Binance Futures Tactics: Step-by-Step Guide to Profitable Crypto Trading on Binance Futures

Trading Binance Futures presents an opportunity to potentially profit from the cryptocurrency market’s volatility without owning the underlying assets. Learn how to engage in futures trading with CScalp. We also invite you to visit our free futures trading course.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Understanding Binance Futures

Binance Futures is a platform that allows you to engage in futures contracts of cryptocurrencies, offering a way to leverage your trades.

As a trader on Binance Futures, you have access to various tools that can help optimize your strategies. The platform provides different types of orders and leverage options, which can be tailored to match your trading style and risk tolerance. Understanding how these tools work is crucial. For example, knowing the difference between cross and isolated margin modes can significantly affect the level of risk you take on.

It’s important to emphasize the risks associated with futures trading on cryptocurrencies. While the potential for high returns exists, so does the chance of significant losses, especially when leverage is employed. Navigating the futures market requires a clear strategy, constant market analysis, and an awareness of the financial commitment you’re undertaking. The volatility of the cryptocurrency market can lead to rapid price changes, which can dramatically affect your positions.

To take full advantage of Binance futures trading, try the professional platform CScalp by leaving your email in the form above. With the free terminal, you will be able to connect to the exchange and place orders with one click, automatically set Stop-Loss and Take-Profit targets, as well as manage your risks.

What Are Futures Contracts?

Futures contracts are agreements to buy or sell a particular crypto at a predetermined price at a specific time in the future. Unlike the Spot market where cryptocurrencies are traded instantaneously, futures contracts provide an opportunity to speculate on the future price without the immediate exchange of the asset.

- Perpetual Futures: Contracts that do not have an expiration date.

Binance Futures Products and Features

Binance Futures offers a multitude of products and features, designed to cater to traders of varying experience levels. Here you can find:

- Leverage: Control larger positions with a smaller initial margin.

- Risk Management Tools: Including Stop-Loss orders for minimizing potential losses.

- Variety of Contracts: Access to a diverse range of cryptocurrency futures contracts.

Types of Contracts: USDS-M and Coin-M Futures

Binance offers two main types of futures contracts, each with its own characteristics:

- USDS-M Futures: Quoted and settled in fiat currency equivalents (like USD). You can trade these with up to 125x leverage.

- Coin-M Futures: Quoted and settled in the cryptocurrency itself. Leverage varies depending on the coin, but it offers higher leverage options compared to USDS-M futures contracts.

Setting Up a Binance Futures Account

Before you can start trading with Binance Futures, you need to set up and fund your account, as well as connect CScalp to Binance Futures. This section will guide you through each step.

Account Registration and Verification

To begin trading futures on Binance, first, ensure you have a Binance account. If you don’t, visit the Binance website and select the ‘Register’ option. Fill in the required fields with your email address and a secure password. After registration, proceed with the necessary verification processes to secure and authenticate your identity. To receive special discounts on Binance, use our Binance referral code.

Transferring Funds to Futures Wallet

Once your account is set up, you’ll need to transfer funds to your Futures Wallet. Access the ‘Derivatives’ menu, and choose either the USDⓈ-M (stablecoin margined) or COIN-M (coin margined) Futures trading section. Here, you can transfer your cryptocurrency funds, such as USDT, USDC, or BTC, into your Futures Wallet to begin trading. These funds act as the margin for your futures positions.

Connect Binance Futures to CScalp

With your account verified and your Futures Wallet funded, it’s time to create API Keys and connect your Binance Futures account to CScalp:

- Generate API and Secret Keys in your Binance account under API Management

- Set API Restrictions correctly: Enable “Spot & Margin Trading”, and enable “Futures” trading.

- Save the Secret Key

- Adjust leverage on the exchange through the Binance interface for the futures market as per your trading strategy.

- Connect CScalp using the generated API and Secret Keys by entering them into CScalp’s settings.

- Select the order size in CScalp to define how much of the asset you want to trade per order and make your first trade

Learn more: How to Buy Futures Contracts: Learn Trading Futures Contracts with a Step-by-Step Guide

Managing Risks in Futures Trading

Understanding and applying risk management strategies is crucial for your trading success.

Leverage and Margin Explained

Leverage allows you to gain a larger exposure to the market with a smaller initial capital, often termed the margin. There are two types of margins you can use:

- Isolated margin: Limits your potential loss to the margin allocated for a specific position.

- Cross margin: Spreads the risk across all open positions, utilizing the full balance of your account to prevent liquidation.

Be aware that using high leverage amplifies both gains and risks.

Risk Management Techniques

Effective risk management is essential to preserve your capital. You should implement the following practices:

- Calculate risk tolerance to determine appropriate leverage

- Utilize risk warning tools provided by exchanges to stay informed about the volatility and risks associated with your positions

- Apply diversified portfolio strategies, spreading your capital among various assets to reduce the impact of any single trade

Use of Stop-Loss and Limit Orders

Stop-Loss and limit orders are tools designed to enforce discipline in your trading. Here’s how they function:

- Stop-Loss orders: Automatically close a position at a predetermined price to limit potential losses.

- Limit orders: Set a maximum or minimum price at which you’re willing to buy or sell, providing control over the execution price.

CScalp has implemented an automatic Stop-Loss feature that you can use to protect your assets.

Executing Trades on Binance Futures

Entering the Binance Futures market requires an understanding of different order types, the significance of market trends, and strategies for managing long and short positions to navigate the complexities of cryptocurrency futures trading effectively.

Market, Limit, and Stop Orders

Market orders allow you to buy or sell immediately at the best available current price. They are executed quickly, but the price at which you buy or sell is not guaranteed. Limit orders let you set a specific price at which you want to buy or sell. They only execute if the market reaches your specified price. Stop orders, or Stop-Loss orders, are similar to limit orders but are triggered to execute when the market hits a certain price, helping you manage risks.

Order Types and Price

- Market Order: Buy/sell at the best current price. It is executed immediately. The price is based on the last price.

- Limit Order: Set your desired buy/sell price. It is executed when the market hits your price. The price reflects the desired entry price or exit price.

- Stop Order: Triggers a limit order at a predetermined price. It is used to minimize losses or protect profits. Stop Orders activate at the chosen stop price.

Analyzing Market Trends and Volatility

Identifying market trends is crucial for deciding whether to enter a long or short position. Volatility indicates the price variation of a cryptocurrency over time. High volatility can lead to significant price movements, which can affect both trading volume and the risk of liquidation. Understanding the Spot price, mark price, and the difference between them is important to execute trades intelligently.

Market Analysis

- Volatility: Assessing the potential for price swings.

- Trading Volume: Higher volume can indicate the strength of a trend.

- Spot vs. Mark Price: Spot price reflects current market value, mark price prevents unfair liquidations.

Trading Strategies for Long and Short Positions

When you buy with the expectation that the price will rise, you are taking a long position. Conversely, selling with the anticipation of a price drop is a short position. Successful trading strategies involve setting appropriate entry and exit points for your positions and considering the liquidation price, particularly in high-leverage trades.

Long Position

Buy when expecting price increases.

- Objective: Buy low, sell high

- Risk factor: Potential liquidation if the price falls

Short Position

Sell when anticipating price decrease.

- Objective: Sell high, buy back low

- Risk factor: Potential liquidation if the price rises

By grasping these execution tactics on Binance Futures, you’re better equipped to navigate the ebbs and flows of the cryptocurrency futures markets.

Trading Strategies for Binance Futures

When trading Binance Futures, your success hinges on a sound strategy. Each approach varies in technique and time horizon, with some catering to quick, small gains while others rely on market trends’ longevity.

Scalping and Day Trading

Scalping is your go-to method for taking advantage of small price gaps created by order flows or spread differences. In the world of Binance Futures, this involves:

- Entering and exiting trades swiftly, often within minutes

- Keeping position sizes manageable to reduce risk

Learn more: How to Scalp Binance Futures and Trade Futures on Binance

For day trading, your focus is completing trades within the same trading day. This method involves:

- Analyzing short-term charts for patterns

- Remaining vigilant to market movements to adjust your positions accordingly

Swing Trading and Position Trading

Swing trading is ideal if you prefer capitalizing on price ‘swings’ extending over a few days to several weeks. It requires:

- A thorough analysis of market trends

- Patience in holding positions for the optimal period

In position trading, you’re in it for the long haul. You’ll be:

- Utilizing a more extensive market analysis, often looking at weekly or monthly charts

- Managing your position size to hedge against larger market moves

Advanced Trading Options

In the realm of cryptocurrency trading on platforms like Binance, understanding advanced trading options can markedly influence your strategy. This knowledge is particularly valuable when exploring futures markets, where options, liquidity, and various order types have a significant impact.

Funding Rate and its Impact

The Funding Rate is a mechanism in perpetual futures markets that helps keep the futures prices aligned with the Spot price of the underlying asset. It represents periodic payments made based on the difference between perpetual contract markets and Spot prices. If you’re holding positions open at the funding timestamp, you’ll either pay or receive the funding rate. This rate is variable and could be indicative of a market that is heavily longing or shorting – a critical detail for your trading strategies.

Liquidity and Its Effects on Execution

Liquidity refers to how easily an asset can be bought or sold at a stable price in a given market. High liquidity eases the process of entering or exiting positions without causing a significant impact on the asset’s price. In contrast, low liquidity can lead to slippage – when an order is filled at a different price than expected – particularly in volatile markets. Your awareness of the liquidity levels of the assets you’re trading in conjunction with the types of orders you’re implementing can significantly affect the execution and the eventual outcome of your trades.

Leveraging Market Data

Market data analysis is crucial for making informed decisions. Your success in implementing Binance Futures trading tactics can significantly improve by leveraging real-time data and trends.

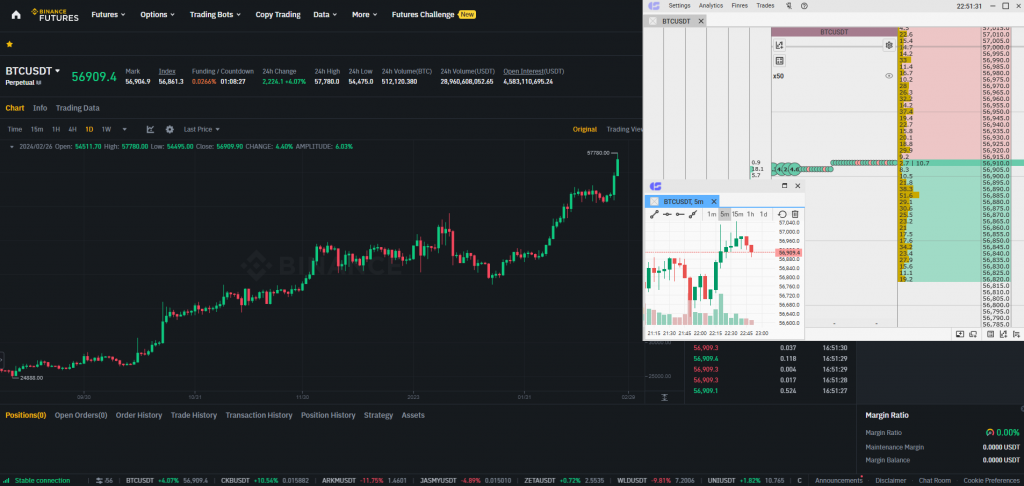

Chart Analysis and Technical Indicators

To interpret market dynamics accurately, you should analyze charts with various time frames. This allows you to spot trends and patterns that could trigger your next trade. Focus on incorporating technical indicators, such as moving averages and Relative Strength Index (RSI), to identify potential entry and exit points. For Binance Futures, the candlestick charts provide deep insights into market sentiments which, when paired with indicators, serve as a strong foundation for your buy/long or sell/short decisions.

Influence of Cryptocurrency Market Trends

The cryptocurrency market is driven by various macro and microeconomic trends that can influence your trading decisions. Stay abreast of significant happenings in the blockchain space, such as regulatory changes or technological advancements, which can drastically sway market sentiments. By monitoring these trends and integrating them with thorough market data analysis, you position yourself to respond proactively to market movements.

Evaluating Profit and Loss

When trading Binance Futures, you have to understand how to measure profitability and the costs that impact your bottom line. Your ability to evaluate these aspects effectively can influence your trading strategy and risk management.

Calculating Potential Earnings

To calculate your potential earnings from Binance Futures, first determine the asset’s entry and exit price. Profit is realized when your exit price is higher than your entry price. For instance, buying 10,000 USDT worth of BTCUSDT contracts at an entry price of 50,000 USDT and selling at an exit price of 55,000 USDT yields a profit. It will be automatically calculated by CScalp.

Understanding Fees and Costs

Every trade on Binance Futures includes fees and costs, which can affect your net profit. You must account for trading fees, which are small percentages applied to each trade. These are usually split between maker fees and taker fees. Additional fees might include funding rates for holding positions open over a certain period. CScalp will automatically subtract the fees from your gross profit to help you better understand your net earnings.

Getting Liquidated

Futures trading on Binance requires you to manage collateral as a safeguard against potential losses. If the market moves against your position beyond your collateral’s value, you may face liquidation. Binance uses an insurance fund to protect investors from debt if a counterparty’s position is liquidated and cannot cover the loss. Stay aware of the liquidation price when you enter a trade, as reaching this point will trigger the liquidation of your assets to cover the position.

FAQs: Frequently Asked Questions About Binance Futures Tactics

In navigating the complexities of Binance Futures, your success hinges on grasping effective strategies, risk management techniques, and understanding the tools at your disposal.

What Are Effective Strategies for Beginners Getting Started With Binance Futures Trading?

As you start with Binance Futures trading, it’s essential to grasp the fundamentals of the order book and how it works. Consult the order book trading course on our YouTube channel.

What Techniques Can Be Employed to Manage Risk When Trading Binance Futures?

To manage your risk on Binance Futures, use Stop-Loss orders and choose between cross or isolated margins wisely. Always be aware of the market conditions and adjust your strategies accordingly to protect your positions.

Can You Explain a Method for Making a Consistent Daily Profit, Such as $100, on Binance Futures?

Making a consistent profit, such as $100 daily on Binance Futures, requires a well-considered trading plan, keen market analysis, and disciplined risk management. Setting realistic profit targets can help lock in earnings while allowing for upside potential.

What Are Some Common Winning Tactics for Trading on Binance Futures?

Common tactics for successful trading on Binance Futures include following trends, scalping small profits in short time frames, and using technical analysis to inform trade decisions. It is crucial to have a deep understanding of market indicators and chart patterns. Consult different profitable crypto trading strategies in our blog.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT