Short-Term Trading Strategy: Learn Crypto Scalping, Day Trading and Swing Trading

Short-term trading in cryptocurrencies aims to profit from rapid price changes. CScalp helps you select the best short-term trading strategy between high-frequency trading (scalping), day trading, and swing trading. We also provide risk management and asset management tips that will make your short term trading successful.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Understanding Short-Term Trading With Cryptocurrencies

Short-Term Trading Definition

Short-term trading in the crypto market involves buying and selling digital assets within a brief time frame, typically ranging from seconds to several days. The so-called day traders make short term trades, often holding positions for just minutes or hours, while a single swing trade may last for days. Short period trading strategies often rely on order book reading, technical analysis, and quick reactions to market movements. To take full advantage of short-term trading, try the professional trading platform CScalp by leaving your email in the form above. With the free terminal, you will be able to connect to an exchange and place orders with one click, automatically set Stop-Loss and Take-Profit targets, as well as manage your risks.

CScalp free professional trading platform

Pros and Cons of Short-Term Trading

Short-Term Trading Pros

Potential for quick profits due to the high volatility in cryptocurrency markets.

More opportunities for short period trades due to frequent market movements.

Short-Term Trading Cons

Higher levels of risk with the rapid fluctuation of cryptocurrency prices.

Increased transaction costs from frequent day trades can eat into profits.

For trading and investment strategies, managing these trade-offs is a key aspect of your success in short-term trading.

Learn more in our blog: Day Trading vs. Investing: Select a Strategy That is Right for You

Comparing Short and Long-Term Trading

In comparison to long-term trading where positions are held for months or years, short-term trading requires a more proactive approach. Scalpers, an extreme example of short-term traders, capitalize on minuscule price movements within minutes. The accelerated nature of short-term trading accentuates both potential gains and losses, and it demands a sizeable time investment for monitoring the markets. Your success in short-term trading versus long-term holding depends on your ability to tolerate risk, your market knowledge, and the ability to swiftly respond to changes.

Short-Term Trading: Fundamental and Technical Analysis

Mastering both fundamental and technical analysis is pivotal to your success in crypto, commodities, Forex, or the stock market.

Technical Analysis Basics

Technical analysis in cryptocurrency trading involves examining past market data, primarily price and volume, to forecast future price movements. You should focus on identifying trends and patterns through various indicators and charts. Key tools in your arsenal include:

- Moving Averages: These help smooth out price actions to identify trends.

- Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Volume: Heavier volume confirms the strength of a trend (either an uptrend or a downtrend).

Role of Fundamental Analysis in High-Frequency Trading

While technical analysis revolves around the ‘how’ and ‘when’ of your trades, fundamental analysis answers the ‘why.’

- Network Data: Information like transaction count and active addresses.

- Project Fundamentals: Development activity, team expertise, and technological advancements.

- Adoption Trends: News, institutional support and retail adoption rates.

Short-Term Trading Key Indicators and Chart Patterns

When constructing your trading strategy, visually represented data can offer insights at a glance. Here are some specific tools you should familiarize yourself with:

- Candlestick Patterns: Offer detailed information about price movements within specific time frames.

- Fibonacci Retracement: A tool used to identify support and resistance levels based on the Fibonacci sequence.

- MACD (Moving Average Convergence Divergence): A trend-following momentum indicator that shows the relationship between two moving averages of a cryptocurrency’s price.

Short-Term Trading Strategies and Techniques

Before you dive into the fast-paced world of short-term cryptocurrency trading, it’s essential to familiarize yourself with the strategies and techniques that could potentially enhance your trading performance. These strategies for making money are based on order books, ticker tape, and technical analysis.

Scalping

Scalp traders focus on making numerous transactions to capture small price gaps, often caused by spread differences or order flows. Use order books that are integrated into professional trading platforms like CScalp to determine quick entry and exit points.

- Speed: This strategy requires you to act fast to exploit small price changes, which could result in substantial gains over time.

Day Trading

In day trading, you buy and sell cryptocurrencies within the same trading day. Key indicators for this strategy include high volume, which indicates strong interest, and moving averages, which can help identify trends.

- Volume: Ensure there is sufficient volume to support your trades.

- Patterns: Look for established patterns forming within the day to predict price movements.

- Slippage: Be aware that executing trades at the exact desired price may be challenging, and you may experience slippage, at which your trade gets filled at a slightly different price than expected.

- High-frequency trading: Some traders engage in high frequency trading, where they execute numerous trades in a very short time frame to capitalize on tiny price fluctuations.

Swing Trading

For swing trading, you hold positions for several days to capitalize on expected upward or downward market shifts. Swing traders use a mix of technical indicators to predict these movements.

- Patterns: Identify patterns that indicate a potential swing.

- Moving Averages: Utilize long-term moving averages to gauge the overall trend direction.

Momentum Trading

With momentum trading, you capitalize on the strength of price trends. Identify strong momentum in a cryptocurrency, confirmed by high trading volumes, and ride the wave before it dissipates.

- Entry Points: Enter a trade after confirming a trend’s momentum through volume surges.

- Exit Points: Exit before the momentum shifts, as indicated by a decrease in volume or a reversal pattern in the price movement.

Risk Management and Asset Management in Short-Term Trading

Effective risk management and asset management are crucial in short-term crypto trading. Your primary goal is to protect your capital and secure profits while minimizing potential losses.

Setting Stop-Loss Orders

Stop-Loss orders are an essential tool for controlling risk. You place these orders to sell your cryptocurrency when it reaches a certain price, preventing greater losses if the market turns against you. For instance, if you buy Bitcoin at a cost of $30,000, you might set a Stop-Loss order at $27,000 if the market turns bearish, thereby capping your potential loss at 10%.

Remember that CScalp has implemented an automatic Stop-Loss feature that you can use to protect your assets.

Position Sizing

Position sizing is determining how much of your portfolio to allocate to a particular trade. A prudent approach could be utilizing a fixed percentage of your capital for each trade – often between 1 and 5%. For example, with a portfolio of $10,000 and deciding to risk 2%, you would allocate $200 to a single trade.

Diversification

A diversified portfolio can reduce the risk inherent in the cryptocurrency market. Rather than committing all your funds to a single coin, spread your capital across various digital assets. You can also engage in forex trading or check out some stock brokers. This can protect your investments from the volatility. However, be aware that market-wide downturns can still affect diversified portfolios, albeit to a potentially lesser extent.

Margin Trading

Margin trading is a technology that allows you to leverage borrowed funds to amplify your trading positions, potentially leading to substantial gains or losses. It’s crucial to use margin trading cautiously and only if you fully understand the implications and risks involved.

Privacy and Security

In addition to setting Stop-Loss orders, position sizing, and diversifying your portfolio, it’s essential to pay attention to your privacy and security when trading cryptocurrencies. Protect your personal and financial information, use secure platforms, and consider using hardware wallets or other cold storage methods to safeguard your assets from potential hacks and breaches.

Psychological Aspects of Trading

In short-term cryptocurrency trading, psychological factors can have a profound impact on your decision-making process and overall performance. Your emotional state, stress management abilities, and discipline all play crucial roles in navigating the highly volatile crypto markets.

Dealing with Emotions in Short Term Trading

Emotion governs much of the sentiment in cryptocurrency trading. As a trader, your ability to recognize and control emotions like fear and greed is essential. Fear can cause you to sell at the lowest point, while greed might lead you to hold onto assets for too long, hoping for even greater profits. Consider the following strategies:

- Maintain a trading journal to reflect on emotional triggers

- Set clear entry and exit points to avoid impulsive decisions

- Manage FOMO (Fear of Missing Out) by sticking to your predefined trading plan

Stress Management

Stress is an inevitable aspect of trading, particularly in the fast-paced world of cryptocurrencies. It can cloud your judgment, leading to rushed or poorly thought-out trades. To manage stress:

- Ensure you have a well-structured trading plan to provide a sense of control

- Make regular breaks from trading. They can help clear your mind and reduce stress levels

Discipline and Patience

In the crypto market, discipline and patience are virtues that could strongly influence your trading outcomes. Discipline helps you stick to your trading plan despite the market’s noise, while patience is about waiting for the right trading opportunities. Implement these practices to strengthen these traits:

- Only trade with a predetermined portion of your portfolio

- Avoid chasing trends and practice waiting for your trade setups to align

- Use Trading Tools and Resources

Choosing an Exchange for Short Term Trading

When selecting an exchange for short period cryptocurrency trading, it’s essential to ensure they offer a robust and secure platform. Look for one that provides:

- Real-time access to cryptocurrency markets

- A reliable trading environment with minimal downtime

- Competitive fees and spreads

- A range of cryptocurrencies to trade

- Transparent pricing structures

- Compatibility with your preferred trading terminal

Leveraging Professional Trading Software

Effective trading software equips you with the tools to analyze the market and execute trades efficiently.

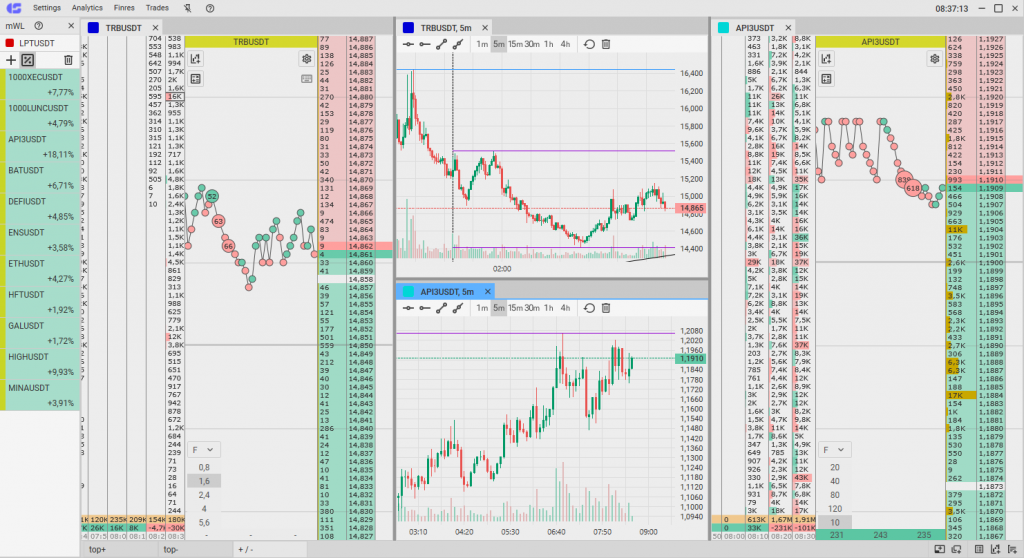

Consider using CScalp, a powerful trading software designed to optimize your trading experience. CScalp offers a suite of features tailored for short-term traders looking to execute transactions through order books.

With CScalp, you can access:

- Real-Time Market Analysis: Stay ahead of the curve with real-time access to cryptocurrency markets. CScalp provides up-to-the-second data, ensuring you make well-informed trading decisions.

- Charting Tools: Harness the power of advanced charting tools to identify trends and patterns, giving you a competitive edge in the fast-paced world of short-term trading.

- Customizable Alerts: Stay updated on market movements with personalized alerts. Receive notifications that matter most to your trading strategy. For example, when an iceberg order has been placed.

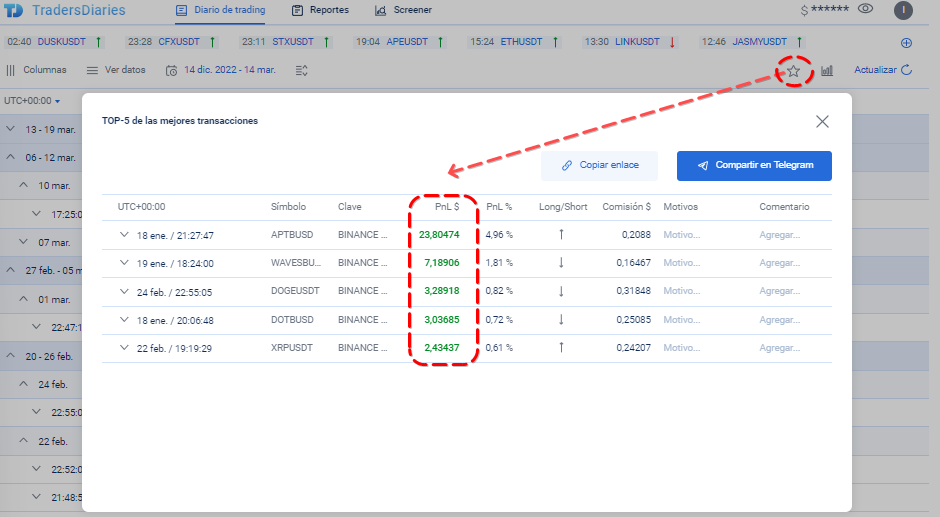

In CScalp’s Trading Diary, you’ll find tools that allow you to generate statistics, analyze trades, and detect errors.

Options for Analysis Tools in the Trading Journal

- TOP Transactions: This feature displays the top-performing trades recorded in your trading history. When a trader sets a new personal record, that transaction appears in the TOP section. Don’t forget to add comments to your best trades!

CScalp’s Trading Diary top transactions overview

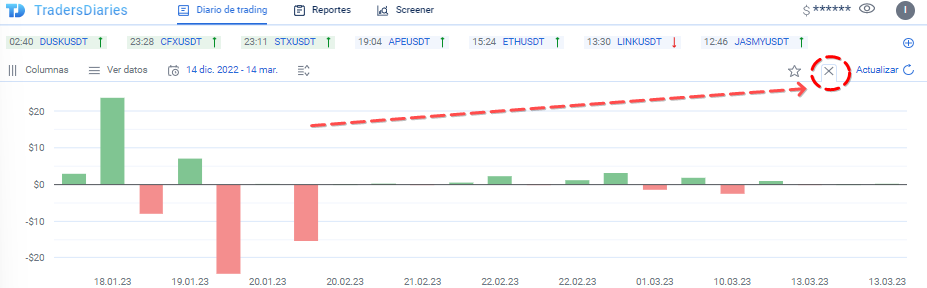

- Results Chart: The bar chart showcases the results of your trades in USDT. Each column represents a transaction, and the chart displays a fixed number of trades. When a new trade occurs, the previous one “leaves” the chart.

CScalp’s Trading Diary results chart

For an optimized trading experience, integrating CScalp with your preferred crypto trading exchange is a game-changer. The professional terminal not only simplifies your trading processes but also enriches your market analysis capabilities. The connection between CScalp and various exchanges through API keys enables you to enjoy a professional trading platform, where efficiency and speed are paramount.

Frequently Asked Questions: FAQs About Short-Term Trading

Short-term trading in the cryptocurrency market necessitates a strategic approach backed by informed decision-making. We will address some common queries to help you navigate this market.

What Are the Essential Strategies for Engaging in Short-Term Stock Trading?

To succeed in short-term cryptocurrency trading, it’s crucial to employ strategies like day trading to capitalize on small price movements within a single day (long or short trade), and swing trading, which involves holding positions for several days to take advantage of expected directional shifts. A focus on technical analysis and market trends is paramount in implementing these strategies.

Can You Recommend Educational Resources for Improving Short-Term Trading Skills?

Enhance your short-term trading proficiency by exploring online courses specific to cryptocurrency trading, webinars hosted by seasoned traders, and virtual trading simulators. CScalp’s free futures trading course offers detailed insights and strategies to enhance your trading performance, while our crypto scalping course teaches essential techniques for quick and efficient trading in the cryptocurrency market.

How Do Market Indicators Influence Short-Term Trading Decisions?

Market indicators are essential in short-term trading as they help discern potential entry and exit points. In the cryptocurrency market, traders often utilize volume, volatility, and momentum indicators alongside technical analysis tools like moving averages and trend lines to make more calculated trading decisions.

What Are the Characteristics That Define a Successful Short Term Trade in the Cryptocurrency Market?

A successful short-term cryptocurrency trade typically involves quick entry and exit, precision in timing based on technical signals, and robust risk management. Successful trades are also characterized by the ability to adapt to market volatility and manage emotions to avoid impulsive decisions.

What Is the Optimal Time Frame to Consider When Engaging in Short-Term Trading?

The optimal time frame for short-term cryptocurrency trading can vary from mere seconds in scalping to days in swing trading. The choice of time frame should align with your trading style, risk tolerance, and the specific market conditions at the time.

How Does Short-Term Trading Differ From Long-Term Investing in Terms of Profitability and Risk?

Short-term trading in the cryptocurrency market often presents opportunities for quicker and potentially higher percentage gains compared to long-term investing. However, this comes with increased risk from market volatility and the need for constant vigilance. Long-term investing usually revolves around the fundamental value proposition of a cryptocurrency, while short-term trading leverages price movements.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT