Start Crypto Trading Today: A Complete Guide to Cryptocurrency Trading

Crypto trading is a popular and exciting way to engage with cryptocurrencies. CScalp prepared a comprehensive guide to help you understand the basics, choose the right platform, and get started with crypto trading. Explore advanced strategies, stay informed with market trends, secure your assets, and discover additional opportunities in the crypto market. Don’t forget to download the CScalp free professional terminal by leaving your email in the form below.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Understanding Crypto Trading

In this article, we will explore the basics of crypto trading, starting from the fundamental concepts to the associated risks. Let’s dive in!

What is Crypto Trading?

Crypto trading refers to the buying and selling of cryptocurrencies on various platforms or exchanges. It involves speculating on the price movements of cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and others to generate profits.

Cryptocurrency Trading Basics

Market Trend

The market trend is the general direction of an asset’s price. There are two types of trends: bullish and bearish. A bullish market is an upward trend, bearish – a downward trend. There is also a sideways market (flat), which occurs during consolidation when there’s no clear movement in the asset’s price.

BTC/USDT price chart on TradingView. It displays price movements in red and green candlesticks, with a blue trend line indicating an uptrend

During a long-term trend, the price of a cryptocurrency may change direction. For example, short-term bearish trends can occur in a long-term bullish market and vice versa. This is a normal situation. Long-term trends are more significant for the market than short-term ones.

BTC/USDT chart featuring a downtrend

Bulls and Bears

“Bulls” are traders who earn from the rising prices of assets. Bulls buy cheaper, wait for the price to rise, and then sell at a higher price. For example, bulls can buy Bitcoin at $28,500. When the price of Bitcoin rises to over $30,000, they sell it and pocket the difference.

The bull market is a time when a rising trend dominates it, meaning that prices of coins are increasing. Buyers earn, while in the derivatives market, holders of long positions on futures contracts profit.

“Bears” are traders who earn from the falling prices of assets. Bears open short positions in the futures market and also “short” coins in Spot trades. The rules of short selling are such that the trader borrows coins, sells them at the current price, and when the price of the coins drops – buys them back and returns the debt. Profit is made if the buyback price is lower than the selling price. If a trader borrows assets and the price rises – they will have to buy back the crypto at a higher price to return the debt.

For short sellers, the opportunity to profit comes with a bear market. During this period, asset prices fall, and crypto becomes cheaper.

Learn more: Crypto Futures Trading: How It Works

Long Position and Short Position

A long position is buying a trading instrument in anticipation of its value increasing. A short position is selling a trading instrument with the expectation that its value will decrease. Short selling involves selling an asset and then buying it back (after its price drops).

Short trading is closely related to margin trading (which we will discuss later), as it often uses borrowed assets. In the stock market, traders borrow from brokers for short trading. In the cryptocurrency market, they borrow from exchanges or other traders through special mechanisms.

Liquidity

Liquidity is the ability of an asset to be quickly bought or sold at market price. This rule applies to the cryptocurrency market as well.

Liquid cryptocurrencies have a high level of demand and supply, are traded on all (or almost all) cryptocurrency exchanges, and can be quickly bought or sold at market value. For example, such cryptocurrencies include BTC, ETH, DOGE, etc. As a rule, traders only work with highly liquid assets. Low-liquidity assets are risky. Sometimes there may simply not be enough volume to buy them, or demand to sell them.

Order Book

The order book is a collection of buy and sell orders for a trading instrument, sorted by price. Stock traders and investors, as well as cryptocurrency traders, use order books. They can be found in trading terminals, on the exchange website, or in the broker’s mobile applications. It is a popular and widely used tool that some traders prefer even to charts.

Order books look different on various platforms. Nevertheless, they always contain basic information: buy and sell orders for an instrument and their price.

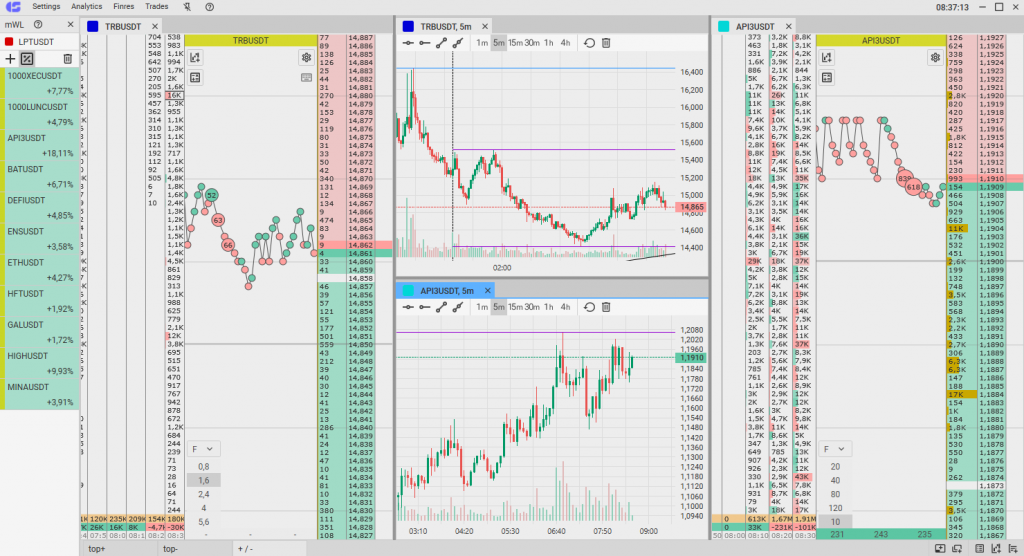

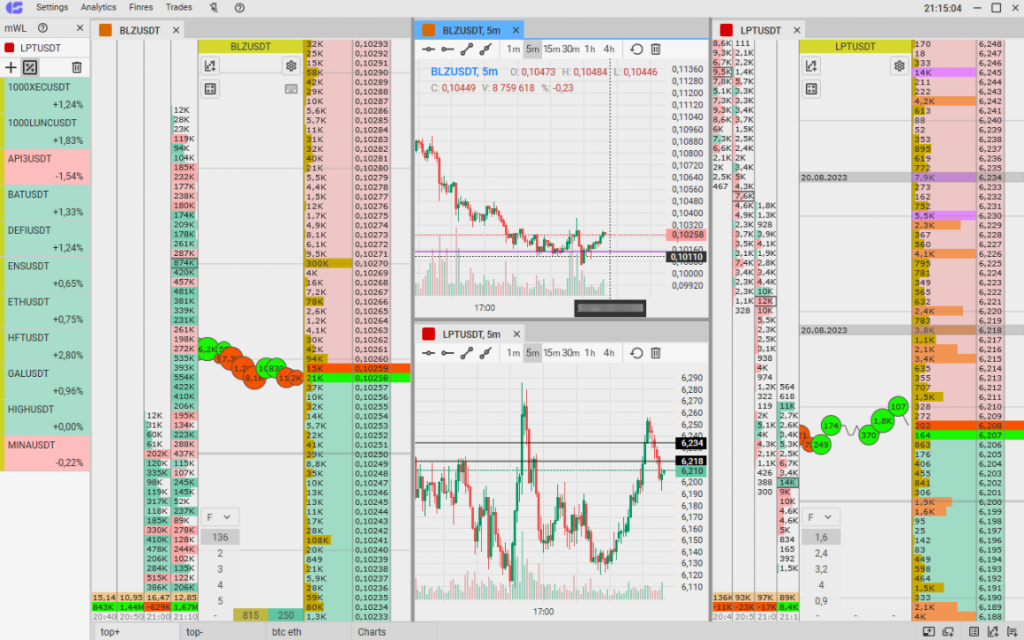

CScalp crypto trading terminal

The depth of the order book refers to its technical component (how many orders can be displayed simultaneously on both sides) or the liquidity volume of the instrument. In the latter case, the “deeper” the market, the more liquid the order book. The more liquid the order book, the larger the orders that can be executed without significantly affecting the price.

Trade Tape

The trade tape is an analysis tool that shows the number of trades that have occurred at each price level. The trade tape allows you to quickly assess the activity of an instrument at close price levels, which is useful in scalping. Unlike clusters, the tape does not show volumes, but the sheer number of orders executed in the market.

Professional crypto trading terminal developers offer several ways to display the trade tape. For example, in CScalp, the tape is implemented as a “chain” of circles. The number of completed trades is indicated in the circles. The chain “stretches” depending on the selected timeframe. Other trading platform developers offer the trade tape as a table where completed market orders are listed.

Market Order

A market order is an order to buy or sell an instrument at the best available price. If there is high liquidity in the order book, a market order is executed instantly. Typically, market orders are used when you need to urgently open or close a position.

Execution of a trade by a market order is guaranteed. But there are some drawbacks. When placing a market order, the trader cannot determine the transaction price in advance. Orders are executed at the best available price, which can change in fractions of a second. In other words, slippage is possible for market orders.

Limit Order

A limit order is a request to buy or sell a digital asset at a specified price. Once placed, the limit order goes to the order book (if there’s no matching market price). For the order to be executed, a counter order must arrive in the order book, and its price must be at least the price set in the limit order. Hence, the execution of a limit order is not guaranteed. It might be partially filled or not filled at all.

Stop-Loss and Take-Profit

Stop-Loss and Take-Profit are stop orders used to minimize risks in cryptocurrency trading. Stop-Loss limits losses, while Take-Profit locks in profits. SL/TP activate when the price reaches a certain level predetermined by the trader. Both orders are placed only when there is a position equal to the open order. It’s important to note that Stop-Loss and Take-Profit are executed at market prices.

Slippage

Slippage occurs when, in placing a market order, the price falls, and the order is executed at a lower price than expected. Slippage can be caused by low liquidity or gaps in the order book following transactions by large market participants in a volatile market.

Slippage usually happens when trading in large volumes. It’s risky because there can be a significant difference between the expected execution price and the actual price, to the trader’s disadvantage.

Makers and Takers

Most cryptocurrency exchange commission systems operate on a maker/taker principle. Makers are orders that go into the order book and wait for a counter order. Takers are executed using the orders in the order book. In other words, makers add liquidity to the exchange, and takers remove it. Therefore, the commission for makers is typically lower than for takers.

There’s a common misconception that makers place only limit orders, and takers place only market orders. In reality, any order that goes into the order book and waits to be filled can be a maker. Takers are orders that “take” the maker out of the order book.

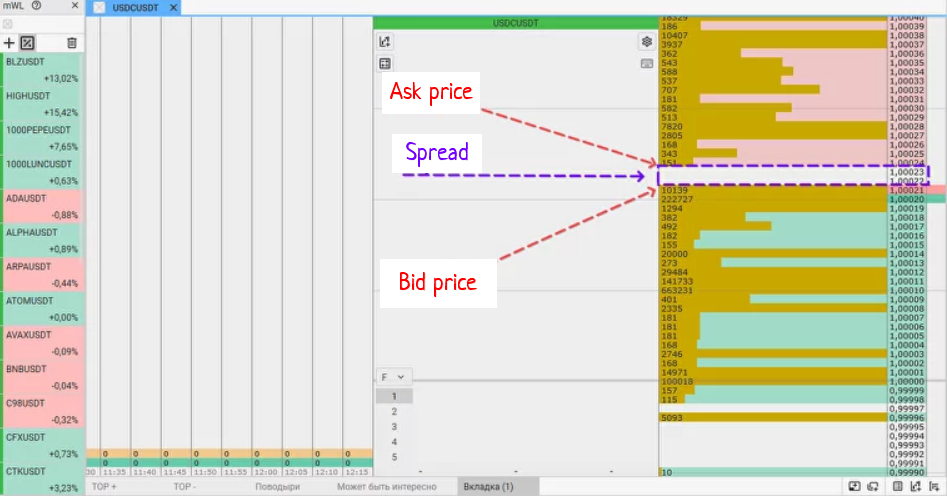

Ask, Bid, and Spread

Asks are sell orders in the order book, while bids are buy orders. The ask and bid price is the offer price or the lowest price at which a seller/buyer is willing to sell/buy. Market orders are executed instantly at ask or bid prices.

In the order book, asks are placed in the upper part, and bids in the lower. The difference between the ask and bid price is the spread, which indicates the liquidity of an asset. The narrower the spread, the more liquid the cryptocurrency, and vice versa. The spread is influenced by the number of orders in the order book. The more popular the coin, the smaller the spread.

Cryptocurrency Charts

Charts are the foundation of technical analysis. Knowing how to read charts is a crucial skill for traders. There are many types of charts, each designed for specific purposes. Classic types include line, candlestick, and bar charts. Let’s look at different types of charts using TradingView charts as examples.

The line chart is built on time and price axes and follows the price movement.

The candlestick chart consists of Japanese candles. Each candle has a body and wicks (shadows). The size of the candle’s body and the height of the wicks determine the trend’s strength. The candle’s body shows the opening and closing prices. The shadows show the price highs and lows for a specific period.

The bar chart resembles the candlestick chart, but instead of candles, it has lines. The vertical line shows the price minimum and maximum. The horizontal lines show the opening and closing prices.

Trend Lines

A trend line is a diagonal that connects the price peaks or their bases. It forms support and resistance levels. On a bullish market, the line goes through the lower points of the chart, and on a bearish market, through the upper points.

Support and Resistance Levels

Support and resistance levels are important price levels where the price reacts (rebounds or breaks through). On a chart, support levels are the lower values, resistance levels are the upper values.

If the price breaks through a resistance level and stabilizes above it, it becomes a support level. The longer the level resisted, the stronger the support will be. When a support level is breached, a mirror situation is observed.

Support and resistance levels help traders determine the point of entry into a position or exit from it.

Candlestick Patterns

Candlestick patterns are figures made of several candles, whose appearance can indicate the emergence of a particular market situation (trend reversal, trend continuation, etc.). Usually, candlestick patterns are divided into bullish, bearish, and continuation patterns.

Graphic Patterns

Graphic patterns are areas on a chart that form a certain model. Periodically, the price movement forms patterns that can be used to predict the development of the market situation. There are graphic patterns for trend continuation, trend reversal, and uncertainty patterns.

Graphic patterns form over a relatively long period. Therefore, in some situations, they allow a better understanding of the market context than candlestick patterns. But like candlestick models, graphic patterns, are not a signal to buy or sell. They are market indicators, allowing for more quality asset price analysis.

Technical Indicators

Technical indicators are “assistants” in conducting technical analysis. Indicators gather information from the market and “package” it into signals. Some indicators visualize data as a graph with a line. Others as histograms and tables.

Usually, technical indicators are divided into four groups:

- Trend indicators: Tools that help determine the current market trend and its strength.

- Momentum indicators: Assess price impulses, and the speed of price changes.

- Volatility indicators: Count how often the price falls and rises above.

- Volume indicators: Allow evaluation of the trading volume of an instrument. For example, you can see at what price Bitcoin was traded in the last hour or two. By evaluating crypto trading indicators, a trader can guess where the price will move.

Indicators are usually weak when used alone. It is preferable to use them in a combination of two or three. Then it is possible to identify correlations in the readings and make a balanced decision. However, indicators are not a panacea. Even the best tools can make mistakes, especially in the volatile cryptocurrency market.

The Risks Involved in Crypto Trading

While crypto trading can be lucrative, it also comes with inherent risks. Volatility in cryptocurrency prices can lead to substantial gains or losses. Additionally, the lack of regulation in the crypto market poses security and fraud risks. It is crucial to approach crypto trading with caution and employ risk management strategies to protect your assets.

Selecting the Best Crypto Trading Platform

When it comes to crypto trading, selecting the right platform is crucial for your success. Let’s explore factors that you should consider to make an informed decision:

Factors to Consider in Selecting a Crypto Trading Platform

- Security: Look for platforms that prioritize robust security measures, such as two-factor authentication or encryption protocols, to protect your funds.

- Availability of Cryptocurrencies: Ensure that the crypto trading platform supports a wide range of cryptocurrencies, including popular ones like Bitcoin, Ethereum, and Litecoin.

- Liquidity: Opt for crypto trading platforms with high liquidity to ensure smooth trading and minimal price slippage.

- User-Friendly Interface: Choose platforms that offer intuitive and easy-to-navigate interfaces, suitable for both beginners and experienced traders.

CScalp Crypto Trading Platform Overview

CScalp is a free professional crypto trading platform. Used by over 12,000 traders from 50 countries, it stands out for its comprehensive suite of features tailored to enhance your crypto trading experience.

One of the most striking aspects of CScalp is its ability to integrate multiple exchanges in a single interface. This feature enables you to switch between different cryptocurrency exchanges without the need to change platforms, streamlining your trading process. Additionally, the platform supports multi-account functionality, allowing you to manage several accounts from a single exchange.

CScalp offers a range of tools designed to provide real-time insights and control over your trades. The order book allows trading with a variety of instruments simultaneously, enabling quick execution of limit orders. A real-time display of market trade history ensures that you stay informed about market movements as they happen. Furthermore, the platform includes clusters to track market dominance by buyers or sellers, customizable charts for monitoring price dynamics, and comprehensive statistics for tracking your trading history and performance. A key feature of CScalp is its focus on risk management to safeguard your digital assets.

Understanding Market Analysis and Price Movements

Understanding market analysis and price movements is essential for successful crypto trading. Here are some key concepts to grasp:

- Study technical analysis indicators, such as moving averages, MACD, and RSI, to identify trends and potential entry or exit points for trades.

- Learn fundamental analysis to evaluate the underlying value and potential growth prospects of different cryptocurrencies.

- Follow market news, events, and trends that may impact cryptocurrency prices.

- Monitor market charts and patterns to identify support and resistance levels.

- Practice risk management by setting Stop-Loss orders to limit potential crypto trading losses.

With these insights, you can navigate the crypto market with more confidence and make informed trading decisions.

Advanced Crypto Trading Strategies and Techniques

When it comes to advanced crypto trading, there are various strategies and techniques that experienced traders employ to maximize their profits and minimize risks. This section delves into some key approaches used in the dynamic world of cryptocurrency trading.

Margin and Derivatives in Crypto Trading

One strategy that advanced traders employ is margin trading, which involves borrowing funds to amplify their trading position. By using leverage, traders can increase their potential returns, but it also exposes them to higher risks. It’s crucial to understand the concept of margin and the potential consequences of venturing into this strategy. Additionally, derivatives such as futures and options can be utilized to hedge against potential losses or speculate on price movements.

Risk Management and Position Sizing in Crypto Trading

Risk management is a critical aspect of successful crypto trading. Advanced traders employ various techniques to manage their risk exposure, including setting stop-loss orders, diversifying their portfolio, and implementing proper position sizing. These strategies help traders protect their capital and minimize the impact of potential losses. Understanding risk management principles and applying them consistently is essential for long-term success in the crypto trading arena.

Market Data and News

To stay informed about the crypto market, it’s crucial to regularly follow market data and keep up with the latest news. Stay updated on the price movements, trading volumes, and market trends of different cryptocurrencies. Utilize reliable sources such as reputable news websites, crypto exchanges, and financial platforms that provide real-time data and accurate analysis. Subscribe to newsletters, join crypto forums, and follow influential figures in the crypto space to stay informed about market developments.

Crypto Trading Tools and Indicators

Increase your chances of making informed trading decisions by utilizing various trading tools and indicators. Technical analysis tools such as moving averages, Bollinger Bands, and relative strength index (RSI) can help you analyze price patterns and identify potential market trends. Trading platforms often provide built-in charting tools and customizable indicators, allowing you to make data-driven trading decisions.

Cryptocurrency Market Trends

Analyzing cryptocurrency market trends is essential for successful trading. Understanding market trends can help you identify potential opportunities and make informed investment decisions. Pay attention to market cycles, price patterns, and emerging trends. Track the performance of different cryptocurrencies over time and analyze their historical data. By studying market trends, you can gain insights into potential price movements and adjust your trading strategies accordingly.

How to Safeguard Your Cryptocurrencies?

Protecting your digital assets is essential to minimize the risk of unauthorized access or loss. Here are some steps you can take:

- Enable Two-Factor Authentication (2FA): Add an extra layer of security on the cryptocurrency exchange you are using by enabling 2FA to authenticate your transactions and account access.

- Use Strong Passwords: Create unique, complex passwords for your crypto-related accounts. Consider using a password manager to securely store and manage your passwords.

- Stay Vigilant Against Phishing: Be cautious of phishing attempts and only interact with trusted websites and emails. Verify the authenticity of links and double-check the addresses before providing any sensitive information.

- Keep Software and Wallets Updated: Regularly update your wallet software to ensure you have the latest security patches and bug fixes.

Blockchain Technology and Transactions

Blockchain technology is the underlying technology behind cryptocurrencies. It is a decentralized and immutable ledger that records all transactions. Understanding how blockchain works can help you make informed decisions while managing your crypto assets.

- Transaction Confirmation: In the blockchain network, transactions need to be verified by multiple nodes before they are considered valid and added to the blockchain.

- Transaction Fees: When sending or receiving cryptocurrencies, transaction fees may apply. These fees vary depending on network congestion and the priority of your transaction.

- Public and Private Keys: Cryptocurrency transactions require the use of public and private keys. Public keys are used to receive funds, while private keys are used to access and authorize transactions from your wallet.

- Security Advantages: Blockchain technology provides transparency, immutability, and robust security features, making it difficult for malicious actors to tamper with transactions.

Embracing the Future of Finance: A Trip to Crypto Trading

Crypto trading goes beyond the mere buying and selling of digital assets. It’s a foray into the future of finance, where decentralized technologies like blockchain and DeFi are reshaping our understanding of monetary transactions and investments. With platforms like CScalp offering a multitude of features for professional trading, the tools and resources available to traders are more sophisticated and user-friendly than ever.

However, this journey is not without its risks. The volatile nature of cryptocurrencies, combined with the complexities of market analysis and risk management, calls for a cautious and well-informed approach. It’s essential to continuously educate yourself, stay updated with market trends, and employ prudent strategies to safeguard your investments.

Crypto trading is not a simple venture; it’s a continuous learning process and a gateway to digital finance. Stay curious, stay cautious, and embrace the opportunities that financial markets present. Happy trading!

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT