts of limit orders, price rebounds from such limit orders.

The main advantage of the strategy is very good risk-reward ratio. Entering market in a point where the price rebounds from the limit order amount, we can place stop loss behind it making stop loss very short (0,3-0,5%). However, the lack of volatility brings much less profit rather than breakout strategy.

CScalp trading terminal

Main factors to use the strategy:

- Lack of activity while price reaches the huge amount of limit orders

- Density of limit orders huge enough to resist the price, making it rebound and change direction

- BTC movement should coincide with your potential position direction

- Your potential position should be alongside the main trend

Risk management

The strategies above will be absolute useless if you infringe your risk management. Whenever strategy you use while trading, you should bear in mind the risks. The first strategy is much more risky, and we recommend using the half of your standard working volume to minimize the loss in case the impulse will fail to be realized properly. In case of breakout strategy we recommend setting 1-1,5% max stop loss (from the entry point). The pullback strategy is less risky and there is a possibility to set up short stop loss. Using such strategy, you can increase your standard working volume to X3-X5 with stop loss 0,3-0,5% according to the recommendations stated above.

Be aware, that profitable traders are not those who close 10 out of 10 trades in profit, but those who follow the risk management rules. You can have 5 out of 10 trades closed in loss (3-7$ of loss each) according to your risk management, but the next trade will bring you 100$ profit, covering previous loses and adding you profit.

Be careful! Risk management first, then trading strategy!

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT