Scalping Strategy | When and how to fix your profit

Every trader knows that searching for a perfect entry point is a half way. An equally important aspect is the closing your position properly to maximize your potential profit. However, the real mastery of psychological discipline is not opening the position in the setup that looks perfect, but has tiny signs that slightly confuse you.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

When to refrain from holding the position?

The first question we should ask ourselves as traders is not how much we could earn by a single trade, but how much we can afford to lose per trade and how to filter out the trades that shouldn’t be made or should be closed in time.

Breakout strategy

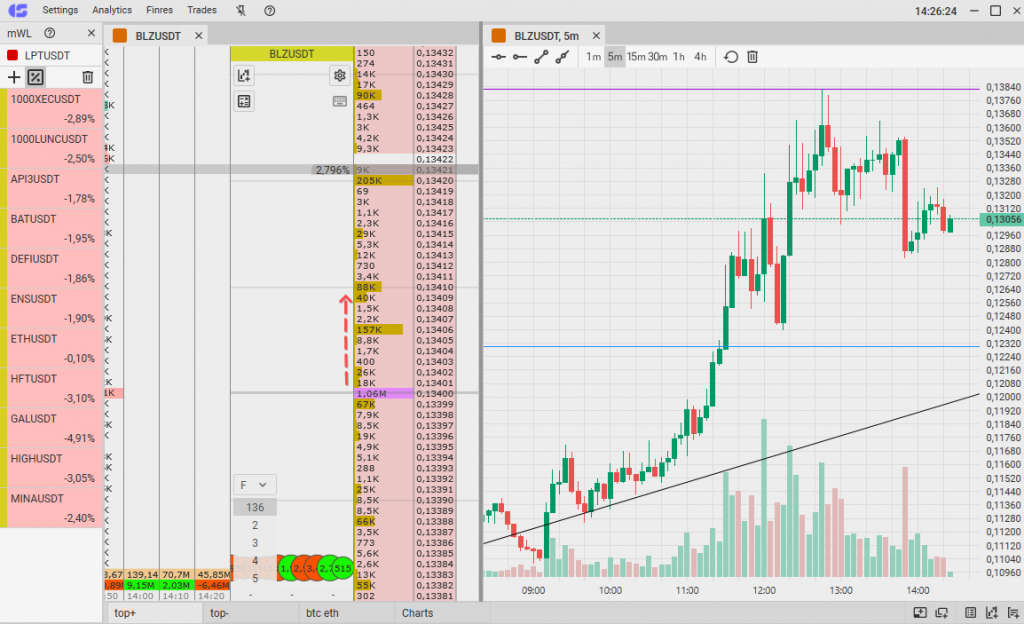

CScalp trading platform order book

While applying breakout strategy, we should understand the mechanism of the movement. When a strong level is broken, the impulse is made by participants’ stop losses and other scalpers participating in the movement. It takes a few seconds for initial impulse to be realized, regardless of how long it takes further (0.8% or >10% of movement).

If you entered the market waiting for the impulse, and it is not realized during more than 30 seconds, it is better closing the position due to lack of participants or stop losses as a core fuel of the level breakout. Holding opened position in such situation is risky, as a pullback could happen, increasing your lose. Sometimes the realization of an impulse could happen even with a long delay after breaking the level, however waiting for it with an open position is a lottery.

Pullback strategy

While applying pullback strategy, you should rely on the huge amount of limit orders or point of control that you place the stop loss behind.

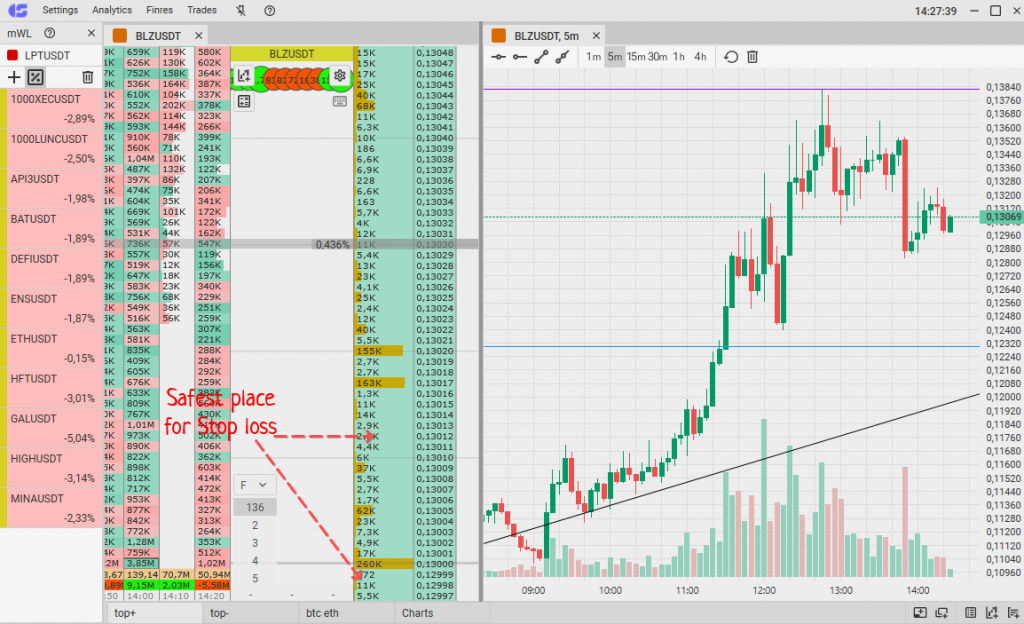

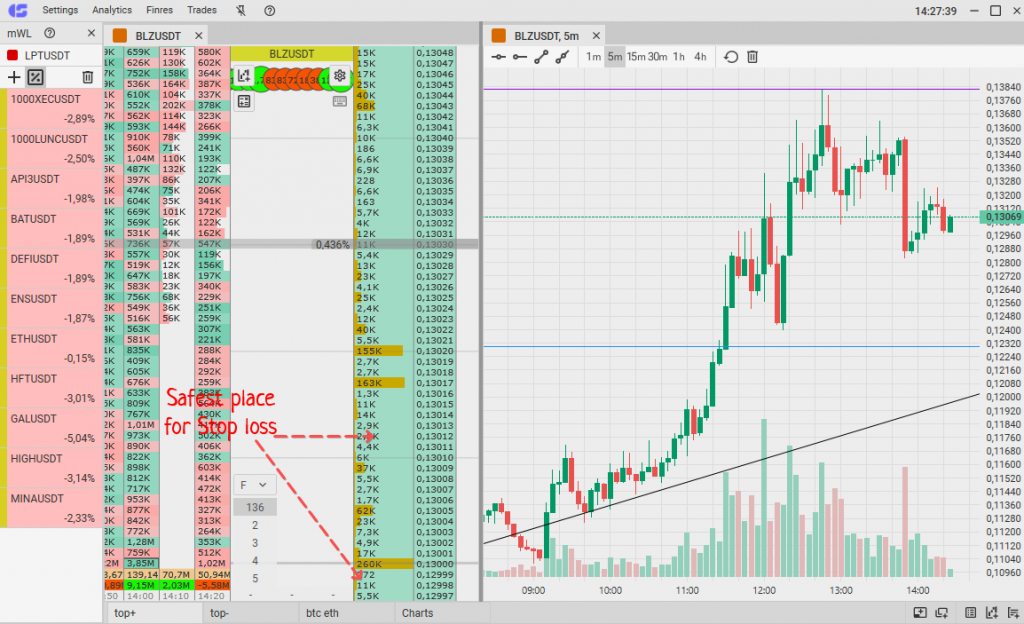

CScalp trading platform order book

If the limit order that you expect the price will rebound from is executed by 50% within 5 minutes, it is a better closing position, otherwise it will be broken, and your position will be closed by stop loss with a long slippage made by drastic impulse.

Partial closing of positions

In order to maximize your potential profit and avoid FOMO (Fear of missed opportunity) we recommend closing positions partially along the movement. Divide your position into three equal parts that will be closed upon reaching a certain percentage of profit. First part should be closed at 0,7%-1% of profit displayed in percentage and stop loss should be placed in breakeven point. This allows to compensate the fee for the trades and get minimal profit in case the setup loses its relevance and the movement drastically reverses. The second part should be closed at 1.5%-1.7% fixing the main profit from the trade and leaving the last part with stop loss in breakeven. The last part of lots left in the position could potentially bring you more profit than the first two parts. The last part should be closed either by take profit or stop loss.

Such simple principle of partial closing of positions will bring more stability in your trading.

Instant signs for closing positions

Every trader has had a situation when nothing portends losses, unfixed profit grows , and you want to take more, but something changes dramatically in the market and recent profit melts closing you at breakeven or even at a loss.

Let’s consider the signs the market gives you to close the positions (at least partially) in time and save your profit.

Support in clusters

When the movement faces such a support and the price significantly stuck within the zone as shown on the screenshot below it is a solid sign to close the position or do it partially to fix your profit as there is a risk that the price will probably pullback from such a point of control reducing your profit.

CScalp trading platform order book

Support of limit orders

It is better closing positions at least partially when the movement faces the support in the form of huge limit orders, as it is shown on the screenshot below. Otherwise, you risk losing your profit as there is a high probability that the price will pull back from the huge limit order.

CScalp trading platform order book

Spoofing and algotraders

When you notice the limit orders to be replaced automatically in the order book several times (especially in the spread) there is a high probability that algotraders or spoofers are engaged there. You could be lucky , and the price manipulation will coincide with the direction of your position, however it is better closing most of your position and place stop loss to breakeven point.

We hope this article will help you to maximize your profit. Be aware that the market gives us signs, and we should properly read them to stay profitable!

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT