What Is Ethereum Blockchain?: Understanding Proof of Stake and Decentralized Apps

The Ethereum blockchain is a platform for validating cryptocurrency and creating decentralized applications. CScalp delves into what Ethereum is, its structure, and the opportunities it offers for traders.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Freepik

What Is Ethereum?

Ethereum is a blockchain ecosystem where users can create and launch decentralized applications (DApps). The network’s ETH (ether) cryptocurrency serves as a unit of exchange within the ecosystem.

Ethereum was founded by a team of developers led by Vitalik Buterin, who published the Ethereum whitepaper in 2013. The principles underlying Ethereum were largely aimed at correcting the shortcomings of the Bitcoin network.

Ethereum Creator Vitalik Buterin

After its launch in 2015, Ethereum expanded the horizons of blockchain use by introducing smart contracts. These contracts allow anyone to create their tokens and applications based on the network, enabling a level of programmability that opens up blockchain technology to a broader range of applications. Ethereum’s innovations have facilitated the creation of a wide range of markets and concepts, including decentralized finance (DeFi), initial coin offerings (ICOs), blockchain gaming (GameFi), non-fungible tokens (NFTs), decentralized exchanges (DEX), and decentralized autonomous organizations (DAOs).

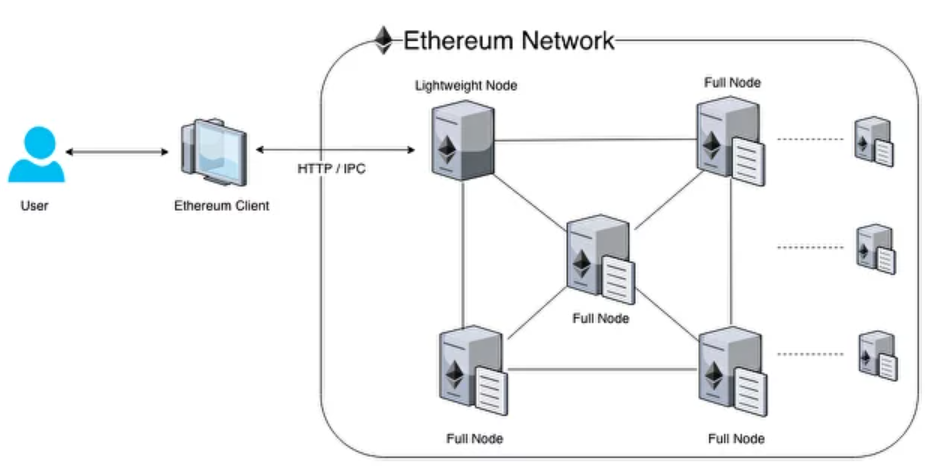

Ethereum Network

Today, Ethereum is a complex and extensive ecosystem that supports most well-known cryptocurrency projects and many altcoins (ERC-20 standard tokens). It continues to be at the forefront of blockchain innovation, with a strong community of developers and an ever-expanding suite of decentralized services and applications.

To take full advantage of trading Ethereum, try the professional trading platform CScalp by leaving your email in the form above. With the free terminal, you will be able to connect to your preferred exchange and place orders with one click, as well as automatically manage your risks.

Ethereum Blockchain: from Proof-of-Work to Proof-of-Stake (PoS)

Since its inception, the Ethereum network has operated through a Proof-of-Work (PoW) consensus mechanism. On September 15, 2022, the network transitioned to a Proof-of-Stake (PoS) mechanism, an event known as “The Merge.” This transition marked a significant evolution in Ethereum’s approach to securing its network and validating transactions.

Vitalik Buterin’s Message about the Merge of Ethereum

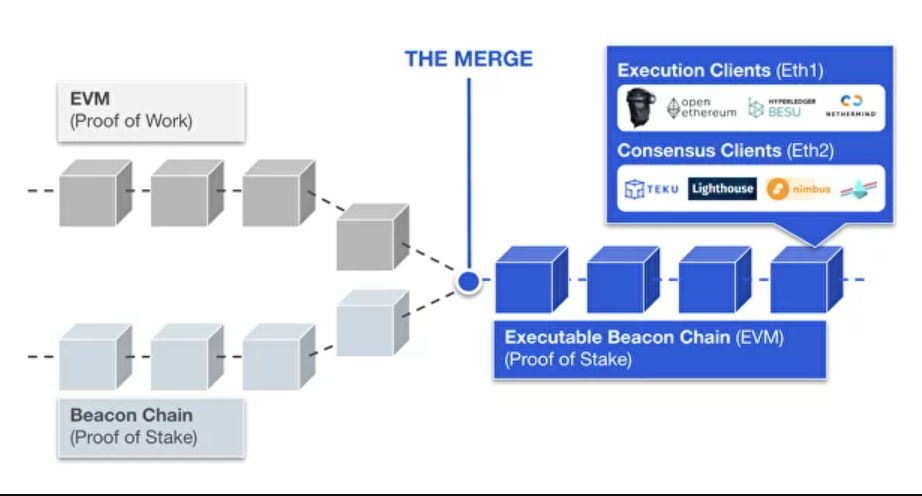

During “The Merge,” the main Proof-of-Work network and the Beacon Chain, which was specifically created for the transition to Proof-of-Stake, were merged. As a result, the PoW mechanism, which required miners to solve complex mathematical problems, became obsolete. Subsequently, the previous version of the network was named Ethereum PoW, and the earlier version of the cryptocurrency was referred to as ETHW.

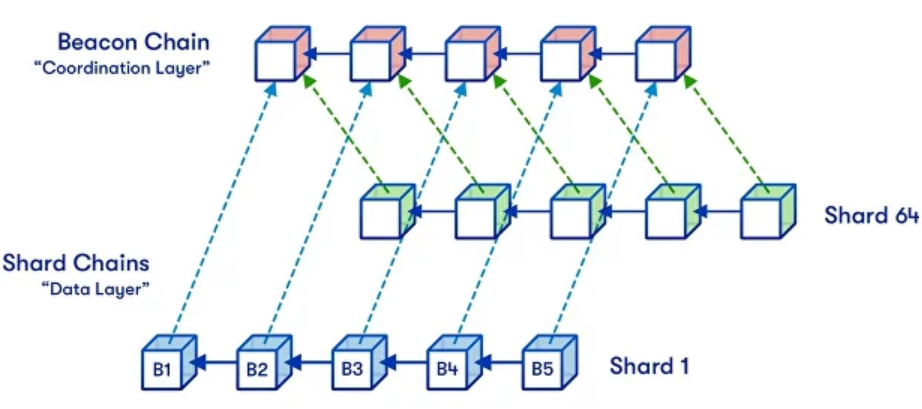

The update is fundamentally based on eliminating the energy-intensive process of mining and implementing “shard chains.” This approach divides the network into 64 smaller blockchains, each responsible for processing separate sets of transactions and data packets. This division is designed to enhance the network’s scalability, allowing it to handle significantly more transactions per second than was previously possible.

The Merge

As a direct result of these changes, validators, who are responsible for creating new blocks and verifying transactions, no longer need expensive, energy-consuming equipment. Consequently, the updated Ethereum network is expected to consume 99.95% less energy than it did under the Proof-of-Work protocol. This dramatic reduction in energy consumption not only makes Ethereum more environmentally friendly but also lowers the barrier for entry, making it more accessible for individuals to participate in the network’s activities.

Moreover, this shift to Proof-of-Stake is anticipated to strengthen the security of the Ethereum network. Under PoS, the potential for a 51% attack is reduced since it would require obtaining 51% of the staked ETH, which would be prohibitively expensive. This security feature, combined with increased transaction throughput capabilities and reduced costs, is expected to significantly impact the development of applications on Ethereum, leading to greater adoption and a broader range of functionalities.

Shard Chain

“The Merge” represents a pivotal development in the history of the Ethereum blockchain, emphasizing sustainability, security, and scalability. As Ethereum continues to develop and adapt, it remains a central hub for innovation in the cryptocurrency and blockchain sectors, offering a plethora of opportunities for developers and users alike. The future of Ethereum looks promising as it embraces these new changes and continues to evolve in its role as a leader in decentralized blockchain solutions.

Ethereum 2.0 Staking: How to Become an ETH Validator

To become a validator on Ethereum 2.0, one must commit at least 32 ETH to the network as a stake. This staking process involves locking up a specified amount of ETH within the Ethereum 2.0 network through a compatible network client or via a staking pool, which collectively secures and executes network operations.

Locked tokens are not only a financial commitment but also act as a security deposit. Validators are responsible for processing transactions, creating new blocks, and maintaining the network’s security. In return, they receive rewards in the form of additional ETH, derived from network transaction fees and block rewards. The more ETH locked and staked, the greater the responsibility and potential reward for the validator.

Options for Staking:

- Solo Staking: This is the process where an individual runs their own validator node. It requires technical knowledge to set up and manage the node and enough ETH to meet the minimum staking requirement. Solo staking gives the validator full control over their operations and the potential to earn all the rewards generated by their node.

- Pool Staking: For those who do not have the full 32 ETH or prefer not to run their own node, staking pools offer a popular alternative. These pools aggregate ETH from multiple stakeholders, spreading the costs and rewards among all participants proportionally based on their contributions. Staking pools are managed by third parties, reducing the technical barrier for individual stakers.

Staking Services: Several platforms offer staking as a service, handling all the technical aspects of becoming a validator for a fee. These services provide an easy entry point for individuals interested in staking without the need to manage the operational complexities of a node.

Ethereum and Gas: Understanding Transaction Fees

Gas in Ethereum represents the computational effort required to execute operations such as transactions and smart contracts on the Ethereum network. Users must pay gas fees as a way to compensate for the computing energy required to process and validate transactions.

Function and Necessity of Gas

Gas fees help to prevent spam on the network and allocate resources fairly among users. By charging a fee for every computation executed on the network, Ethereum ensures that the resources are used efficiently and only for valuable and agreed-upon purposes.

Gas prices are denoted in gwei, which is a smaller denomination of ETH; specifically, one gwei equals one-billionth of an ETH. This allows for a more precise measurement of costs for transactions and smart contract executions.

Factors Affecting Gas Costs:

- Network Load: The demand for transaction processing on the Ethereum network significantly influences gas prices. During periods of high transaction volume, the network experiences greater load, leading to higher gas prices as users compete to have their transactions processed quickly.

- Validator Efficiency: The speed and efficiency of validators in processing transactions also affect gas costs. More efficient processing can reduce costs, whereas delays can lead to higher prices.

- Transaction Complexity: The complexity of a transaction or smart contract also dictates the gas required. Simple transactions like transferring ETH may consume less gas, while complex interactions with smart contracts involving multiple steps and calculations need more gas.

Gas Limit and Gas Price

Each transaction allows the sender to specify a gas limit, which is the maximum amount of gas they are willing to consume for their transaction. Setting a gas limit too low can result in failed transactions, while a high gas limit may lead to unnecessarily high fees if not matched with an appropriate gas price.

Users can influence how quickly their transactions are processed through adjusting their offered gas price. Offering a higher gas price can make a transaction more appealing to validators, thus faster processing. Conversely, a lower price can save money but risk slower processing times.

Market Dynamics and Gas

The cost of gas in Ethereum can be highly volatile, mirroring changes in network activity and cryptocurrency market conditions. Significant fluctuations can occur in short periods, making gas cost predictions challenging but crucial for regular users.

Users can choose to execute transactions during off-peak times to potentially benefit from lower gas prices. Tools and services also exist to help predict gas prices and optimize transaction timing.

Ethereum Smart Contracts

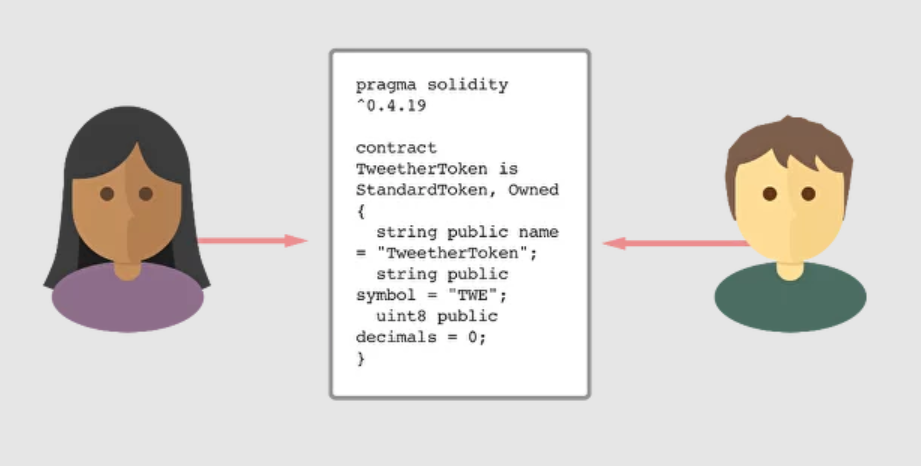

A smart contract on Ethereum is a self-executing contract with the terms of the agreement directly written into lines of code. The contracts automatically execute the encoded functions when predetermined conditions are met. For instance, if 0.001 ETH is transferred from account X to account Y (sub-account 1), the contract can trigger account Y to transfer 2 USDT back to account X (from sub-account 2).

ETH Smart contract /CScalp

The flexibility of the Ethereum blockchain allows smart contracts to range widely in complexity and functionality. These contracts can be designed to carry out simple transactions or manage complex decentralized autonomous organizations (DAOs) with numerous stakeholders and layered operational functions. This versatility makes smart contracts ideal for a myriad of applications across finance, real estate, governance, and more.

Once deployed on the Ethereum network, smart contracts are immutable, meaning they cannot be altered or deleted. This ensures that no one, not even the original creator, can change the terms once the contract is running, providing a high level of security and trustworthiness.

Smart Contracts Origins and Importance

The concept of smart contracts was first proposed by computer scientist and legal professional Nick Szabo in 1994, long before blockchain technology was developed. However, Ethereum was the pioneering platform to implement them as a core feature, integrating smart contracts directly into its blockchain architecture. This innovative approach has set Ethereum apart from other blockchain technologies and has been fundamental in its success.

Smart contracts on Ethereum are primarily written in Solidity, a programming language specifically designed for creating and implementing smart contracts. Solidity was developed by Gavin Wood, one of Ethereum’s co-founders and later the founder of Polkadot. It is designed to be both powerful and security-focused, enabling developers to write clear and comprehensive contracts that can perform various automated tasks.

Impact and Applications

The introduction of smart contracts has revolutionized several industries by enabling automated, decentralized, and trustless systems. In finance, they underpin various decentralized finance (DeFi) applications, facilitating everything from automated loans and interest payments to complex derivative trading systems. In supply chain management, smart contracts offer transparency and traceability, automating workflows and payments based on product movement or milestone completions.

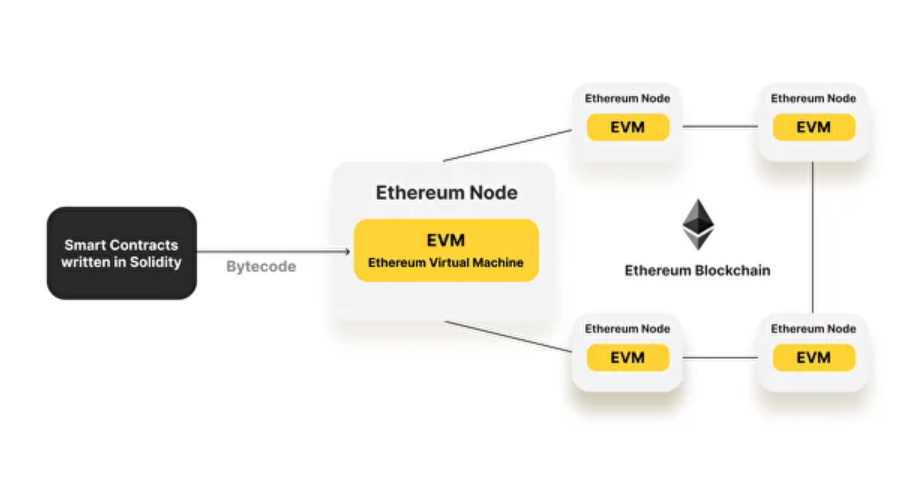

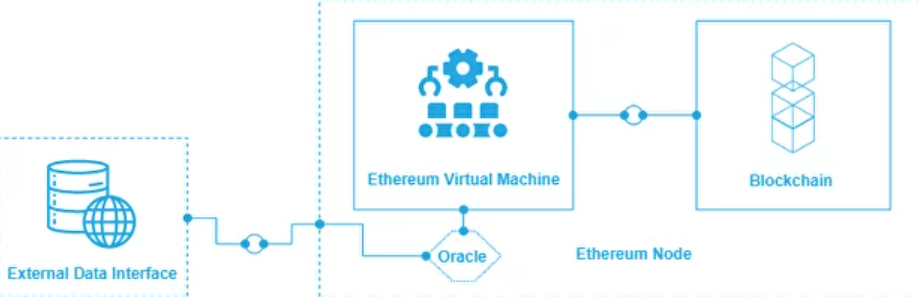

Ethereum Virtual Machine (EVM)

The Ethereum Virtual Machine (EVM) is a cornerstone of the Ethereum blockchain, serving as a virtual computing environment that allows developers to create and deploy smart contracts, which are self-executing contracts with the terms directly written into code. The EVM is crucial for maintaining the decentralized, trustless nature of the Ethereum network, ensuring that all transactions and smart contracts operate uniformly across all nodes.

Ethereum Virtual Machine

How the EVM Functions

The EVM ensures that every node in the Ethereum network executes smart contracts in the same way. This consistency is vital for maintaining the integrity and security of the blockchain. Each node’s EVM executes operations identically, which means that smart contracts are carried out without any central oversight or possibility of tampering.

Each EVM operates in a completely isolated environment. This isolation protects the rest of the Ethereum network from potential vulnerabilities or bugs within individual smart contracts. It ensures that problematic contracts cannot corrupt or interfere with the operation of other contracts or the broader Ethereum system.

Transaction Validation and Execution

- Transaction Processing: When a transaction is sent to a smart contract, the EVM processes the bytecode of the contract. This bytecode is a low-level, highly efficient set of instructions that the EVM can interpret and execute.

- Smart Contract Interaction: Developers write smart contracts in high-level languages, such as Solidity, which are then compiled into the bytecode that the EVM can understand. This process ensures that complex contractual terms can be implemented and automatically enforced by the blockchain.

- Simulated Environment: Before any changes are finalized on the blockchain, each EVM simulates the execution of the transaction. This allows each node to predict and agree on the outcome of transactions before they are added to the blockchain. This simulation is critical for preventing incorrect or malicious transactions from being recorded.

Ethereum Virtual Machine

Ethereum Virtual Machine Role in Decentralized Applications (DApps)

The EVM not only supports smart contracts but also provides the runtime environment for decentralized applications (dApps) built on Ethereum. These dApps use smart contracts to manage their logic and data, relying on the EVM to execute their code securely and reliably.

The EVM’s compatibility with various programming languages and its support for complex applications make it an extremely flexible tool for developers. This flexibility encourages innovation and the development of a wide range of applications, from financial tools to games and social networks.

ERC-20 and Other Tokens

On the Ethereum blockchain, users can create their own tokens in various standards. Each token standard serves as a sort of file format, and they serve different purposes and interact with the system in different ways.

Ethereum token standards

- ERC-20: The standard for fungible tokens (virtual currencies, tokens for voting, staking, etc.). The most well-known cryptocurrencies are ERC-20 tokens or their derivatives/modifications.

- ERC-721: The standard for non-fungible tokens (NFTs).

- ERC-777: A standard for tokens with advanced functionalities such as mixer contracts, enhanced transaction privacy, or emergency recovery features in case of key loss.

- ERC-1155: A multi-token standard that allows sending different types of tokens (e.g., cryptocurrencies and NFTs) in one transaction.

- ERC-4626: A standard for optimizing yield vaults.

ETH is the second largest and most popular cryptocurrency after BTC. You can purchase ETH on all centralized cryptocurrency exchanges (e.g., Binance) or on decentralized exchanges (DEX). ETH can also be purchased through online exchanges (e.g., Prostocash, 60cek, etc.), and in cryptocurrency wallets.

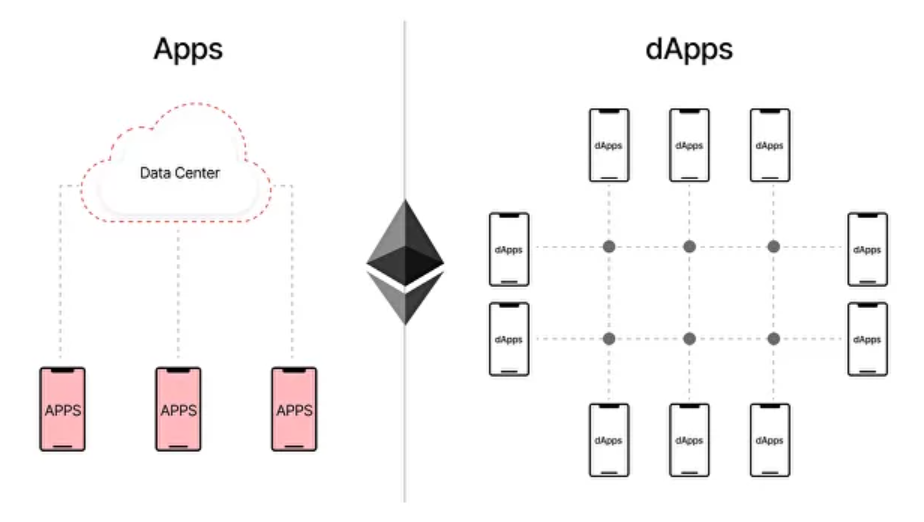

Decentralized Applications (DApps) on Ethereum

Ethereum decentralized applications, or dApps, represent a core aspect of Ethereum’s usage and functionality. Built on Ethereum’s blockchain, these applications operate autonomously without the need for central authority, enabling a wide range of activities from finance to gaming.

Apps vs. dApps

DApps are similar to any other applications made on Windows, iOS, etc. The difference is that they are launched on the blockchain and are “powered” by cryptocurrency. Unlike conventional applications, which are regulated by centralized groups of developers, dApps are regulated by smart contracts, with developers only maintaining them.

Decentralized applications can be of any kind and purpose – from financial services to creative tools and development, and even games. Most of them focus on cryptocurrencies and their applications.

Definition and Nature of DApps

DApps run on a blockchain network powered by smart contracts. Once deployed, these apps operate independently, with the smart contracts automatically executing as programmed without any possibility of downtime, censorship, fraud, or third-party interference.

DApps Logos

Typically, dApps are open source, meaning their code is publicly available for verification and enhancement by anyone. They operate on a decentralized network, using Ethereum’s blockchain to decentralize data and governance.

Categories of Ethereum DApps:

- Finance (DeFi): Decentralized Finance (DeFi) applications are among the most popular types of DApps on Ethereum. They offer financial services such as lending, borrowing, and trading through decentralized platforms, removing the need for traditional financial systems. Examples include Uniswap, MakerDAO, Aave, Curve Finance.

- Gaming and Collectibles: Blockchain games and virtual collectibles utilize Ethereum to create transparent and fair gaming environments and to issue and track ownership of unique digital items, respectively. Examples include OpenSea, CryptoKitties, Axie Infinity, SuperRare.

- Social Media and Content Creation: New platforms are emerging that use Ethereum to give content creators more control over their work and manage their digital identity. Examples include Steemit, Mirror, Audius, Livepeer.

Main page of the website dAppRadar /CScalp

Benefits of Ethereum DApps

Many Ethereum dApps can interact with each other thanks to the shared infrastructure of the Ethereum blockchain. This interoperability allows for complex financial instruments, such as tokenized assets, that can be used across multiple applications.

Ethereum boasts an array of significant projects that make money exchange easier and avoid traditional banking systems. Uniswap emerges as a leading decentralized exchange (DEX), leveraging an automated market maker (AMM) protocol to facilitate token swaps. MakerDAO and its stablecoin DAI stand out in the DeFi space, offering a decentralized lending system and governance structure. Aave is another heavyweight, providing decentralized lending and staking services. Its prominence is highlighted by the massive value locked in its liquidity pools, evidencing robust user trust.

With no central point of control, users have complete control over their personal and financial data. The transparency of blockchain also provides users with detailed information about transaction histories and app functionality.

Decentralized Autonomous Organizations (DAOs)

Decentralized Autonomous Organizations (DAOs) represent a revolutionary form of organizational governance enabled by the Ethereum blockchain. These entities operate through smart contracts, allowing them to function without the traditional management structure or human intervention in decision-making processes.

Nature and Purpose of DAOs

DAOs are designed to democratize the way organizations operate, placing power directly in the hands of members rather than a central authority. Every decision within the DAO ecosystem – from allocating resources to modifying operational rules – is made through a collective voting process where each member’s vote is typically recorded and executed via blockchain transactions. This ensures transparency, accountability, and resistance to censorship, which are often lacking in traditional organizational structures.

How DAOs Operate

At their core, DAOs use a collection of smart contracts to encode the rules of the organization and automatically execute agreed-upon decisions. Members of a DAO interact with these contracts by submitting proposals, voting on them, and executing the group’s decisions. Tokens are often used within DAOs both to represent voting power and to handle financial transactions, aligning the incentives of all participants with the success of the organization.

Examples and Applications:

- Venture and Grant Funding: Some DAOs focus on pooling resources to fund new projects or ventures. For example, the Ethereum-based MolochDAO is dedicated to funding Ethereum development projects.

- Charitable Organizations: DAOs can also be structured to ensure that charitable contributions are spent transparently on agreed-upon causes.

- Operational and Governance Decisions: Other DAOs operate more broadly, handling everything from financial decisions to changes in policy and operational rules.

Challenges and Considerations

Despite their benefits, DAOs face challenges such as potential for code vulnerabilities, which can lead to financial loss or operational disruption if not adequately audited. Additionally, regulatory uncertainty remains as governments and legal systems adapt to these novel entities.

As blockchain technology matures, DAOs are expected to become more sophisticated, potentially reshaping how organizations are formed and managed across various industries. This could lead to wider adoption of decentralized governance models, particularly in areas requiring high degrees of trust and transparency.

- To learn more about DAOs, dApps and Ethereum Tokens, check out our article “Ethereum Ecosystem: Discover Top Tokens and Market Cap.”

Ethereum and Bitcoin: Which Crypto Money to Choose?

Let’s explore the primary differences between the Ethereum and Bitcoin blockchains. These distinctions highlight fundamental differences in design philosophy, capability, and functionality between Ethereum and Bitcoin, underscoring Ethereum’s role as a versatile and expansive platform for decentralized applications.

With an overwhelming number of crypto assets available, it can be challenging to determine which are the top cryptocurrency choices for day traders. The CScalp free crypto screener simplifies this process by providing real-time data on new cryptocurrencies and their potential for day trading. By identifying the best crypto to day trade, traders can profit from short-term price movements.

Purpose

The Bitcoin network is solely dedicated to facilitating transactions with the BTC cryptocurrency, which effectively functions as digital money. In contrast, Ethereum supports a broader range of applications, including all tokens and smart contracts deployed on its platform. Unlike BTC, ETH is not just a digital currency; its primary value derives from supporting the operations and development of the Ethereum blockchain.

Node Operation

The concept of a “blockchain” was first introduced by Bitcoin. Ethereum, too, is based on blockchain technology. However, Ethereum differentiates itself in that its nodes are required to track not only transaction data but also the “state” of the network. This includes up-to-date information on all active applications, account balances, smart contract code, and any modifications that occur.

Transaction Model

Bitcoin employs the Unspent Transaction Output (UTXO) model. Under this system, the network processes data on the remaining cryptocurrency after a transaction is completed and uses this data to facilitate new transactions. The system tracks only the outcomes of transactions and does not store user-specific data.

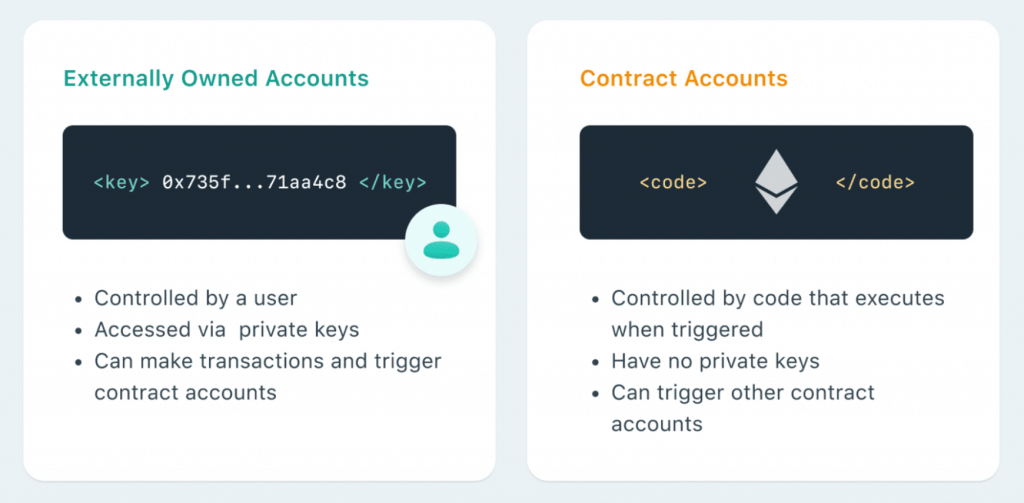

Ethereum operates on an account-based model, which is divided into two categories:

- Externally-Owned Accounts (EOA): These are used by individuals to store and send cryptocurrencies. Creating an external account is free, and transactions between such accounts involve only the transfer of ETH or other tokens. Each account is secured with a cryptographic pair of keys—public and private.

- Contract Accounts: These accounts house smart contracts and are activated by transactions of ether from an EOA or other events. Creating a contract consumes network resources and thus incurs costs. Unlike EOAs, contract accounts are reactive and respond only to incoming transactions or specified triggers. The code within these contracts can encompass a wide array of operations, from simple transfers to the deployment of new contracts based on predefined protocols.

A user conducts transactions through a registered account. For example, in a wallet. Accounts free the network from the need to create a new address for each transaction. At the same time, this model reduces anonymity.

Difference of contracts between Bitcoin and Ethereum /CScalp

Security Considerations

While the Ethereum blockchain is relatively secure and resistant to hacking, its sidechains can be quite vulnerable, as demonstrated by incidents involving the Ronin sidechain and the Axie Infinity game. Moreover, the inherent complexity of smart contracts on Ethereum can lead to programming errors, occasionally resulting in significant financial losses.

According to Ethereum creator Vitalik Buterin, a traditional blockchain, like Bitcoin, is a “calculator” – a maximally simple device that flawlessly performs a single function – while Ethereum is a “smartphone” – a complex, multifunctional system possessing Turing completeness, i.e., capable of performing any type of computational operation. This system allows users to decide for themselves which functionalities to implement.

While the Ethereum blockchain itself is relatively resistant to hacks, its sidechains are still quite vulnerable (as evidenced by the Ronin sidechain and Axie Infinity game incident). Moreover, due to the uncontrolled complexity of smart contracts, Ethereum sometimes falls victim to errors that lead to significant losses.

BTC and ETH Emission

Bitcoin’s supply is limited to 21,000,000 BTC, whereas Ethereum has no limit on the supply. The amount of ETH currently exceeds 120,000,000 and is theoretically infinite. Only the issuance rate decreases, typically during hard forks.

Speed and Throughput

Bitcoin can process about 4 transactions per second, while Ethereum handles about 15. Both networks are working to increase their speed and throughput. The Lightning Network is theoretically supposed to improve Bitcoin’s throughput, whereas Ethereum uses sharding (each transaction is divided into smaller parts). Ethereum also resorts to a number of second-layer solutions – Polygon, Ethereum Plasma, Arbitrum One, Optimism, Loopring, and others – to increase transaction processing speed.

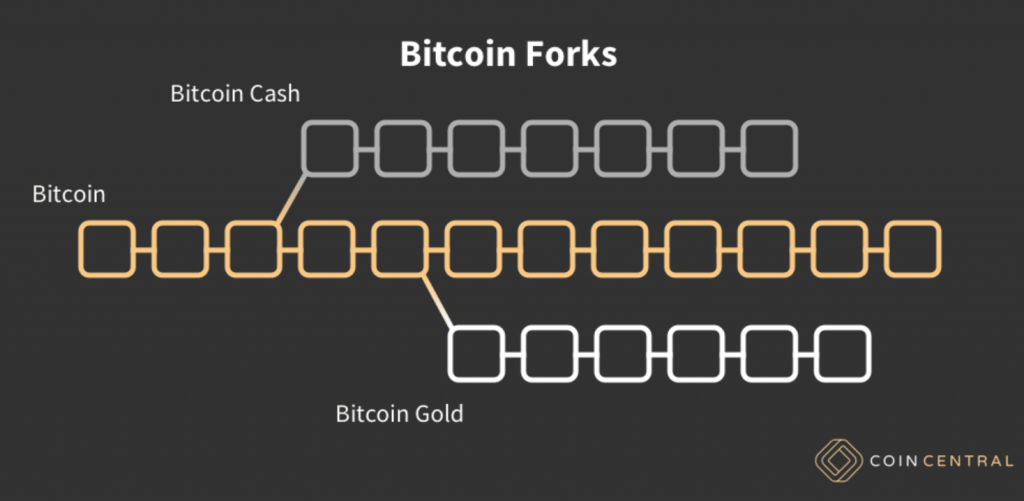

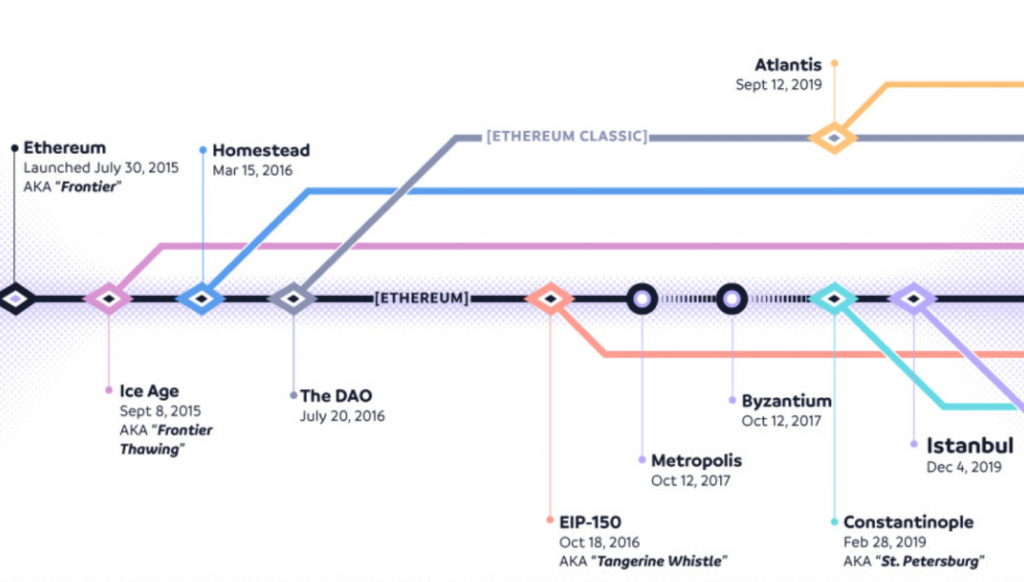

Forks (Network Updates)

Bitcoin updates follow a soft-fork model. After each update, a copy of the previous version is preserved. This allows the network to maintain operation for those nodes that have not yet updated.

Bitcoin forks

Ethereum adheres to a hard-fork model. In this model, each network update is accompanied by a complete transition of all nodes to the new version.

Ethereum forks /CScalp

All active nodes are forced to adhere to the fork if they wish to continue operating. This is largely justified because Ethereum has a cohesive community with a high level of consensus on which direction to move forward. Therefore, hard forks usually do not lead to any disruptions in the network’s operation.

Bitcoin also experiences hard forks – for example, the updates leading to Bitcoin Cash and Bitcoin Gold – as well as soft forks, similar to those in Ethereum. However, such cases are more the exception than the rule.

Emerging Trends and Innovations in the Ethereum Ecosystem

As Ethereum continues to solidify its position as a leading platform for decentralized applications and smart contracts, several emerging trends and innovations are shaping its future. These developments not only enhance its capabilities but also address existing challenges, paving the way for broader adoption and new use cases.

Ethereum 2.0 and Scalability Enhancements

Ethereum 2.0 marks a significant upgrade aimed at improving the network’s scalability and efficiency. One of the most anticipated features is sharding, which will partition the database into smaller, easier-to-manage pieces, or “shards,” that can process transactions in parallel. This, along with Layer 2 solutions like rollups, which handle transactions off the main chain, promises to drastically increase Ethereum’s transaction throughput while reducing congestion and fees.

The switch from Proof of Work (PoW) to Proof of Stake (PoS) in the Ethereum network not only aims to decrease energy consumption by over 99% but also intends to make the network more secure and scalable.

Decentralized Finance (DeFi) Expansion

The DeFi sector is witnessing exponential growth on Ethereum, introducing sophisticated financial instruments such as automated market makers (AMMs), yield farming, and liquidity mining. These innovations offer users higher yields on their investments and more flexibility than traditional banking, with developments aimed at enhancing security, usability, and interoperability among different DeFi applications.

As DeFi matures, integrating compliance with existing financial regulations is becoming a priority. This trend includes the development of decentralized identity solutions and privacy-preserving technologies that facilitate compliance without compromising the decentralized ethos of blockchain technology.

Non-Fungible Tokens (NFTs) and the Digital Economy

Beyond digital art and collectibles, NFTs are expanding into areas like real estate, intellectual property, and even identity verification. This broadening of scope illustrates Ethereum’s capability to tokenize and securely verify ownership of any asset.

Innovations are underway to enhance the interoperability of NFTs across different blockchain platforms and to introduce concepts like fractional ownership, which could open up markets to a wider audience by lowering entry barriers.

Enterprise Adoption and Institutional Interest

As large corporations and institutions increasingly explore blockchain technology, Ethereum is set to benefit from the growth in private or hybrid blockchain solutions. These solutions leverage Ethereum’s robust architecture while providing the privacy and control that enterprises demand.

Developments in creating standardized frameworks and protocols for enterprise applications on Ethereum are facilitating its adoption across industries such as finance, supply chain, and healthcare.

Technological Advancements and Ecosystem Growth

Enhancements in Ethereum’s development infrastructure, such as improved smart contract languages and more robust security tools, are making it easier and safer to build on Ethereum.

The rise of decentralized autonomous organizations (DAOs) is promoting a new form of organizational management and governance. Ethereum’s continued support for DAOs and similar structures highlights its role in facilitating decentralized governance structures.a

What is Ethereum Blockchain? – Conclusion

In terms of market capitalization and the value of its native cryptocurrency, ETH, Ethereum consistently holds the position of second only to Bitcoin, making it a significant consideration for investment. However, drawing direct comparisons between Bitcoin and Ethereum is not particularly productive; while Ethereum was initially inspired by Bitcoin, the two systems have evolved to serve distinctly different purposes.

Bitcoin primarily functions as digital gold, a store of value, whereas Ethereum is designed as a platform for decentralized applications (dApps) and smart contracts, significantly broadening its use cases and offering diverse opportunities for investing. With Ethereum, users can interact with the blockchain directly from their internet-connected devices, which act as a bridge to this vast network, much like a computer connects to the internet.

DApps are intimately connected to the concept of Web3, often referred to as the third generation of the internet, which envisions a decentralized and open web. The key attributes of dApps include being open-source, decentralized consensus mechanisms.

The Ethereum blockchain serves as the foundational platform for the entire modern decentralized finance (DeFi) ecosystem that operates outside of the traditional financial system. It was pioneering in its introduction of numerous concepts that now form the bedrock of the contemporary cryptocurrency industry.

The ongoing development and upcoming full launch of Ethereum 2.0, transitioning the network from Proof of Work (PoW) to Proof of Stake (PoS), could have profound implications for the broader cryptocurrency industry. This update aims to enhance Ethereum’s scalability and efficiency, potentially leading to increased adoption of its technology. As Ethereum 2.0 brings these fundamental changes to the network’s architecture, it is expected to have a significant impact on the overall utility and financial value of ether.

Frequently Asked Questions: FAQs About Ethereum Blockchains and Cryptocurrency

What Is Ethereum?

Ethereum is a global decentralized platform for money and new kinds of applications. It allows developers to build and deploy smart contracts and decentralized applications (dApps) without third-party interference, fraud, or control.

What Are Smart Contracts?

Ethereum is a blockchain network that introduced a built-in turing complete programming language, allowing for the creation and execution of complex smart contracts and decentralized applications.

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute actions according to the contract terms when certain conditions are met.

ETH: What Is This?

ETH, or ether, is the native cryptocurrency of the Ethereum platform. It is used to compensate participants who perform computations and validate transactions, and is also used for paying transaction fees and computational services on the Ethereum network.

How Does Ethereum Differ From Bitcoin?

While Bitcoin was designed primarily as a digital currency, Ethereum was created as a platform to facilitate immutable, programmatic contracts, and applications via its own currency. Ethereum supports smart contracts and dApps, which are not available on Bitcoin’s platform.

What Is Ethereum 2.0?

Ethereum 2.0, also known as Eth2 or Serenity, is an upgrade to the Ethereum blockchain. The upgrade aims to enhance the speed, efficiency, and scalability of the Ethereum network so that it can process more transactions and alleviate congestion.

What Are ERC-20 Tokens?

ERC-20 is a standard used to create and issue smart contracts on the Ethereum blockchain for token implementation. It defines a common list of rules that an Ethereum token has to implement, giving developers the ability to program how new tokens will function within the Ethereum ecosystem.

What Are Non-Fungible Tokens (NFTs)?

A Non-fungible token (NFT) is a unique digital asset that represents ownership of specific items using blockchain technology, typically on Ethereum. They can represent anything from digital art and music to virtual real estate and more.

What Is DeFi?

Decentralized Finance (DeFi) refers to the financial services available on public blockchains, primarily Ethereum. DeFi platforms allow people to lend or borrow funds from others, speculate on price movements on a range of assets using derivatives, trade cryptocurrencies, insure against risks, and earn interest in a decentralized manner.

How Do I Buy Ethereum Cryptocurrency?

Ethereum can be purchased on various cryptocurrency exchanges such as Binance, Bybit, OKX, Bitget, Coinbase, and Kraken. You can buy Ethereum by setting up an account on one of these exchanges and purchasing it with fiat currency or other cryptocurrencies.

What Are the Risks of Using Ethereum?

The risks include smart contract vulnerabilities, network congestion, high transaction fees during peak times, and scalability issues. Users should also be aware of the volatile nature of Ethereum’s price and the regulatory environment, which can impact the overall adoption and use of Ethereum.

The Ethereum Network Is Responsible for Storing and Recording All Transaction and Smart Contract Data Known as the Blockchain Ledger. Is This Ledge Secure Enough?

While Ethereum’s blockchain ledger is secure, it’s important to note that the applications built on top of it, such as smart contracts, can still have vulnerabilities if not properly written or audited. The platform itself provides a robust and secure infrastructure, but the security of individual dApps and smart contracts also depends on the developers’ adherence to best security practices.

A Blockchain Is a Database of Transactions That Is Updated and Shared Across Many Computers in a Network. Are There Any Differences Between Ethereum’s and Bitcoin’s Blockchains?

Yes, there are key differences between these types of blockchain. Their consensus algorithms are different. Bitcoin’s blockchain primarily functions as a digital currency, using a Proof of Work consensus mechanism to secure transactions. In contrast, Ethereum’s blockchain not only supports its cryptocurrency, Ether, but also enables the execution of smart contracts and decentralized applications using a transition to a Proof of Stake mechanism for enhanced efficiency and scalability. Ethereum is a public block chain network that focuses on running programming code of any decentralized application.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT