Short Trading Strategies: Understanding How to Short-Sell Crypto Assets

Short trading, commonly referred to as short selling, is a financial strategy that speculates on the decline of a currency’s price. CScalp delves into the world of short trades and provides insights into tools as well as resources to assist traders in understanding and utilizing this strategy with crypto assets.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Short Trading Risks and Rewards

Short trading is a high-risk strategy with the potential for significant returns, but it also comes with the possibility of substantial losses, particularly in the cryptocurrency market. Your understanding of the market and ability to analyze market trends is crucial when considering short trades. Successful short selling not only involves anticipating price drops but also requires a strategic approach to managing risks and managing the complexities of the cryptocurrency market.

Freepik

Key Takeaways

- Short trading involves borrowing a cryptocurrency and selling it, anticipating a price drop to buy back cheaper.

- Analyzing market trends and regulatory norms is essential to managing risks in short trades.

- Executing successful short trades requires a strategic approach and a deep understanding of the cryptocurrency market.

Short Selling Fundamentals

Understanding the tactic of short selling is crucial. It allows you to capitalize on market downturns, but it comes with a set of intricacies and risks.

Short Trading Definition and Mechanics

Short selling, or shorting, is when you – as an investor or trader – sell a cryptocurrency that you do not own at the moment, with the expectation that its market price will drop. To short-sell, you first borrow the cryptocurrency through a trading platform and sell it at the current market price. You aim to buy back the same amount of the cryptocurrency at a lower price in the future, return the borrowed assets, and pocket the difference as profit.

The process involves these steps:

- Borrow: Secure cryptocurrency to short from an exchange.

- Sell: Sell the borrowed assets at the current market price.

- Repurchase: Buy the cryptocurrency back after a fall in price.

- Return: Return the borrowed assets to the exchange.

- Profit or Loss: The difference between the sale and the repurchase price, minus fees, is your profit or loss.

Short Position vs. Long Position

A short position in cryptocurrency is essentially a bet that the price of a digital asset will decline. It’s the opposite of a long position, where you buy a cryptocurrency with the belief that its price will rise.

- Short Position: You’re hoping to profit from a price decrease. Remember, a short position includes borrowing, which entails a risk; if the market price increases instead of decreasing, it could lead to significant losses.

- Long Position: When you take a long position, you’re investing in the cryptocurrency’s potential for growth.

In either case, market analysis and a well-thought-out strategy are key to managing the associated risks and maximizing your potential for success.

Ready to dive deeper into market strategies? Explore the differences between long positions and short positions in our blog: Long Position vs. Short Position: Understanding Market Strategies

Executing a Short Trade

How to Execute a Short Trade with CScalp

Executing a short trade with CScalp involves a slightly different process compared to regular buy orders. Here’s a step-by-step guide to executing a short trade:

- Choose a Cryptocurrency Exchange: Choose an exchange that supports short selling. We suggest you try out Binance, Bybit, OKX, or HTX.

- Open a Futures Account: If you haven’t already, open a futures account with the chosen exchange. It will allow you to borrow cryptourrency for your short trade.

- Install the CScalp trading terminal: Install the free professional software by leaving your email in the form above. Then connect CScalp to your preferred crypto exchange.

- Select a Cryptocurrency to Short-Sell: Use CScalp’s free crypto screener to select the cryptocurrency you want to short-sell.

- Place a Sell Order: Select a working volume and place a sell order. Learn more about how to make your first trade in CScalp.

- Monitor Your Trade: Keep a close eye on the market as your short position unfolds. If the price of the cryptocurrency drops as expected, you can buy it back and make a profit.

- Exit Your Short Trade: When you’re ready to exit your short trade, place a buy order for the same amount of cryptocurrency you initially borrowed. This will effectively close your short position.

Remember that short trading is a sophisticated strategy that carries risks, and it’s essential to fully understand the mechanics and implications of short selling before engaging in such trades. CScalp provides the tools and resources to help you make informed decisions and execute short trades effectively in the cryptocurrency market.

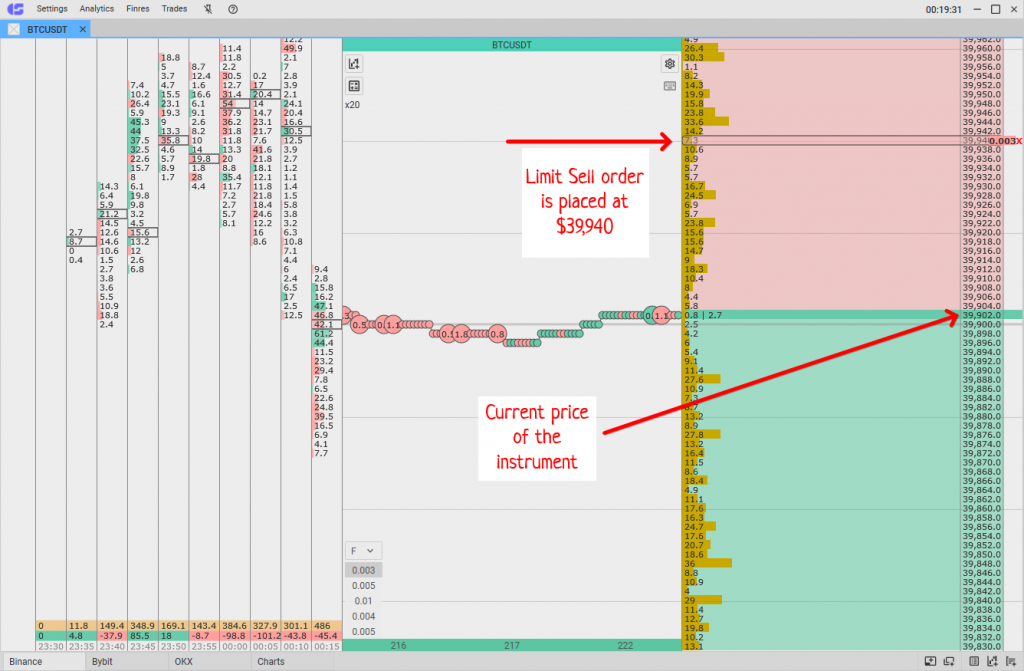

BTCUSDT limit sell order is placed at $39,940

Financial Implications of Short Selling

Short trading can be both a lucrative strategy and a high-stakes gamble. You need to understand the dual nature of financial outcomes associated with this practice.

Short Trading Profit Potential

When you short-sell a cryptocurrency, your profit potential emerges if the asset’s price drops below the price at which you initiated the short-sell. Here’s a simple breakdown:

- Entry Price: Suppose you short-sell Bitcoin at $40,000.

- Exit Price: You later buy it back (cover your short position) at $30,000.

- Profit: The difference ($10,000) is your profit, minus any fees.

Keep in mind that profit is not guaranteed, and it’s directly correlated to how much the price falls, as well as the size of your position.

Risks and Losses

While the profit potential is an appealing aspect of short-selling cryptocurrencies, the risks and losses you might face are significant.

- Unlimited Losses: Contrary to purchasing cryptocurrencies, short selling can lead to losses that exceed your initial investment, since there is no ceiling to how high the price can rise before you choose or are forced to cover your short.

- Interest & Fees: When you open a short position, you often pay interest on the borrowed coins, as well as commissions to the exchange or broker.

- Margin Calls: If the price of the cryptocurrency begins to rise, you may face a margin call, which requires you to deposit additional funds to maintain your position or be forced to cover at a loss.

It is essential to employ risk management strategies to mitigate potential losses. CScalp has implemented an automatic Stop-Loss feature that you can use to protect your positions.

Speculative Short Trading

Speculative short trading in cryptocurrency carries a high risk but can be profitable for the well-informed trader. Here, speculation is not mere guesswork; it’s about making educated decisions based on thorough analysis.

- Identify High Volatility Cryptos: Look for cryptocurrencies with significant price swings, as they offer more opportunities for short trading.

- Timing Is Key: Enter a short trade when your analysis indicates a potential sharp decrease in the crypto’s value.

- Use Technical Analysis Tools: Utilize charts and technical indicators to determine the best entry and exit points for your speculative short trades.

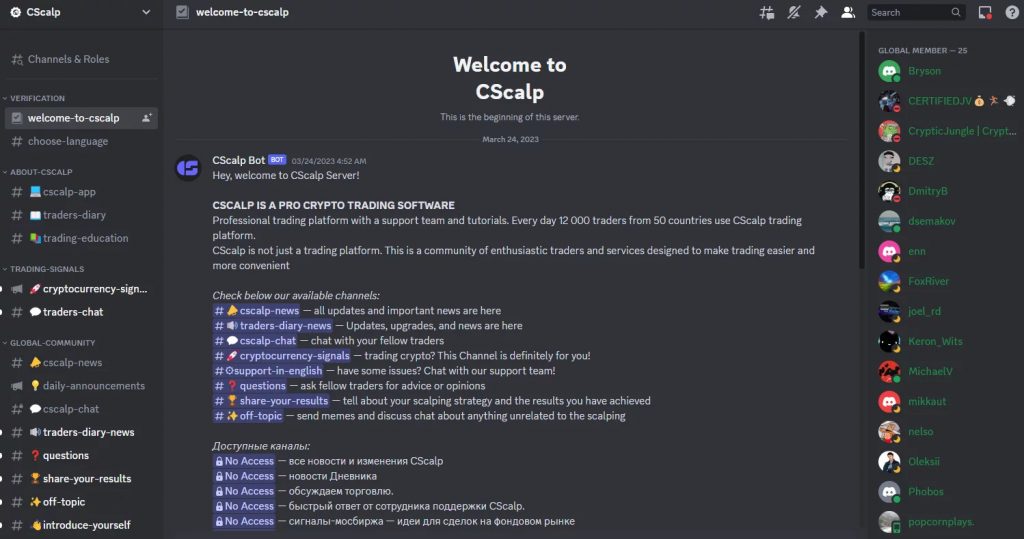

Join the CScalp Crypto Discord Server for Even More Insights

Are you eager to explore the world of speculative short trading in cryptocurrencies further? Joining our CScalp Crypto Discord Server can be your gateway to a wealth of additional resources and community engagement:

- Free Crypto Trading Signals: Gain access to valuable trading signals that can help you identify potential short trading opportunities in real time.

- Engaging Discussions: Participate in discussions with fellow traders, share insights, and exchange ideas on short trading strategies.

- Opportunities to Learn from Experts: Interact with seasoned trading experts who can provide valuable guidance and answer your burning questions about speculative short trading.

- Educational Content: Access a treasure trove of educational content, including tutorials, guides, and market insights, to enhance your knowledge and trading skills.

- Technical Support: Receive technical support for the Free CScalp terminal, ensuring you have a seamless trading experience.

CScalp trading community Discord server

Joining our Discord community is a fantastic way to stay informed, connect with like-minded traders, and elevate your speculative short trading game. Don’t miss out on this opportunity to enhance your trading journey with CScalp. Simply click the link below to join us:

Analyzing the Market for Short Opportunities

When considering short trading in the cryptocurrency market, it’s crucial to analyze the landscape carefully for overvalued assets, keeping an eye on short interest and market sentiment indicators that could signal potential downturns.

Identifying Overvalued Cryptocurrencies

To spot overvalued cryptocurrencies, you need to examine price trends to the intrinsic value of the digital asset, which can be a complex assessment due to the inherent volatility and lack of traditional valuation methods in the crypto market. Look for signs of speculative trading that has pushed the currency price well above its usual trading patterns without any corresponding improvement in fundamentals.

- Check Technical Indicators: Utilize tools like moving averages to gauge if the current price is significantly above historical averages.

- Watch Trading Volumes: Anomalously high volumes coupled with price spikes might suggest an impending correction.

Assessing Short Interest and Market Sentiments

Evaluating interest and market sentiment for cryptocurrencies requires attention to social media trends, news, and community perceptions since the crypto market is highly sentiment-driven.

- Analyze On-Chain Data: Look for on-chain analytics that shows if large amounts of a cryptocurrency are being moved to exchanges, which can suggest potential sell-offs.

- Examine Social Sentiment: Utilize sentiment analysis on social platforms to gauge the mood and expectations of the crypto community.

- Monitor High Short Interest: A high short interest in a crypto asset could indicate that a significant portion of the market is betting on a price decrease.

By focusing on these specific areas, you can gain insights into when it might be strategic to initiate a short position in the cryptocurrency market.

Short Squeeze Scenario

A short squeeze occurs when a cryptocurrency’s price rapidly increases, forcing short sellers to buy back their positions at a loss to cover their trades. This scenario typically unfolds when there’s a sudden surge in demand for the cryptocurrency, often fueled by positive news or developments within the market. When many traders are short-selling a particular coin, and its price starts to rise, long positions gain, while shorts may rush to exit their trades to minimize losses. This rush can further drive the cryptocurrency’s price upward, compounding the squeeze.

FAQs – Frequently Asked Questions About Short Trading

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT