Bybit Funding Rate: How Funding Works on Bybit

CScalp has prepared an introduction to crypto funding rates on the Bybit exchange. We explain what the Bybit funding rate is and why this mechanism is needed. We also delve into how Bybit funding rates are calculated and how they can be used in trading.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

What Is the Bybit Funding Rate?

Bybit funding rate is a mechanism to align the prices of perpetual futures with their underlying assets.

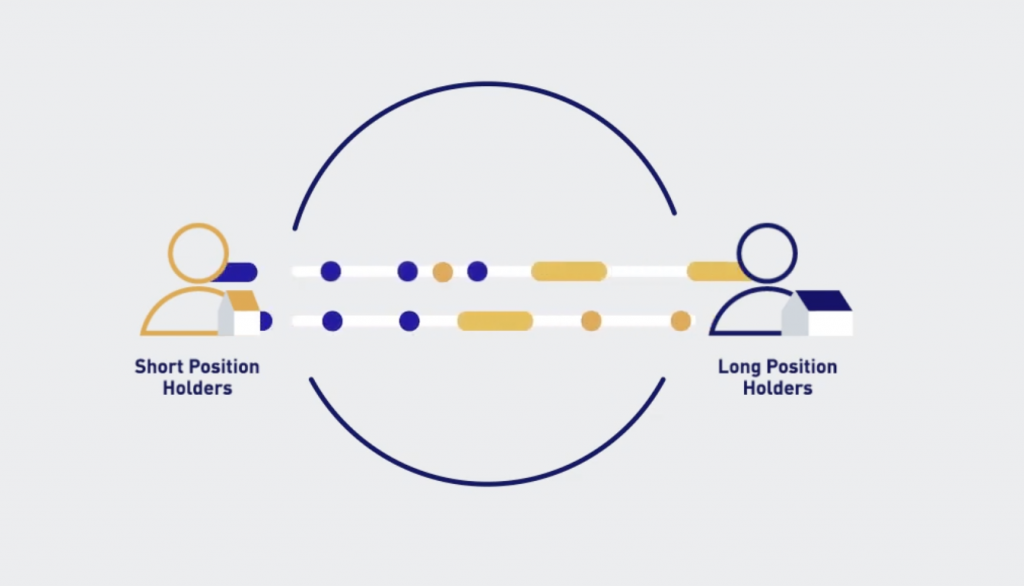

Perpetual futures, which trade continuously without expiration, often see their contract prices diverging from the Spot prices of the assets they represent. To correct this divergence, Bybit employs funding – regular financial exchanges between traders holding long and short positions. The direction and size of these funding payments depend on whether the funding rate is positive or negative. A positive funding rate indicates that the futures price is higher than the underlying asset’s price, typically leading to long position holders paying shorts. Conversely, a negative rate suggests that the futures price is lower, resulting in shorts compensating longs.

How the Bybit Funding Rate Works

Funding on Bybit is paid peer-to-peer – from trader to trader. The exchange does not receive payments from funding and only distributes assets. Therefore, funding cannot be called a trading commission.

Positive Funding Rate on Bybit

When the price of a coin rises, traders “jump” into long positions and push the price even higher. If the contract price deviates from the underlying asset, it creates an imbalance. Then Bybit sets a positive funding rate, motivating traders to close long positions and open short ones. At the funding recalculation, long traders pay a premium to short traders. The more the contract price moves away from the Spot price, the higher the funding rates.

Negative Funding Rate on Bybit

When the price of a coin falls, traders take short positions, causing the futures price to drop even more. Each new leveraged short pulls the contract further down. Then Bybit introduces a negative funding rate to encourage traders to close short positions and open long ones. At the recalculation, short traders pay long traders.

How Bybit Funding Is Calculated

Bybit’s funding rate consists of the interest rate and the premium index.

Interest Rate is a fixed percentage of funding. At the time of writing, this is 0.03% per day or 0.1% for the settlement period (8 hours).

Suppose you only pay the base rate. The payment calculation looks like this. Funding rate: 0.01%, position size 5 BTC, current market price of BTC – $10,000.

Formula:

- Position Value = 5 x 10,000 = $50,000

- Funding = 50,000 x 0.01% = $5

The Premium Index is an additional rate on top of the interest rate. The premium on Bybit constantly changes. The basis is the price index – the average market price of the underlying asset on other exchanges. In other words, the fair market price of the asset.

The price of the perpetual future should follow the price index. If the contract price exceeds the index, it means the future is trading at a premium (and vice versa). In such cases, the exchange charges a percentage on top of the base rate. The exchange motivates trading in the opposite direction from the price deviation to bring the contract price back to the Spot price.

How the Bybit Funding Rate is Calculated

The formula for the Bybit funding fee:

- Funding Fee = Position Value x Funding Rate

- Position Value = Number of Contracts / Mark Price

Mark Price (mark price) – an algorithmic averaging of the Spot price for the underlying asset. Similar to the price index, but internal to the Bybit exchange.

Here’s an example. A long position of 10,000 BTC is opened. The current mark price is 8,000 USD for 1 BTC, and the funding rate is 0.01%. Then:

- Position Value = 10,000 / 8,000 = 1.25 BTC

- Funding = 1.25 BTC x 0.01% = 0.000125 BTC

Important! Bybit’s funding takes leverage into account. If funding is not considered in the calculation of the liquidation price, one could face liquidation at the rate of recalculation.

When is Funding Paid on Bybit

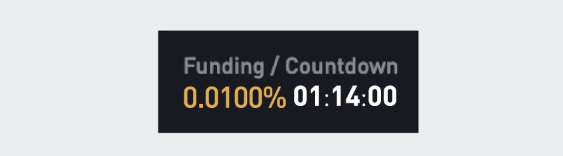

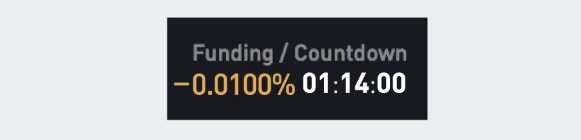

Funding on Bybit is paid three times a day: at 00:00 UTC, 8:00 UTC, and 16:00 UTC. The premium payment occurs at the junction of the settlement periods. To receive a funding premium (or pay a fee), you need to hold the position at the time of recalculation.

Suppose there are five minutes left until the end of the settlement period. If you close the position now, you will neither receive nor pay the funding. If you hold the position for another five minutes, you will either receive or pay the funding. The premium rate changes within the settlement period. Therefore, you pay or receive the current amount at the time of recalculation.

Where to Find Bybit Funding Rate

The actual funding rate on Bybit can be found in two places: in the futures web terminal or in a separate section where current and historical funding rates are located.

Futures Terminal

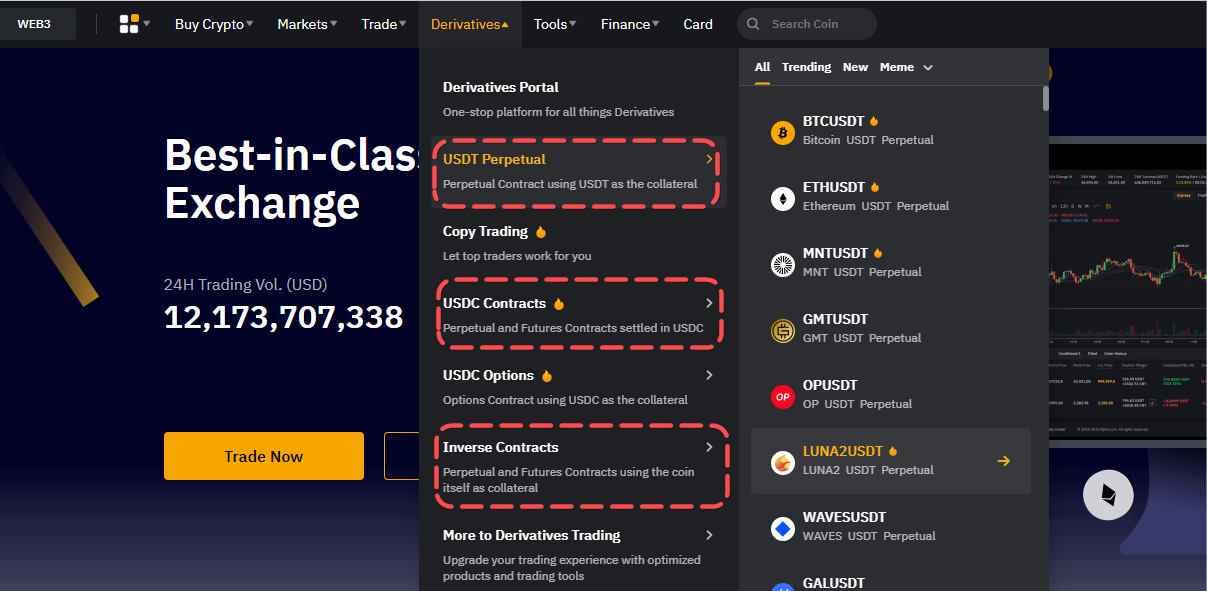

The current funding rate is indicated in the dashboard of the futures contract. On the main page of Bybit, go to the “Derivatives” section. Then, follow the path to “USDT Perpetual”, “USDC contracts”, or “Inverse contracts”.

The futures web terminal will open.

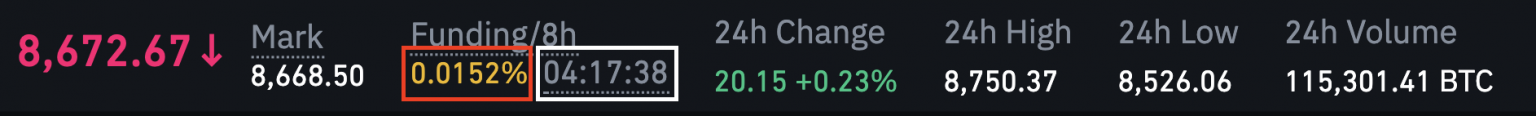

Select the required contract. In the “Rate/Countdown” column above the chart, the current rate for the contract and the time until recalculation are indicated.

Bybit Funding Table

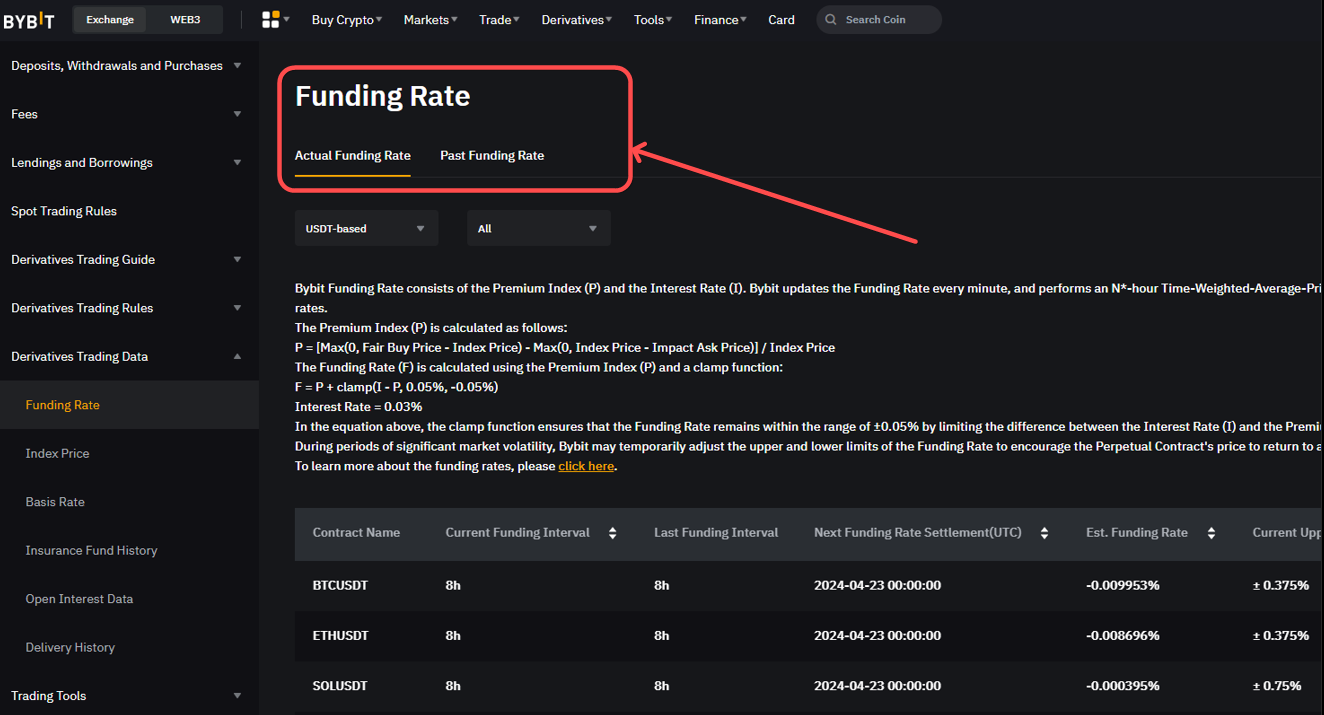

To view a detailed summary of funding rates, go to the “Derivative Trading Data” tab. Here, the first two tabs are of interest: “Actual Funding Rate” and “Past Funding Price”.

Actual Funding Rate

In the “Actual Funding Rate” tab, the current funding rates for all Bybit perpetual contracts are collected. It is possible to display data for a specific contract or all at once. This option is convenient for searching for high rates – you can filter all contracts on the exchange by percentage.

Table of Actual Rates

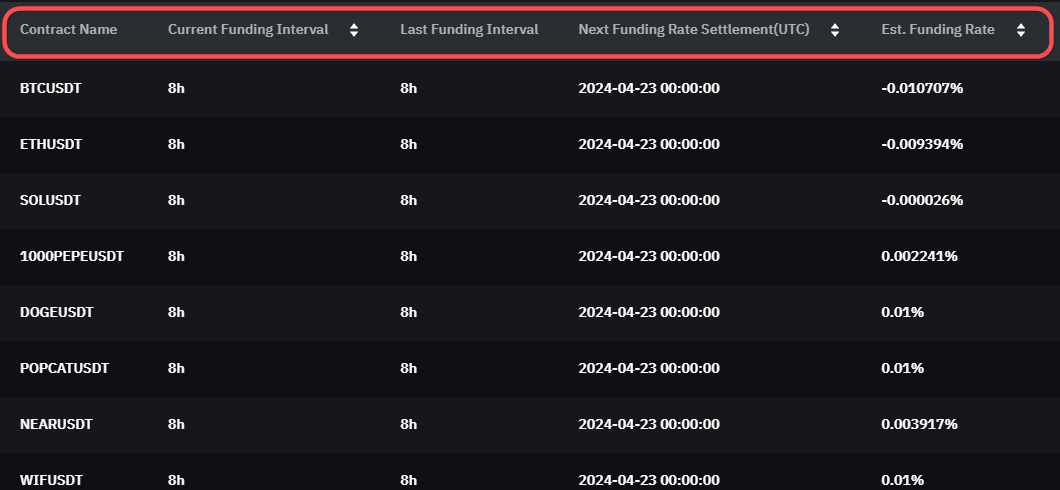

The actual funding rates for Bybit futures are presented in a standard table.

The table consists of several columns:

- Contact name: the symbol of the contract

- Current/last funding interval: the duration of the current and last funding intervals

- Next funding rate settlement (UTC): the time of the next rate settlement and the start of a new period

- Est. funding rate: the actual funding

By clicking on the parameters, you can sort the data in ascending/descending order. For example, you can sort by the highest rates to find the most “overheated” contracts.

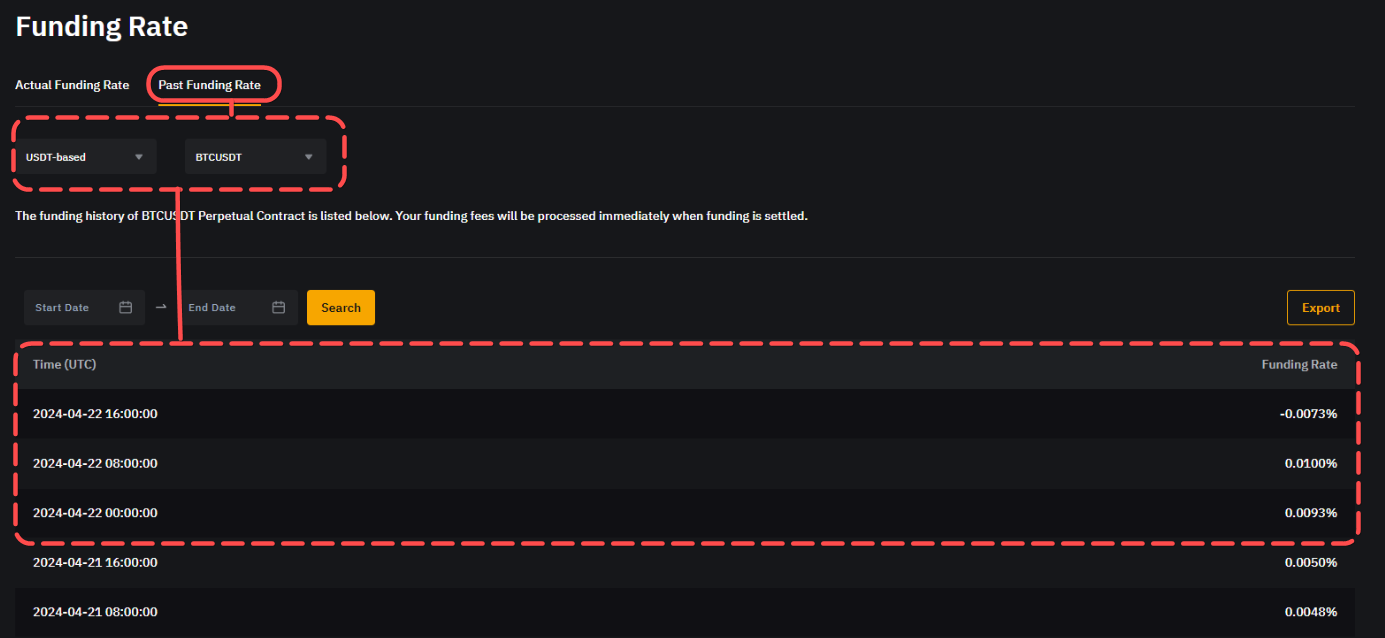

Past Funding Price

The “Past Funding Price” tab collects historical funding rates for futures. The visual presentation of historical rates differs for USDC contracts.

Past Rates for USDT and Inverse Futures

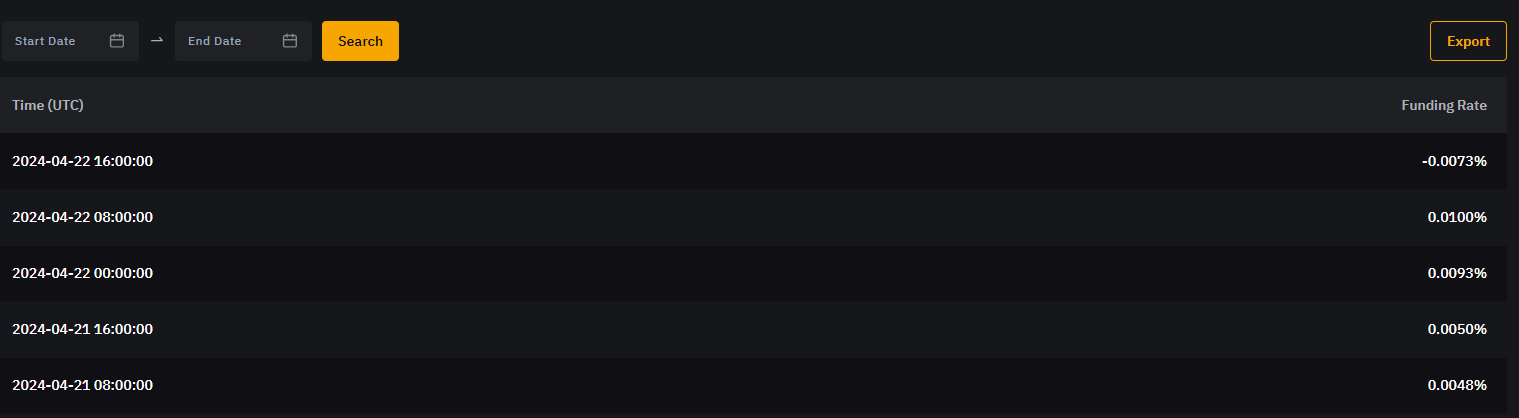

For USDT contracts, historical funding is presented in two columns: “Time” and “Rate”: the time of settlement and the funding rate for a specific period are indicated.

There is a data filter for time frames – you can set a specific period. The table can be exported in .XLSX format. For inverse futures (the “Coins” tab), the data is presented similarly. The same table, the same filters, and the data export option.

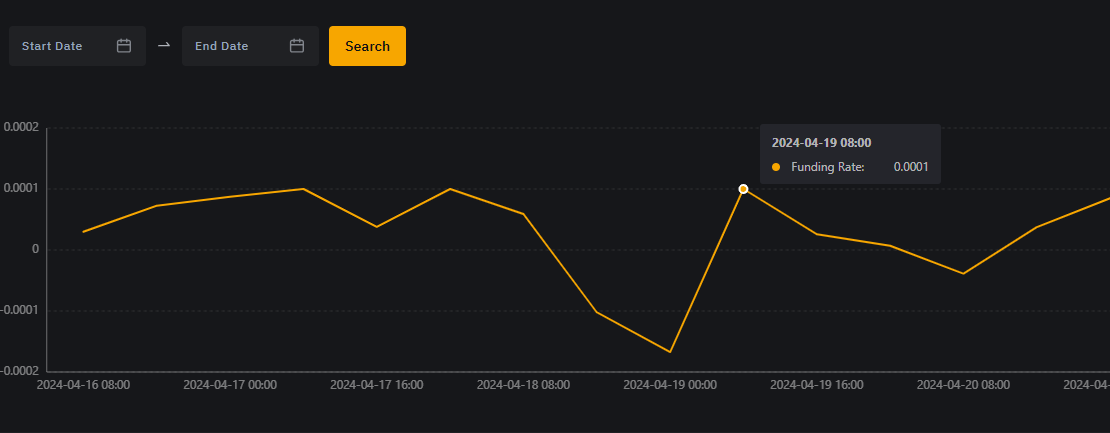

Past Rates for USDC Contracts

For USDC contracts, historical funding rates are presented as a line graph. Horizontally is the time, and vertically is the funding rate. Each point on the graph represents paid funding. You can set a time range.

The chart allows not only to see specific numbers but also to identify trends in rate changes. Therefore, it is a convenient tool for analyzing funding dynamics. The rate graph can be compared with a candlestick chart for a more detailed market analysis. Currently, such a graph is not available for USDT contracts and inverse futures. Possibly, Bybit will enhance this aspect in the future.

How to Use Bybit Funding in Trading

Bybit funding can be used for several purposes: 1) in market analysis to identify trends, 2) as an additional basis for entering or exiting a position, and 3) as a hedge/delta-neutral earning strategy. Let’s consider each point separately.

Funding in Market Analysis

Funding on Bybit follows a simple logic: the longer and stronger the price increase, the higher the positive rate. Conversely, the longer an asset falls, the higher the negative rates. In both cases, high funding is a signal of market “overheating.” If the rates on an asset are high and there is a clear uptrend on the chart, it means the exchange is setting a barrier for traders in the direction of the trend. Therefore, a correction and/or reversal can be expected.

Take, for example, the funding history of the ETCUSDC contract. Let’s compare the funding history with the price trend history from December 1 to December 5.

We see that the rise and fall of funding follow the movements on the candlestick chart. When an uptrend begins, the funding also increases. A rollback or correction is also accompanied by a “cooling” of rates. Sometimes funding can almost exactly replicate the movements of the price chart. Thus, high and volatile rates can be used as a potential signal for market corrections and reversals.

Funding as a Basis for Entry/Exit

Funding can be used as a basis for entering or exiting a trade, especially for large positions. Remember, with a positive rate, longs pay shorts, and with a negative rate, shorts pay longs. Therefore, if the rate is positive and we enter a long position, we pay a premium. The same is true for shorts with negative rates. To minimize the “weight” of funding, consider the time until recalculation before entering a position.

Entry at Positive Rates

Suppose the rate is positive and there is half an hour or less until the payout. If we enter a long position and hold it until the calculation, we will pay a premium for entry. It is more advantageous to wait for the recalculation and enter the position at the start of a new interval. Conversely, it is advantageous for shorts to enter at the end of the positive rate period to receive a premium.

Entry at Negative Rates

With negative positions, the logic is reversed – if we are going long, we enter at the end of the period to receive a premium. If shorting, it makes sense to wait for the recalculation and then enter in the new interval.

A complete course on trading perpetual futures on Bybit can be found on the CScalp YouTube channel.

Funding and Hedging

Funding on Bybit can be used as an independent source of income, for example, in hedging Spot and futures positions. Suppose the funding rate is negative and shorts receive payments. We buy the asset on the Spot market and open a short position on the future for the same amount of the asset.

If the price of the coin goes up, our Spot transaction is in profit, and the futures position in short is at a loss (and vice versa). We do not profit from the position, but for holding it, the exchange pays a funding premium. Thus, we achieve a hedge with a “dripping” interest in our favor. Of course, it is necessary to monitor the dynamics of the funding and close the short if the rate changes.

Bybit Funding Rate – Conclusion

The Bybit funding rate is an important mechanism in trading perpetual futures. It must be considered when creating a trading strategy. Even if we do not intend to work on funding at the re-settlement, tracking the direction of the rate is necessary. This will minimize risks and help calculate the possible short-term market movement.

If you are interested in funding rates on other exchanges, be sure to check out related articles: “Binance Funding Rate: How Funding Works on Binance,” “Huobi Funding Rate: Methods Of Funding Calculation for Traders.”

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT