Bitfinex markets and fees: Review for traders

Bitfinex cryptocurrency exchange provides access to the spot and futures markets, as well as the margin market. In this article, we review each of the markets, analyze Bitfinex trading fees and methods of reducing them.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Bitfinex spot market

Bitfinex spot market offers trading paired with fiat currencies (USD, EUR, GBP and JPN) and cryptocurrencies (BTC, ETH, USDT, EOS, XCHF, CNHT, EURT, XAUT and MIM). TradingView charts are integrated into the Bitfinex interface for technical analysis purposes.

There are two modes of spot market:

1. Exchange trade: conversion of available assets.

2. Margin trading: trading with leverage.

Funds are not provided by the exchange on Bitfinex, but by the users. The percentage and format (one-time payments or daily) are set by the lenders. The maximum leverage is 10x.

The user can apply for funding while opening a margin position. To do this, you need to specify the amount, interest rate and period. There is also an option for opening a margin position, in which the system will automatically select a user who is ready to provide his funds at the best rate currently available.

Bitfinex spot market

Derivatives markets

Bitfinex futures market offers perpetual contracts: cryptocurrency contracts, as well as contracts for commodities and stocks.

A feature of perpetual derivatives is the absence of expiration (end date). This is a more flexible instrument than traditional futures. A trader holds a position in perpetual contracts for as long as needed.

The maximum leverage for derivatives trading on Bitfinex is 100x. Leverage determines the amount of collateral provided.

Margin funding

Bitfinex exchange provides a margin funding feature that is directly related to margin trading. Users can lend to other traders through a peer-to-peer financing platform (P2P, trade between users without intermediaries). This gives a certain percentage of income, which depends on the funding rate, duration and amount of funds.

As soon as there is a buyer for the proposed offer, it will immediately be executed. Interest is paid at the agreed rate until the borrower repays the funds. The risk of funding is low, thanks to the limitation mechanism developed on the service.

Bitfinex fees

Bitfinex fee calculation depends on the following factors:

● type of order (maker or taker);

● trading volume for the last 30 days;

● the number of UNUS SED LEO tokens (Bitfinex native token) on the trader’s account;

● type of deposit funds (fiat or cryptocurrency);

● fees for margin funding;

● referral link.

We talked about the maker/taker system in detail in the review on Binance fees.

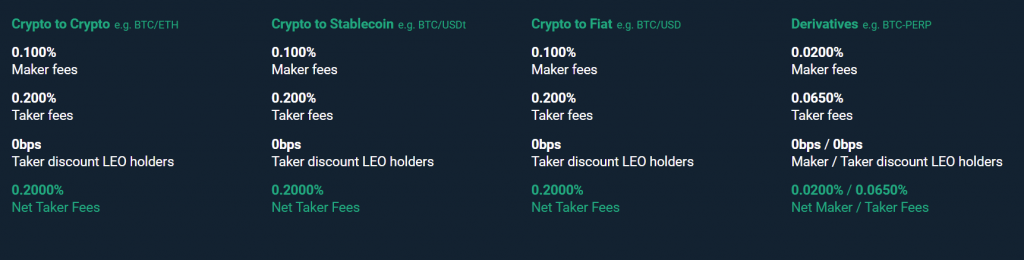

Bitfinex’s base spot market fee is 0.1% maker, 0.2% taker. Net maker and taker fees are shown in the table.

Fees table

The basic fee of the futures market is 0.02% maker, 0.065% taker.

There are also fees for funding traders:

● fee from the borrower of funds: calculated per second (details on the official website of Bitfinex);

● fee from the creditor: fee 15% or 18% (depending on the type of order).

For the convenience of calculating fees, you can use a special calculator on the website.

Discount for UNUS SED LEO holders

Users who own the UNUS SED LEO token receive some benefits. Discounts on trading volume vary depending on the amount of UNUS SED LEO held in the account for the previous month, as well as the type of transaction (maker / taker). Bitfinex has implemented a 3-tier discount system:

● 1st level. At least one TETHER (USDT) token in UNUS SED LEO tokens for the last month (calculated daily);

● 2nd level. At least 5000 USDT in UNUS SED LEO tokens;

● 3rd level. At least 10,000 USDT in UNUS SED LEO tokens.

Trading crypto-to-crypto and crypto-to-stablecoin pairs gives Level 1 users a 15% discount on fees. Level 2 users receive 25%. Tier 3 users receive a discount of up to 6 basis points.

Discount for UNUS SED LEO holders

CScalp referral link

New Bitfinex users can get a 6% off on the exchange’s trading fees when they sign up using the CScalp referral link. The discount works as a rebate – the return of part of the commission to the trader. Read more about getting a discount here.

Conclusion

The Bitfinex exchange is aimed at professional cryptocurrency traders. This is due to the minimum entry threshold of $10,000. The exchange has spot and futures markets, tools for passive income, and a flexible fee system. Therefore, Bitfinex will suit large participants with trading experience.

Binance, Bybit and other exchanges are popular among novice traders. You will find more cryptocurrency exchanges in our catalog.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT