Futures are one of the most popular instruments in trading. CScalp explores the difference between standard futures vs. perpetual futures, as well as lists several popular platforms where quarterly and perpetual futures contracts are traded. We also invite you to visit our free futures trading course.

What Are Futures?

A future is a contract for the purchase or sale of an exchange asset in the future at a fixed price. The benefit of such a transaction lies in speculation on the price change of the underlying asset. Futures are traded on both stock and cryptocurrency exchanges.

The underlying asset is the asset from which the future derives its value. The underlying assets can be securities (stocks, bonds, etc.), commodities (oil, gas, etc.), national currency rates, and cryptocurrencies. As an example, let's consider a Brent crude oil futures contract on the stock exchange.

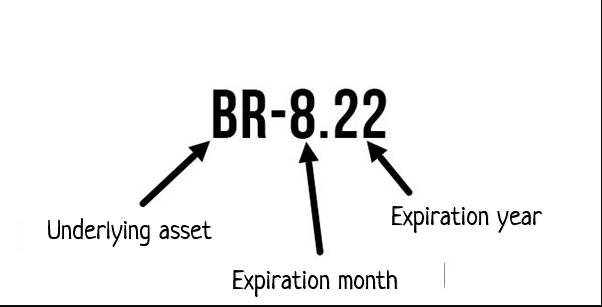

The underlying asset BR stands for Brent. The expiration date of the futures contract is 8/22: the month and year when the expiration (settlements between buyers and sellers) will occur.

To buy a futures contract, you do not need to pay its full price. It is enough to have funds in the account to cover the open position. If after buying the future, the price of the asset starts to move in an unfavorable direction, the margin amount will decrease. When the trader lacks funds to maintain the position, the exchange or broker forcibly closes the trade (known as liquidation).

In the futures market of stock exchanges, the concept of margin is important. Essentially, this is a cash deposit insurance in case one of the parties refuses to fulfill the obligations under the futures contract. When entering into a transaction, the trader's liquid assets are blocked as a margin. The size of the margin is determined by the exchange and is approximately 10% to 40% of the full price of the futures contract. After the successful closing of the transaction, the margin amount is unblocked.

Example of a Futures Transaction

Victor goes to the vegetable store to buy 50 kilograms of potatoes. However, the seller Stephen says that there are no potatoes available now and offers to sign a contract for purchase at a certain price, leaving a cash deposit for the delivery of potatoes. Thus, Victor buys a future on potatoes. When the price of potatoes rises, Victor can sell it at a higher price, making a profit from the price difference.

Types of Futures Contracts: Perpetual Futures vs. Standard Futures

Delivery Futures

Delivery contracts imply that at the end of the transaction, the buyer will receive the underlying asset, and the seller will receive money. The delivery of the underlying asset occurs at the settlement price on the last trading date.

Settlement Futures

Settlement contracts imply cash settlements between the parties of the transaction, without the delivery of the underlying asset. The seller and the buyer receive the difference between the contract price and the settlement price on the expiration day.

Perpetual Futures

Perpetual contracts operate on the same principle as settlement futures but without an expiration date. The buyer or seller can stay in the transaction as long as they need. This type of contract is very popular on cryptocurrency exchanges such as Binance. Let's delve deeper into perpetual futures.

How Do Perpetual Futures Differ from Delivery Futures?

The difference between perpetual futures and delivery futures is the absence of an expiration date (expiration). Traditional futures have a specific settlement date. There are weekly, bi-weekly, quarterly, and semi-annual delivery futures. A position in perpetual futures can be held by the trader for an indefinite amount of time and closed at any moment.

The operation of a perpetual contract is determined in hours (the exact time depends on the specific exchange). After the n-term expires, the exchange automatically "rolls over" (transfers/extends) the position in the perpetual contract to the next contract.

The absence of expiration is what makes perpetual futures popular. It is a flexible instrument that is traded with high leverage on most cryptocurrency exchanges. The potential profit when trading perpetual futures is higher than when trading on the Spot market. But so are the risks.

When trading perpetual futures, the funding rate mechanism is used. It is necessary to ensure periodic convergence of the futures price and the index price (the price of the underlying asset). The funding rate is a small amount paid by one party of the contract to the other. It is not related to exchange commissions.

The funding rate is set by the market and changes depending on the market situation. Typically, in a bull market, traders trading long (long position) pay traders trading short (short position). The opposite situation is characteristic of a bear market.

Why Futures Are Necessary

Futures, especially perpetual ones, are the main tool for active traders. This is due to several factors:

- Leverage: Futures instruments on cryptocurrency exchanges have high leverage to increase the size of the trader's position. The exchange provides leverage in the form of borrowed funds. However, it's important to understand that the higher the leverage, the higher the risks.

- Short trading: Shorting is selling an asset that the trader does not own at the time of sale. The exchange lends the asset so that the trader can bet on a price decrease and profit from the difference. There are no restrictions on short selling in futures.

- Liquidity: Futures have a high speed of transaction execution in the market. Liquidity allows for quickly buying or selling an asset.

- A wide variety of instruments: A vast number of futures instruments are available on almost all exchanges, both stock and cryptocurrency. This offers a convenient opportunity for diversifying a trader's portfolio.

- Low commissions: Typically, exchanges set low commissions for executing futures transactions, for example, compared to the stock market.

Where Are Perpetual Futures Traded?

Delivery futures and perpetual futures are traded on most major cryptocurrency exchanges. Here are the main platforms for trading perpetual contracts.

Quarterly and Perpetual Binance Futures

On Binance, delivery and perpetual futures are traded on the USDS-M and COIN-M markets. USDS-M market features futures paired with USDT and BUSD. COIN-M futures are traded in pairs with USD. The available leverage on both markets is up to 125x. Binance has relatively favorable fees for futures trading.

OKX Futures and Perpetual Swaps

OKX trades futures and perpetual swaps – an analog of perpetual futures. Futures and swaps are traded in pairs with USD and USDT. The maximum leverage size for trading perpetual swaps is 125x.

Bybit Perpetual Futures

Bybit trades classic USDT futures and inverse perpetual futures. When trading inverse contracts, traders do not pay a funding fee for holding a position. Inverse futures are quoted in USD but settled in the base asset.

Standard Futures vs. Perpetual Futures – Conclusion

Futures and perpetual futures are the main trading tools for traders. However, they are complex and high-risk instruments. When trading them, one must be cautious and adhere to risk management. This is especially true for traders using leverage. Trading futures requires an understanding of the market, knowledge of its mechanics, and experience trading simpler instruments (Spot and margin trading).

Start your cryptocurrency journey today and unlock the power of futures trading! Join our CScalp TV channel on YouTube for a wealth of educational videos, insightful market updates, and expert trading tips. Hit that subscribe button and ring the notification bell to never miss an update.