As crypto trading continues to grow in popularity, understanding how to manage the leverage on online platforms becomes increasingly important. CScalp explores the basics of crypto futures trading and explains how to choose the right exchange for you.

Crypto Futures Trading: The Basics

In crypto futures trading, you're essentially engaging in a contract to buy or sell a cryptocurrency at a future date, but at a price that's agreed upon today. This form of trading allows you to navigate the often volatile crypto markets without needing to hold the actual digital asset. It's a tool for hedging and managing risk, as well as for speculation.

One of the key distinctions in futures trading, as opposed to Spot trading, is the leverage involved. Futures contracts can often be purchased with a fraction of the contract's value, known as margin trading. This can amplify both gains and losses, making it crucial to understand the risks involved.

To learn more, check our article: Margin Trading Crypto: Your Ultimate Guide

One of the key distinctions in futures trading, as opposed to Spot trading, is the leverage involved. Futures contracts can often be purchased with a fraction of the contract's value, known as margin trading. This can amplify both gains and losses, making it crucial to understand the risks involved.

To learn more, check our article: Margin Trading Crypto: Your Ultimate Guide

Types of Crypto Futures Contracts

There are two types of futures contracts: standard and perpetual.

Understanding Standard Futures Contracts

These contracts have a fixed expiry date, which is essential to keep in mind. The expiration dates are typically standardized, occurring on a monthly or quarterly basis.

When trading standard futures, as the contract nears its end, you must decide whether to settle your positions (by either taking delivery of the asset, which is rare in crypto or settling in cash) or to roll over their position to a new contract. This expiry aspect can significantly impact the trading strategy, as the prices of futures can converge with the Spot prices as the expiry date approaches. This phenomenon is known as 'convergence'.

When trading standard futures, as the contract nears its end, you must decide whether to settle your positions (by either taking delivery of the asset, which is rare in crypto or settling in cash) or to roll over their position to a new contract. This expiry aspect can significantly impact the trading strategy, as the prices of futures can converge with the Spot prices as the expiry date approaches. This phenomenon is known as 'convergence'.

Perpetual Futures Contracts

Perpetual futures, a relatively newer concept particularly popular in the cryptocurrency market, are innovative in that they do not have an expiry date. This allows you to hold a position indefinitely, as long as you can meet the margin requirements. Perpetual futures mimic the Spot market but with the added advantage of leverage.

The key mechanism that differentiates perpetual futures from standard futures is the funding rate. This rate ensures that the prices of perpetual futures stay aligned with the underlying Spot price of the asset. You either pay or receive this funding rate, which is typically exchanged between long and short position holders periodically throughout the day. If the rate is positive, long position holders pay short position holders, and vice versa when negative. This mechanism incentivizes to take positions that bring the futures price closer to the Spot price.

The key mechanism that differentiates perpetual futures from standard futures is the funding rate. This rate ensures that the prices of perpetual futures stay aligned with the underlying Spot price of the asset. You either pay or receive this funding rate, which is typically exchanged between long and short position holders periodically throughout the day. If the rate is positive, long position holders pay short position holders, and vice versa when negative. This mechanism incentivizes to take positions that bring the futures price closer to the Spot price.

Advantages of Cryptocurrency Futures Trading

Cryptocurrency futures trading has become increasingly popular for several reasons. This trading method offers unique advantages over traditional Spot trading of digital assets. Let’s highlight the key benefits:

Leverage and Capital Efficiency

Cryptocurrency futures allow you to use leverage, meaning you can open positions much larger than your initial margin. This can significantly amplify potential profits (though it also increases potential losses). Leverage enables traders to be more capital efficient, as there is no need to commit the full value of the asset to gain exposure to its price movements.

Hedging Against Price Volatility

One of the primary benefits of futures trading in the crypto space is the ability to hedge against volatility. Cryptocurrencies are known for their price fluctuations, and futures contracts can be used to lock in prices for future transactions, reducing the risk of adverse price movements. This is particularly beneficial for miners and long-term holders who want to protect against downward price swings.

Diversification of Investment Portfolio

Futures trading allows for easy diversification of an investment portfolio. You can access a wide range of cryptocurrencies without the need to own the underlying assets. This opens up opportunities to explore different markets and asset classes, spreading risk across various investments.

Access to Short Selling

Although short selling is possible on the Spot market, futures trading allows for higher profits from declining markets. This aspect is particularly advantageous in the crypto market, where price corrections are common.

Price Discovery and Transparency

Futures markets play a crucial role in price discovery, helping to determine the asset's underlying value based on market perceptions of future price movements. This is beneficial for the overall transparency and maturity of the cryptocurrency market.

No Need to Own the Actual Asset

Trading futures doesn't require ownership of the actual cryptocurrency, which simplifies operations like storage and security. You don't need to worry about wallet security or the technicalities of handling digital assets, reducing the operational risks associated with crypto ownership.

Best Trading Platforms and Exchanges for Crypto Futures Trading

When you decide to engage in crypto futures trading, selecting a suitable cryptocurrency exchange and trading platform is crucial. These platforms vary in order types, features, customer service, and security. Popular exchanges often offer a variety of digital currencies, including Bitcoin Ethereum, and USD Coin. Let's dive into top cryptocurrency exchanges, renowned for their features, and highlight their key aspects.

Binance

Binance is the world's largest cryptocurrency exchange by trading volume. Known for its extensive variety of digital currencies, including mainstream options like Bitcoin, Ethereum, and USD Coin, Binance caters to traders of all levels. Its robust platform offers a multitude of order types, advanced trading features, and strong security measures, making it a top choice for many.

Bybit

Bybit is a major player on the global stage. It ranks among the world's largest cryptocurrency exchanges, with a trading volume of $2.75 billion. Bybit is recognized for its user-friendly interface, advanced trading tools, and competitive trading fees. Due to regulatory compliance, it is not available to United States citizens, which is an important consideration for traders based in this country.

Phemex

Launched by a group of experienced derivatives traders in 2019, Phemex has quickly made a name for itself in the crypto futures market. Phemex is appreciated for its speed, reliability, and wide range of trading options, making it an attractive platform for both new and seasoned traders.

OKX

OKX presents an array of trading options, with hundreds of pairs available for crypto futures trading. The platform is celebrated for its robust system, extensive range of order types, and a strong commitment to security, providing a comprehensive trading environment for its users.

Integrate Your Crypto Exchange with CScalp

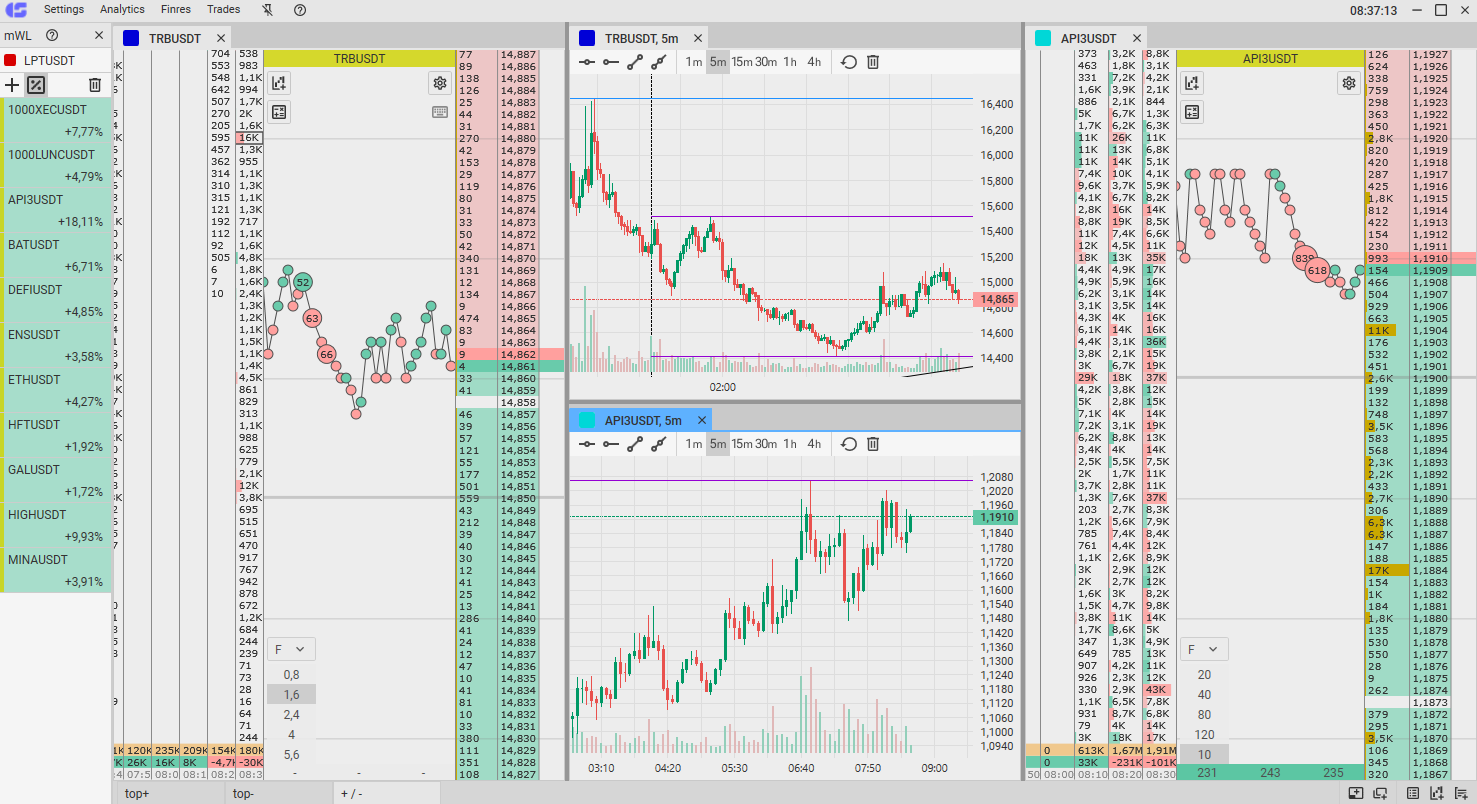

Integrating free professional terminal CScalp with your preferred crypto futures trading exchange offers numerous benefits, from streamlined trading processes and enhanced market analysis tools to improved risk management and a customizable trading environment.

By connecting CScalp to your chosen crypto futures trading exchange, you gain free access to a more efficient trading process. This integration allows you to manage your trades directly through CScalp's platform, which is designed for trading efficiency. Our CScalp Discord channel is a great place to find more experienced traders willing to help you in this process.

When you connect CScalp to your exchange, you benefit from sophisticated analysis tools, aiding in more informed and strategic trading decisions. You can also place and cancel orders with one click. This option is especially beneficial in a market known for its volatility, where the ability to quickly execute trades can significantly impact your trading outcomes.

This centralization makes it easier to track your portfolio, view your trading history, and analyze your performance over time. It simplifies the trading process, making it more accessible, especially if you are new to crypto futures trading.

By connecting CScalp to your chosen crypto futures trading exchange, you gain free access to a more efficient trading process. This integration allows you to manage your trades directly through CScalp's platform, which is designed for trading efficiency. Our CScalp Discord channel is a great place to find more experienced traders willing to help you in this process.

When you connect CScalp to your exchange, you benefit from sophisticated analysis tools, aiding in more informed and strategic trading decisions. You can also place and cancel orders with one click. This option is especially beneficial in a market known for its volatility, where the ability to quickly execute trades can significantly impact your trading outcomes.

This centralization makes it easier to track your portfolio, view your trading history, and analyze your performance over time. It simplifies the trading process, making it more accessible, especially if you are new to crypto futures trading.

The Power of Crypto Futures Trading with CScalp

Crypto futures trading offers flexibility, leverage, and opportunities to hedge against volatility, making it an indispensable tool for traders.

For an optimized trading experience, integrating CScalp with your preferred crypto futures trading exchange is a game-changer. This integration not only simplifies your trading processes but also enriches your market analysis capabilities. The connection between CScalp and various exchanges through API keys enables you to enjoy a centralized trading platform, where efficiency and speed are paramount.

Remember, trading crypto futures is a journey that involves continuous learning and adaptation. To stay ahead in this dynamic market, it's vital to be part of a community that shares insights, tips, and experiences. Happy trading, and we look forward to seeing you in our community!

For an optimized trading experience, integrating CScalp with your preferred crypto futures trading exchange is a game-changer. This integration not only simplifies your trading processes but also enriches your market analysis capabilities. The connection between CScalp and various exchanges through API keys enables you to enjoy a centralized trading platform, where efficiency and speed are paramount.

Remember, trading crypto futures is a journey that involves continuous learning and adaptation. To stay ahead in this dynamic market, it's vital to be part of a community that shares insights, tips, and experiences. Happy trading, and we look forward to seeing you in our community!