Binance Staking: Earn Passive Income with Cryptocurrencies

Binance has revolutionized the way we perceive and interact with digital assets. Through Binance staking, you can unlock a world of passive income, leveraging cryptocurrencies to earn interest and participate in network governance. From conventional staking to the more nuanced DeFi staking and yield farming, Binance not only empowers you to amplify your investment but also provides mechanisms to mitigate inherent risks. In this article, CScalp will delve into the intricacies of staking on Binance, exploring its benefits, risks, and the myriad of options available.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Understanding the Core of Cryptocurrency Binance Staking

Staking is the process of participating in the proof-of-stake (PoS) consensus mechanism by locking up a certain amount of cryptocurrency to support network operations, such as transaction validation, security, and governance. ‘How to choose the best staking platforms?’ becomes a pivotal question in this context, especially if you are looking to maximize your investment returns. When it comes to platforms like Binance, it is not merely about locking up your cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), Zero (ZRO), or Cardano (ADA). It’s about strategically participating in network governance, ensuring network security, and contributing to the stability of the blockchain, all while earning rewards through Binance staking incentives.

Binance Staking Options

Binance offers a spectrum of staking options, each with its unique risk profiles and potential returns. Conventional Binance staking, on the one hand, allows you to participate in network security and governance, enhancing the stability of the blockchain network and earning rewards. On the other hand, Binance DeFi staking opens up a gateway to decentralized finance (DeFi), allowing you to earn rewards by participating in various DeFi protocols, thereby supporting the decentralization and development of financial frameworks on the blockchain.

Binance Staking Options

Binance offers a spectrum of staking options, each with its unique risk profiles and potential returns. Conventional Binance staking, on the one hand, allows you to participate in network security and governance, enhancing the stability of the blockchain network and earning rewards. On the other hand, Binance DeFi staking opens up a gateway to decentralized finance (DeFi), allowing you to earn rewards by participating in various DeFi protocols, thereby supporting the decentralization and development of financial frameworks on the blockchain.

Conventional Staking: The Foundation of Passive Income

Conventional staking on Binance allows you to participate in network security and governance by locking up your assets, thereby earning rewards and enhancing the stability of the blockchain network. This method provides you with a secure and straightforward way to earn passive income while contributing to the overall health and security of the blockchain.

Binance DeFi Staking

Engaging in DeFi staking, you collaborate with third parties (be it companies or other users) who borrow your cryptocurrencies at a certain percentage. Governed by smart contracts, this method minimizes the risk of fraud. The standout benefits of this staking type include rapid fund withdrawal (with compensation accrued daily, eliminating the need to wait a month) and a potentially high yield, soaring up to 100% per annum, contingent on the cryptocurrency and duration.

How Does Binance Staking Work?

When you hold a cryptocurrency that utilizes a proof of stake (PoS) blockchain, you have the opportunity to stake your tokens. By staking, you secure your funds, contributing to the security and functionality of the network’s blockchain. In exchange for locking up your assets and participating in network validation, validators reward you with staking incentives in that cryptocurrency.

You also have the option to create a wallet that enables staking.

If your tokens are housed in one of these wallets, you can delegate the portion of your portfolio you wish to stake. To find a validator, you might select from various staking pools, pooling your tokens with others to enhance your chances of generating blocks and reaping rewards

Benefits of Staking Cryptocurrencies on Binance

Binance staking stands as a testament to the evolution of financial systems, offering a secure platform to earn, learn, and participate in the cryptocurrency market. These are the benefits of Binance staking:

Earn Passive Income

Staking allows you to earn passive income, especially if you have no intention of selling your cryptocurrency tokens soon. Without staking, this income from your cryptocurrency investment would remain unrealized.

Ease of Getting Started

You can initiate your staking journey immediately through Binance’s official website, mobile or desktop app.

Support of Your Preferred Crypto Projects

Staking not only benefits you but also the blockchain projects you support. Staking also provides the supplementary benefit of bolstering the security and efficacy of the blockchain projects you endorse. By allocating a segment of your funds to staking, you fortify the blockchain’s defenses against potential attacks and augment its transactional proficiency.

The Mechanics Behind Proof of Stake (PoS) in Binance

PoS is a consensus mechanism that allows you as a cryptocurrency holder to “stake” your assets in a network, thereby participating in block creation, transaction validation, and securing the network against malicious activities. It stands as an energy-efficient alternative to the traditional proof of work (PoW) used in mining. The platform provides many options, including DeFi staking and NFT staking, ensuring a diverse range of opportunities for investors.

The Role of Validators in Staking

Validators are network participants who lock up their coins as a “stake” and are subsequently responsible for processing transactions and creating new blocks. In return for their services and locked assets, validators earn staking rewards, enhancing their investment through passive income.

Binance and DeFi: A Symbiotic Relationship

Binance DeFi staking allows you to earn rewards by participating in various DeFi protocols, offering a high-yield investment avenue while simultaneously supporting the decentralization and development of financial frameworks on the blockchain. This symbiotic relationship not only empowers you with additional earning opportunities but also propels the development and adoption of DeFi protocols.

Navigating Through DeFi Protocols

With a plethora of DeFi protocols available, Binance provides a curated selection, ensuring you have access to secure and rewarding DeFi staking options. From lending protocols to decentralized exchanges, Binance DeFi staking offers a range of options, each with its unique risk and reward profile.

Mitigating Risks and Ensuring Secure Binance Staking

While Binance staking offers lots of opportunities, it’s crucial to navigate through the potential risks and ensure a safe staking experience. From understanding the lock-up periods to evaluating the volatility of assets, you must tread cautiously.

Lock-Up Periods in Binance Staking

When you engage in Binance staking, understanding lock-up periods is crucial. These periods, during which your staked assets are held in a staking contract, can influence your liquidity and impact your ability to capitalize on market fluctuations. When you stake your assets, you commit to lock-up periods where your tokens are held in a staking contract and cannot be accessed. While this allows you to earn rewards, it also means that your assets are not readily available for trading or withdrawal, potentially causing you to miss out on trading opportunities or need liquidity in case of market volatility.

The implications of lock-up periods are:

- Commitment: You commit to holding a certain amount of cryptocurrency for a specified period.

- Reward Potential: Often, longer lock-up periods may offer higher staking rewards.

- Reduced Liquidity: Assets cannot be accessed for trading or selling during the lock-up period.

Binance’s Approach to Lock-Up Periods

Binance offers a variety of staking options with different lock-up periods, ranging from flexible staking with no lock-up period to staking with predetermined lock-up durations. This allows you to choose a staking option that aligns with your investment strategy and liquidity needs.

Each period offers unique opportunities and considerations:

- Fixed Staking: Here, you select a convenient asset placement period and, in return, receive a fixed payout at its conclusion. Beware, though, if you retrieve your coins prematurely, your anticipated compensation is forfeited.

- Flexible Staking: This method allows you to place assets without a fixed timeframe, granting you the freedom to withdraw coins at any moment without sacrificing your compensation. However, it’s worth noting that the stakes tend to be significantly lower compared to fixed staking.

As you navigate through these staking options, consider your financial strategy and risk tolerance to select a path that aligns with your investment goals.

Understanding Liquidity in Binance Staking

Liquidity in Binance staking refers to the ease with which an asset can be converted into cash or a cash equivalent without affecting its price. In staking, liquidity is influenced by factors such as lock-up periods and the inherent liquidity of the staked asset.

Liquidity Considerations when Staking on Binance

In the realm of staking, particularly on a platform like Binance, liquidity considerations revolve around two primary facets: asset accessibility and prevailing market conditions.

- Asset Accessibility: The ability to quickly access staked assets, especially in flexible staking options.

- Market Conditions: The state of the market, which can influence the demand and price of a cryptocurrency.

Binance and Liquidity Management

Binance provides options like flexible staking, which allows you to retain a degree of liquidity, enabling you to unstake your assets at any time. This ensures that you can strategically pivot according to market conditions, providing a balanced approach to earning rewards while maintaining liquidity.

Striking a Balance: Lock-Up Periods and Liquidity in Binance Staking Strategy

You need to align your financial goals, risk tolerance, and liquidity needs when choosing a staking option on Binance. Whether prioritizing liquidity or maximizing rewards through longer lock-up periods, Binance provides a spectrum of options to cater to diverse needs.

Risk Management in Staking

Understanding and managing the risks associated with lock-up periods and liquidity is crucial. You need to consider market volatility, financial position, and investment goals when determining your staking strategy.

Diversification in Staking Strategy

Consider diversifying your staking strategy by allocating assets in both flexible and locked staking, balancing the pursuit of higher yields with maintaining adequate liquidity.

Addressing Security and Network Risks

Ensuring network security and safeguarding against malicious activities is paramount. Binance employs robust security protocols and provides you with resources, such as a frequently asked questions (FAQ) section and a blog, to stay informed and secure.

Continuous Monitoring of Cryptocurrencies

Keeping a close eye on market conditions and adjusting your staking strategy accordingly to navigate through the volatile cryptocurrency market.

Binance Staking: Rewards, Taxes, and Profits

Staking on Binance provides a steady stream of passive income and involves considerations regarding tax implications and profit calculations.

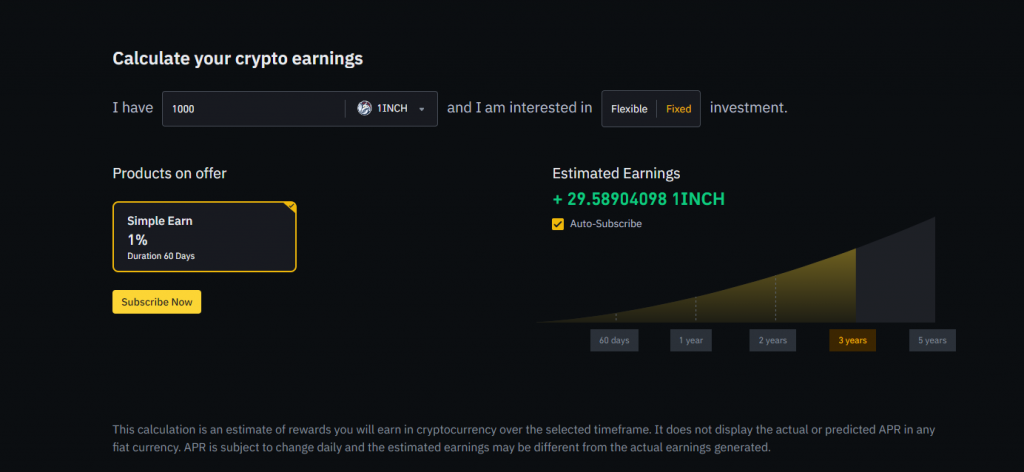

Calculating Rewards and Understanding Profit Margins

Binance provides transparent pricing and reward structures, enabling you to calculate potential earnings and understand the profit margins of various staking options.

Tax Implications of Staking Rewards

Understanding the tax implications of staking rewards is crucial for compliance and accurate reporting. Utilizing tools like CoinTracking can assist you in managing your crypto transactions and tax calculations efficiently.

What is Binance Yield Farming?

Yield farming involves lending your assets to a DeFi platform, often through a liquidity pool, and earning returns in the form of interest and additional tokens. Yield farming offers potentially lucrative returns, but comes with its set of complexities and risks. Binance, while providing access to yield farming opportunities, also ensures that you are well-informed and prepared to work with this tool.

Canva

The Risks and Rewards

Yield farming, often associated with high returns, also comes with substantial risks, including smart contract vulnerabilities and impermanent loss. Binance provides resources and information, ensuring that you understand the volatility risk, potential returns, and sustainability of yield farming protocols.

Strategies for Sustainable Yield Farming

- Developing a sustainable yield farming strategy involves understanding the associated risks, potential returns, and the stability of chosen protocols. Binance offers insights and tools, such as technical analysis and risk management features, to assist users in developing strategies that align with their investment goals and risk tolerance.

Striking a Balance in Binance Staking

Binance staking is a tool where the digital and financial worlds intertwine, offering opportunities to earn, learn, and contribute to the field of cryptocurrencies. From understanding the core mechanics of staking and exploring the diverse options available on Binance, to diving into the depths of DeFi and yield farming, you are empowered to harness the potential of your digital assets in various innovative ways.

Binance

While the pros such as passive income, diverse options, and platform security make it an attractive option, it’s imperative to weigh them against the cons like liquidity concerns, market volatility, and regulatory risks. Striking a balance that aligns with your investment goals and risk tolerance is key to performing Binance staking effectively.

The platform balances offering lucrative staking and yield farming opportunities by ensuring you have access to comprehensive information and tools to manage risks, understand tax implications, and formulate strategic investment decisions.

Moreover, Binance’s approach to liquidity and lock-up periods provides a flexible framework, enabling you to tailor your staking strategies to align with your financial goals, risk tolerance, and liquidity needs.

As we delve into the future, where blockchain technology and cryptocurrencies continue to evolve and permeate various facets of our digital and financial landscapes, platforms like Binance stand as pillars that not only provide access to these technologies but also play a pivotal role in shaping the future of digital finance. Through staking, yield farming, and participation in network governance, every user becomes a vital participant, contributing to the growth, security, and evolution of the digital assets ecosystem.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT