The list of decentralized exchanges (dex)

We have prepared a list of popular decentralized cryptocurrency exchanges (DEX). Decentralized exchanges operate on the blockchain, do not have a single regulatory institution and operate on the P2P principle. The list is based on the ratings of CoinMarketCap and CoinGecko.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

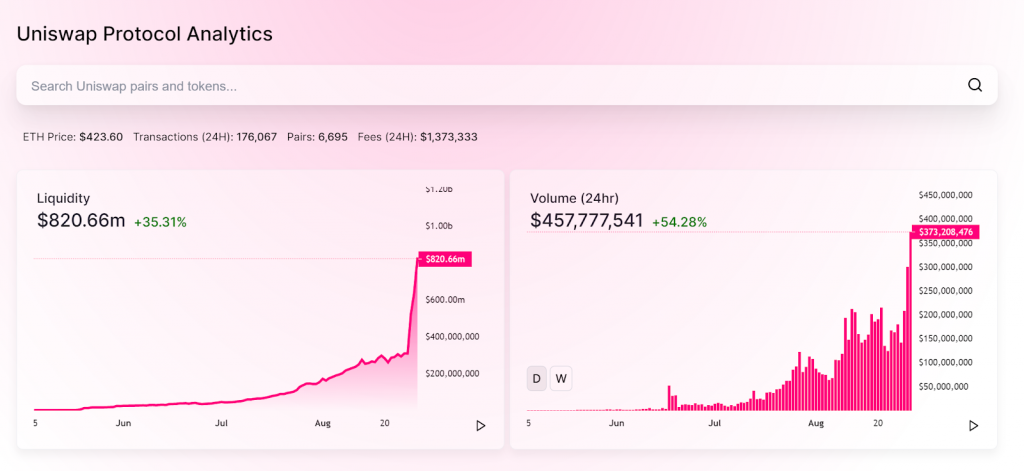

Uniswap

Uniswap is a decentralized exchange (DEX) powered by the Ethereum blockchain. The exchange uses an automated liquidity protocol. The key features of Uniswap are Swap and Pool. Swap allows you to trade ETH and ERC-20 tokens. Through the Pool feature, exchange users are rewarded by providing liquidity.

Liquidity providers on Uniswap can create paired contracts for any ERC-20 token. The exchange calculates the exchange rate using a special formula. Uniswap’s fixed fee per transaction is 0.3%.

Uniswap Interface

Uniswap’s own token is UNI. The token was listed on the largest cryptocurrency exchanges, in particular Binance, OKX and Huobi. Holders of UNI token have the right to vote on changes within the platform, new developments, a way to distribute new tokens among the community and developers, changes in fees.

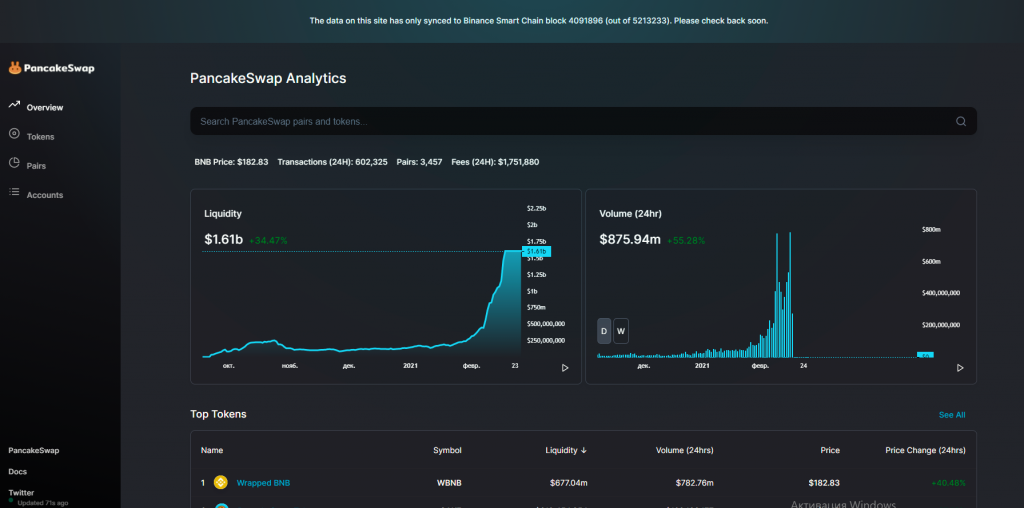

PancakeSwap

PancakeSwap decentralized exchange is powered by the BNB Smart Chain (Binance Smart Chain) blockchain. The platform uses an automated market maker model. Through Swap, users trade BEP-20 tokens and BNB Smart Chain. Implemented the possibility of farming and staking.

On PancakeSwap, users trade against a pool of liquidity. Pools are filled with funds from exchange users. In return for funds, users receive liquidity provider (LP) tokens. These tokens can be used to return their share and part of the trading fee.

Interface PancakeSwap

The native PancakeSwap CAKE token is used within the platform for farming, staking, participating in lotteries and creating an NFT profile. Also on the exchange, the possibility of earning money on price prediction of BNB/USDT is realized and it is possible to store and sell collectible NFT cards.

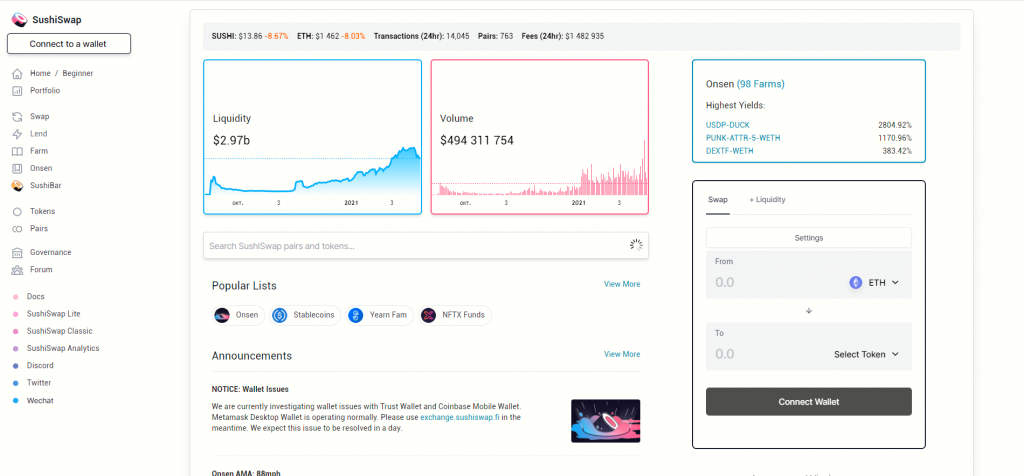

SushiSwap

SushiSwap is a decentralized exchange based on the Ethereum blockchain. The exchange was created by the developers of Uniswap. Featureally, the SushiSwap platform is identical to the second version of Uniswap. The key difference is that the exchange’s own token, SUSHI, accumulates value.

Early adopters of SushiSwap are considered the most significant contributors to the protocol. Therefore, when withdrawing funds from the liquidity pool, they continue to receive passive income.

SushiSwap Interface

To become a liquidity provider, you need to block your own tokens in a smart contract. Locked tokens are combined into liquidity pools. Any user can open a similar pool with a new cryptocurrency on the SushiSwap exchange.

Transactions can be made between any ERC-20 tokens and ETH. The transaction fee is 0.3%. 0.25% goes directly to the participants in the liquidity pool. The remaining 0.05% is converted to SUSHI and distributed among token holders.

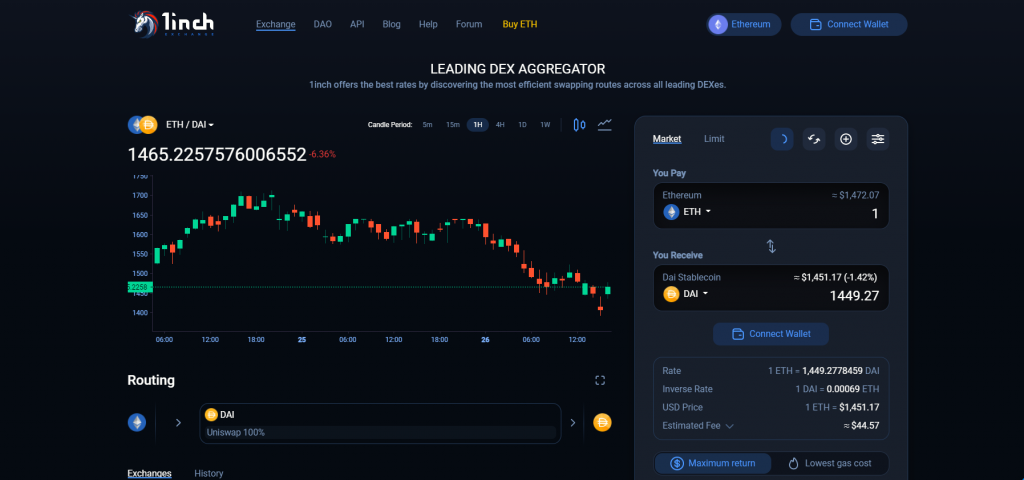

1inch

1inch is a decentralized exchange aggregator. Powered by the Ethereum blockchain. The platform is designed to combine all major DEXs into one network with liquidity and prices in order to simplify the conclusion of transactions (sometimes on decentralized exchanges this is problematic due to low liquidity and a thin order book).

1inch makes it possible to split trades across different decentralized exchanges in order to minimize slippage and get the best price. The exchange offers liquidity and exchange rates on one board. You can trade Ethereum and ERC-20 tokens.

1inch Interface

The feature of the 1inch exchange allows you to place limit orders. Implemented an interactive price chart, active order tab and order history tab. This is the key difference between 1inch and most decentralized exchanges: the user gets tools for market analysis, risk management and order tracking.

The 1inch platform does not charge withdrawal and purchase fees. At the same time, the fee for Gas (the internal currency for transactions in Ethereum) is saved. The exchange has its own CHI Gas token. The token can be used to pay transaction fees with a 42% discount.

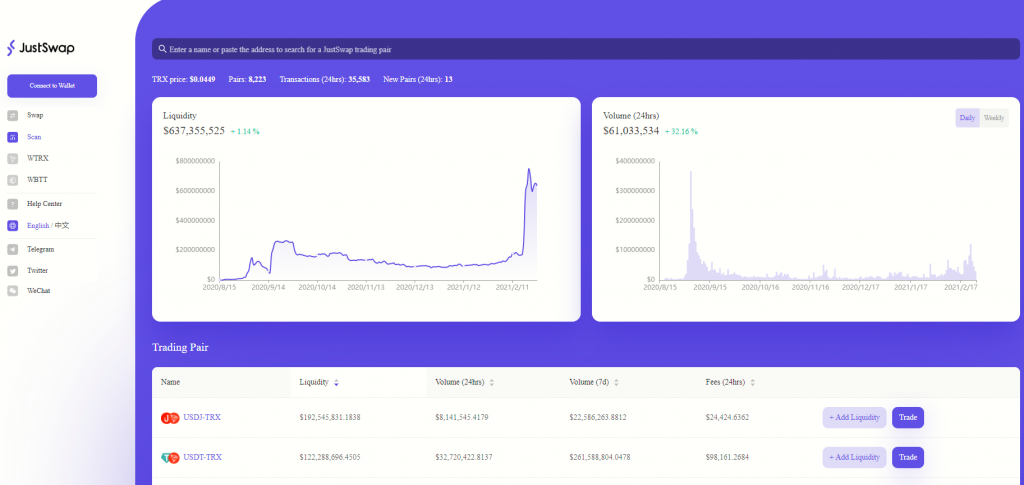

JustSwap

JustSwap is a decentralized exchange (DEX) powered by the Tron blockchain. The platform became TRON’s first decentralized exchange protocol. Exchange users can exchange TRX and TRC-20 tokens instantly and without fee.

The JustSwap exchange only supports the TronLink Wallet. The wallet can be used through Chrome and the iOS and Android app. Listing of tokens, like on other decentralized exchanges, takes place without the participation of the administration of the service. Because of this, there are quite a few fake tokens on the platform, as well as on Uniswap.

JustSwap Interface

The problem of fake tokens is solved in the same way as on Uniswap. To verify tokens, you must enter the address of the token smart contract in the search bar. Justin Sade, the creator of JustSwap, announced the work on a mechanism that can filter fake tokens.

One of the ways to make money on JustSwap is to provide liquidity. Users who add liquidity to the exchange receive a percentage of the transaction fees on the exchange.

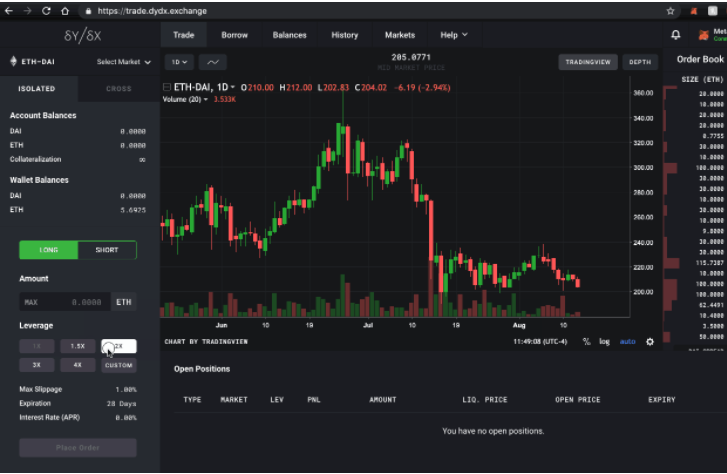

dYdX

The dYdX Decentralized Exchange (DEX) operates on the Ethereum blockchain. The key difference between the exchange and other decentralized platforms is the possibility of margin trading and trading in perpetual futures. All supported assets can be exchanged, borrowed and lent on the exchange.

With margin trading on dYdX, leverage up to 5x is available. Available pairs are ETHDAI, ETHUSDC, DAIUSDC. Perpetual futures are only available for BTCUSDC with up to 10x leverage. Credits are provided in ETH, DAI and USDC. Starting LTV is 75%, liquidation starts at 85% LTV.

dYdX Interface

dYdX aggregates spot and credit liquidity from multiple decentralized exchanges. Users can track portfolio performance. Deposits in ETH, DAI and USDC are also possible. There is no minimum term for deposits. Interest on deposits is calculated immediately, approximately every 15 seconds (each block).

While trading on dYdX exchange, a fee is traditionally charged for maker and taker. There is less fee for the maker as it creates liquidity. The taker takes liquidity.

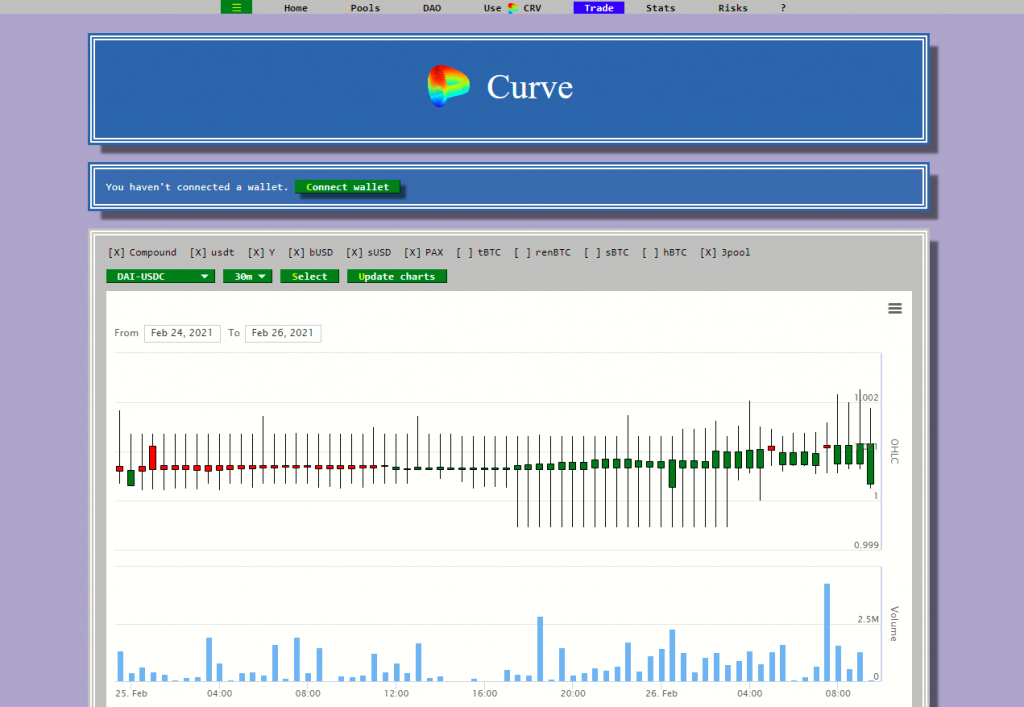

Curve Finance

Curve Finance is a decentralized exchange (DEX) powered by the Ethereum blockchain. The exchange has 7 liquidity pools. Some of them are equipped with a lending protocol. Credit protocols run in the background. It allows you to receive interest for adding liquidity to the pool.

Interest rates are not fixed and may vary depending on the market situation. This is the case for all decentralized exchanges. Current rates can be found on the official Curve Finance website.

Curve Interface

One of the key features of Curve Finance is stablecoin trading. The platform uses algorithms developed specifically for stablecoins. Their main advantages are low fee and minimal slippage.

The Curve Finance platform has its own yToken and CRV token. The first is the yield aggregator token. It allows you to find the pool with the best interest rate. CRV is a control token. It was received by all exchange users who participated in pools.

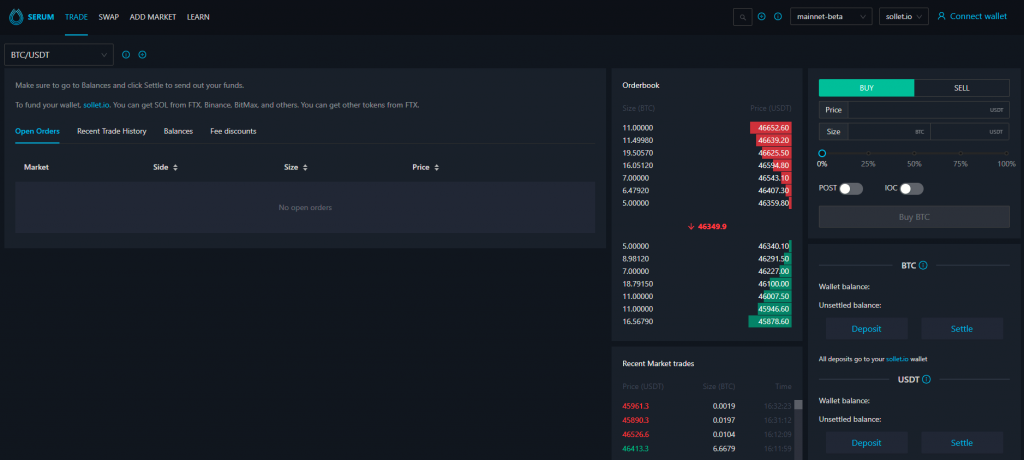

Serum Dex

Serum Dex is a decentralized exchange, powered by the Solana blockchain (SOL). At the same time, the platform is compatible with Ethereum and Bitcoin. The project has its own SRM token. It has been listed on exchanges such as BitMEX, HBTC, 1inch, etc.

Serum Dex implements a decentralized oracle. Transaction fees are lower than earlier blockchain networks. At the same time, the speed of execution of transactions is higher.

Serum DEX Interface

For interaction with other blockchain networks and internal regulation, the Serum Dex platform has issued its own tokens – SerumBTC, SerumUSD and a governance token. SerumBTC is pegged to Bitcoin. The SerumUSD stablecoin has an ERC-20 standard and is used for cross-chain contracts. The control token is analogous to BNB. Provides a discount on trading fees.

SRM token staking is available for investors on the Serum Dex exchange. To participate in staking, 10 million SEMs and one MegaSerum (MSRM) must be locked. One MSRM equals one million SRM.

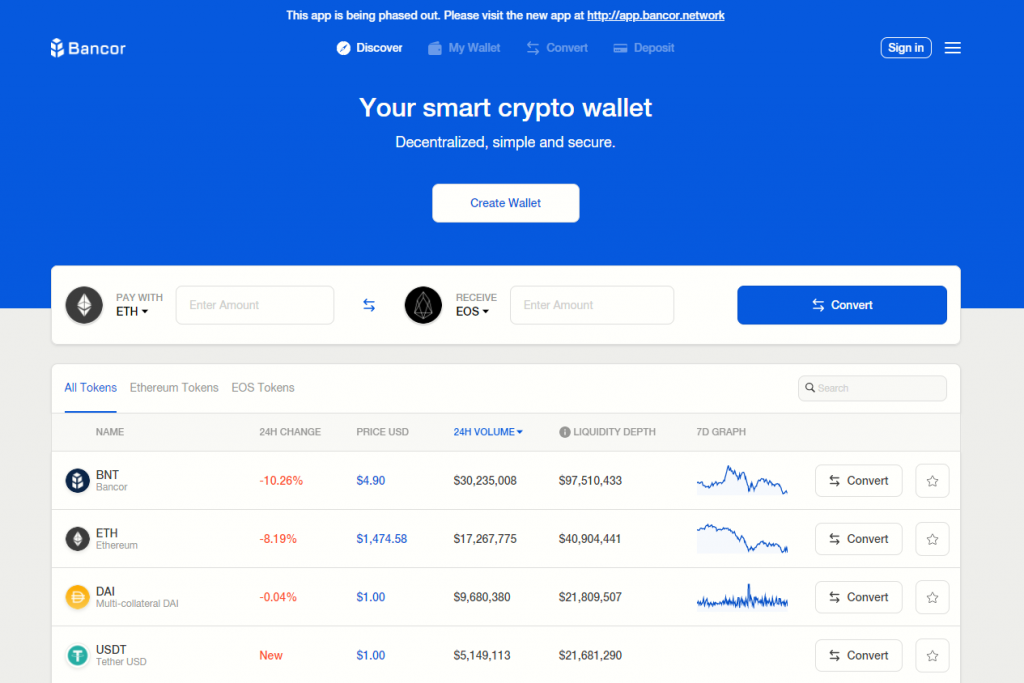

Bancor Network

Bancor Network is a decentralized exchange (DEX) powered by the Ethereum blockchain. The native token of the BNT platform is used to form the Bancor Network structure.

The main feature of Bancor Network protocol is that the exchange of tokens takes place directly with the platform. No second party is required. The platform protocol ensures the constant availability of tokens in reserve. The balance of tokens is determined by the Permanent Reserve Ratio (CRR).

Bancor Network Interface

Bancor Network users can create Ethereum-based smart tokens. Initially, the developer sets the number of smart tokens. Subsequently, the amount is regulated by sales and purchases within the platform.

Bancor Network provides high liquidity to tokens. Each token has a reserve, so transactions take place instantly, regardless of demand. There are no fees for exchanging tokens on the platform. Buying / selling coins occurs with minimal volatility. There is practically no spread.

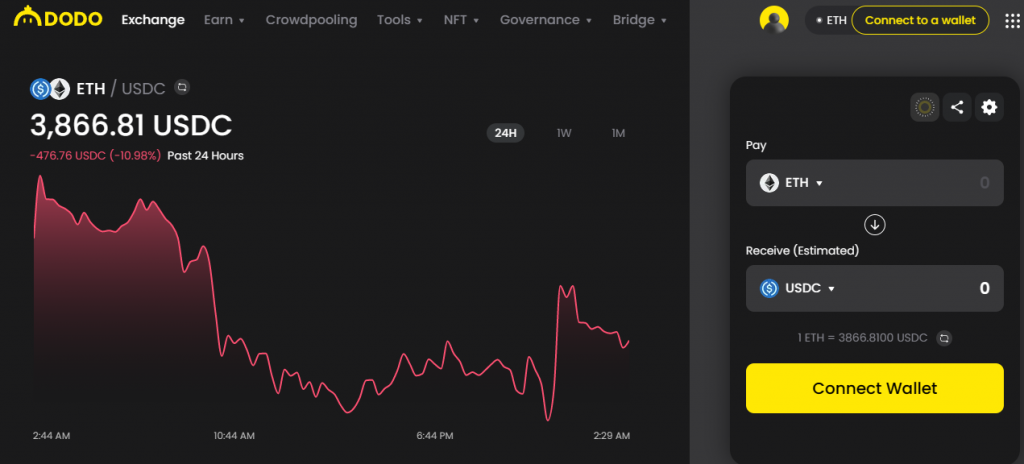

DODO

DODO decentralized exchange uses a multi-chain architecture. The exchange can be used through the Ethereum, BSC, Polygon and Huobi ECO Chain networks. ECR-20 tokens are supported.

DODO uses a proactive market maker (PMM) system implemented through a blockchain oracle. This system is used to reduce fees and increase the speed of transactions. DODO Smart Trade aggregator compares liquidity sources and finds asset offers at the best price.

DODO Interface

On the DODO exchange, an exchanger, liquidity pools, crowdfunding, stablecoin mining (staking) and vDODO are available. vDODO is the exchange’s own token. Token holders receive a percentage of the exchange’s trading fees and can participate in staking using the Proof-of-Membership protocol.

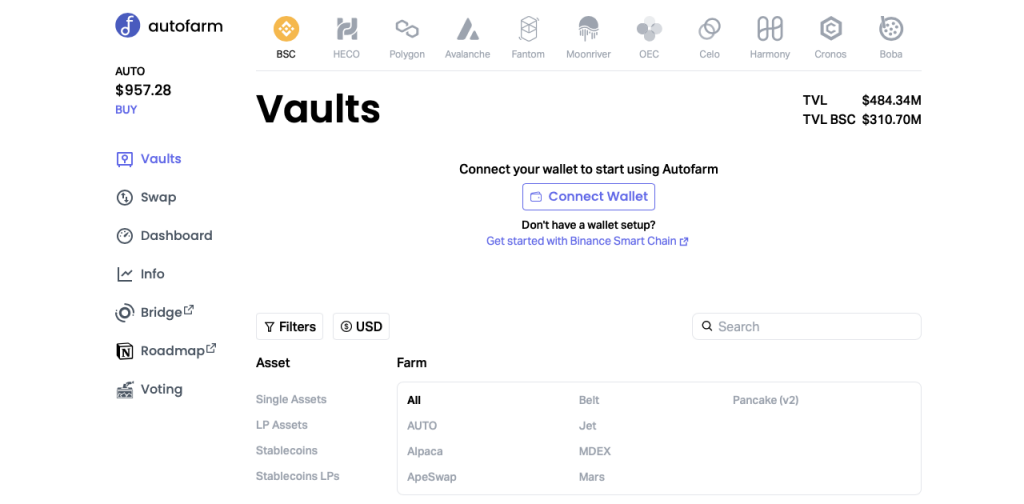

Autofarm

The Autofarm platform is based on a multi-chain protocol. Autofarm can be used through 11 blockchain networks, including BSC and Polygon. The platform primarily acts as a farming aggregator.

AutoSwap Exchanger is a DEX aggregator supporting BSC, Polygon and Avalanche networks. The exchanger protocols analyze the liquidity of PancakeSwap, HyperSwap and other exchanges and distribute transactions along different routes. This helps to find better exchange rates and reduce the risk of slippage.

Autofarm Interface

Staking of the AUTO token is available on Autofram – the platform’s own token. AUTO is mined through the Proof-of-Stake-Allience protocol. Token staking is available only for users of the pool of the same name.

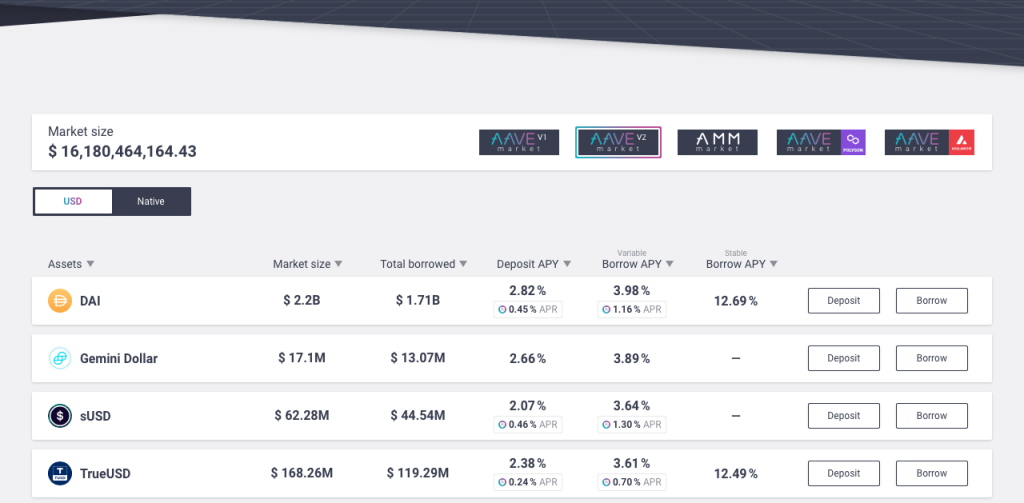

Aave

The Aave platform on the Ethereum blockchain serves as a decentralized exchange (DEX) and lending protocol. Aave users can also use the Polygon blockchain network for landing and lending purposes.

Lending and escrowing on the Aave platform is implemented through liquidity pools. Investors block funds in the pool, for which they receive interest and a portion of fees. Borrowers take funds from these pools. To participate in lending, you need to open a deposit.

Aave Interface

To use the Aave Swap exchanger, you must open at least one deposit on the platform. Due to this, the exchange increases liquidity and reduces the risk of slippage. In addition to lending, depositing and exchanging, staking of AAVE and BPT tokens is available on the platform.

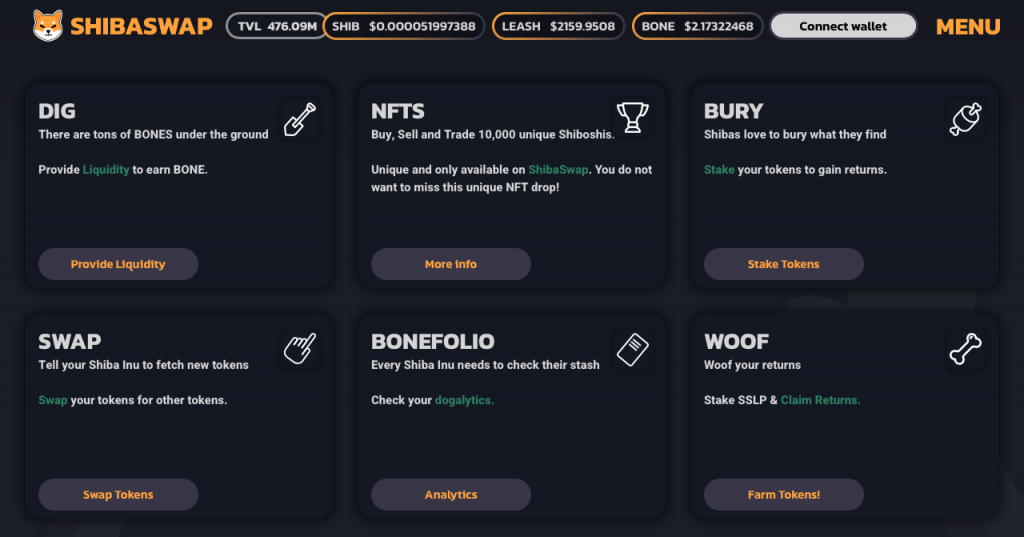

ShibaSwap

ShibaSwap decentralized exchange operates on the Ethereum blockchain network. The ecosystem of the exchange is built on three ECR-20 tokens: SHIB, LEASH and BONE. SHIB token is the main asset of the settlement. It is used for trading, holding and calculation purposes.

In addition, liquidity pools are available on the ShibaSwap exchange, farming and staking are implemented. The LEASH token is used to work with farming pools. BONE serves as a reward for deliveries to liquidity pools, farming and staking, and acts as a governance token.

ShibaSwap Interface

SHIB, LEASH and BONE staking is available on ShibaSwap. ShibaSwap exchanger is a classic DEX exchanger. Supports only work with ECR-20 tokens.

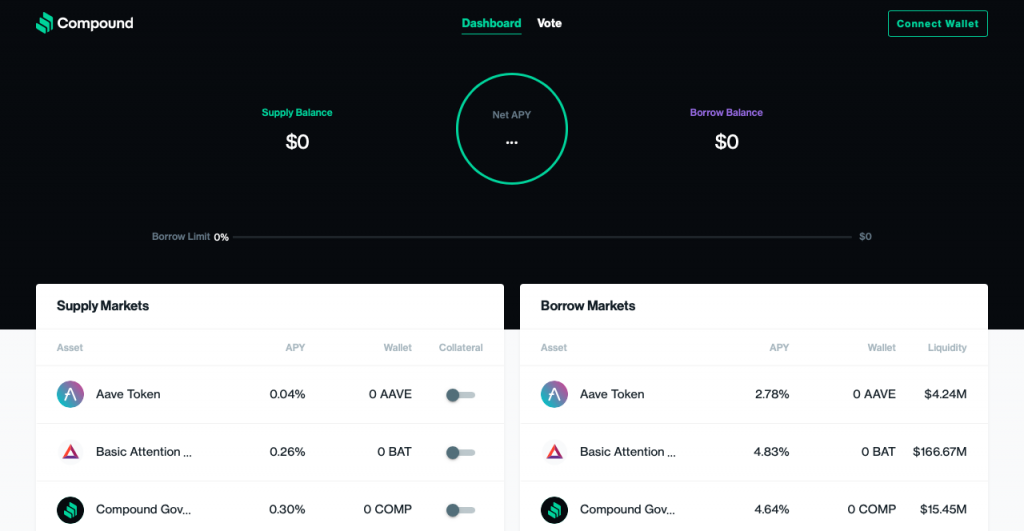

Compound

The Compound service is a lending and landing platform based on the Ethereum blockchain. Lending and landing service markets operate through liquidity pools. The operation of the platform is supported by the COMP service token, which is also used as a control token.

Currently, Compound has 10 markets for participation in liquidity pools. The list is gradually expanding through decentralized voting.

Compound Interface

New tokens are integrated into the Compound protocol through a smart contract with Tokens. The smart contract creates an analogue of the cryptoasset used in Compound. The amount of the reward depends on the amount of the deposit.

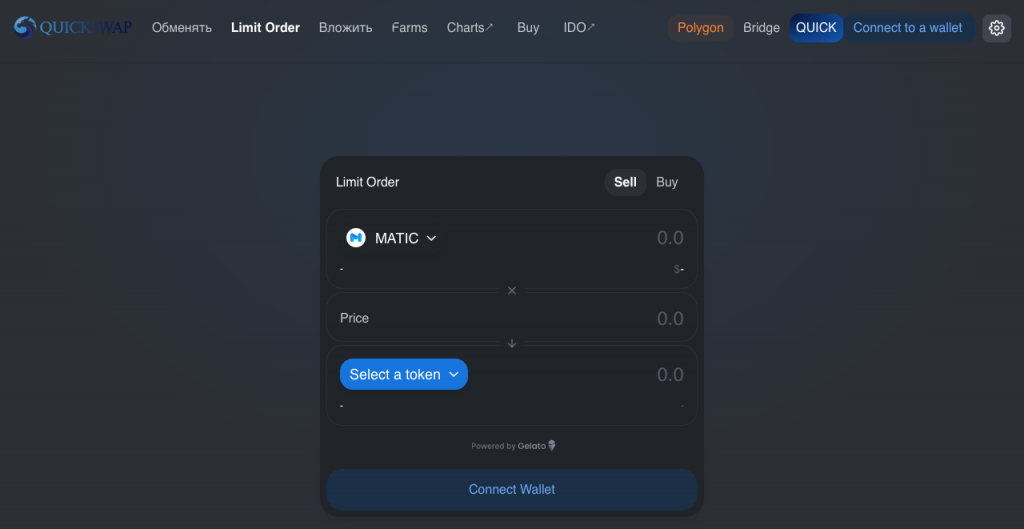

QuikSwap

QuikSwap decentralized exchange operates on the Polygon blockchain network based on the Ethereum infrastructure. ECR-20 tokens are traded on the platform. Currently, more than 100 tokens and about 200 liquidity pools are available on QuikSwap.

QuikSwap liquidity providers are rewarded from token exchange fees. Funds are allocated according to the QUICK share of each supplier.

QuikSwap Interface

Farming pools provide an opportunity to earn on the Proof-of-Stake protocol and the provision of funds for lending. When staking QUICK tokens, users receive dQUICK tokens, which increases their share in the liquidity pool. Also, QUICK holders can take part in community management.

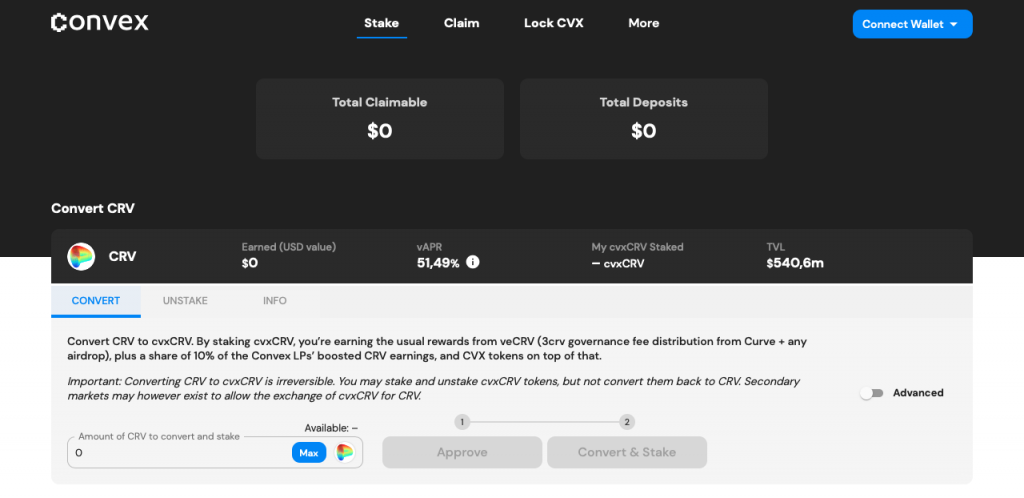

Convex Finance

The Convex Finance decentralized staking service is linked to Curve exchange and uses its protocols. Convex integrates Ethereum, Polygon, Fantom and xDai blockchain networks.

Convex Finance allows Curve users to generate additional income from liquidity pools without blocking additional CRV tokens. To increase income from liquidity pools on Curve, it is necessary to carry out a boost – freeze CRV tokens.

Convex Finance Interface

When a user receives income from Curve fees, he can boost CRV without blocking tokens. The reward will be generated through staking of the Curve LP liquidity provider tokens. Holders of Curve LP tokens can stake on Convex Finance.

O3 Swap

The O3 Swap decentralized exchange operates on the Ethereum, BNB Smart Chian, Polygon, NEO and Huobi ECO Chain blockchain networks. The use of multiple networks allows for cross-network transactions. The exchange protocol selects transaction routes to minimize transaction fees.

O3 Swap is a DEX aggregator. The exchange protocol compares the token rate on different decentralized exchanges. Uniswap, SushiSwap, PancakeSwap, Curve and other decentralized exchanges are integrated on the platform. While exchanging, the aggregator takes into account at least three exchanges for each network.

Interface O3 Swap

Other exchanges are also integrated into the O3 Swap liquidity pools. For popular trading pairs, the exchange has its own cross-chain pools. Liquidity providers are rewarded in O3 tokens.

Wrapped Bitcoin

The Wrapped Bitcoin (WBTC) platform is designed to issue WBTC tokens on the Ethereum and Tron blockchain networks and issue ETH on the Tron network. The WBTC token of ECR-20 standard is an analogue of BTC, its value is backed by the value of Bitcoin.

The Wrapper Bitcoin service is integrated into the protocols of various decentralized exchanges, including Uniswap, Aave, and Compound. WBTC and WETH tokens are the basis of the protocol. The smart contract used to create tokens freezes the same amount of BTC / ETH on Wrapped Bitcoin accounts. Bitcoin and Ethereum liquidity is supported directly.

WBTC Interface

Wrapped Bitcoin allows you to trade BTC on the Ethereum and Tron networks, ETH on the Tron network. Using the protocol allows you to bypass centralized exchanges and slow BTC transactions. Holders of WBTC and WETH can participate in lending, farming and staking programs on various decentralized exchanges.

Honeyswap

The Honeyswap exchange is based on a multi-chain architecture: Polygon and xDai blockchain networks are supported. Exchange users have access to ECR-20 tokens. Honeyswap is implemented as a single decentralized application (dApp), but some features are only available through the 1Hive community site.

Honyeswap implements an exchanger, liquidity pools and farming. While funds are blocked in pools, liquidity providers receive a percentage of platform fees. Farming Honeycomb is based on providing additional liquidity and is based on the Proof-of-Stake protocol.

Honeyswap Interface

Holders of the HNY project token have the right to participate in project management through voting. Also implemented the COMB control token. When allocating liquidity pools, 1/12 goes to finance HNY, 1/12 goes to finance COMB. The rest of the funds are evenly distributed among the liquidity providers in the form of HNY.

Venus

Venus is a decentralized landing and crediting service running on BNB Smart Chain. Landing and crediting are implemented through liquidity pools: the user deposits funds into the pool, borrowers take out a loan secured by other tokens. Liquidity providers receive interest on the use of their assets.

Staking is also implemented on the platform. VAI and XVS staking programs are presented. The reward for participation in the program is paid daily, you can withdraw funds at any time.

Venus Interface

VAI is a synthetic stablecoin pegged to the US dollar. By placing funds in the liquidity pool, users receive vTokens that can be converted to VAI. XSV is also paid as a reward for providing funds in the pool.

Maker DAO

MakerDAO is a decentralized lending system based on Ethereum blockchain network. Lending was implemented through the Oasis smart contract. The user opens a collateralized debt position (CDP) and receives DAI tokens. It is a stablecoin pegged to the US dollar.

The stability of the MakerDAO protocol is ensured by the MKR token. MKR holders can participate in community governance through voting. Depending on the voting results, it is possible to make a profit.

Oasis Interface

MakerDAO has a stabilization fee, liquidation system, and penalties. The stabilization fee is intended to support the DAI rate and is added to the user’s debt when taking out a loan. Liquidation – writing off the collateral against the debt. For the liquidation of funds, an additional fee is charged, that is, a fine.

Conclusion

The DeFi field is actively developing and gaining more and more popularity. In addition to decentralized exchanges, collectible NFT tokens and blockchain games attract new users to the cryptocurrency market. The popularity of DEX exchanges is due to anonymity: no verification is required, funds are stored in the user’s cryptocurrency wallet. Transactions take place on the P2P principle, that is, directly between users, without intermediaries.

Decentralized exchanges differ from centralized ones (Binance, etc.) in anonymity, transparency of transactions and low fees. At the same time, decentralized exchanges do not bear any responsibility for the safety of users’ funds. The possible risks should be taken into account while choosing an exchange. We wrote more about the differences between decentralized and centralized exchanges here.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT