Bitcoin Trading: Start Learning Crypto Trading and Make Your First BTC Transaction With CScalp

The CScalp training terminal team has prepared a comprehensive guide for mastering Bitcoin trading. Explore insights, strategies, and essential tips to navigate the cryptocurrency market successfully. Whether you’re a beginner or an experienced trader, discover the world of Bitcoin trading and unlock the potential for financial success.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Discover the World of Cryptocurrency Trading

Cryptocurrency is a form of digital currency that relies on cryptographic techniques for secure transactions. It operates on a decentralized ledger called the blockchain, which records all transactions across a network of computers. Let’s delve deeper into some aspects of cryptocurrency trading you should know about before making your first transaction.

- Cryptocurrency Market: The cryptocurrency market encompasses a wide array of digital assets beyond Bitcoin. Get acquainted with the various cryptocurrencies available (BTC and altcoins), their use cases, and how market dynamics affect their values. Stay updated on market capitalization, trading volumes, and learn to interpret market trends to make informed trading decisions.

- Cryptocurrency Exchanges: Cryptocurrency exchanges are the platforms where you can buy, sell, and trade digital assets. Learn about centralized and decentralized exchanges, their features, and the factors to consider when selecting an exchange. Stay updated on exchange security measures and how to conduct transactions securely.

- Professional Trading Tools: To take full advantage of Bitcoin trading, try the professional trading platform CScalp by leaving your email in the form above. With the free terminal, you will be able to connect to an exchange and place orders with one click, automatically set Stop-Loss and Take-Profit targets, as well as manage your risks.

- Wallets and Security: To keep your assets safe, you will need a digital wallet. Explore the different types of wallets, such as hardware, software, and paper wallets, and understand how to protect your private keys.

What Is Bitcoin?

Bitcoin is the first and most well-known cryptocurrency, created by an anonymous entity known as Satoshi Nakamoto.

The fundamental features of Bitcoin include its limited supply, security through cryptographic proof-of-work concept, and the decentralized nature of its network. These characteristics make Bitcoin a unique digital asset.

Additional information you should know about Bitcoin to trade successfully:

- Market Dominance: Bitcoin’s dominance refers to its share of the total cryptocurrency market capitalization. Explore in our blog how Bitcoin’s dominance impacts the market sentiment and influences the price movements of other cryptocurrencies. This knowledge will help you assess market trends effectively.

- Trading Strategies: Effective trading strategies are essential for success in Bitcoin trading. Dive into various strategies such as day trading, swing trading, and long-term investing, and select the one that suits you best. It is also helpful to understand technical analysis, candlestick patterns, and chart indicators to make well-informed trading decisions tailored to Bitcoin’s unique price behavior.

- Risk Management: Cryptocurrency trading involves risk, and understanding how to manage it is crucial. Explore risk management techniques, including setting Stop-Loss orders, diversifying your portfolio, and calculating position sizes. These strategies will help protect your investments and minimize potential losses in the volatile crypto market.

Start Your Bitcoin Trading Journey With CScalp

Connect a cryptocurrency exchange of your choice to the free CScalp professional trading platform for a seamless trading experience.

Select a Bitcoin exchange suitable for trading with CScalp:

- Binance

- Bybit

- Huobi

- OKX (OKEx)

- dYdX

- BitMEX

- Bitfinex

- Phemex

Place Orders via CScalp

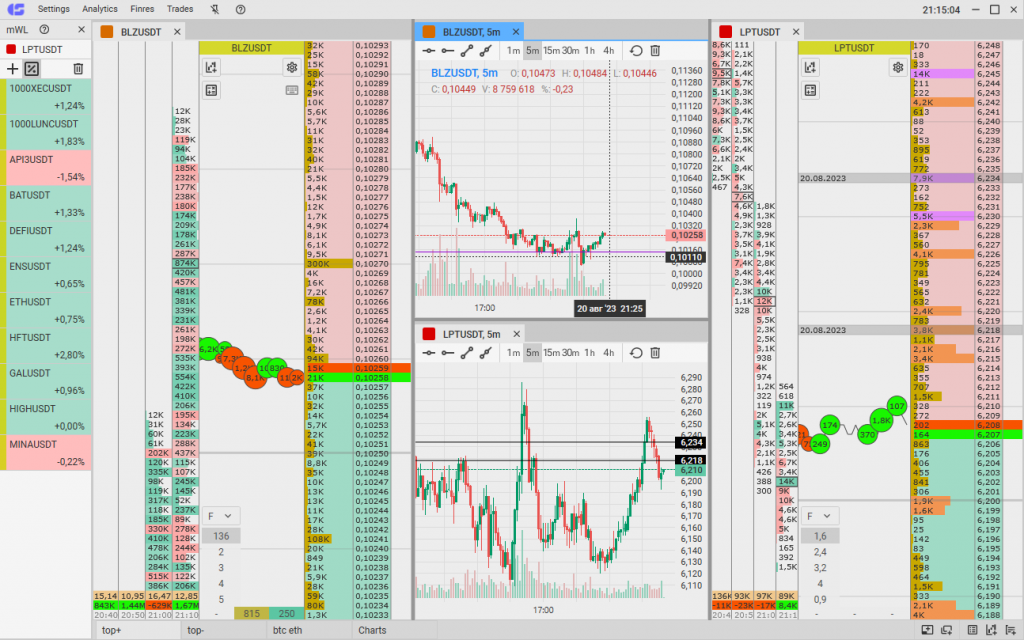

After connecting the cryptocurrency exchange to the free terminal, learn how to make your first trade by placing the orders within the order book. In CScalp, it is possible to start trading with one click of the mouse. The left mouse button is for buying, and the right mouse button is for selling. Orders are placed at the selected price in the order book.

Understand the Order Book

Get familiar with the order book and how it impacts your trading decisions. Sellers are represented in red and buyers in green. Prices are arranged from smallest at the bottom to largest at the top.

Practice Placing Orders

Practice placing and canceling orders multiple times. Try executing a trade and promptly closing it with the opposite order for minimal losses. Improve your mouse proficiency through practice sessions.

CScalp free professional trading terminal

Crypto Exchange Options

When it comes to cryptocurrency exchanges, there are two primary types: centralized and decentralized. Centralized exchanges (Binance, Bybit, OKX, etc.) act as intermediaries, offering a user-friendly interface for trading. In contrast, decentralized exchanges (dYdX) enable peer-to-peer trading directly from your wallet, promoting enhanced privacy and control. Understanding the differences between these exchange types will help you choose the one that aligns with your trading preferences.

Cryptocurrency exchanges come with a range of features, including various order types (e.g., market, limit, Stop-Loss), a wide selection of trading pairs, liquidity levels, and trading interfaces. Familiarize yourself with these features to optimize your trading experience. Keep in mind that user experience and security measures vary among exchanges, so choose one that suits your needs.

Selecting the right Bitcoin exchange is pivotal for a successful BTC trading journey. Begin by researching the exchange’s reputation and track record. Look for user reviews and testimonials to gauge the experiences of other traders. Consider factors such as trading fees, deposit and withdrawal options, customer support, and the range of supported cryptocurrencies. Additionally, ensure that the exchange complies with relevant regulations in your jurisdiction.

Prioritize security when using cryptocurrency exchanges. Verify that the exchange employs robust security measures such as two-factor authentication (2FA), encryption, and cold storage of user funds. Some exchanges even offer insurance coverage for potential losses due to security breaches. Be proactive in securing your account by enabling 2FA and regularly updating your login credentials.

Mastering Cryptocurrency Trading

For a solid foundation in cryptocurrency trading, delve into the technical aspects. Understand how mining works, including proof-of-work (PoW) and proof-of-stake (PoS) consensus algorithms. Explore the concept of smart contracts and their role in web3 decentralized applications (DApps). This deeper knowledge will empower you to make informed decisions and engage in advanced cryptocurrency activities.

Elevate your trading skills by exploring advanced strategies such as margin trading and leverage in our blog. Be aware that these strategies carry higher risks and require careful risk management.

Technical analysis is a key tool for traders. Master chart patterns, support and resistance levels, moving averages, and oscillators. Use these technical indicators to analyze price charts and make data-driven trading decisions. Combine technical analysis with fundamental analysis for a comprehensive approach to cryptocurrency trading.

Strengthen your security practices to protect your cryptocurrency holdings. Consider using hardware wallets for long-term storage, multi-signature wallets for added security, and cold storage solutions to keep your assets offline and safe from threats. Regularly update your wallet software to patch any vulnerabilities. Be cautious of phishing attempts and only use trusted sources for wallet downloads and updates.

Learning to Stay Ahead of the Market

- Market Research: Staying informed about the latest cryptocurrency developments is crucial. Follow reputable news sources, subscribe to cryptocurrency-related newsletters, and monitor social media channels for updates. Keep an eye on regulatory changes and major announcements from influential figures in the crypto space. In-depth market research will help you make timely and informed decisions.

- Market Analysis: Develop the ability to analyze market trends and patterns. Understand the factors influencing price movements, such as market sentiment, supply and demand dynamics, and macroeconomic events. Learn to anticipate market shifts and adjust your trading strategy accordingly. A data-driven approach will assist you in identifying profitable opportunities.

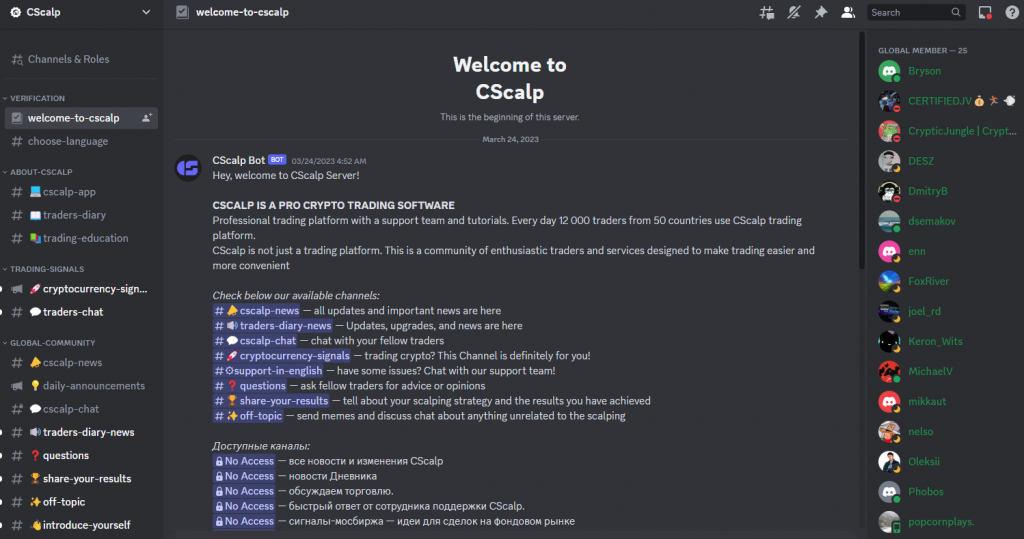

- Community Engagement: Engaging with the cryptocurrency community provides valuable insights and a sense of camaraderie. Collaborating with peers allows you to gain diverse perspectives on market trends, trading strategies, and emerging projects. We invite you to join our Discord server. Your insights, questions, and discussions will be a valuable addition to our growing community of traders.

Join the CScalp Discord server

Secure Your Investments

Risk Mitigation Strategies

Safeguarding your investments in the cryptocurrency market is of paramount importance. Here are key risk mitigation strategies to consider:

- Setting Stop-Loss Orders: When trading cryptocurrencies, it’s crucial to set Stop-Loss orders. These orders automatically sell your assets if their prices reach a predetermined level, limiting potential losses. Remember that CScalp has implemented an automatic Stop-Loss feature that you can use to protect your assets.

- Diversification: Diversifying your portfolio involves spreading your investments across different cryptocurrencies (or even other assets). This strategy helps reduce risk by ensuring that poor-performing crypto won’t significantly impact your overall holdings.

- Position Sizing: Determine the appropriate size of each position relative to your overall investment capital. Avoid overexposing yourself to a single asset.

Cold Storage Solutions

Cold storage is an essential practice for securely storing cryptocurrencies, especially for long-term investments. Here’s what you need to know:

- Hardware Wallets: Hardware wallets are physical devices designed to store cryptocurrencies offline. They are immune to online threats and hacking attempts, making them one of the safest ways to protect your assets.

- Paper Wallets: A paper wallet is a physical document containing your cryptocurrency’s public and private keys. It provides an offline storage solution, ensuring that your assets are safe from digital threats.

Scam Awareness

The cryptocurrency space is unfortunately rife with scams and fraudulent schemes. Protect your investments by staying informed:

- Phishing Awareness: Be cautious of phishing attempts, where malicious actors impersonate legitimate services or websites to steal your private keys or login credentials. Always verify website URLs and double-check email sources.

- Ponzi Schemes and ICO Scams: Familiarize yourself with common scams like Ponzi schemes and fraudulent initial coin offerings (ICOs). Scammers often promise guaranteed returns (200 billion USD in returns doesn’t sound legitimate) or revolutionary projects to lure unsuspecting investors.

- Due Diligence: Before investing in any cryptocurrency project or offering, conduct thorough due diligence. Research the team behind the project, review their white paper, and assess their track record. Look for community reviews and feedback to gauge the project’s legitimacy.

Your Source for Crypto News

Importance of Up-To-Date Information: Staying informed with the latest cryptocurrency news is crucial for making well-informed decisions in this fast-paced market:

Market Influence: Cryptocurrency prices and market sentiment are highly influenced by news events, regulatory changes, and technological developments. Timely information allows you to react effectively to market shifts.

Decision-Making: Access to accurate and current information helps you make informed decisions when buying, selling, or holding cryptocurrencies. It enables you to anticipate market movements and adjust your strategies accordingly.

Reputable News Sources

To ensure you receive accurate and trustworthy cryptocurrency news, rely on reputable sources like CoinTelegraph:

Established News Websites: Established financial news websites often provide comprehensive cryptocurrency coverage. These sources have a reputation for accurate reporting and credibility.

Crypto-Focused Publications: Crypto-focused publications and blogs specializing in cryptocurrency news and analysis offer in-depth insights and commentary on the crypto market.

Community Insights: Engage with the cryptocurrency community through forums and social media channels. Discussions and insights shared by experienced traders and enthusiasts can provide valuable perspectives and real-time updates.

Analyzing News Impact

Learning how to assess the impact of news events on cryptocurrency prices and market sentiment is a valuable skill:

Market Reactions: Understand that major news announcements can trigger rapid price fluctuations. Analyze how the market reacts to news and distinguish between short-term volatility and long-term trends.

Fact-Based Decisions: Avoid making impulsive decisions based solely on news headlines. Instead, use a data-driven approach by considering the broader context and potential implications of news events on the cryptocurrency market.

By staying informed through reputable sources and analyzing news events effectively, you can navigate the cryptocurrency market with greater confidence and make informed trading decisions.

Get Started with Bitcoin Trading Today

Effective learning and practice are essential for success in cryptocurrency trading:

Start Small: Begin with a small amount of capital that you can afford to lose as you gain experience. Avoid risking large sums until you are confident in your trading skills and strategies.

Application of Knowledge: Apply the knowledge you’ve gained through research and education to real-world trading scenarios. Keep a trading journal to track your progress, record your decisions, and learn from both successful and unsuccessful trades.

When you decide to start your Bitcoin trading journey, visit our blog, “Beginner’s Guide: How to Make Money with Bitcoin in Simple Steps“, and learn what you need to know to enhance your experience.

Community Engagement

Engage with the cryptocurrency community to enrich your knowledge and network with fellow enthusiasts:

Forums and Meetups: Participate in cryptocurrency forums and attend local or online meetups to exchange ideas and insights with like-minded individuals. Collaborating with peers can accelerate your learning curve and provide valuable support.

Online Discussions: Join online discussions on social media platforms and specialized cryptocurrency communities. Engage in conversations about market trends, trading strategies, and emerging projects. Sharing and receiving insights from others can broaden your perspective.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT