How Keeping a Trading Log Could Improve Your Results

A trader tracker is a key tool for traders looking to improve their performance in the financial markets. By recording and analyzing your trades, you can identify patterns, mistakes, and opportunities for improvement in your strategy. In this article, we will explore how keeping a trading log can enhance your results and how to use a trading journal effectively.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Identify Success and Failure Patterns in Your Trades

The importance of keeping a trading journal is that it can significantly improve your results. By keeping a detailed trading log, you can identify patterns in your behavior and analyze your past decisions. This enables you to enhance your decision-making process and reduce errors. Furthermore, the trader tracker can help you spot areas for improvement in your strategy and take steps to optimize your performance in the future. Let’s delve into it further.

When you maintain a trading log, you can record each trade you make, including details like market entry and exit points, position size, and the reason behind executing the trade. But the information doesn’t stop there.

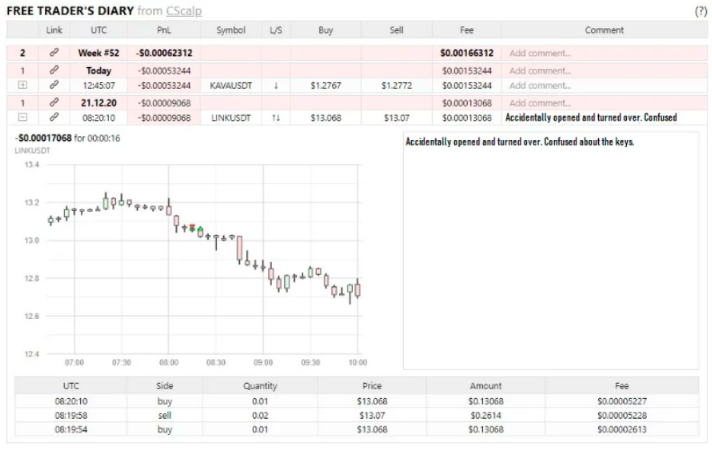

With an automated trading log like the one offered by free CScalp Trading Diary, you can also analyze your transactions to identify success and failure patterns. This can be especially useful if you are seeking to improve your results.

You can discover patterns in your performance that you might not have noticed before. For instance, you may find that you tend to have more success with certain currency pairs or during specific times of the day. Once you have identified these patterns, you can adjust your trading strategy accordingly and avoid costly mistakes in the future.

Learn to Adjust Your Strategy and Reduce Risk with a Trading Log

Within the realm of trading, risk management stands as an essential pillar of longevity and profitability. Here, the trader tracker proves to be an indispensable ally in your quest to safeguard your capital. Through our complimentary service, you gain the ability to vigilantly monitor and systematically reduce your exposure to risks.

This entails a diligent examination of your trades to identify discernible patterns of risk. Armed with these insights, you are well-equipped to implement proactive measures that steer clear of potential hazards, preventing you from engaging in trades that might carry an elevated level of risk in the future.

As you become more adept at analyzing your trading patterns, you gain the upper hand in customizing your strategy to align with market conditions and fluctuations. This calibration positions you to capitalize on favorable market movements while mitigating exposure to unfavorable outcomes.

Moreover, as you methodically reduce risks within your trading activities, you invariably set the stage for optimizing your long-term profitability. The symbiotic relationship between strategy adjustment and risk reduction becomes the bedrock of a formidable trading approach that stands the test of time and prevailing market dynamics.

In the crucible of the financial world, adaptability and prudence prove to be potent weapons against uncertainty and volatility. As you harness the insights gleaned from your trading log, you unlock the potential to evolve as a trader, consistently refining your strategy and embracing a dynamic approach that adapts to ever-changing market circumstances. This journey towards continuous improvement not only maximizes your chances of achieving profitability but also instills resilience in the face of challenges.

Remember, the essence of effective trading resides not merely in executing successful trades, but in having the wisdom and foresight to adjust your strategy and navigate the treacherous waters of risk. Armed with the data and analysis provided by your trading log, you possess a formidable toolkit that empowers you to navigate the markets with a discerning eye and a shrewd hand.

Embrace the learning process, the insights, and the transformation that comes from being a proactive and adaptive trader. Your journey toward mastery begins with harnessing the power of the trader tracker and culminates in a legacy of profitable and principled trading endeavors. Learn more tips and tricks on our Discord channel.

Make The Most Of Your Winning Trades

When it comes to trading in the financial markets, it is essential not only to minimize losses, but also to maximize profits. The trading log can be a valuable tool to achieve this goal, as it allows you to analyze your winning trades in detail and find patterns that you can replicate in the future.

Identify The Reasons Behind Your Successful Trades

Discovering the factors contributing to your successful trades is a prominent benefit of keeping a trading log. This invaluable tool enables you to delve into the intricacies of your triumphs. Was it a well-timed strategy that led to the positive outcomes? Or did the prevailing market conditions play a crucial role in favoring your positions?

Through a meticulous analysis of your winning trades, you gain profound insights and a deeper comprehension of your strengths and weaknesses in the trading arena. Armed with this knowledge, you can fine-tune your approach, capitalize on your strengths, and mitigate potential pitfalls.

The trading diary empowers you to build a well-informed and effective trading strategy that aligns with your unique style and preferences, fostering a greater likelihood of sustainable success in the dynamic world of financial markets.

Trading Log: Repeat What Works and Eliminate What Doesn’t

Repeating what proves effective and discarding what does not is a fundamental principle for traders seeking long-term success. Once you have discerned the underlying factors that contribute to your profitable trades, it becomes crucial to replicate those successful patterns diligently.

By doing so, you can enhance your chances of achieving favorable outcomes consistently, thereby reinforcing your overall trading strategy. For instance, if thorough analysis reveals that your current approach yields impressive results when applied to a particular currency pair, incorporating it into analogous trades in the future can lead to sustainable gains.

On the contrary, if your short-term trading strategy fails to deliver consistent outcomes, it is imperative to be discerning and adaptive. In such cases, a pragmatic approach entails either revisiting and revamping the strategy to address its shortcomings or, in extreme cases, completely phasing it out in favor of more reliable alternatives.

By proactively recognizing and eliminating subpar elements from your trading methods, you can fine-tune your overall approach and substantially increase your chances of success in the dynamic and challenging world of trading. Remember, the key to enduring prosperity lies not merely in embracing what works, but in having the courage to part ways with what does not contribute to your goals and aspirations as a trader.

Use the Trading Log to Refine Your Strategy for Success

The trading log can be an invaluable tool for improving your results in the financial market. By identifying success and failure patterns, making the most of your winning trades, learning to adjust your strategy, and reducing risks, you can enhance your performance and increase your long-term profits. Keeping a detailed record of your trades, thoughts, and emotions can also help you develop a more disciplined and focused trading mindset.

Take advantage of available technology to simplify the process and gain a clearer insight into your performance. Remember, the CScalp Trading Diary is not just an automatic record of your trades, but a tool to improve your overall trading.

Still using Excel to track your trade history? Read our article on CScalp Trading Journal vs. Excel.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT