CScalp shows how to scalp Binance futures and trade on the Binance exchange. We'll look at the specifics of trading USDT futures and COIN-M futures. For more details on how to start trading on Binance, check out our free futures trading course. We consider what a beginner trader should start with on the exchange and why it's risky to immediately jump into futures trading from the get-go.

Facts About Binance Futures

Binance Futures are featured in a separate section of the exchange. To access futures trading, you need to complete the KYC process and open a special futures account. Also, consider the specifics of futures trading. Let's discuss the main ones.

Futures Delivery Date

Binance trades perpetual and delivery futures. Perpetual futures are "eternal" contracts. Traders can hold a position in a perpetual future for as long as they want. Delivery futures are contracts with a delivery date. On the delivery date, the contract "expires," and the holder-trader receives the asset: cryptocurrency. Binance trades quarterly term futures. They "live" for three months until the delivery date.

Binance Futures Leverage

Leverage is a financial "lever" that helps to significantly increase the volume of the transaction. Accordingly, the potential profit and loss are increased. Leverage is provided by Binance. A 10x leverage means that the trader puts 1/10 of the transaction volume and the rest of the funds come from Binance. If the leverage is 5x, Binance multiplies the trader's "contribution" five times, and so on. After closing the position, the funds used as leverage are returned to the exchange. The trader keeps the result of the transaction (profit or loss) from the total volume of the transaction.

Binance Futures Fees

The trader pays the exchange a fee for each trading operation with futures. The futures market has its own tariff grid, different from the Spot market. Commissions also differ depending on the type of futures (USDS-M or COIN-M) being traded. With leverage, the trader pays the same percentage commission as without leverage. But in "numbers," the commission increases – proportional to the size of the position, increased with the help of leverage. For example, if a trader invested $100 of their own with 5x leverage, the position size is $500. The trader pays the commission not on their $100, but on the entire position amount.

Binance Futures Funding

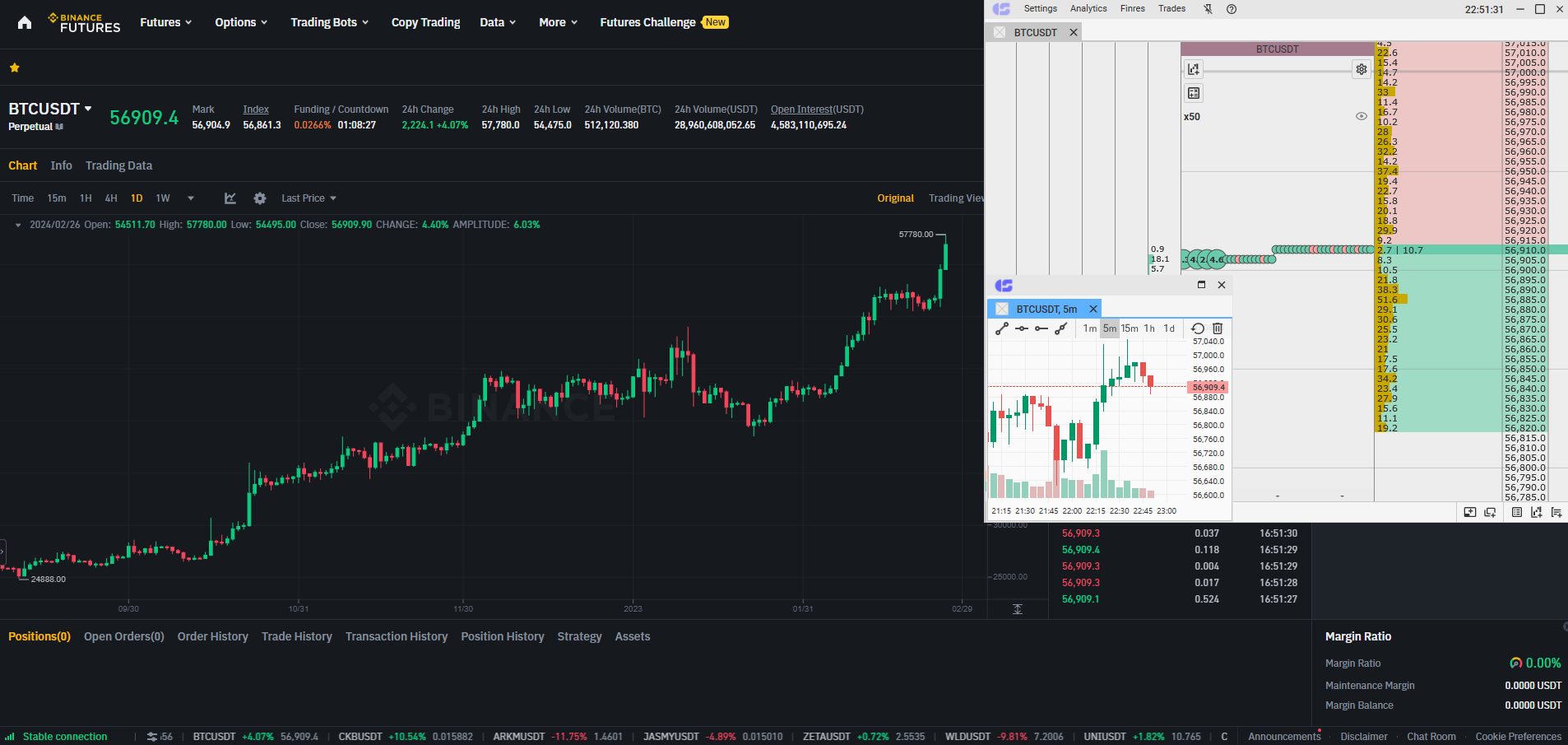

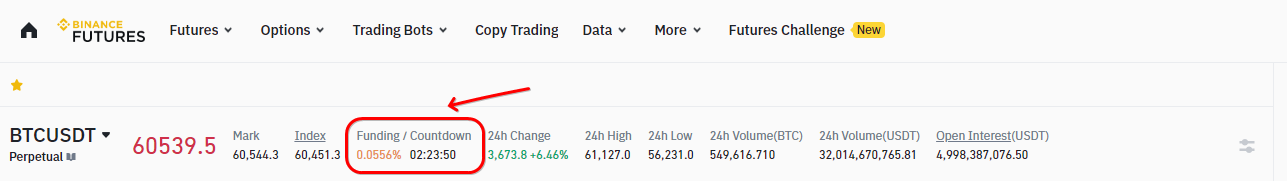

Funding is the mechanism that keeps the price of a perpetual future close to the Spot price of the underlying asset. When the future is more expensive than the asset, Binance "motivates" selling, so funding is accrued to those who short the contract and deducted from those who have a long position opened. When the future is cheaper than the asset, funding is deducted from the accounts of short-sellers and transferred to long traders. The size of the funding is calculated using a complex formula, taking into account the funding rate. The rate can be viewed on the perpetual future's page.

Liquidation

A liquidation occurs when the exchange forcibly closes a trader's position due to a lack of margin. For example, a trader enters a position with $100 and uses 20x leverage. The total position is $2,000. If the future depreciates by 5%, the position decreases to $1,900. Thus, the trader's “burns” $100. According to the contract terms, the trader must maintain a margin of $100. However, since the margin is depleted, the trader's "obligations" are not met. The exchange can automatically close the position to prevent losses and as a result, the trader can lose the $100 investment.

How to Scalp USDT Binance Futures

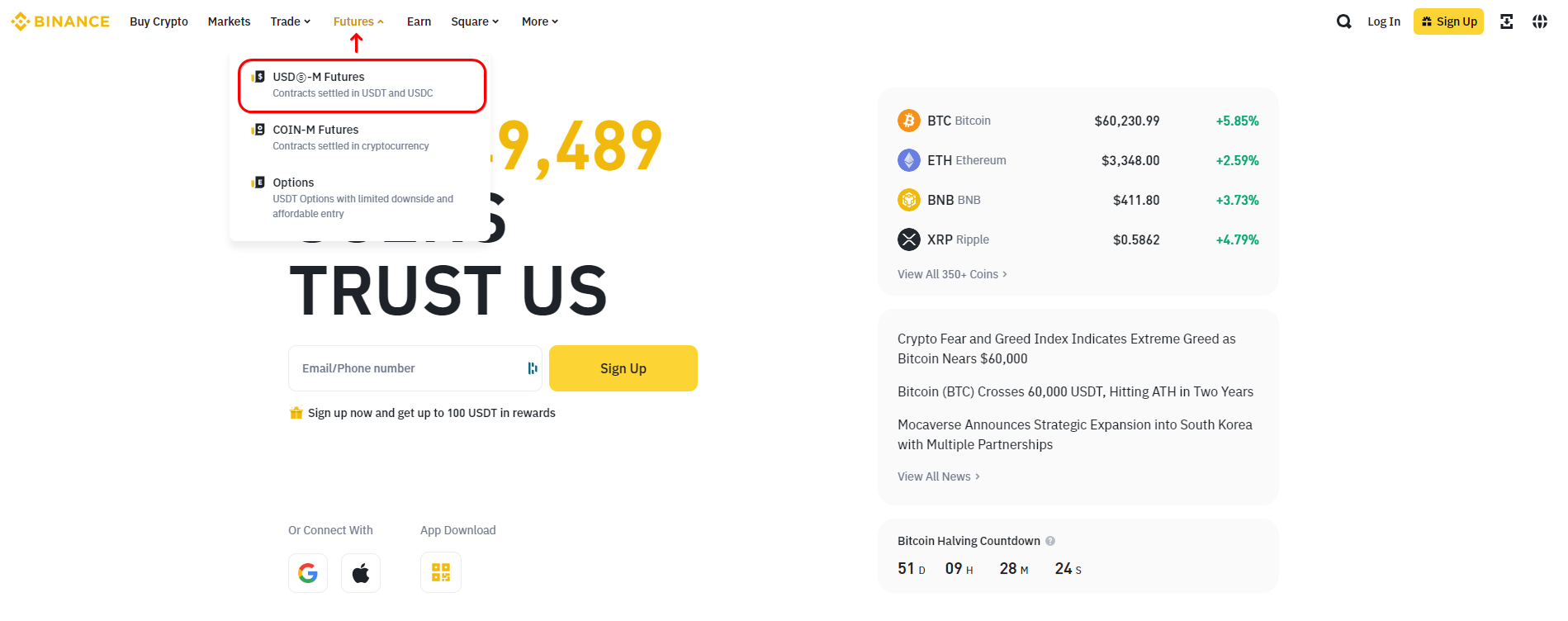

USDT futures are contracts denominated in the USDT stablecoin. These are perpetual and quarterly contracts. Transactions with such futures are settled in USDT. To engage with Binance USDT futures, you need to transfer USDT to the futures account.

To trade USDT futures, go to the main menu of Binance, open the "Futures" section, and click "USDS-M Futures".

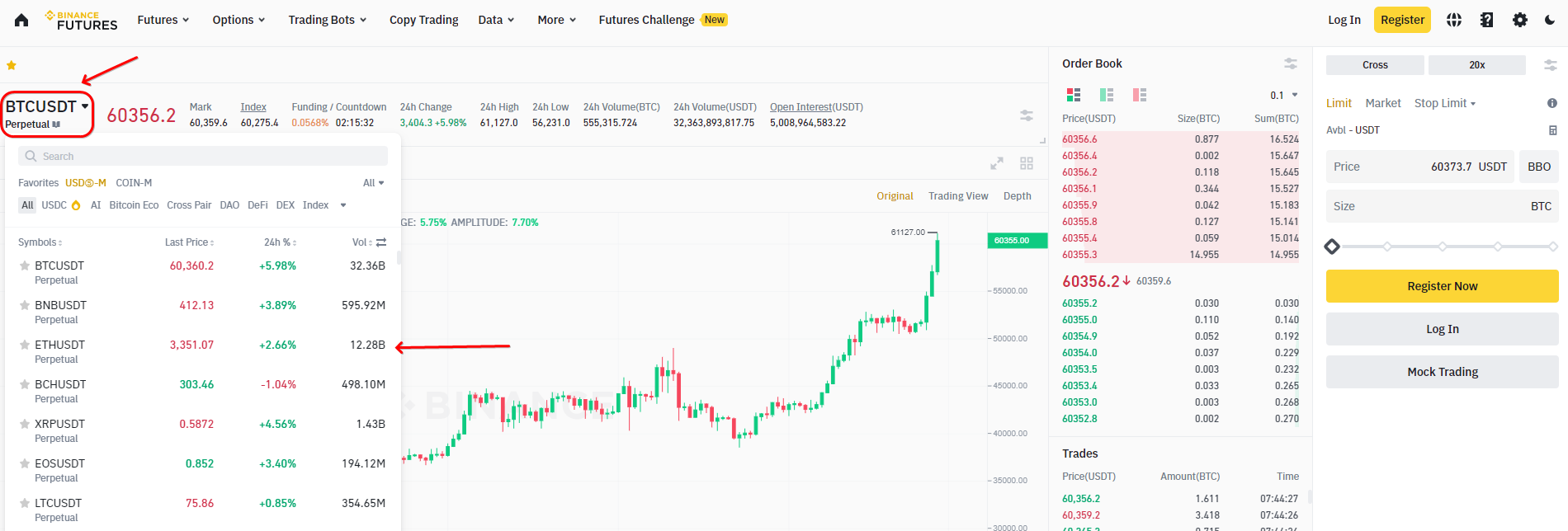

By default, the BTCUSDT contract opens. To select another instrument, hover over the contract ticker on the left side, above the chart. A dropdown list with other futures will appear. Find the desired one and click on its name.

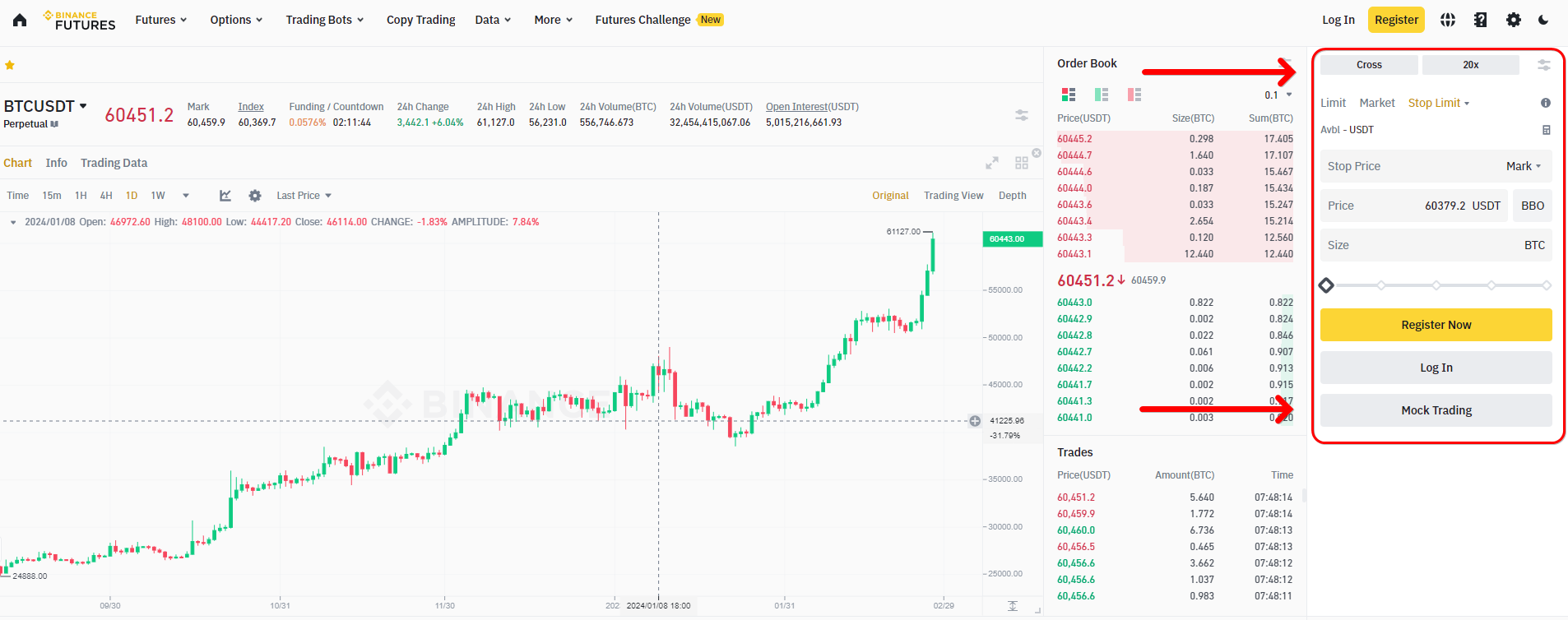

On the right side of the page, you will find the order submission block. There are two buttons at the top: setting the type of margin (isolated or cross) and the size of leverage (up to 125x).

The choice of order type is located below. "Limit" at the price specified by the trader and "Market" at the current market price. If you hover over the "Stop Limit" button, a list of possible "restrictive" orders appears, including Stop-Loss, Trailing Stop, etc.

The "Size" block indicates the amount the trader wants to spend on the order. You can also choose the number of contracts to buy/sell.

Once the order is filled, all that remains is to click "Buy/Long" or "Sell/Short" to open or close a position, depending on the direction of the trade and the order of transactions.

For an optimized trading experience, connecting CScalp with Binance Futures is a game-changer. This integration not only simplifies your trading processes but also enriches your market analysis capabilities thanks to the order book-oriented interface.

How to Trade or Scalp Binance COIN-M Futures

COIN-M are futures transactions that are paid in the base asset-cryptocurrency. That is, for transactions with the BTCUSD future, the margin must be deposited in BTC, for transactions with ETHUSD in ETH, etc. Meanwhile, futures quotes are calculated in fiat USD, not in stablecoins. Binance trades both perpetual and quarterly COIN-M futures.

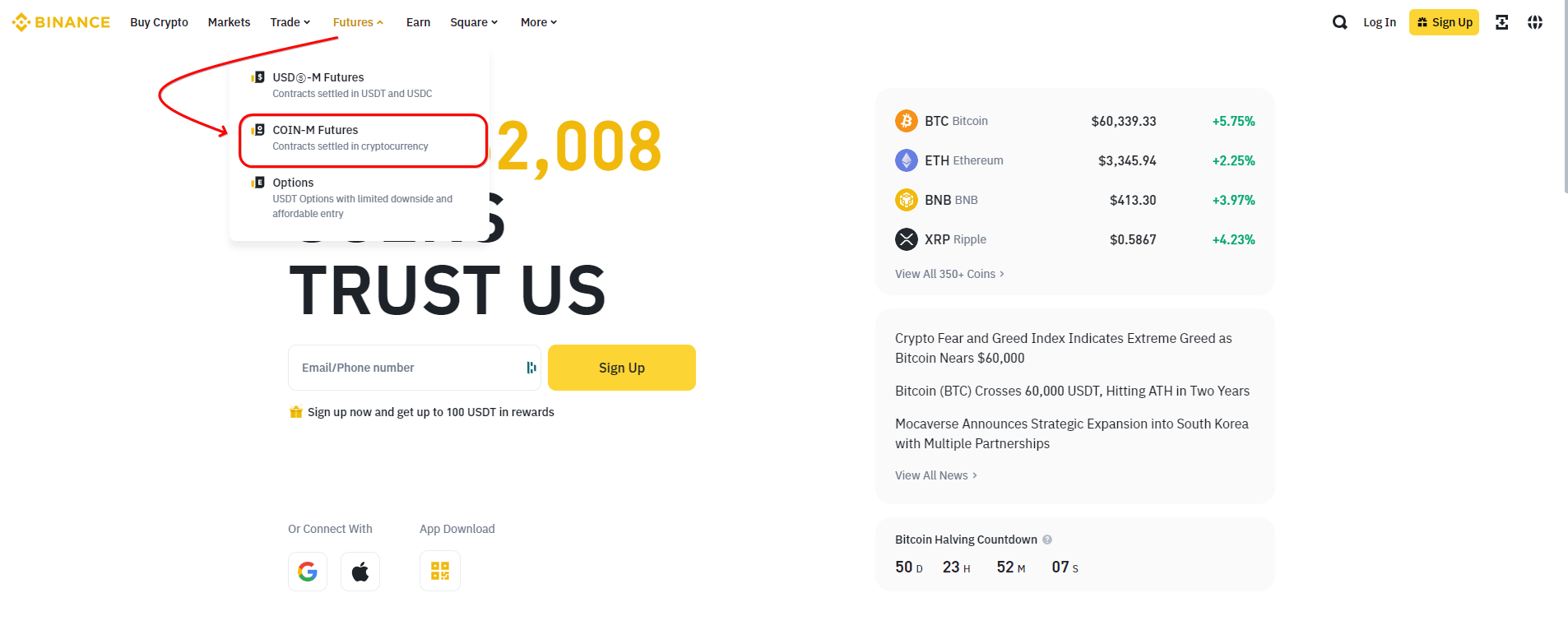

To trade COIN-M futures, select "Derivatives" in the main menu of the site, click "COIN-M Futures".

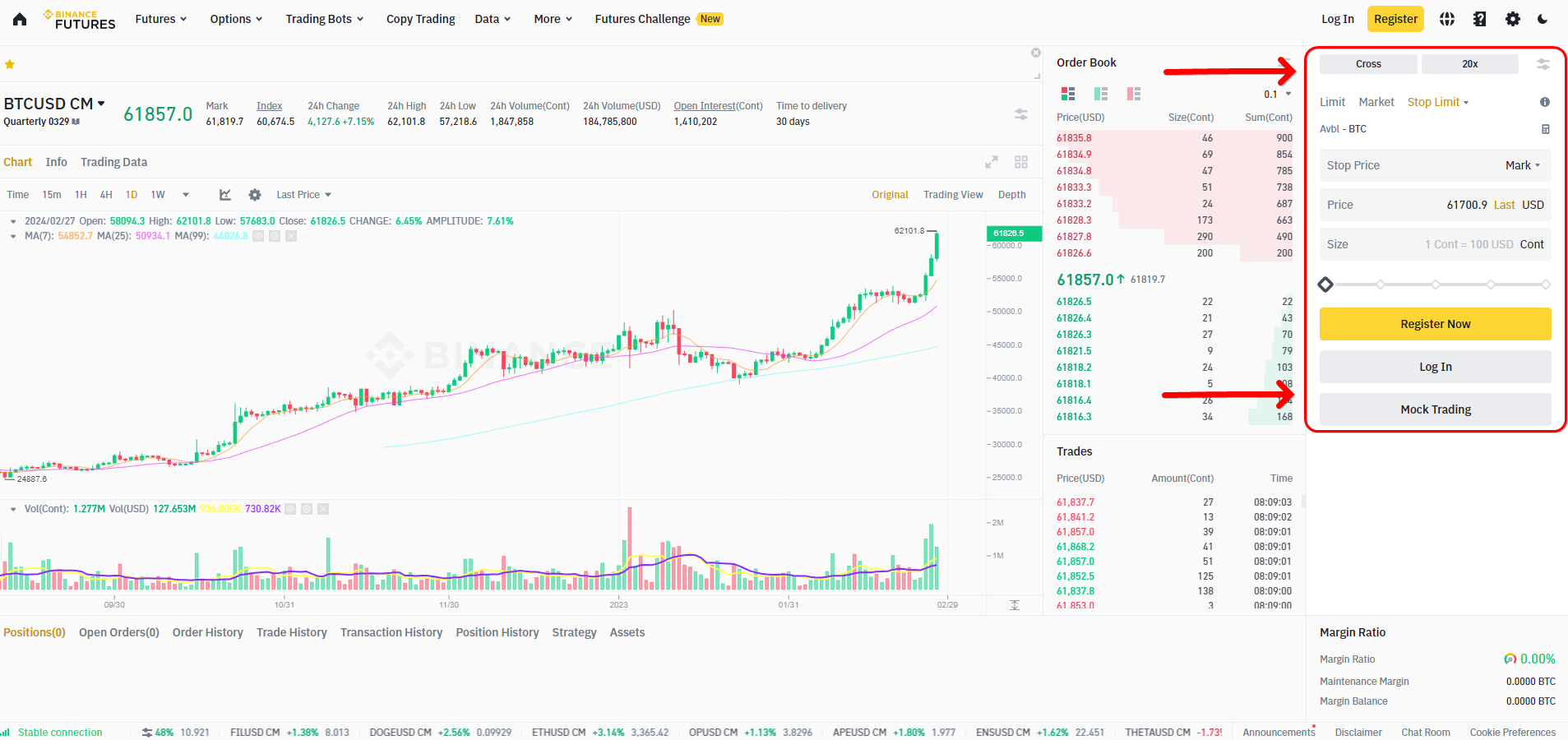

To select an instrument, hover the cursor over the ticker of the open future and choose the required contract from the list. To trade the contract, you need to pre-fund the futures account in the corresponding cryptocurrency.

Orders for COIN-M contracts are executed in the same way as for other futures through the order block, located on the right side of the page. Here, traders can select the type of leverage, set the leverage size, specify the order type, and enter the order parameters, including the number of contracts. Once you filled out the order, click "Buy/Long" or "Sell/Short" to send the corresponding order.

How to Scalp Binance Futures – Conclusion

Trading futures can be profitable if approached wisely. The key to a positive outcome is strategy.

Learn more: Binance Futures Tactics: Step-by-Step Guide to Profitable Crypto Trading on Binance Futures

If scalping appeals to you, then trading through the Binance interface will not be suitable. The exchange’s interface is burdened with extra functions needed by a "one-time" cryptocurrency buyer, but not by a scalper who works daily. Full-fledged scalping is only possible through a dedicated trading terminal like CScalp, where you will find the order book, trade tape, and clusters.

To further enrich your experience, we invite you to join our Discord server. Your insights, questions, and discussions will be a valuable addition to our growing community of traders.