Binance Arbitrage: How Does it Work?

CScalp explains the types of Binance arbitrage that can be implemented on the largest cryptocurrency exchange. We also list the tools available for arbitrage on the platform, as well as delve into the risks associated with arbitrage trading on Binance.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Arbitrage Trading on Binance

Binance arbitrage is accessible to almost all users who have passed the KYC verification process, but it’s crucial to understand that it is a relatively complex and resource-intensive approach. In arbitrage trading, there is immense competition. Opportunities (pairs) on Binance diminish rapidly, requiring a constant search for new ones and the ability to analyze and execute current ones promptly.

Arbitrage transactions on Binance take time and demand cyclical actions. Making a mistake or slowing down in this routine can lead to financial losses. The greatest profits are obtained by full-time arbitrageurs who utilize various tools such as screeners, bots, and sometimes specialized trading platforms. Naturally, they are consistently engaged in the trading process.

What Is Binance Arbitrage?

Arbitrage trading involves speculating on the price differences of the same assets on different exchanges or within a single exchange. It is a distinct type of trading that does not involve analyzing price movements, trends, charts, or oscillators. Arbitrage traders seek trading pairs and their sequences. An arbitrage pair allows for profit if it is “looped” or traded cyclically a certain number of times in a row. The number of cycles depends on the pair. The result is a profit or spread.

In arbitrage, the spread is the percentage yield from one round of an arbitrage pair. A 1% spread means that, after completing a round of the pair with a total value of 100,000, the trader would have 101,000, realizing a fixed profit of 1,000. The pair can be “looped” until the spread is exhausted.

Binance arbitrage tends to involve relatively low risks and low profitability per trade. Rather than learning how to read charts or work with indicators, the key is to be able to identify pairs, calculate the cost of one “run,” and execute trades promptly and cyclically. The crucial skill is agility. Pairs operate on a “first-come, first-served” basis, as there are many arbitrageurs in the market, each helping to “smooth out” spreads with their actions. Therefore, arbitrage requires constant engagement in the process.

Over time, arbitrage trading has become more challenging due to trading bots, who operate on exchanges and “smooth out” internal price imbalances. That is why finding viable pairs within Binance becomes increasingly problematic.

Types of Arbitrage on Binance

Intra-Exchange Arbitrage or Triangular Arbitrage

Considered the technically simplest form of arbitrage trading on Binance, intra-exchange (triangular) arbitrage is implemented on both Spot and futures markets.

Let’s say we’ve noticed a price discrepancy in cryptocurrency on the Binance spot market:

ETH/BTC – 0.034560

ETH/USDT – 783.08

BTC/USDT – 22,600

Assuming we have 1 BTC, our arbitrage transaction could look like this:

- Sell BTC for ETH: At the current rate (ETH/BTC 0.035), we would get approximately 28.57 ETH.

- Sell ETH for USDT: At the current rate (ETH/USDT 783), we would receive around 22,367.71 USDT.

- Buy BTC with USDT: Purchase BTC at the current rate (BTC/USDT 22,600). This transaction yields about 1 BTC.

In the end, we are left with approximately 1 BTC and 232.71 USDT – this is the profit. It can be considered a short transaction without waiting for price declines.

When engaging in Binance arbitrage, remember to account for transaction fees. While fees on Binance Spot and futures markets are reasonable, they can still impact the profitability of the arbitrage pair. If you intend to engage in triangular arbitrage, Binance offers commission discount programs.

Inter-Exchange Arbitrage

Inter-exchange arbitrage is based on trading identical instruments on different exchanges.

For instance, if BTC on Binance is currently priced at $26,500, and on Bybit it’s $26,600, there’s a potential spread of about 0.5% (before accounting for commissions). You can buy BTC on Binance, transfer it, and sell it on Bybit to generate profit. The proceeds can be transferred back to Binance to repeat the cycle as long as the pair is active.

The number of exchanges and trading pairs is unlimited – you can trade on dozens of different exchanges. Naturally, such a method is not suitable for manual tracking. For inter-exchange arbitrage, you need to work with screeners and specialized bots.

Arbitrage on Binance P2P

Arbitrage on Binance P2P is the most common type of arbitrage on the cryptocurrency exchange. Transactions take place in cryptocurrency-fiat pairs, with settlements conducted through bank cards and digital wallets. Binance offers a variety of fiat currencies and payment methods, making the P2P platform well-suited for arbitrage.

Intra-Exchange P2P Arbitrage

Intra-exchange P2P arbitrage is possible on Binance. Price disparities among different sellers sometimes allow for buying at a lower price and selling at a higher price without switching to another exchange. The work is carried out in two P2P sections – “Buy” and “Sell.”

Let’s take a look at an example of Binance P2P arbitrage. Assume we have USDT on the cryptocurrency exchange. We go to the P2P platform and find another user selling BTC slightly below the market price for USDT. We buy BTC from this user. Then, we find a third user willing to buy BTC via bank transfer. They are willing to buy at a higher price than what we paid. We sell BTC to this user and profit from the price difference.

The challenge lies in the settlement currencies and payment methods. On Binance P2P, users who place ads determine the price. Spot prices and their profit targets serve as references. Suppose the spot price for ETH is currently $1,920. One P2P user may offer to sell ETH for $1,900, while another might ask for $1,930.

Each user utilizes a specific set of payment methods. Suppose we see a favorable rate and a potential arbitrage deal. However, it will be “available” only if we have funds in the payment methods used by the seller/buyer. If not, the pair becomes unattainable, or we’ll have to go through the hassle of transferring funds – consuming time and incurring additional fees.

Inter-Exchange P2P Arbitrage

P2P arbitrage operates between exchanges, exchangers, and other platforms – even through Telegram bots for P2P. A pair consists of at least two exchanges with a price difference for the same asset.

For example, on Binance P2P, you might buy BTC for $28,000, while on Bybit P2P, you can sell it for $29,000. The price difference is $1,000 (3.57%) – our potential profit. Sometimes, P2P pairs involve multiple platforms and assets with intermediate transactions. We pay a commission for each transaction (transfer, purchase, sale). Additionally, some services take a relatively long time to process payments. If the commissions and waiting time do not “eat up” our potential profit, then we are in the positive and the trades still make sense.

The more complex the pair, the higher the commissions due to a larger number of transactions. Therefore, “complex” arbitrage is generally expected to yield higher profits compared to “simple” arbitrage. Finding and implementing complex pairs requires more time and resources, often entrusted to bots.

Instead of constantly transferring funds from one exchange to another, you can have a certain amount of funds ready for trading to be more efficient. This way, you save time and resources on transfers, buying and selling on different platforms with minimal costs.

However, the nuance of this approach is a clear understanding of the operation of both platforms and the potential for pairs on each of them. Additionally, funds may remain in the wallets of different exchanges for an extended period. Therefore, this approach is suitable for professional arbitrage traders who work on different platforms with advanced tools.

International P2P Arbitrage

International arbitrage involves transferring funds between banks in different jurisdictions, using different fiat currencies. In theory, international P2P arbitrage on Binance is possible.

Let’s take a look at an example. Suppose we are in the European Union and want to buy BTC on Binance P2P. We notice that the exchange rate in India (INR) is lower than in the EU (EUR). The process is as follows:

- Convert EUR to INR.

- Buy BTC on Binance P2P with INR.

- Sell BTC on Binance P2P for EUR.

Profit is the difference between the purchase and sale prices, minus all commissions. Naturally, the commissions here are substantial and unpredictable.

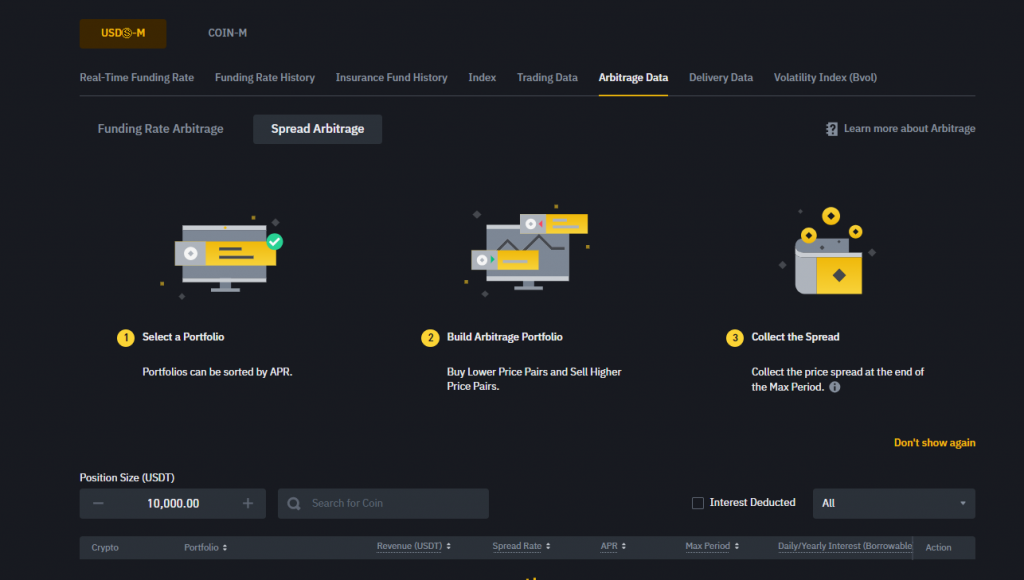

Binance Arbitrage Tools

Searching for deals manually by scrolling through price lists on P2P platforms is inefficient. The market has many sellers, buyers, and instruments, all in constant dynamics. Arbitrage screeners help find pairs by allowing comprehensive monitoring of connections and identifying efficient paths for transactions.

Learn more: 5 Best Crypto Arbitrage Screeners

Full-fledged arbitrage, especially inter-exchange and international, is typically entrusted to bots. Bots operate through API keys and execute transactions on behalf of the user, under their supervision but without direct involvement. There are numerous P2P bots for Binance and other platforms in the arbitrage market. Professional arbitrageurs often write custom bots for their specific needs.

Read our article: Arbitrage Trading Bots: What Are They and How Do They Work?

Risks of Arbitrage on Binance

Arbitrage is often considered an “easy” and “risk-free” way to make money. However, this is a rough generalization. Arbitrage comes with its complexities and risks that need to be taken into account.

Market Risk

Prices of trading instruments can change rapidly and unexpectedly. When choosing a pair, it’s crucial to keep an eye on the assets and consider the possibility of price fluctuations, which can reduce the expected profit from arbitrage.

Technical Risks

Delays in executing operations, system failures, or issues with access to trading platforms are possible technical risks. Even simple internet problems can significantly complicate trading. In P2P arbitrage, there may be delays on the counterparties’ side, during which time the arbitrage pair may disappear. The same applies to bank transfers. If our transactions in P2P arbitrage raise suspicions with the bank, it may slow down transactions or freeze the account.

Liquidity Risks

Some assets may have low liquidity in certain trading pairs, making it difficult to execute arbitrage opportunities. Additionally, low liquidity poses the risk of slippage.

Slippage is a situation where we place a market order at one price, but it is executed at another (usually not in our favor). Slippage is a common occurrence in low-liquidity markets.

Pairs with wide spreads can be deceptive. Most cryptocurrency pairs with large spreads (5% to 10%) arise due to a lack of liquidity. If we see a pair with a 10% spread, it’s not advisable to rush into the trade. It makes sense to check the order book and chart to ensure that the asset is being actively traded. If not, limit orders for the asset may not be filled, and market orders may be executed with significant slippage.

Fees

The primary challenge in arbitrage is dealing with commissions. You need to pay fees for transactions, fund transfers, and more. If a pair involves three or four transactions, the commissions multiply significantly. Therefore, all costs must be carefully calculated in advance. Otherwise, you might end up with a loss after the final transaction, even if the trade went smoothly.

P2P arbitrage also comes with big fees. Therefore, when working with specific platforms, it’s crucial to know exactly how much they charge for deposits, withdrawals, buying, selling, and internal transfers.

Fake Platforms and Bots

In the P2P market, there are numerous fraudulent services, bots, and other scam platforms. Unknown exchanges, Telegram bots, and cryptocurrency swaps might be a one-way ticket for our deposit. P2P bots from dubious developers could drain all funds from our exchange account. Therefore, when looking for pairs, it’s essential to thoroughly check the reputation of each platform you plan to engage with.

Legal Risks

Trading cryptocurrencies is generally legal. However, the profits we withdraw to the bank are subject to taxation. Therefore, before engaging in Binance arbitrage, it’s essential to determine how long we are willing to trade and on what scale. Small transactions are unlikely to attract the attention of tax authorities.

Binance Arbitrage – Conclusion

Arbitrage trading on Binance is a complex strategy that requires a thorough understanding of its specifics and a deep involvement in the process. Profit in Binance arbitrage is possible if you engage in it seriously and with substantial sums. It’s not feasible to jump into arbitrage with a minimal amount and achieve significant profits by working on a few connections.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT