How to Scalp Binance Futures: A Winning Strategy for Cryptocurrency Traders

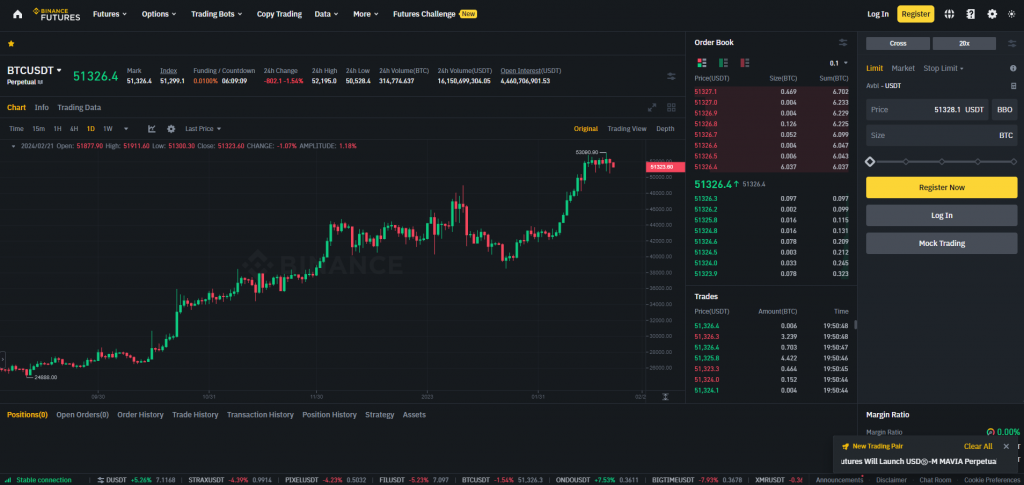

Scalping Binance futures is a popular strategy among cryptocurrency traders looking to take advantage of the best pair for scalping. With its wide range of liquid assets, low fees, and compatibility with CScalp, the crypto exchange is perfect for executing this short-term strategy. Find out how you can capitalize on small price movements with proper risk management.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Understanding How to Scalp Binance Futures

Binance Futures scalping is a dynamic and fast-paced strategy that focuses on taking advantage of short-term price movements in cryptocurrencies. This approach involves opening and closing positions within a short time period, often within minutes or even seconds.

Traders who engage in scalp trading on the Binance Futures platform aim to capitalize on even the smallest price fluctuations, seeking to generate profits quickly. This strategy requires a strong understanding of market dynamics, technical indicators, and risk management.

By executing multiple trades throughout the day, Binance Futures scalpers aim to compound smaller gains into larger profits over time. This style of trading can be highly rewarding for experienced traders who possess the necessary skills and discipline.

Successful scalpers of Binance Futures rely heavily on the availability of assets with high liquidity and tight spreads. They also use trading terminals like CScalp to open and close trades by using mouse buttons.

Traders looking to scalp Binance Futures should have a solid understanding of the market and utilize various indicators to identify potential entry and exit points.

To minimize risks, Binance Futures scalpers often employ tight Stop-Loss orders. These orders automatically trigger an exit from a position if the market moves against the desired direction, limiting potential losses.

In summary, scalping Binance Futures is a strategy that aims to profit from short-term price movements in cryptocurrencies. Traders must possess analysis skills, utilize appropriate indicators, and employ effective risk management strategies to succeed in this fast-paced trading approach.

Read more: The Best Crypto Pair for Scalping: Turn Your Trades into Profits with the Optimal Crypto Pair

The Importance of Utilizing a Professional Trading Terminal

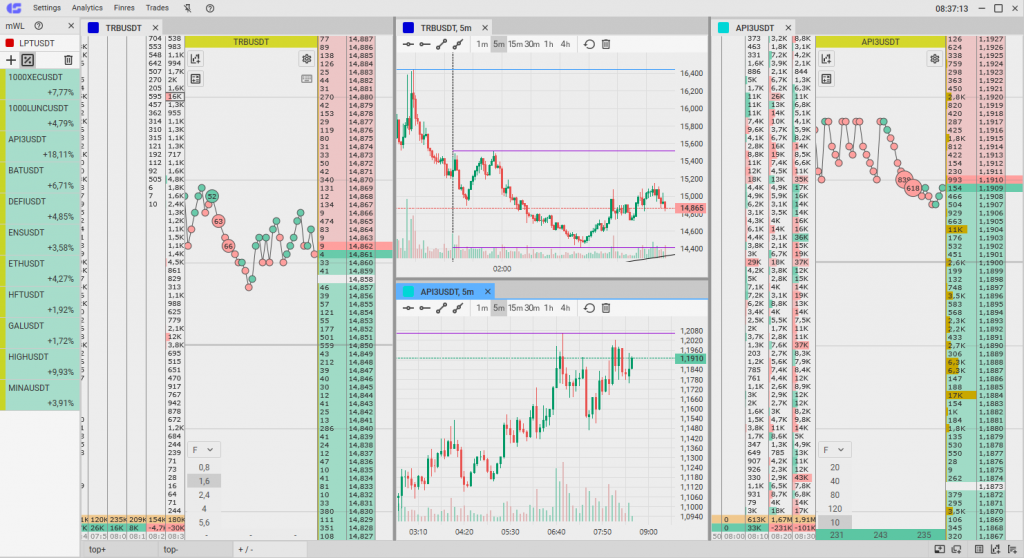

Utilizing professional trading terminals like CScalp for Binance Futures scalping is crucial for traders aiming to maximize their profits. These terminals offer a comprehensive suite of tools designed specifically for high-frequency trading, enabling traders to execute orders with lightning speed and precision.

By leveraging CScalp, traders gain access to real-time data, advanced charting tools, and customized trading strategies based on the order book, essential for identifying short-term market opportunities in the volatile cryptocurrency market. The ability to quickly analyze trends and execute trades can significantly enhance profitability.

Additionally, CScalp facilitates risk management features, allowing traders to set manual and automatic Stop-Loss and Take-Profit orders. This level of control is vital for traders looking to exploit the rapid price movements characteristic of the Binance Futures market, thereby ensuring they maximize returns while minimizing risks.

Benefits of Using Scalping Strategies in the Binance Futures Market

Scalping strategies have gained popularity among traders in the Binance Futures market due to their numerous benefits. By focusing on short-term price movements, traders can take advantage of quick profit opportunities with the order book.

Watch this video about scalping secrets and subscribe to CScalp’s YouTube channel to learn about more profitable strategies.

Here are some key benefits of using scalping strategies on Binance Futures:

- Profit Potential: Scalping allows traders to capitalize on frequent and small price movements, which can lead to significant profits over time. By executing multiple trades in a day, traders can accumulate profits without relying on significant market shifts.

- Reduced Exposure: The scalping strategy aims to minimize exposure to market fluctuations by quickly entering and exiting trades. This approach reduces the risk of adverse price movements and provides traders with more control over their positions.

- Liquidity Advantage: Binance Futures scalping offers a wide range of assets with high liquidity, making it an ideal platform for this trading style. Traders can easily enter and exit positions without significantly impacting the market price.

- Compatibility with CScalp: It is possible to integrate Binance Futures with the free CScalp trading platform for enhanced performance.

- Discipline: Scalping requires traders to adhere to strict entry and exit rules, fostering discipline in their trading approach. This can lead to improved decision-making and risk-management skills over time.

- Efficient Use of Capital: By targeting small price movements, traders can effectively utilize their capital while maintaining a favorable risk-reward ratio. This allows for diversification and higher potential returns.

Overall, the Binance Futures scalping provides traders with the potential for consistent profits, reduced exposure, and flexibility in various market conditions. However, it is important for traders to continuously assess market conditions and implement proper risk management techniques to maximize the benefits of this strategy.

Technical Indicators for Successful Binance Futures Scalping

If you are looking to scalp Binance Futures, utilizing the right technical indicators can enhance your chances of making profitable trades. These indicators help you identify potential entry and exit points, as well as validate the strength of the market trends. Professional scalpers, however, mostly rely on the order book densities to determine when to open and close positions in the market.

Volume Indicator

Monitoring the volume is crucial for scalping. Increasing volume often accompanies significant price movements, indicating higher market participation. Volume spikes can validate price trends and confirm potential entry and exit points.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100. Typically, a reading above 70 indicates an overbought condition, suggesting a potential reversal or correction. Conversely, a reading below 30 indicates an oversold condition, signaling a possible buying opportunity.

Moving Average Convergence Divergence (MACD)

The MACD is a commonly used trend-following indicator. It consists of two lines, the MACD line and the signal line. When the MACD line crosses above the signal line, it indicates a potential bullish trend, signaling a buying opportunity. When the MACD line crosses below the signal line, it suggests a potential bearish trend, indicating a selling opportunity.

Bollinger Bands

Bollinger Bands consist of three lines: the upper band, the lower band, and the middle band. They help identify volatility and potential price breakouts. When the price touches the lower band, it suggests a potential buying opportunity, as the price may reverse and move back toward the middle band. Similarly, when the price touches the upper band, it indicates a potential selling opportunity.

Remember, these indicators are tools to assist you in making informed trading decisions. It’s important to combine them with your own analysis and market research to increase the probability of successful scalp trades.

Risk Management in Scalping

When engaging in scalp Binance Futures trading, implementing effective risk management strategies is crucial for minimizing potential losses and maximizing profits. Here are some essential risk management techniques to consider:

- Tight Stop-Loss orders: Placing Stop-Loss orders ensures that if the market moves against your anticipated direction, your position will be automatically closed, limiting potential losses.

- Position sizing: Determine the appropriate position size for each trade based on your risk tolerance and account balance. Avoid risking more than a certain percentage, such as 1%, of your account balance on a single trade.

- Monitoring leverage: If you choose to use leverage while scalping on Binance Futures, it is crucial to regularly monitor your leverage level and adjust it accordingly. Adjusting leverage can help manage potential losses and prevent overexposure.

- Utilizing Take-Profit orders: Setting precise take-profit levels enables you to lock in profits when the price reaches a predetermined target. This helps maintain disciplined trading and prevent giving back gains.

Implementing these risk management techniques can help traders navigate the inherent volatility of scalp Binance Futures trading. By carefully managing risk, traders can maintain a sustainable approach and improve their overall profitability.

If you are concerned with risk management in scalping, we encourage you to use the free CScalp trading terminal. CScalp has implemented an automatic Stop-Loss feature that you can use to protect your assets.

How to Scalp Binance Futures – Conclusion

Scalping Binance Futures presents an exciting opportunity for cryptocurrency traders to capitalize on short-term price movements. By leveraging indicators and employing effective risk management strategies, you can navigate the fast-paced environment of Binance Futures scalp trading with confidence.

Stay informed with the latest news and trending articles to enhance your skills and adapt your strategies to changing market conditions. With dedication and discipline, mastering the scalping of Binance Futures trading can unlock a world of profitable opportunities in the cryptocurrency market.

To start scalping Binance Futures today, leave your email in the box above to receive a download link for CScalp’s free trading platform, optimized for scalp trading. Start making a profit in just a few clicks with the free CScalp trading terminal!

To learn more about scalping as a trading strategy, visit our YouTube channel, CScalp TV, where our team has curated a wide selection of videos about scalping and other aspects of crypto trading.

Related article: Bybit Scalping: Boost Your Crypto Trading Profits with Effective Strategies

FAQs: Frequently Asked Questions About Scalp Binance Futures Trading

Can Anyone Participate in Scalping Binance Futures?

Yes, anyone with a verified Binance Futures account can participate in scalp trading. However, it is important to have a solid understanding of the market and risk management before engaging in this strategy.

What Is the Ideal Time Frame for Scalp Trading on Binance Futures?

The 1, 5, and 15-minute time frames are commonly used for scalp trading on Binance Futures. These time frames allow traders to identify small price movements that can be exploited for quick profits.

How Should I Manage Risk While Scalp Trading?

Effective risk management is crucial in scalp trading. Set Stop-Loss orders below support levels for long positions and above resistance levels for short positions. Additionally, never risk more than 1% of your account balance on a single trade.

Can I Apply Scalp Trading Strategies to Other Cryptocurrency Exchanges?

While scalp trading strategies can be applied to various exchanges, it is crucial to familiarize yourself with the specific features and trading conditions of each platform. Binance Futures offers a wide range of assets and favorable liquidity, making it a popular choice for scalp trading.

How Do I Get Started With Scalp Trading on Binance Futures?

To get started with scalp trading on Binance Futures, open a Binance Futures account and link it to the free CScalp professional terminal. Then familiarize yourself with the platform and its features, learn about different scalp trading strategies, and practice with small trade sizes before scaling up.

Can Scalp Trading Be a Profitable Strategy on Binance Futures?

Scalp trading can be a profitable strategy on Binance Futures if executed properly. It requires discipline, patience, and continuous learning. It is essential to test and refine your strategies, analyze your trades with a Trading Diary, and adjust your approach accordingly.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT