How to Catch a Falling Knife: The Daring Scalping Strategy Explained

Scalping within involves various strategies to capitalize on rapid price movements. Are you interested in how to catch a falling knife? Well, the concept of “catching falling knives” stands out as a high-risk, high-reward approach. This article delves into the dynamics of scalping strategies, with a particular focus on the world of catching falling knives.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

The Nature of Falling Knives: What Does “Catching a Falling Knife” Mean?

Scalping strategies are diverse, each offering a unique angle to seize swift market opportunities. Among this repertoire, the technique of catching falling knives commands attention.

Before we embark on our exploration, let’s establish a common understanding of the phrase “catching a falling knife.” Imagine a scenario where a stock’s value is rapidly plummeting. Attempting to buy it at this point is akin to trying to catch a knife in midair – it’s dangerous and could lead to painful consequences. However, seasoned traders are known for their ability to strategically time these moments and potentially reap substantial rewards.

It’s important to note that employing such scalping strategies requires expertise due to the need for split-second decision-making amidst volatile price swings.

What is a Knife in Trading?

In trading, a “knife” refers to a sharp and rapid price movement within a short period, often involving a significant percentage change. The percentage of movement depends on the market, timeframe, and coin type – it could be 5%, 20%, or even more. In this article, we will focus on “knife catching” in scalping.

This is what a falling knife looks like in scalping:

“Knives” are divided into downfalls (downward movement) and upswings (upward movement). They resemble “pumps” and “dumps” (learn more about pumps and dumps here) but on a smaller scale. Unlike pumps and dumps, “knives” occur on very short timeframes (usually 5 minutes) and have a technical, rather than artificial, nature.

In the screenshot below, you can see a 5-minute BTC / USDT chart. The price moved up more than 500 points in 15 minutes.

This is what an upward knife (upswing) looks like in scalping:

This movement can be unequivocally characterized as an “upswing” or “upward knife.” Typically, a “knife” forms over a few candles, usually between 3 and 5. Unlike other impulse movements, “knives” have no clear divisions between their sides. After the “knife” is fully formed, an immediate retracement follows. The price sharply reverses direction on the next candle and returns to the previous trading range. Scalpers catch these retracements and take advantage of them to make a quick profit.

How to Catch a Falling Knife? Explaining the Knife-Catching Strategy in Scalping

Catching a falling knife involves opening a position when the formation of the “knife” is completed, and it starts retracing. Essentially, this is trading against the prevailing trend. The position is opened as the reversal movement begins, following the initial pattern formation.

The formation of “knives” is influenced by the following factors:

- Dominance movements: Due to the strong correlation between most cryptocurrencies and BTC/ETH, sharp impulse movements in the dominant coins can drag other coins along. Therefore, when catching “knives,” it’s important to keep the dominant coin’s chart open.

- Presence of strong support or resistance levels: Like other impulse movements, “knives” have a limited range. Local support and resistance levels define this range. When a “knife” occurs, it’s crucial to accurately identify where the bottom or top of the movement will be.

- Volume imbalance: Every “knife” is accompanied by a significant volume, followed by a reverse movement. Typically, the volumes during a “knife” are much higher than other market averages.

Recognizing the End of a Knife

How can you recognize the end of a “knife”? The initial impulse of a “knife” almost always features a clearly defined medium-length tail before the reversal. The end of the initial movement usually appears as follows: the last candle reaches a level, attempting to breach it unsuccessfully, and bounces back, leaving a wick behind.

When a knife is formed in scalping, it creates a wick and bounces back.

If the candle sharply reverses after this, it’s a signal to open a position. However, there are no universal rules to determine exactly when a movement might end and a reversal starts. This needs to be gauged visually at the moment.

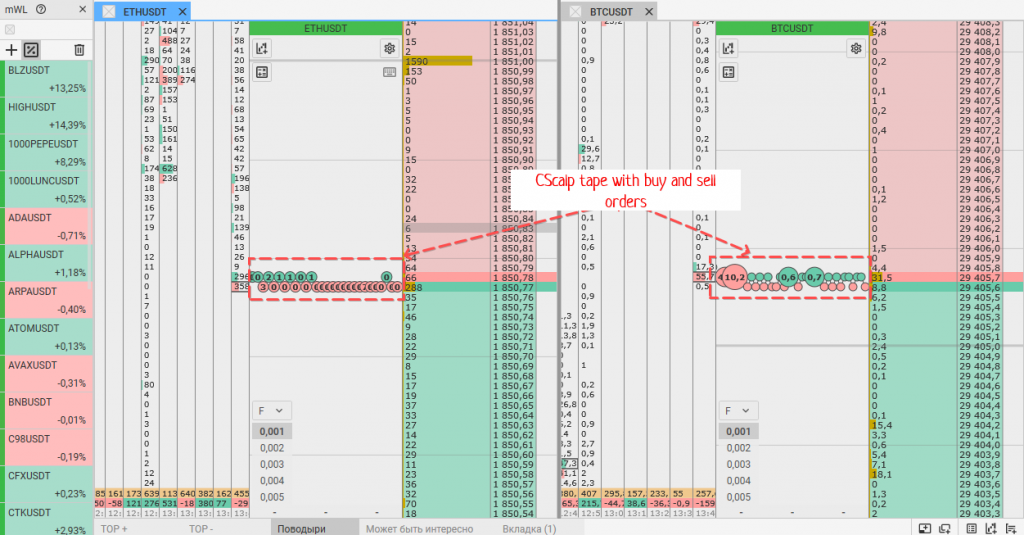

Using the order book allows you to assess the level of activity based on market orders.

We recommend you use the order book in the CScalp terminal to get a strong visualization of a falling knife. When a “knife” is forming, the order book becomes “tightened” – the volumes of passing orders decrease. The direction of movement changes in the order book – sales start prevailing over purchases, or vice versa (depending on the direction of the “knife”).

Catch a Falling Knife: Trade Potential and Insurance

Catching falling knives is not for the faint of heart. It demands a blend of courage, strategy, and quick thinking. As you venture into this art, remember that knowledge and preparation are your best allies. Educate yourself, practice with caution, and learn from both successes and failures.

The art of catching falling knives epitomizes the duality of risk and reward in the financial world. It’s a reminder that while the potential for gains is enticing, careful consideration and a calculated approach are essential to navigate the treacherous waters of market volatility.

The potential of a trade depends on the direction of the “knife.” If it’s a falling knife, you can expect a retracement upwards of at least 50% from its peak. If it’s an upward knife, it might retrace downwards by 80% or more.

However, the potential of a specific knife depends on its context, and it should be assessed at the moment. It’s possible to partially close a trade – let’s say, 1/3 of the deposit – using market orders. There’s no strict rule for setting a Stop Loss when trading knives.

Unlock the world of scalping trading strategies on our CScalp TV YouTube channel! Join our vibrant community of traders as we delve into market dynamics, trading techniques, and expert analysis. Are you ready to catch a falling knife? The art beckons – approach with both excitement and caution.

Related article: How to Choose the Best Crypto to Scalp

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT