5 best alternatives for TigerTrade terminal

TigerTrade is one of the popular trading terminals, but there are other software options available for trading as well. In this article, we have compiled five top terminals that can serve as good alternatives to TigerTrade. You can also explore our articles where we reviewed the features of TigerTrade.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

CScalp

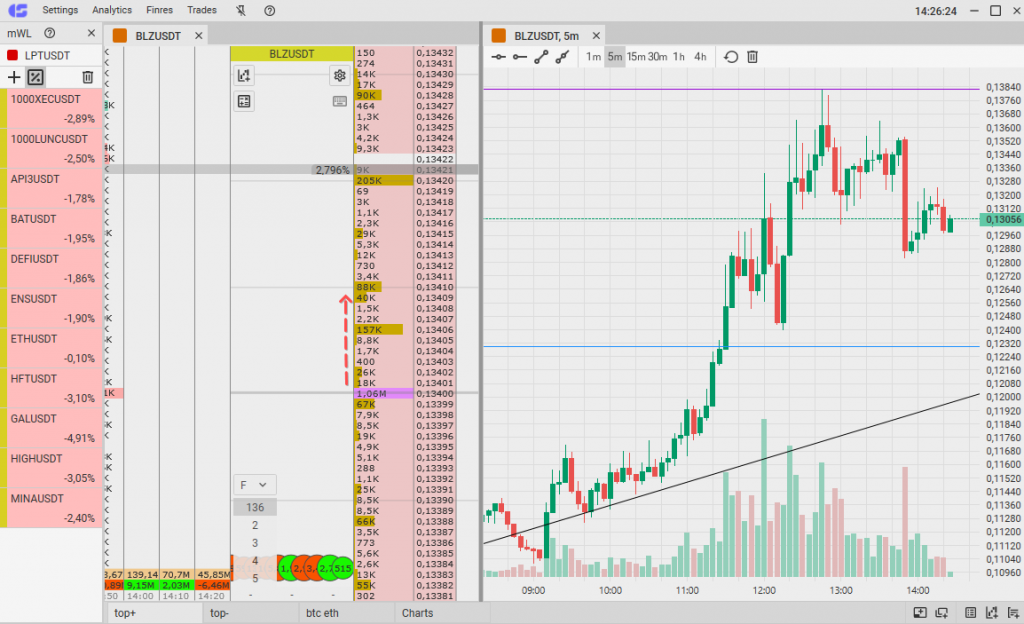

CScalp is a powerful trading terminal designed to meet the needs of professional traders. With its comprehensive features and intuitive interface, CScalp offers a seamless trading experience across various markets, including stocks, futures, and cryptocurrencies.

One of the standout features of CScalp is its advanced order execution capabilities. Traders can quickly execute trades with precision and efficiency, thanks to its lightning-fast order routing and low latency. Whether you’re a day trader or a scalper, CScalp’s quick execution ensures you can take advantage of market opportunities without delay.

The terminal provides a range of charting tools and indicators that help traders analyze market trends and make informed trading decisions. You can customize your charts according to your preferences and use various technical indicators to identify potential entry and exit points. The real-time market data feeds keep you up-to-date with the latest price movements, ensuring you have accurate information to base your trades on.

CScalp also offers risk management features to protect your capital. You can set stop-loss and take-profit levels for your trades, helping you manage risk and lock in profits. The platform provides real-time position monitoring, allowing you to track your trades and make adjustments as needed.

The developers of CScalp have also released a range of products that help traders enhance their efficiency. With the Trading Diary service, market participants can track comprehensive statistics of their trading, while Screener allows for quick identification of market changes.

The CScalp team provides free access to a trading course and a Telegram channel with trading signals.

MetaTrader 4

MetaTrader 4 (MT4) is a widely recognized and popular trading platform that has been a staple in the financial markets for many years. It offers a comprehensive set of tools and features designed to cater to the needs of traders across various asset classes, including forex, stocks, and commodities.

One of the key strengths of MetaTrader 4 is its extensive charting capabilities. Traders can access a wide range of chart types, including candlestick, bar, and line charts, and apply numerous technical indicators and analytical tools to conduct in-depth market analysis. The platform’s customizable charting interface allows traders to personalize their charts according to their preferences and trading strategies.

MT4 also provides a robust order execution system. Traders can execute trades quickly and efficiently using various order types, such as market orders, limit orders, stop orders, and more. The platform’s One-Click Trading feature enables traders to enter and exit trades with just a single click, ensuring timely execution in fast-moving markets. Additionally, MT4 supports algorithmic trading through its built-in MetaQuotes Language 4 (MQL4), allowing traders to develop and deploy their own automated trading strategies.

Read also: What is TigerTrade Broker and why it is needed.

NinjaTrader

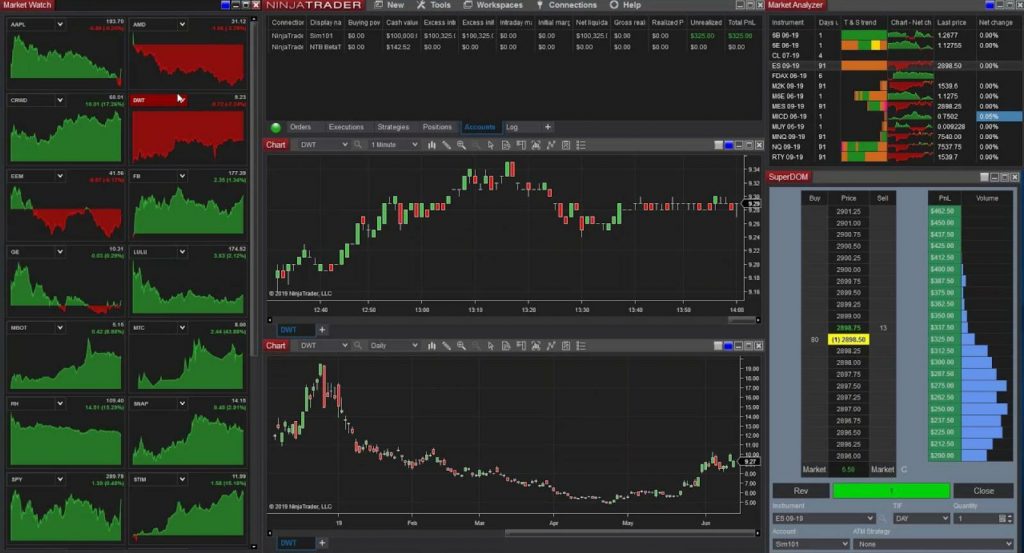

NinjaTrader is a leading trading platform renowned for its advanced features and robust functionality. Traders of all experience levels, from beginners to professionals, can benefit from the comprehensive tools and resources offered by NinjaTrader.

One of the standout features of NinjaTrader is its advanced charting capabilities. Traders can access a wide range of chart types, including candlestick, bar, and line charts, and customize them with various technical indicators and drawing tools. The platform’s extensive library of over 100 built-in indicators and strategies empowers traders to conduct in-depth technical analysis and make informed trading decisions.

NinjaTrader also excels in its order execution capabilities. Traders can place orders directly from the charts, providing a seamless and efficient trading experience. The platform supports a variety of order types, including market, limit, stop, and more, allowing traders to execute their strategies with precision. Moreover, with NinjaTrader’s advanced trade management features, traders can easily set profit targets and stop-loss levels to manage risk effectively.

Another noteworthy aspect of NinjaTrader is its strategy development and backtesting capabilities. Traders can create, test, and deploy custom automated trading strategies using NinjaScript, a proprietary C#-based programming language. The integrated Strategy Analyzer allows for detailed performance analysis and optimization of trading strategies, empowering traders to refine their approaches for better results.

Quantower

Quantower is a cutting-edge trading platform designed for both professional and retail traders seeking advanced tools and comprehensive functionality. With its intuitive interface and powerful features, Quantower provides a seamless trading experience across multiple asset classes, including stocks, futures, options, and cryptocurrencies.

One of the standout features of Quantower is its highly customizable and modular interface. Traders can arrange and configure various panels, widgets, and workspaces according to their preferences, creating a personalized trading environment. The platform supports multiple monitors, ensuring traders have ample space to analyze charts, monitor positions, and track market data simultaneously.

Quantower’s charting capabilities are impressive, offering a wide range of chart types, including candlestick, line, bar, and Renko charts. Traders can apply an extensive array of technical indicators, drawing tools, and charting styles to conduct in-depth market analysis. Additionally, Quantower allows for the creation of custom indicators and trading strategies using its proprietary QScript language, providing flexibility for traders who prefer to develop their own tools.

The platform’s Order Entry module provides seamless and efficient order execution. Traders can place market, limit, stop, and other order types directly from the chart or order book. With one-click trading and advanced order management tools, Quantower enables rapid trade execution and allows traders to manage their positions with ease. Real-time order and position tracking keep traders informed about their open positions, executed orders, and account balance.

Read also: How to connect TigerTrade to a cryptocurrency exchange.

cTrader

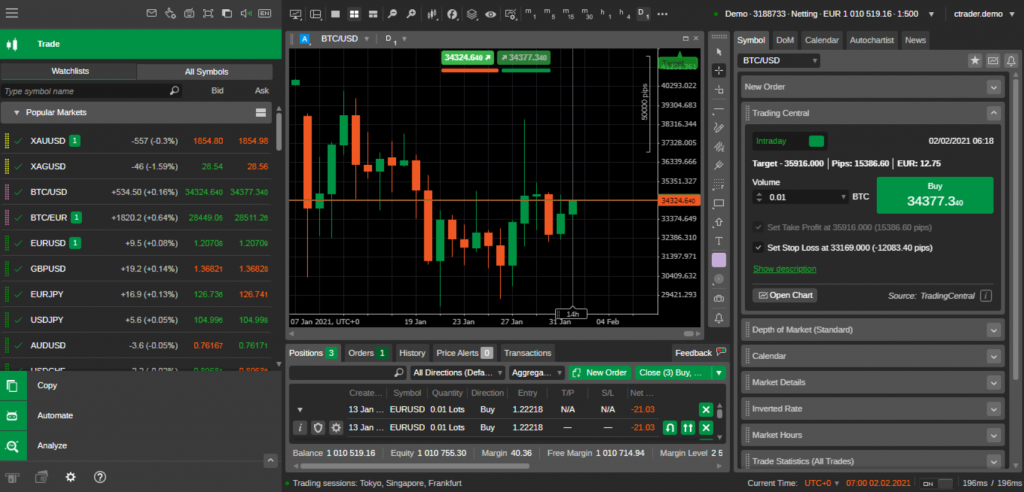

cTrader is a leading multi-asset trading platform that provides traders with advanced tools and a seamless trading experience. Known for its user-friendly interface and extensive functionality, cTrader caters to both beginner and experienced traders in the financial markets.

One of the standout features of cTrader is its powerful charting capabilities. Traders can access a wide range of chart types, including candlestick, bar, and line charts, and customize them with various technical indicators and drawing tools. The platform’s intuitive charting interface allows for easy analysis of market trends, patterns, and price movements, enabling traders to make well-informed trading decisions.

cTrader excels in its order execution capabilities, providing traders with lightning-fast trade execution and minimal latency. The platform supports a variety of order types, including market, limit, stop, and trailing stop orders, giving traders flexibility in executing their trading strategies. With its advanced order management tools, cTrader enables traders to set take-profit and stop-loss levels for their trades, helping them manage risk effectively.

Another notable feature of cTrader is its extensive range of built-in algorithmic trading capabilities. Traders can develop, test, and deploy their own automated trading strategies using the platform’s integrated cAlgo functionality. The cAlgo platform supports the C# programming language, providing a flexible and powerful environment for creating custom indicators and automated trading systems.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT