Binance Funding Rate: How Funding Works on Binance

The CScalp team has prepared an introduction to crypto funding rates on the Binance exchange. Discover what funding is and how Binance funding rates are structured, how the funding rates are calculated, where to find the current and historical rates on the exchange’s website, and how to use funding in trading to make a profit.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

What Is Binance Funding Rate?

Binance funding rate is a method used to align prices in perpetual futures contracts. The purpose of funding on Binance is to synchronize the prices of the perpetual futures with those of the underlying assets. Funding rates are dynamic and change throughout the day. Funding can be used to generate income and can also be utilized in market analysis and trading strategies.

How Binance Funding Rates Are Structured

Funding rates are crucial in the perpetual futures market. They represent regular, small payments made from one Binance trader to another and can be viewed as a commission or a reward for holding futures positions. These payments are peer-to-peer, with Binance not participating but rather facilitating the process by determining who pays whom and how much during each settlement period. Whether a trader pays or receives funding depends on the market conditions and their position’s direction.

Funding mechanisms on Binance and other crypto exchanges add significant value to futures trading by preventing the market from becoming excessively volatile or “overheating.” The funding rate itself is calculated based on the difference between the perpetual future’s price and the cryptocurrency’s Spot price, which serves as the benchmark. In a bull market, the funding rate is typically positive, leading holders of long positions to pay those in short positions. Conversely, in a bear market, the funding rate is negative, and traders with open short positions compensate those holding longs. This system encourages traders to maintain positions that align with the prevailing market trend while discouraging contrarian positions.

As a bull run prolongs, it becomes increasingly costly to maintain long positions due to rising fees. Similarly, as the market declines, fees for holding short positions escalate. This mechanism serves as a counterbalance, preventing traders from disproportionately influencing the futures market.

Funding Commissions

Funding is not a trading commission. In addition to funding, traders pay a Binance commission for transactions. However, a fixed fee is included in the Binance funding rate, which can roughly be equated to a commission.

What’s Included in the Binance Funding Rate

Binance funding consists of two payments – the funding rate and the premium. Funding on Binance can be compared to paying for a car rental. You pay a fixed rate for the rental itself and on top for renting during peak hours or the “hot” season.

Binance Funding Rate Amount

The fixed funding rate on Binance is 0.03% of the position size per day, equating to 0.01% every 8 hours. This means that for every 8 hours a position is held, at least 0.01% is paid. For certain contracts on Binance Futures, the rate could be as low as 0.005% per hour, or there may be no funding rate at all.

Funding payments on Binance are scheduled based on the liquidity of the contract and can occur every 4 hours or every 8 hours. For contracts with 8-hour funding intervals, payments are transferred at 00:00, 08:00, and 16:00 UTC. Meanwhile, contracts with 4-hour intervals see payments made at 00:00, 04:00, 08:00, 12:00, 16:00, and 20:00 UTC.

Premium

The premium is the amount we pay in addition to the fixed rate. The size of the premium changes depending on the market situation.

A crucial element in calculating the funding premium is the “Index,” which represents the average price of the base cryptocurrency across various leading exchanges. This index serves to mirror the real market value of the asset. When the futures price on Binance diverges from the index price, the funding rate is modified to correct this difference.

For instance, if the price index for a perpetual BTC future indicates a value of $20,000 – reflecting the price on several major exchanges – and the futures price on Binance is $20,200, this indicates that the future is trading at a premium. To address this, the funding rate will be adjusted to promote the selling of futures, thereby reducing their price to more closely align with the index value.

How the Binance Funding Rate Is Calculated

The final size of funding is determined by two parameters: the nominal value of positions and the funding rate.

Nominal Value of Positions

For contracts settled in USD (USDS-M futures), the nominal value is determined by multiplying the contract price by the position size. For example, if there is a contract for 0.1 BTC at a contract price of $60,000, the nominal value of the contract would be $60,000 * 0.1 BTC = $6,000. To calculate the funding, you multiply the nominal value of the position by the funding rate. If the funding rate is 0.05% per day, and the nominal position value is $6,000, then the funding amount would be $6,000 * 0.05% = $3 per day.

For contracts traded in other cryptocurrencies (COIN-M futures), the nominal value is calculated by multiplying the contract price in the corresponding cryptocurrency by the contract size. For instance, consider a contract for 10 ETH at a contract price of 0.1 BTC and a contract size of 100 ETH. The nominal value of this contract would be 0.1 BTC * 10 ETH = 1 BTC. The funding calculation involves multiplying the nominal value of the positions by the funding rate. With a funding rate of 0.05% per day for positions worth 1 BTC, the funding amount would be 1 BTC * 0.05% = 0.0005 BTC per day.

Funding and Leverage

Funding on Binance considers the leverage of a position, which can significantly affect profit and loss (PnL). For example, if you increase the leverage aggressively and misjudge the required margin, the funding costs can push the position closer to liquidation. Conversely, if your trading strategy proves successful, using high leverage can amplify the profits received from the funding mechanism. Essentially, while high leverage can increase potential returns from funding, it also heightens the risk of substantial losses.

Where to Find Funding on Binance

Funding for an individual contract on Binance is available in the futures terminal dashboard. A detailed summary of the funding is located in a separate table.

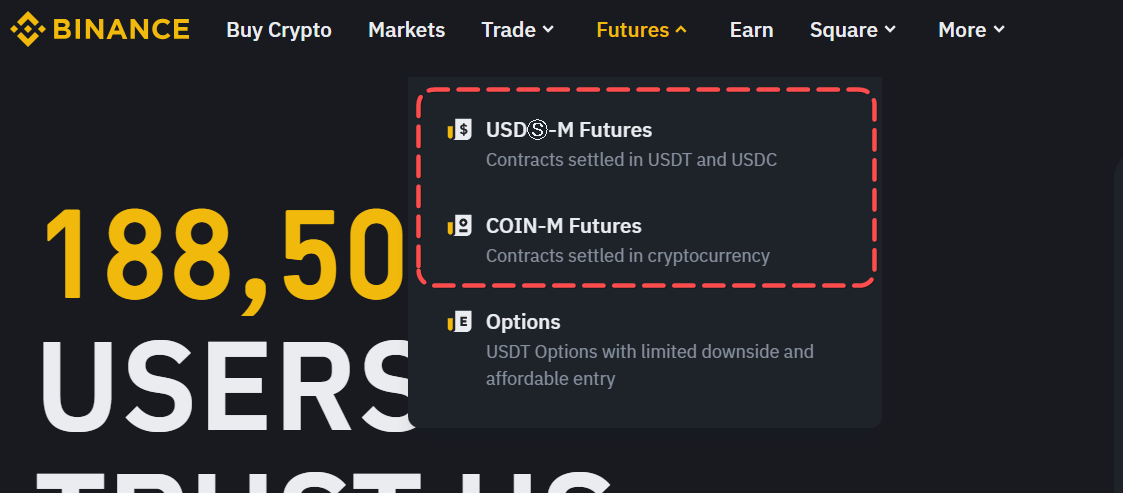

To view the current funding for a contract, go to “Futures”, then you will see “USDS-M Futures” or “COIN-M Futures”.

The Binance Futures terminal will open. Select (or find in the search) the contract of interest. Funding is indicated in the column “Funding/Countdown”. The ‘funding’ is the current funding rate and ‘countdown’ is the time until the recalculation of rates and the start of a new interval.

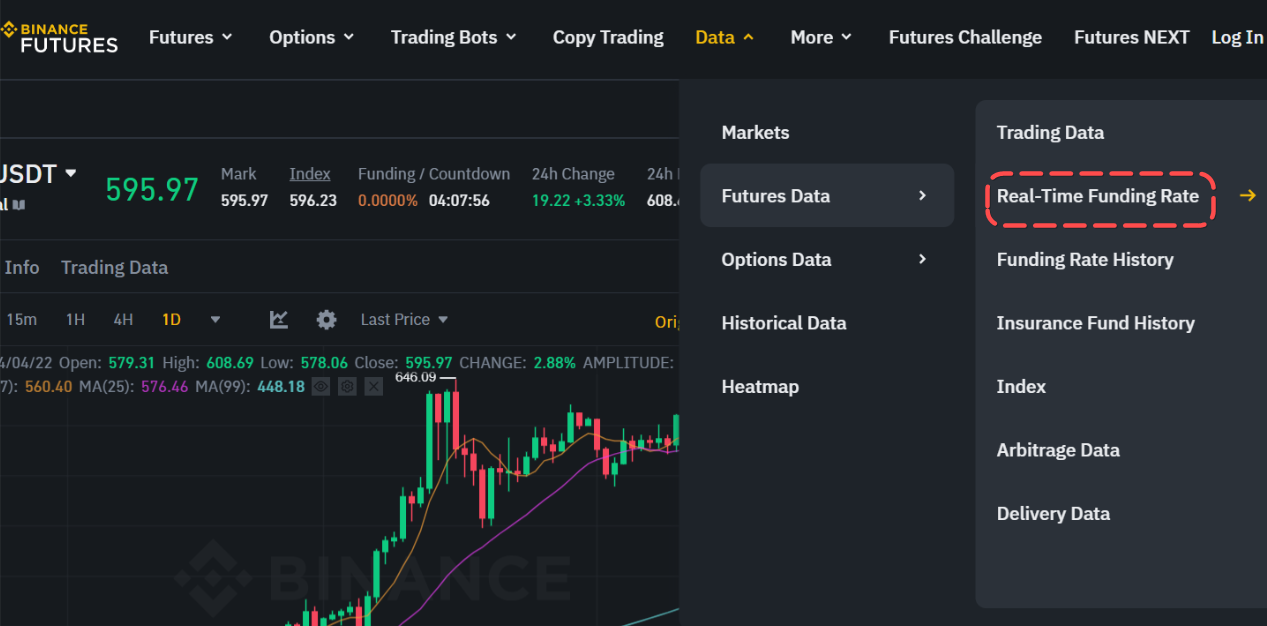

A detailed summary of the funding can be found under “Data”, then “Futures data”.

There are two tables: “Real-Time Funding Rates” and “Funding Rate History”.

Real-Time Funding Rates

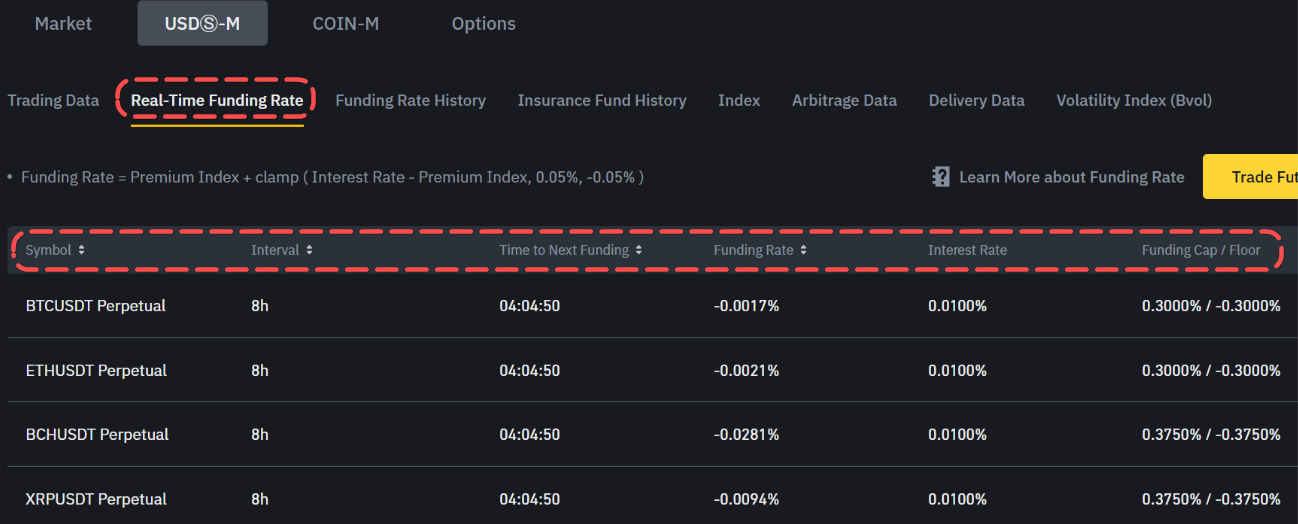

This section contains the current funding rates for all contracts on Binance Futures. Note that Binance Funding Rates are specified separately for USDS-M and COIN-M contracts.

The table has several columns:

- Symbol: ticker and type of instrument

- Interval: frequency of recalculations and funding payments

- Time to next funding: time until the start of a new interval

- Funding Rate: the current funding rate for the contract

- Interest Rate: the portion of the base rate in the current funding. From the current funding rate and the interest rate, one can calculate the contract’s premium

For example, the contract LUNA2USDT has a current rate of -0.024%. The table shows a rate of 0.01%. The premium is the difference between these values: 0.01 – 0.024 = 0.014. Thus, the nominal size of the premium is 0.014%. Remember, the base rate is fixed. The premium can be used to assess the “tension” on the instrument. The premium grows as the market “overheats”. The higher the premium, the likely higher the volatility of the contract, the stronger the trend, or pressure from sellers/buyers.

In the column “Funding Cap/Floor”, the maximum and minimum funding rates are indicated.

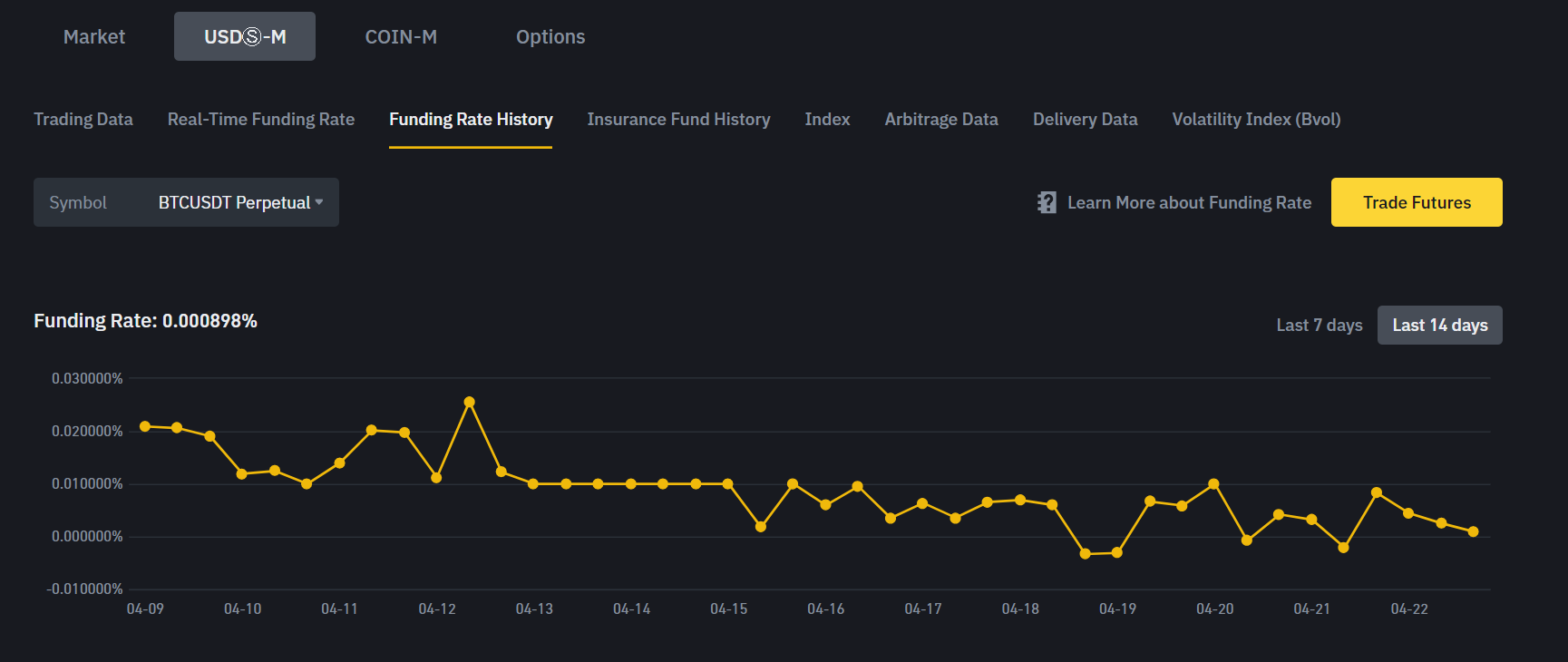

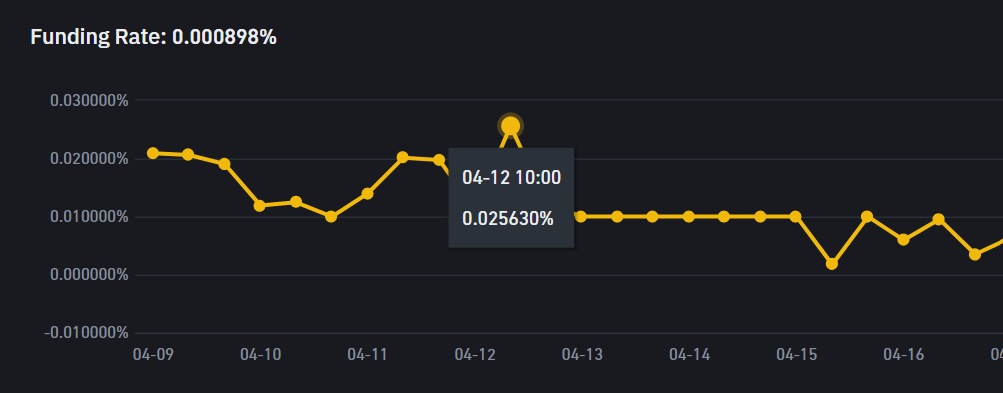

Funding Rate History

In the “Funding Rate History” section, there is a historical summary. The table is divided into two parts: a funding chart and a table.

The funding history is represented by a linear chart for the last 7 or 14 days. On the X-axis are dates, and on the Y-axis are funding rates. The points indicate the boundaries of the calculation intervals. The chart shows when and how much funding was paid for the instrument. Hover over any of the points to see the time of payment and the rate.

The table, which is located below the chart, shows the same data: time, interval, and funding rate. It also indicates the marking price of the contract at the time of payment.

How to Use Funding in Trading

Funding can be used as an additional reference in market analysis. Moreover, it’s possible to earn from funding. Let’s delve into a few examples of how funding can be applied.

Positive Funding Rate

Imagine the market is going up, and the funding rates on Binance are positive meaning long positions pay short ones.

Long Trade with a Positive Funding Rate

You want to open a long position. In the Binance Futures dashboard, look at the funding. You will see that there is little time left until the end of the interval – for example, 30 minutes. If you open a position now, you will pay a “penalty” for rushing. It is more reasonable to wait for the recalculation and the start of a new interval to enter the position. An exception is scalping on Binance, when positions have to be opened quickly.

Short Trade with a Positive Funding Rate

If you want to open a short position, it is more profitable to do so at the end of the period. This way, you immediately receive funding for the remaining short time and then for subsequent intervals.

Negative Funding Rate

Now, imagine the market is going down, and the funding is negative meaning shorts pay longs. The situation changes.

Long Trade with a Negative Rate

For long traders, it will be more profitable to open positions at the end of the period to immediately receive a funding payout.

Short Trade with a Negative Rate

For short traders, it is wiser to open at the beginning of the period to minimize losses from the negative rate.

Funding in Market Analysis

High rates and/or jumps in funding can indicate a potential market overheating. Often, this is followed by a reversal or correction.

If you look at the price chart on an hourly timeframe and below, you can notice many “dumps” and “squeezes” at the junction of funding intervals. For example, the screenshot shows how the funding rate follows the price movement on the chart. At 11:00, the funding was zero, then it sharply increased to ±0.02% at the start of a bullish impulse. As the movement went up, the rate grew. During the pullback, it began to fade to values close to zero. When trading from funding, it’s important to consider the boundary of the calculation periods. Remember, “whales” also aim to profit from funding. Large participants can “pump” the price of an asset as the funding recalculation approaches.

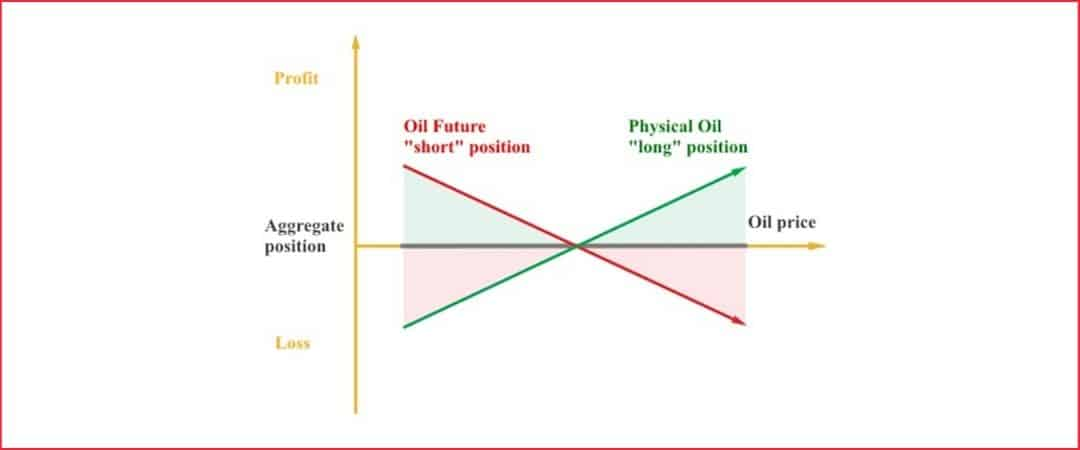

Arbitrage of Binance Funding Rates

You can profit from Binance funding through arbitrage, which is similar to employing delta-neutral strategies in options trading. In this approach, the focus is not on the price movements of the assets themselves. Instead, the strategy aims to exploit the differences in funding rates between long and short positions or across different exchanges. By balancing these positions, you can potentially earn from the discrepancies in funding rates without being significantly affected by the overall market movements. This method allows traders to potentially gain stable returns regardless of the direction in which the market moves.

The strategy involves opening and closing opposite positions on the same asset in both Spot and futures markets to execute a funding arbitrage, akin to a hedge. For example, if you purchase 1 BTC on the Spot market and concurrently open a short futures position on 1 BTC, you create a hedge. If the BTC price increases, your Spot asset gains value while the short futures position incurs an equivalent loss. Conversely, if the BTC price falls, the short futures position profits, offsetting the loss in the Spot position.

The net result of these positions is typically “zero” in terms of price movement impact; however, you can profit from the funding payments collected while holding these positions. For this strategy to be effective, the funding rates should be favorable to the futures position. Specifically, you should open a short position when funding rates are negative and a long position when they are positive.

The key to this strategy is not the price movement of BTC itself, but rather the direction and magnitude of the funding rates. If the hedge is set against the prevailing funding rate trend, it could lead to a loss. Therefore, careful consideration of the market’s funding rate direction is crucial in this arbitrage approach.

Additionally, when using this strategy, it’s essential to carefully manage leverage or avoid using it altogether to minimize risk. Another important factor to consider is Binance’s trading commissions, which need to be lower than the potential gains from collected funding payments to ensure the strategy remains profitable. This careful calculation and management of transaction costs versus funding income are pivotal to the success of funding arbitrage on Binance.

Binance Funding Rates – Conclusion

Binance funding changes over time. Binance funding rates are dynamic and can fluctuate based on market conditions and trader behavior. These changes are important indicators of sentiment and leverage in the futures market. Understanding these trends can help traders make more informed decisions regarding their positions.

Join our CScalp TV YouTube channel for a wealth of educational videos, insightful market updates, and expert trading tips. Hit that subscribe button and ring the notification bell to never miss an update.

To learn more about funding rates on other exchanges, check out our article: “Bybit Funding Rate: How Funding Works on Bybit.”

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT