Crypto Funding Rates: Understanding the Cost of Trading on Margin

Cryptocurrency funding rates are a derivatives market mechanism used specifically for financial instruments like perpetual contracts. Crypto funding rates are fees that traders either pay or earn for holding their positions open, and they are periodically exchanged between the long and short positions on trading platforms. This guide by CScalp explains what crypto funding rates are and how they ensure the price of perpetual contracts stays closely aligned with the underlying asset’s Spot price.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

What Are Funding Rates?

Crypto Funding Rates Definition and Purpose

Funding rates in the cryptocurrency market are periodic payments that traders of perpetual futures contracts either pay or receive. Their main purpose is to keep the prices of futures in line with the underlying asset’s Spot price.

If you’re a trader holding a position at the time of a funding event, you could either be the one paying or the one receiving funds, depending on the market situation and which side of the trade you are on – long or short.

Crypto funding rates are used for maintaining the equilibrium between the perpetual futures contracts and the Spot markets. They influence your trading strategies.

Mechanism of Funding Rates

The mechanism of funding rates involves two main components:

- Interest Rate: This reflects the borrowing costs in the financial market. It’s a fixed rate set by the exchange.

- Premium Index: Expressed as a percentage, this reflects the difference between the perpetual contract prices and the Spot price of the cryptocurrency.

Funding Rate is calculated using the formula:

Funding Rate = (Interest Rate – Premium Index) + Average Premium

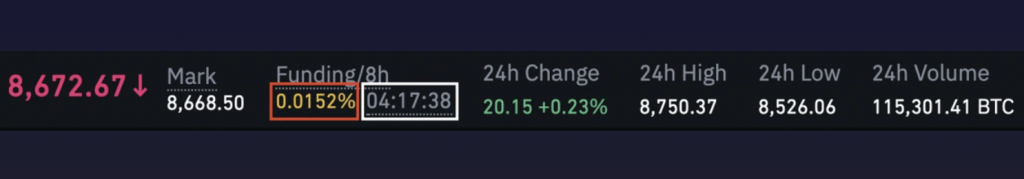

Binance crypto funding rate and countdown for a futures position

When the perpetual futures price is higher than the Spot price (indicating a bullish market), long position holders pay the funding to short position holders. Conversely, if the Spot price is higher, those in short positions pay those holding long positions. These exchanges typically occur every few hours and can significantly impact your profitability in trading perpetual futures exchange contracts.

To take full advantage of the crypto market, try the professional trading platform CScalp by leaving your email in the form above. With the free terminal, you will be able to connect to your preferred exchange and place orders with one click, as well as automatically manage your risks.

Key Factors Influencing Funding Rates

In the cryptocurrency market, funding rates are critical for maintaining the balance between perpetual futures contracts and the underlying asset prices. Specifically, these rates are influenced by traders’ positions and the margin requirements set by exchanges.

Market Sentiment and Positioning

Market sentiment can greatly affect the funding rates in the cryptocurrency market. This sentiment, reflecting whether the majority of traders are bullish or bearish, can be a strong indicator for currencies like BTC and ETH. If most traders are bullish, holding long positions, the funding rate tends to increase to balance out the excess demand. This is because longs will pay shorts to maintain their positions.

Conversely, if the market sentiment is bearish and most traders hold short positions, the funding rate may decrease to incentivize long positions. These fluctuations often correlate with the overall market trend, whether it’s an uptrend or a downtrend.

Leverage and Margin Requirements

Leverage and margin requirements also play a pivotal role in determining funding rates. High leverage can amplify the impact of market movements on funding rates. When traders use high leverage, they may be subject to higher funding rates, as they control larger positions with less capital. The funding rate ensures that the prices of perpetual contracts remain tethered to the underlying asset’s Spot price. Leverage can act as a double-edged sword: it may increase potential profits but can also heighten the impact of funding rate payments, affecting traders with long and short positions.

Interpreting Funding Rates

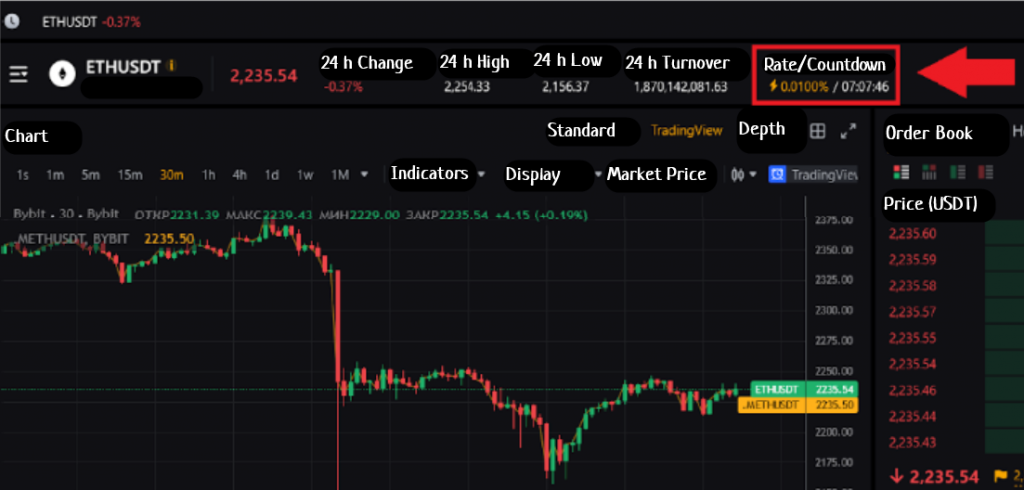

Funding rate and a countdown until settlement in the trading interface of the Bybit exchange

When trading perpetual futures in the cryptocurrency market, understanding how funding rates affect your positions is crucial. These rates indicate the periodic payments that are exchanged between buyers and sellers, shaping the market dynamics.

Positive vs. Negative Funding Rates

Positive Funding Rates: When you encounter a positive funding rate, it suggests that long positions (buyers) are paying the short positions (sellers). This typically occurs when there’s a higher demand to go long in the market, which can drive up the price of the perpetual contracts.

- If the price continues to rise and the funding rate remains high, be cautious; it may signal a crowded long trade which could lead to a market correction.

- A decreasing funding rate coupled with a rising price can imply that traders are starting to counter-trade the initial upward movement.

Positive funding means the futures price is higher than the Spot price

Negative Funding Rates: Conversely, a negative funding rate means that the shorts are paying the longs. This scenario indicates a bearish sentiment where more traders are inclined to bet against the rise of the cryptocurrency market.

- A persistent negative funding rate might suggest bear dominance but, as sentiment shifts, could lead to a short squeeze if the market unexpectedly turns bullish.

- Should the negative funding rate decrease while prices are declining, it can indicate that the bearish trend might be slowing down and a reversal could be underway.

Negative funding: the futures price is lower than the Spot price

Annualized Funding Rates

To comprehend the long-term implications of funding rates on your trading strategy, it’s beneficial to annualize the funding rates. This extrapolates the periodic rate over a yearly period, offering a clearer picture of the cost or gain from holding a perpetual contract over time.

Calculation:

- To annualize a funding rate, multiply the periodic rate by the number of funding periods in a year.

- Example: If the periodic funding rate is 0.01% with an 8-hour funding interval, then the annualized rate is 0.01% * (365 days/year * 3 times/day).

Usage:

- Compare the annualized funding rates across different platforms to determine the most cost-effective ones to hold positions long term.

- Monitor changes in annualized rates to anticipate market sentiment shifts over a broader timeframe, which can influence your trading decisions.

By analyzing both positive vs negative and annualized funding rates, you will have a critical edge in managing your cryptocurrency trades effectively.

Direction of funding payments (longs and shorts)

Impact of Funding Rates on Trading Strategies

Funding rates are an essential aspect of the cryptocurrency derivatives market, serving as a mechanism to align the market price with the Spot price. As a trader, understanding their impact on trading strategies is crucial, particularly for the long-term sustainability of your positions in the volatile crypto markets.

Arbitrage Opportunities

Funding rates vary across different exchanges, presenting an arbitrage opportunity. If you’re engaging in funding rate arbitrage, you essentially capitalize on these discrepancies. Here’s how it can work:

- Identify two exchanges with a significant difference in funding rates.

- Open a long position on the exchange with a lower funding rate.

- Simultaneously, open a short position with the same value on another exchange with a higher funding rate.

This strategy allows you to profit from the spread between the funding rates of the long and short positions, assuming the market remains relatively stable during your trade.

Hedging Strategies

The impact of funding rates can also be mitigated through hedging strategies. As a trader, you must carefully balance your long and short positions to manage risk while leveraging funding rates to your advantage. Consider these points:

- Maintain a long position in an asset while simultaneously keeping an equivalent short position to reduce exposure to market fluctuations.

- Monitor funding rates to determine when to open or close positions as part of your hedging strategy.

By doing so, you essentially insulate yourself from some risk inherent to leverage trading, while still being able to take advantage of the funding rate differentials.

Members of the CScalp community gain access to exclusive resources such as market analysis, trading strategies, and educational materials. These resources can help deepen your understanding of crypto trading and stay updated. Connect with fellow traders, access exclusive resources, and stay ahead of the market trends. Whether you’re a seasoned trader or just starting, our community provides a supportive environment for learning and growing together. Don’t miss out – join us now!

Funding Rates Across Different Cryptocurrencies

Funding rates are crucial in maintaining the equilibrium of perpetual contracts relative to the Spot markets. You’ll find variations among major coins, and altcoins bring their unique impact to bear on these rates.

Comparison Among Major Cryptocurrencies

Funding rates can considerably differ across major cryptocurrencies such as Bitcoin (BTC), Ether (ETH), Ripple (XRP), and stablecoins like Tether (USDT) or USD Coin (USDC). Bitcoin, often being the most established cryptocurrency, typically experiences more stable funding rates compared to altcoins. Ethereum, being closely associated with Bitcoin, often mirrors its funding rate trends but can deviate based on the platform-specific demand within the Ethereum network.

- Bitcoin (BTC): Generally shows lower volatility in funding rates due to larger market cap and liquidity.

- Ether (ETH): Similar characteristics to BTC but can vary based on Ethereum network activity.

- Ripple (XRP) and Solana (SOL): May exhibit higher variation in funding rates owing to less liquidity and market cap when compared to BTC and ETH.

To learn more about the Binance funding rate, check out our article: “Binance Funding Rate: How Funding Works on Binance.”

Influence of Altcoins on Funding Rates

Altcoins such as Polygon (MATIC) and Avalanche (AVAX) can exert their influence on the broader funding rate environment through their specific market activities. For instance:

- Polygon (MATIC): As a scaling solution for Ethereum, its funding rates could fluctuate with the demand for Ethereum scaling and associated dApps.

- Avalanche (AVAX): A high-speed blockchain may see its funding rates impacted by its adoption rate and usage in decentralized finance (DeFi).

The funding rates for altcoins are generally more susceptible to rapid changes than those of major cryptocurrencies, reflecting the newer and often more volatile nature of these markets. Keep a close eye on these rates if you’re considering positions in altcoin perpetual contracts.

Technical Aspects of Funding Rates

Funding rates maintain an equilibrium between futures and Spot markets in cryptocurrency trading. They represent the cost of holding leveraged positions and are essential for understanding market dynamics.

How to Calculate Funding Rates

Calculating funding rates requires you to understand the time intervals at which they’re applied, and the formula used on various exchanges. Generally, funding rates are calculated using the interest rate and the premium or discount the futures contract trades at relative to the Spot price. Here’s a simplified formula:

Funding Rate = Premium Index + (Interest Rate – Premium Index) / Funding Interval

- Interest Rate: Often set at a fixed annual rate, contributing a small part of the rate calculation.

- Premium Index: Reflects the difference between the perpetual contract price and the Spot price.

- Funding Interval: This represents how often the funding is exchanged between traders. This can vary between exchanges but is typically every 8 hours.

Remember, each exchange may have slight variations in how they calculate their funding rates. It’s crucial to consult the specific exchange’s documentation for precise calculations. The impact of these rates is reflected in your trading strategy, as they can either contribute to your gains or eat away at your positions.

Freepik

Risks and Considerations

When engaging with crypto funding rates, you face specific pronounced risks, particularly for highly leveraged positions, including the potential for liquidations and the need for thorough due diligence. Understanding these risks is vital in navigating the market efficiently.

Potential for Liquidations

Liquidation occurs when your position is automatically closed because the market moves against you and your margin level falls below the required threshold. In the realm of cryptocurrencies, funding rates can significantly impact the likelihood of liquidation. If you hold a long position and funding rates are persistently high, the costs can accumulate, potentially leading to liquidation if the market sharply declines or if you are unable to maintain the necessary margin. It’s critical to monitor your positions and maintain awareness of market conditions, as sudden shifts in funding rates can escalate liquidation risk.

Due Diligence and Disclaimer Requirements

Performing due diligence is non-negotiable when participating in cryptocurrency trading. You must scrutinize the terms of service and related disclaimer documents of the exchange you are using to understand your rights, obligations, and the risks involved. It’s essential to understand and respect the financial and regulatory environment in which you’re trading, as insufficient due diligence can expose you to unforeseen risks, including regulatory actions and fraud. Always operate under the assumption that it’s your responsibility to know and adhere to the rules and regulations that apply to your trading activities.

Funding Rates and Market Research

In the dynamic world of cryptocurrency trading, understanding funding rates is crucial for your strategies. These rates directly influence the perpetual contracts market, and staying informed requires access to current data and robust analysis tools.

Current Funding Data

Current funding refers to the hourly funding rate, which is a fee paid by one side of the perpetual contract to the other. It’s designed to align the contract prices with the Spot prices of cryptocurrencies. The rate is variable, recalculated at predetermined intervals, and can be tracked on most exchanges. For example, as of 31 July 2023, exchanges began providing this data at distinct intervals throughout the trading day.

Here’s how you can view this data:

- Timings: The funding rate is calculated at intervals (e.g., 00:00-04:00, 04:00-08:00 UTC).

- Indicators: Platforms may display indicators such as the Current Funding fee that is settled at each hour’s end.

Research and Analysis Tools

To effectively research and predict funding rates, you require analytical tools that can process vast amounts of data and provide insightful analytics and charts. Platforms often provide a range of products to help with this, such as:

- Predicted funding rates: An estimate of what the funding rate could be in the near future based on ongoing market trends.

- Historical data: For examining how funding rates have moved over various time intervals.

Investing time in research is essential to understanding these rates since they represent an important cost or income when trading perpetual contracts. Use the available tools to your advantage to make informed decisions in the cryptocurrency markets.

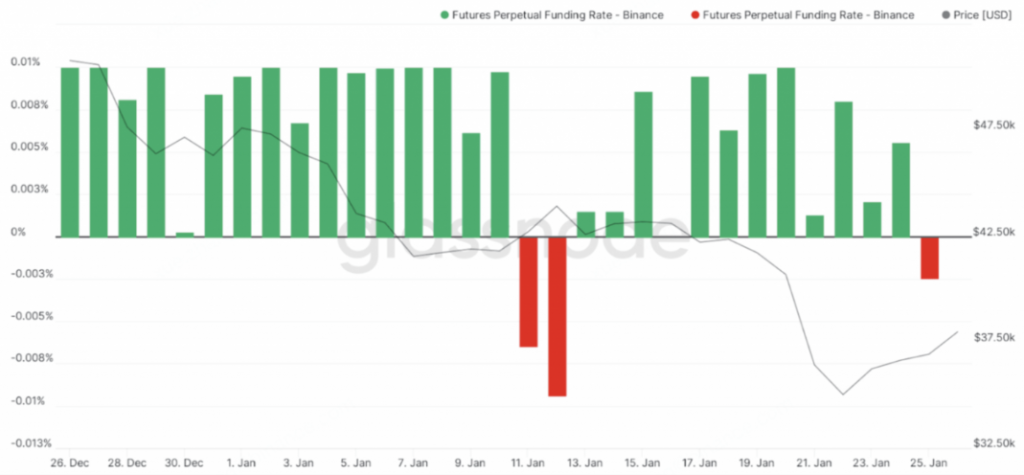

Binance funding + overall market trend (Glassnode portal)

We encourage you to join our growing community on the CScalp Discord server to stay ahead of market trends and developments. Through discussions, analysis, and real-time updates, members can adapt their trading strategies to changing market conditions and maximize their opportunities for success.

Crypto Funding Rates – Conclusion

In the dynamic landscape of cryptocurrencies, funding rates are a significant mechanism within the perpetual futures market. When you trade perpetual contracts on platforms like Binance (BNB), OKX, or Bybit, understanding funding rates is pivotal. These rates align the perpetual contract prices with the actual Spot price of the underlying asset such as Bitcoin (BTC), Ethereum (ETH), or altcoins like Cardano (ADA), Dogecoin (DOGE), or Polkadot (DOT).

Function of Funding Rates:

- Interest Rate Component: Reflects borrowing costs in the market, typically set by the exchange.

- Price Differential Component: Ensures the perpetual contract price stays close to the Spot price.

Examples of Funding Rate Implications:

- Bitcoin (BTC): A high funding rate may indicate bullish sentiment.

- Ethereum (ETH): A low funding rate suggests a bearish outlook or less market leverage.

Your trading strategies on decentralized finance (DeFi) platforms or other crypto exchanges can leverage funding rates to understand the market sentiment for various tokens like Ripple (XRP), Chainlink (LINK), or layer-2 solutions like Arbitrum and Optimism. With projects like Cardano, implementing smart contracts, or Internet Computer (ICP) seeking to expand the utility of blockchain, changes in funding rates can provide insights into trader expectations.

Ultimately, these rates impact your potential returns and risk exposure in the crypto market, whether you’re engaging with large-cap tokens like Ether or small-cap tokens within ecosystems like Fetch.ai, Manta Network, or Sei. They also offer a window into demand for blockchains and linked tokens such as Ethereum Classic (ETC), Polygon (MATIC), and Arbitrum. By monitoring and analyzing funding rates across various platforms, you remain informed, allowing for more grounded decision-making in your crypto trading endeavors.

If you benefited from this guide on crypto funding rates, you can further your trading education through video content on CScalp TV. Check out tutorials for using the free CScalp terminal, as well as explanations of various trading terms and strategies to expand your knowledge over time.

Frequently Asked Questions: FAQs About Crypto Funding Rates

Understanding the nuances of funding rates is crucial to grasping how they can influence your cryptocurrency trading strategies.

How Do Perpetual Contracts Funding Rates Affect My Cryptocurrency Trading?

Perpetual contract funding rates play a pivotal role in shaping cryptocurrency trading strategies. These rates, expressed as a percentage, determine the cost or gain of holding leveraged positions over time. Understanding them is crucial for optimizing trading decisions and maximizing profits.

When engaging in cryptocurrency trading, particularly with highly leveraged positions, traders must comprehend how perpetual contracts funding rates impact their profitability. The funding rates, calculated based on data provided by APIs, reflect market sentiment and dynamics, influencing trading strategies and outcomes.

For example, on platforms like Binance perpetual contracts funding rates are derived from the difference between the interest rate and the premium index, which represents the discrepancy between futures prices and Spot prices of digital assets like Bitcoin or Ethereum. Traders can use analytics tools and charts to monitor these rates, helping them to make informed decisions based on market intelligence.

In an uptrend market sentiment, where traders are bullish, funding rates may increase, indicating higher demand for long positions. Conversely, during downtrends or periods of fear and greed, funding rates may decrease, incentivizing traders to take short positions to capitalize on price volatility.

Moreover, the adoption of stablecoins such as USD Coin (USDC) or Tether (USDT) in futures exchanges has facilitated easier monetization of digital assets and reduced price volatility. This adoption has led to increased liquidity and trading volume, further influencing funding rates and market dynamics.

Overall, perpetual contracts funding rates serve as a crucial indicator of market sentiment and provide valuable insights for traders looking to profit from price movements in the cryptocurrency market. Through understanding and leveraging these rates, traders can effectively manage their portfolios and capitalize on opportunities in the crypto space.

What Impacts Can Negative Funding Rates Have on the Market?

Negative funding rates in the cryptocurrency market signal a bearish sentiment, where short positions dominate. These rates, expressed as percentages, represent the cost paid by shorts to longs, influencing market dynamics and trading strategies.

For instance, on platforms like OKX or Bybit, negative funding rates may arise when there is an imbalance between long and short positions, resulting in a higher demand for shorts. This imbalance can lead to increased price volatility and heightened risk for traders, particularly those holding highly leveraged positions.

In the event of negative funding rates, traders may experience increased pressure to cover their short positions or risk-facing liquidations. This can further exacerbate market downturns and lead to cascading sell-offs, impacting prices across various digital assets such as Bitcoin (BTC) or Ethereum (ETH). Historical chart data for Bitcoin funding rates is available on various platforms and websites that specialize in cryptocurrency analytics and market intelligence.

Where Can I Find Historical Data for Bitcoin Funding Rates?

You can find historical data for Bitcoin funding rates on various platforms and websites that specialize in cryptocurrency analytics and market intelligence. Websites like CoinMarketCap and CryptoQuant offer comprehensive datasets and analytics tools, including historical funding rates for Bitcoin. Additionally, exchanges such as Binance and OKX provide APIs that allow access to real-time data, including historical funding rates for Bitcoin perpetual futures contracts. Moreover, specialized platforms like Amberdata and Matrixport offer user-friendly interfaces and analytics dashboards, making it easy to access and analyze historical funding rate data for Bitcoin and other digital assets.

How Do Funding Rates Vary Across Different Crypto Exchanges?

Funding rates for cryptocurrencies can vary significantly across different exchanges, reflecting variations in market sentiment, liquidity, and exchange-specific dynamics. Platforms like Binance and OKX offer APIs that provide real-time data on funding rates, allowing traders to compare rates across exchanges.

Additionally, analytics platforms such as CoinMarketCap and CryptoQuant aggregate funding rate data from multiple exchanges, offering insights into the broader market landscape. Traders can use these platforms to monitor funding rates and identify arbitrage opportunities between exchanges. Moreover, exchanges like Bybit and Bitget may offer a user guide and tutorials on understanding funding rates, helping traders navigate the complexities of derivatives trading. Overall, understanding how funding rates vary across different exchanges is crucial for traders looking to optimize their trading strategies and maximize profits.

What Does a Positive Funding Rate Indicate for a Cryptocurrency Market?

A positive funding rate in the cryptocurrency market indicates that the price of perpetual contracts is higher than the Spot price, typically meaning that long traders pay shorts. It may reflect bullish sentiment and an abundance of long position traders in the market.

Can You Explain the Concept of Aggregate Funding Rates in Crypto Trading?

Aggregate funding rates in crypto trading involve combining funding rates from various exchanges to provide a broader market perspective. These rates, derived from APIs and analytics platforms like CoinMarketCap and CryptoQuant, offer insights into market sentiment, liquidity, and price volatility. By aggregating funding rates from exchanges such as Binance and OKX, traders can gain a comprehensive understanding of market dynamics and identify arbitrage opportunities.

Additionally, user guides and tutorials provided by exchanges like Bybit and Bitget help traders navigate the complexities of derivatives trading, including funding rates. Overall, aggregate funding rates play a crucial role in shaping trading strategies and maximizing profits in the crypto market.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT