Best Pair for Scalping: Optimal Currency Choices for Scalpers

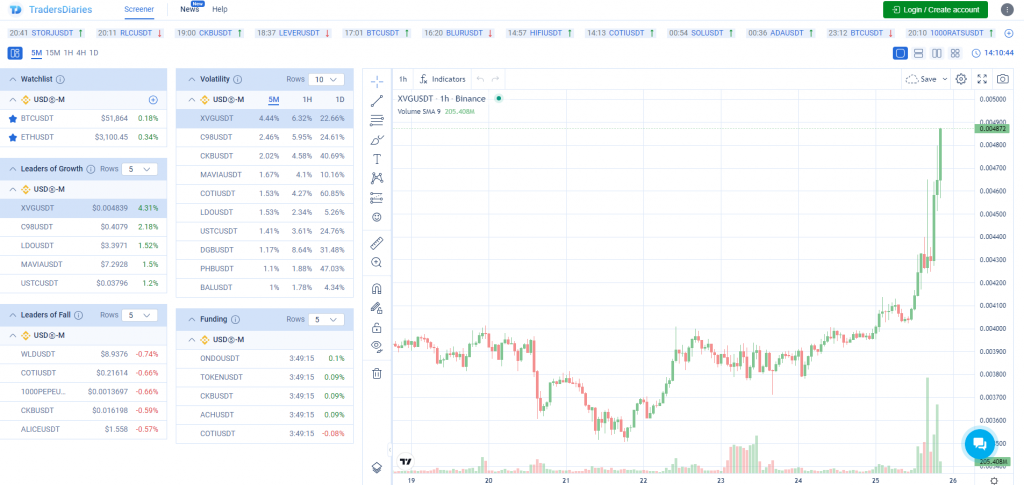

When you’re engaged in cryptocurrency trading, it is important to know how to choose the best pair for scalping. CScalp explains how to do so using a free crypto screener and trading signals, as well as other techniques.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

CScalp free screener can be used to select the best pair for scalping

Understanding Scalping Currency Pairs

Scalping is a trading method to pursue profits in the crypto market through a series of quick trades.

Fundamentals of Scalp Trading

Scalping involves making numerous trades over a short period – often seconds to minutes – to accumulate small gains that add up over time. You aim to exploit the natural market volatility by entering and exiting positions rapidly. Here are the core elements:

- High-frequency Trading: Execute a high volume of trades within a day.

- Short-term Profit: The focus is on making quick, small gains rather than holding assets long-term.

Who are Crypto Scalpers?

As a scalper in the cryptocurrency market, you exhibit specific traits:

- Quick Decision-making: You analyze market trends and make trades in a matter of seconds.

- Risk Management: Despite the rapid pace, you must effectively manage risk to prevent significant losses.

Crypto Scalping vs. Other Trading Styles

Scalping is distinct from other trading styles by its pace and goals:

- Day Trading: While day traders may make a few trades per day, scalpers may execute hundreds.

- Swing Trading: Swing traders hold positions for days to weeks, seeking larger market moves.

- Position Trading: Position traders maintain a long-term outlook, holding for months to years, contrasting sharply with the short-term focus of scalping.

Top Tools to Identify the Best Pair for Scalping

The Free Cryptocurrency Screener by CScalp offers a great solution, providing you with real-time data and analytics to spot the best trading opportunities in the crypto market. Alongside, CScalp’s Trading Signals give you clear, actionable insights on when to jump in and out of trades to make the most of your moves. Let’s take a closer look at how these tools can elevate your trading strategy.

Free Cryptocurrency Screener by CScalp

The Free Crypto Screener by CScalp is a tool designed to streamline the experience for traders, especially those who specialize in scalping. It enables you to efficiently track the most volatile instruments across major exchanges like Binance, Bybit, and OKX. The screener simplifies the process of monitoring price movements by displaying data in a user-friendly tabular interface, which includes the top 30 most volatile tickers and allows for sorting based on different timeframes. The integration of TradingView charts within the screener also enhances its utility by providing detailed candlestick charts and various technical analysis indicators.

Free Cryptocurrency Screener by CScalp

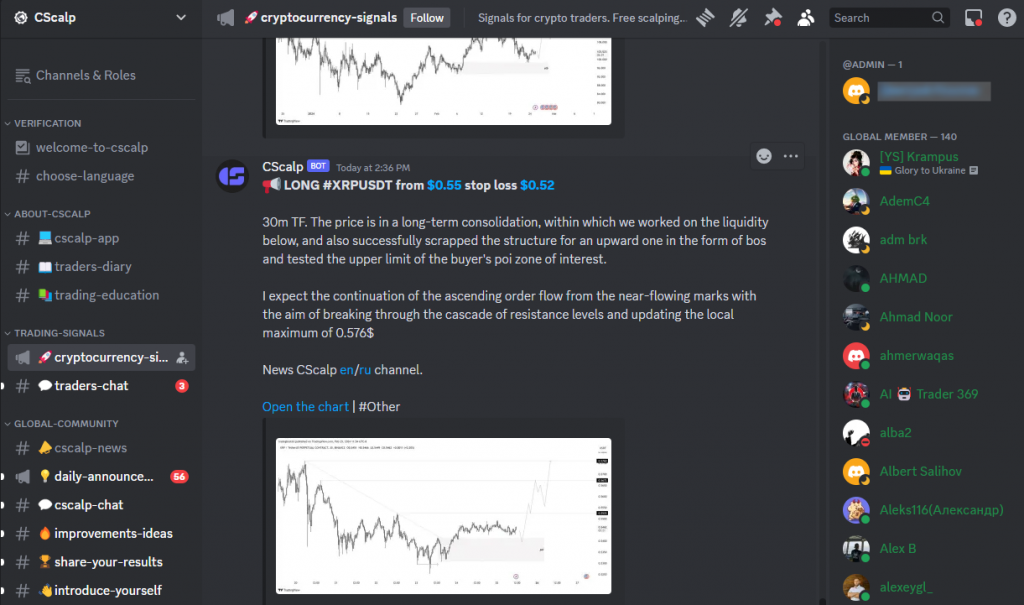

CScalp’s Free Trading Signals

CScalp’s Free Trading Signals provide an edge for those looking to master scalping. By delivering real-time, expert-analyzed signals directly through Discord, this free service empowers traders to quickly identify and act upon lucrative scalping opportunities. Both new and experienced traders can easily interpret and utilize these insights to their advantage. With the emphasis on community and educational resources, traders are supported not just by signals, but also by a wealth of knowledge and a network of peers. This approach will enhance your ability to spot the best pairs for scalping to capitalize on market movements.

Free crypto trading signals by CScalp

Technical Considerations for Scalping Crypto

When scalping cryptocurrencies, precision and efficiency are paramount. You’ll need to use a professional terminal like CScalp, analyze quick price movements, aim for tight spreads to minimize costs, as well as consider the implications of slippage and fees.

Analyzing Price Movements

In scalping, your success hinges on recognizing rapid price changes. Utilize tools like moving averages and volume-weighted average price (VWAP) to determine short-term momentum and entry points. For instance, a moving average crossover can signal an entry opportunity when a short-term average crosses above a longer-term one, indicating upward momentum.

- Moving Average Crossover: Entry indication when the short-term average exceeds the long-term average.

- Volume-Weighted Average Price (VWAP): Helps to identify the market direction within the day

Importance of Tight Currency Spreads

Tight spreads are vital for scalping, as they minimize transaction costs and enable you to seize small profit margins. In cryptocurrencies, the spread is the difference between the bid and the ask price. Digital currencies like Bitcoin (BTC) and Ethereum (ETH) generally have tighter spreads, which are more conducive to scalping strategies.

- Bitcoin (BTC): Often has one of the tightest spreads among cryptocurrencies.

- Ethereum (ETH): Also known for relatively tight spreads.

Impact of Slippage and Fees

Slippage can affect your trades, especially in the crypto market, where orders may not be executed at the anticipated price due to high volatility. Your ability to anticipate and manage slippage can be the difference between profit and loss. Additionally, factor in any fees charged by the exchange, as they can erode profits on small trades.

- Anticipate Slippage: Use limit orders to control the maximum price you’re willing to pay.

- Commissions: Always account for the exchange’s fees in your trading strategy.

Operational Aspects of Scalping

In cryptocurrency scalping, attention to detail in the exchange selection, time management, and financial discipline are paramount to becoming profitable. These operational components help you maximize opportunities and minimize risks during fast-paced trading sessions.

Choosing the Right Exchange

When looking for a good exchange for crypto scalping, ensure that they are compatible with your trading terminal (e.g., CScalp), and offer low transaction fees since frequent trades will accumulate costs. Look for:

- Fee Structure: Preferably a flat-rate fee or a percentage that aligns with high-frequency trading.

- Compatibility: Select an exchange that is compatible with a trading terminal of your choice.

- Execution Speed: Rapid trade execution is essential.

Trading Sessions and Timing

Scalping in crypto markets can be particularly profitable during peak trading sessions when liquidity is highest. Volatility is a scalper’s friend, and finding times when the crypto market is most active will provide more opportunities for small, rapid trades. Consider:

- 24/7 Markets: Crypto markets operate round the clock, unlike traditional markets.

- Market Overlaps: Identify periods when multiple global markets are active, increasing potential trade volume.

Financial Risk and Money Management for a Scalper

Proper risk management is critical in scalping, as even small losses can add up quickly. Setting Stop-Loss orders can help you exit a position to avoid significant losses. Your money management strategy should involve:

- Trade Size Limits: Never risk more than a small percentage of your capital on a single trade.

- Profit Targets: Set realistic profit goals and stick to them.

- Stop-Loss Orders: Utilize Stop-Loss orders to protect your capital.

These operational strategies are the cornerstones for engaging successfully in cryptocurrency scalping.

The free CScalp trading terminal makes risk management easy by allowing users to manually or automatically set Stop-Loss orders and protect their investments in just a few clicks. To download our platform and start scalping today, simply leave your email in the box above, and you will receive a download link.

Top Practical Insights for Scalpers

Successful cryptocurrency scalping hinges on understanding the nuances of the market you’re entering. As a scalper, your focus should be on rapid trade execution and leveraging small price movements.

Good Scalping Pairs for Beginners

When starting out with scalping in cryptocurrencies, it’s crucial to choose pairs with high liquidity and volatility as they provide more opportunities for small, frequent trades. Bitcoin (BTC/USD) and Ethereum (ETH/USD) are popular choices. Ensure you have a reliable crypto exchange that offers real-time data and swift transaction speeds.

- Select pairs carefully: Base your choice on liquidity and volatility.

- Learn the platform: Get comfortable with the trading terminal’s interface and features.

For more insights into the best pair for crypto scalping, explore our recent article, “The Best Crypto Pair for Scalping: Turn Your Trades into Profits with the Optimal Crypto Pair.”

Top Mistakes and Pitfalls

A common pitfall for beginners is not setting a tight Stop-Loss which can result in significant losses. As a scalper, every second counts, and the delay in decision-making could be costly. Be disciplined with your risk management strategies.

- Be disciplined: Always use Stop-Losses to limit potential losses.

- Avoid emotional trading: Don’t let fear or greed drive your decisions.

One tool that can be very helpful when it comes to developing discipline and recognizing patterns in your trading style is a trading journal. CScalp offers a free Trading Diary that helps track all of your trades and is a valuable tool for analyzing both your wins and losses over time.

Advancing Scalping Skills

To refine your scalping skills, develop an analytical approach by keeping abreast of market news and trends affecting your chosen crypto pairs. As you mature as a trader, consider incorporating technical analysis indicators like Moving Averages or RSI to identify entry and exit points more effectively.

- Use technical analysis: Employ indicators to help determine trade timings.

- Stay informed: Monitor crypto news to anticipate market movements.

Best Pair for Scalping – Conclusion

We’ve delved into the critical aspects of selecting the optimal currency pairs for scalping, underlining the importance of liquidity, volatility, and market dynamics that play pivotal roles in the success of scalping strategies.

Scalping demands a high level of discipline, a thorough understanding of the market, and an adeptness at technical analysis. By focusing on these key elements, scalpers can navigate the crypto markets more effectively, maximizing profitability while minimizing risks.

If you are new to the world of scalping or simply wish to expand your horizons, we suggest you explore some of our free resources on CScalp TV. On our YouTube channel, we share a wide variety of videos that focus on scalp trading as well as other topics relevant to cryptocurrency trading.

FAQs: Frequently Asked Questions About Best Pairs for Scalping

As you explore the landscape of cryptocurrency scalping, there are some key aspects you’ll need to understand for a successful trading experience.

What Are the Top Cryptocurrency Pairs Recommended for Scalping Strategies?

When considering scalping in the crypto market, pairs like BTC/USDT (Bitcoin) and ETH/USDT (Ethereum) are popular due to their high liquidity and volatility, which provide more frequent scalping opportunities. Check CScalp’s free crypto screener to find other best pairs for scalping.

Which Indicators Provide the Most Effective Results for Scalping Techniques?

Effective indicators for crypto scalping include the Moving Average Convergence Divergence (MACD) and Bollinger Bands, which help to identify market momentum and potential entry or exit points. Remember that most scalpers trade densities that you can identify by using the free trading terminal by CScalp.

What Are Ideal Cryptocurrency Pairs for Novice Traders to Start Scalping?

As a novice crypto scalper, you might find pairs like BTC/USD and ETH/USD to be suitable given their widespread availability on exchanges and the ample resources available to learn about their market behaviors.

What Is the Optimal Time of Day to Engage in Cryptocurrency Scalping?

Crypto markets operate 24/7, but the optimal time for scalping often aligns with the highest market activity, which can coincide with overlap hours between major global market trading times.

Which Strategies Are Highly Regarded for Successful Scalping in the Markets?

Some successful strategies in crypto scalping include using limit orders for better control over entry and exit points and employing Stop-Loss orders to manage risks associated with rapid price movements.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT